5 Crucial Do's & Don'ts: Succeeding In The Private Credit Job Market

Table of Contents

Do's for Success in the Private Credit Job Market

Develop In-Demand Skills

The private credit industry demands a specialized skillset. To stand out, you must continuously hone your expertise. This includes:

- Strong financial modeling skills: Proficiency in building complex financial models is essential for analyzing investment opportunities.

- Credit analysis expertise: A deep understanding of credit risk assessment, including financial statement analysis and credit scoring methodologies, is crucial.

- Understanding of legal and regulatory frameworks: Familiarity with relevant laws and regulations governing private credit transactions is vital.

- Experience with debt structuring and fundraising: Knowledge of different debt structures and fundraising strategies is highly sought after.

- Knowledge of various investment strategies: Understanding direct lending, distressed debt, mezzanine financing, and other private credit strategies is key.

- Proficiency in financial software: Mastering tools like Bloomberg Terminal and Argus is a significant advantage.

- Excellent communication and presentation skills: Effectively conveying complex financial information to investors and colleagues is paramount.

Continuous professional development is key. Consider pursuing certifications such as the Chartered Financial Analyst (CFA) or Chartered Alternative Investment Analyst (CAIA) to enhance your credibility and marketability within the private credit industry.

Network Strategically

Networking is paramount in the private credit job market. Building strong relationships can open doors to unadvertised opportunities and provide valuable insights. Effective networking strategies include:

- Attend industry conferences: SuperReturn and Private Debt Investor conferences are excellent places to connect with professionals.

- Leverage LinkedIn effectively: Optimize your profile, connect with relevant professionals, and engage in industry discussions.

- Join relevant professional associations: The Turnaround Management Association (TMA) offers valuable networking and educational opportunities.

- Cultivate relationships with private credit professionals: Reach out to individuals in your network for informational interviews and advice.

- Seek Mentorship: Find experienced professionals who can guide you through your career journey.

Remember, networking is about building genuine relationships, not just collecting business cards. Practice effective networking etiquette, be genuinely interested in others, and follow up after meetings.

Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count by:

- Highlight relevant experience and skills: Focus on accomplishments that demonstrate your abilities in the context of private credit.

- Use keywords from job descriptions: Tailor your application materials to each specific role using keywords found in the job description.

- Quantify achievements whenever possible: Use metrics and numbers to illustrate the impact of your work.

- Tailor each application to the specific role and company: Generic applications rarely succeed in a competitive market. Thoroughly research each firm and customize your application accordingly.

- Proofread carefully: Typos and grammatical errors are unprofessional and can eliminate you from consideration.

For example, instead of saying "Managed a portfolio of assets," you could say "Managed a $50 million portfolio of distressed assets, resulting in a 15% increase in portfolio value." This shows quantifiable results and demonstrates your impact.

Don'ts for Success in the Private Credit Job Market

Neglect Networking Opportunities

A passive job search is a recipe for failure in the competitive private credit job market. Avoid:

- Neglecting industry events: Don't miss opportunities to meet professionals and learn about new opportunities.

- Failing to connect with professionals on LinkedIn: An inactive or incomplete LinkedIn profile limits your visibility.

- Not actively seeking mentorship: Mentors can offer invaluable guidance and support.

- Relying solely on online job boards: Many private credit positions are filled through networking.

Actively participate in industry events, connect with professionals online, and seek out mentors to expand your network and uncover hidden opportunities.

Underestimate the Importance of Soft Skills

Technical skills are important, but soft skills are equally crucial in a collaborative environment like private credit. Avoid:

- Ignoring communication skills: Clear and concise communication is vital for success.

- Lacking teamwork abilities: Private credit often involves working in teams.

- Neglecting professional presentation skills: You'll need to present your findings and recommendations effectively.

- Poor time management: Meeting deadlines is essential in a fast-paced environment.

- Inability to handle pressure: The private credit industry can be demanding.

Develop your soft skills through training, workshops, and practical experience.

Submit Generic Applications

Generic applications show a lack of interest and professionalism. Avoid:

- Sending the same resume and cover letter to multiple firms: This demonstrates a lack of effort and personalization.

- Failing to research the company thoroughly: Show your knowledge of the firm's investment strategy and culture.

- Neglecting to address specific requirements in the job description: Tailor your application to match the specific skills and experience required.

- Submitting poorly written applications: Proofreading is essential.

Each application should be meticulously crafted to reflect the specific requirements and culture of the target firm.

Securing Your Place in the Private Credit Job Market

Successfully navigating the private credit job market requires a proactive approach. By developing in-demand skills, networking strategically, and tailoring your applications, you significantly increase your chances of success. Remember to avoid neglecting networking opportunities, underestimating the importance of soft skills, and submitting generic applications. By following these do's and don'ts, you can significantly increase your chances of landing your dream job in the lucrative private credit job market. Start building your network and developing your skillset today to achieve success in this dynamic and rewarding field!

Featured Posts

-

Dr Victoria Watlington Town Hall On Wsoc Tv Key Discussion Points

Apr 30, 2025

Dr Victoria Watlington Town Hall On Wsoc Tv Key Discussion Points

Apr 30, 2025 -

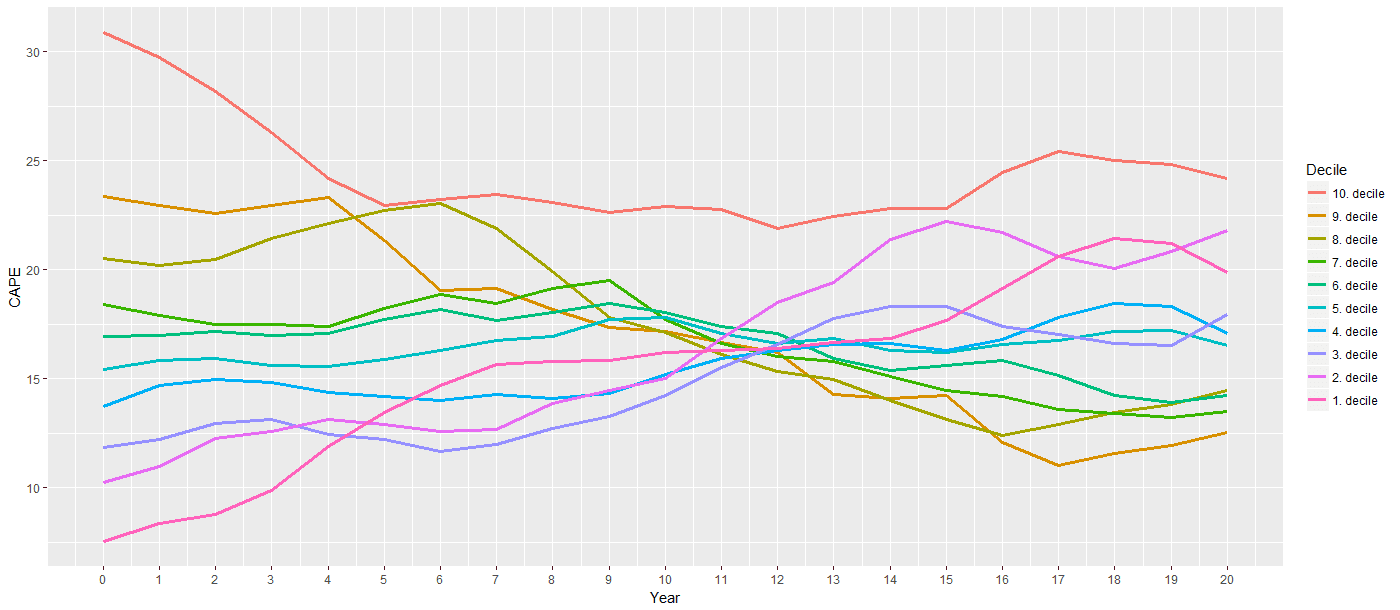

Investor Concerns About High Stock Market Valuations Bof As Response

Apr 30, 2025

Investor Concerns About High Stock Market Valuations Bof As Response

Apr 30, 2025 -

Nothing Phone 2 Redefining Modular Smartphone Design

Apr 30, 2025

Nothing Phone 2 Redefining Modular Smartphone Design

Apr 30, 2025 -

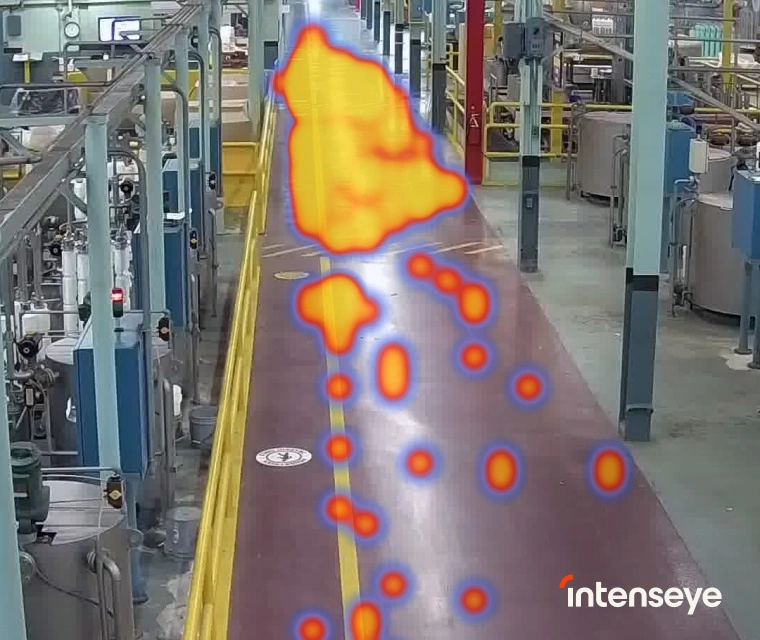

New Patent Leverages Ai To Minimize Process Safety Hazards

Apr 30, 2025

New Patent Leverages Ai To Minimize Process Safety Hazards

Apr 30, 2025 -

Documentario Mostra Trump Beyonce E Jay Z Em Festas Privadas De P Diddy

Apr 30, 2025

Documentario Mostra Trump Beyonce E Jay Z Em Festas Privadas De P Diddy

Apr 30, 2025