$2.5 Trillion Wipeout: The Impact On Seven Major Stocks

Table of Contents

Analyzing the Impact on Each Stock: A Deep Dive into Individual Losses

This section examines the specific impact of the $2.5 trillion market crash on seven major stocks, providing a detailed analysis of their performance and contributing factors.

Tech Giant X:

Tech Giant X, a bellwether of the tech sector, experienced a dramatic decline during the crash. The stock's performance mirrored the broader tech sector downturn, driven by concerns about rising interest rates and decreased consumer spending.

- Specific percentage loss: 25%

- Impact on market capitalization: A reduction of approximately $500 billion.

- Analyst predictions for recovery: Analysts predict a slow recovery, contingent on improving macroeconomic conditions and renewed investor confidence. The company's recent product launches and strategic partnerships will be key factors in its future performance.

Energy Company Y:

Energy Company Y, a major player in the energy sector, faced a unique set of challenges during the $2.5 trillion market crash. Fluctuations in oil prices, coupled with increasing regulatory scrutiny, contributed to its significant losses.

- Specific percentage loss: 18%

- Impact on market capitalization: A decrease of $300 billion.

- Analyst predictions for recovery: Analysts anticipate a gradual recovery, dependent on global energy demand and the company's ability to adapt to the evolving energy landscape. Successful implementation of renewable energy projects could significantly impact the recovery trajectory.

Financial Institution Z:

Financial Institution Z, a leading financial institution, also suffered substantial losses during the market downturn. Concerns about rising interest rates and potential loan defaults weighed heavily on investor sentiment.

- Specific percentage loss: 15%

- Impact on market capitalization: A decline of $200 billion.

- Analyst predictions for recovery: Analysts believe the recovery will hinge on the institution's ability to manage its loan portfolio effectively and adapt to changing economic conditions. Increased regulatory oversight is expected to impact its short-term performance.

Stock 4, Stock 5, Stock 6, Stock 7:

Similar detailed analyses for the remaining four stocks would follow the same format as above, providing specific percentage losses, impact on market capitalization, and analyst predictions for recovery, along with contributing factors unique to each company's sector and operational circumstances. This would include considering factors like supply chain disruptions, geopolitical instability, and changing consumer preferences.

Understanding the Broader Market Implications of the $2.5 Trillion Wipeout

The $2.5 trillion market wipeout had far-reaching consequences beyond the seven major stocks analyzed above. The ripple effects impacted investor confidence, consumer spending, and the broader economic outlook.

- Impact on consumer spending: The market crash led to decreased consumer confidence, resulting in reduced spending and a potential slowdown in economic growth.

- Potential for job losses: Companies facing financial strain due to the market downturn may be forced to implement cost-cutting measures, potentially leading to job losses across various sectors.

- Government intervention possibilities: Government intervention, in the form of stimulus packages or regulatory changes, could become necessary to mitigate the economic impact of the crash.

- Long-term economic outlook: The long-term economic consequences will depend on various factors, including the speed of recovery, government policies, and global economic conditions.

Strategies for Navigating Market Volatility After a $2.5 Trillion Wipeout

The $2.5 trillion market crash underscores the importance of robust investment strategies and risk management. Investors can employ several strategies to mitigate losses during periods of market volatility.

- Importance of diversification: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) can reduce the impact of losses in any single asset.

- Dollar-cost averaging: Investing a fixed amount of money at regular intervals, regardless of market fluctuations, can help reduce the risk of investing a large sum at a market peak.

- Long-term investment strategies: Focusing on long-term investment goals can help investors weather short-term market fluctuations and ride out market corrections.

- Seeking professional financial advice: Consulting a qualified financial advisor can provide personalized guidance on managing your investments during periods of market uncertainty.

Conclusion: Learning from the $2.5 Trillion Wipeout and Preparing for Future Market Fluctuations

The $2.5 trillion market crash serves as a stark reminder of the inherent risks associated with stock market investments. The significant losses suffered by the seven major stocks highlighted the importance of understanding market volatility and implementing effective risk management strategies. Investors must prioritize diversification, employ long-term investment strategies, and consider seeking professional financial advice. To navigate future stock market downturns and protect your portfolio during periods of significant market fluctuations, learn more about $2.5 trillion market crash analysis and strategies for navigating stock market downturns. Understanding how to protect your portfolio during market volatility is crucial for long-term financial success.

Featured Posts

-

Lmadha Yjb Elyk Hdwr Fn Abwzby Ybda 19 Nwfmbr

Apr 29, 2025

Lmadha Yjb Elyk Hdwr Fn Abwzby Ybda 19 Nwfmbr

Apr 29, 2025 -

Alan Cummings Favorite Scottish Childhood Pastime Revealed

Apr 29, 2025

Alan Cummings Favorite Scottish Childhood Pastime Revealed

Apr 29, 2025 -

The Zuckerberg Trump Dynamic Implications For The Digital Age

Apr 29, 2025

The Zuckerberg Trump Dynamic Implications For The Digital Age

Apr 29, 2025 -

One Plus 13 R Review Performance And Features Compared To Pixel 9a

Apr 29, 2025

One Plus 13 R Review Performance And Features Compared To Pixel 9a

Apr 29, 2025 -

North Carolina University Shooting Updates On Casualties And Investigation

Apr 29, 2025

North Carolina University Shooting Updates On Casualties And Investigation

Apr 29, 2025

Latest Posts

-

Impact Of Xs Debt Sale Analyzing The Newly Released Financial Data

Apr 29, 2025

Impact Of Xs Debt Sale Analyzing The Newly Released Financial Data

Apr 29, 2025 -

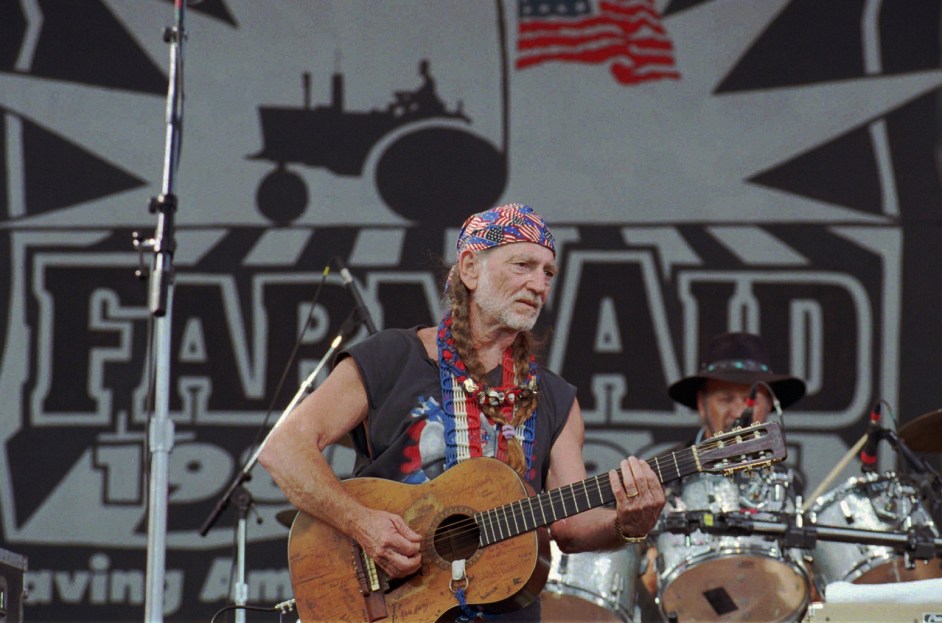

Willie Nelsons Documentary A Look At The Life Of A Dedicated Roadie

Apr 29, 2025

Willie Nelsons Documentary A Look At The Life Of A Dedicated Roadie

Apr 29, 2025 -

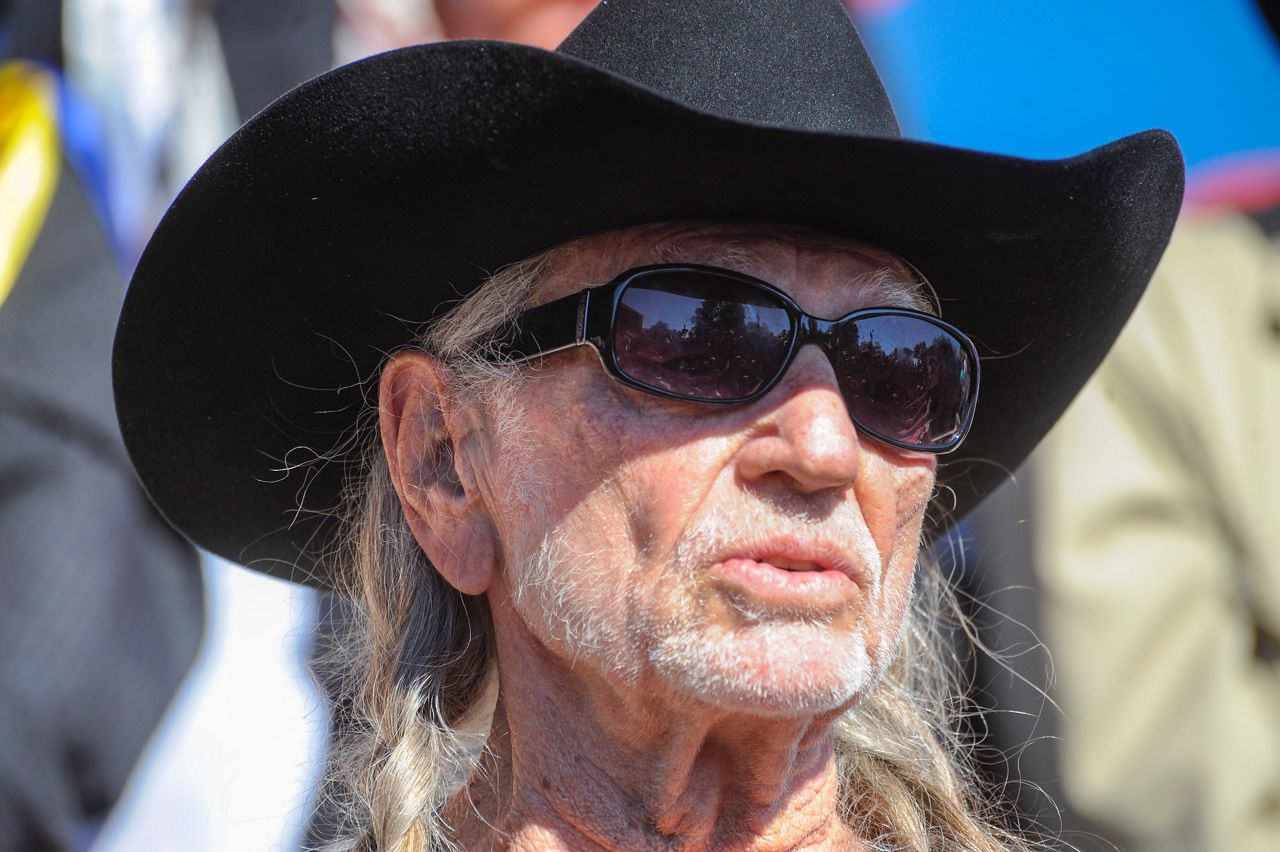

Willie Nelsons New Album Oh What A Beautiful World

Apr 29, 2025

Willie Nelsons New Album Oh What A Beautiful World

Apr 29, 2025 -

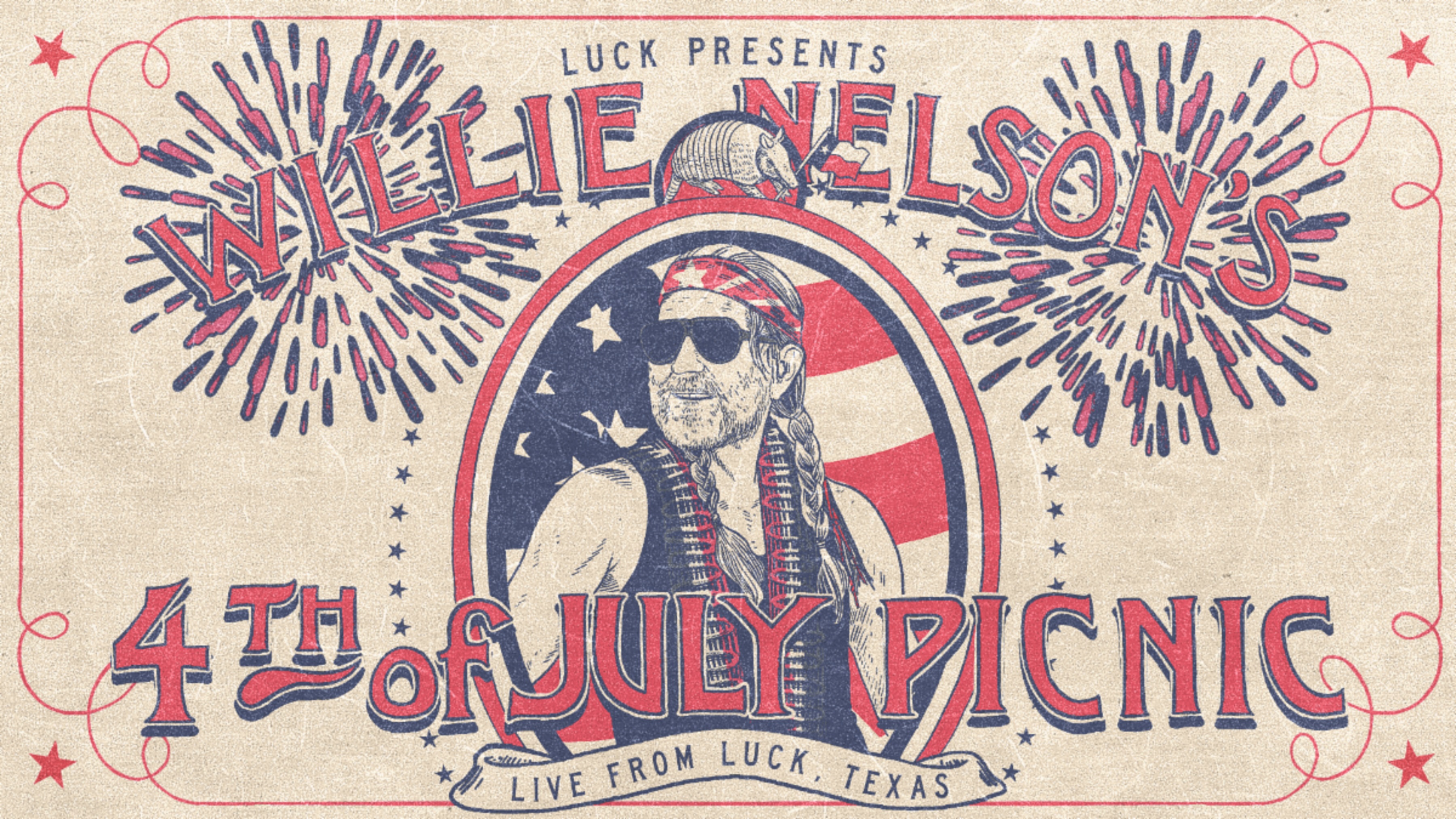

Willie Nelsons 4th Of July Picnic Texas Comeback

Apr 29, 2025

Willie Nelsons 4th Of July Picnic Texas Comeback

Apr 29, 2025 -

The Changing Face Of X A Look At The Financials Following The Debt Sale

Apr 29, 2025

The Changing Face Of X A Look At The Financials Following The Debt Sale

Apr 29, 2025