Analysis: Berkshire Hathaway's Investment And The Future Of Japanese Trading Houses

Table of Contents

Understanding Berkshire Hathaway's Investment Strategy

The Rationale Behind the Investment

Warren Buffett's decision to invest billions in Japanese trading houses surprised many, deviating from his typical focus on established American companies. Several factors likely contributed to this strategic move. One key aspect is the perceived undervaluation of these companies, whose stock prices hadn't fully reflected their robust financial performance and diversified portfolios. Furthermore, these trading houses represent a significant opportunity for long-term growth, offering exposure to a diverse range of industries and global markets. This investment also aligns with Berkshire Hathaway's long-standing commitment to a buy-and-hold, value investing strategy.

- Stable Earnings: Japanese trading houses historically demonstrate stable earnings streams, even during economic downturns.

- Diverse Portfolios: Their businesses span energy, metals, food, and chemicals, offering significant diversification.

- Global Reach: These companies operate on a global scale, providing access to diverse markets and opportunities.

- Investment Size: Berkshire Hathaway invested approximately $6 billion in each of the five trading houses, representing a substantial commitment.

- Percentage Ownership: The investment resulted in Berkshire Hathaway holding approximately 5% ownership in each company.

Comparison with Berkshire's Traditional Investment Approach

While this investment shares similarities with Berkshire's long-term investment philosophy, it differs from its typical acquisitions of entire companies. The Japanese trading house investment represents a passive, minority stake, contrasting with Berkshire's usual approach of acquiring controlling interests in businesses.

- Investment Style: A shift from active management to a more passive, long-term holding strategy.

- Due Diligence: While rigorous due diligence was undoubtedly conducted, the process might have differed from typical acquisition due diligence.

- Risk Assessment: The risk profile is comparatively lower than with controlling investments, but still involves market fluctuations and macroeconomic factors.

Impact on Japanese Trading Houses

Short-Term Effects

The announcement of Berkshire Hathaway's investment caused an immediate surge in the stock prices of the five trading houses. Investor sentiment improved significantly, reflecting confidence in the long-term prospects of these companies.

- Stock Price Increase: Significant upward movement in stock prices immediately following the announcement. (Specific data on percentage increases would need to be added here based on market information).

- Investor Sentiment: A clear improvement in investor confidence and a positive market reaction.

Long-Term Implications

Berkshire Hathaway's involvement is expected to bring numerous long-term benefits to the Japanese trading houses. The association with a renowned investor like Warren Buffett adds credibility and enhances their global reputation.

- Improved Corporate Governance: Berkshire Hathaway's reputation for strong corporate governance could positively influence the trading houses.

- Access to New Markets: Leveraging Berkshire Hathaway's extensive network and expertise could open new market opportunities.

- Technological Advancements: Potential collaboration on technological innovations and efficiency improvements.

- Potential Challenges: Integrating different corporate cultures and adapting to Berkshire Hathaway's management style could present challenges.

Increased Foreign Investment in Japan

Berkshire Hathaway's bold move could serve as a catalyst for increased foreign direct investment in Japan. This could boost the Japanese economy and attract further capital to other undervalued sectors. The signal of confidence from a leading global investor could encourage other international firms to explore investment opportunities in Japan.

The Future of Japanese Trading Houses

Adapting to a Changing Global Landscape

Japanese trading houses face numerous challenges in an increasingly competitive global marketplace. These include adapting to geopolitical instability, technological disruption, and the changing preferences of global consumers.

- Geopolitical Uncertainty: Navigating global trade tensions and political risks.

- Technological Disruption: Adapting to digital transformation and incorporating new technologies into their operations.

- Shifting Consumer Demands: Meeting evolving consumer needs and preferences across different markets.

Berkshire Hathaway's Role in Shaping the Future

Berkshire Hathaway's investment might influence the strategic direction of these trading houses. While a passive investor, its presence could encourage innovation, efficiency improvements, and strategic partnerships.

- Potential Management Changes: While unlikely to dictate management, Berkshire Hathaway's involvement could lead to subtle shifts in strategic decision-making.

- Business Strategy Adjustments: A potential push towards more efficient operations and expansion into new markets.

- Technological Adoption: Increased investment in technology to streamline operations and improve competitiveness.

Conclusion

Berkshire Hathaway's investment in Japanese trading houses represents a landmark event with significant implications. While the short-term impact is evident in the immediate stock price surge, the long-term consequences remain to be seen. The investment's success will hinge on how effectively these trading houses adapt to evolving market dynamics and leverage Berkshire Hathaway's expertise. This strategic move has the potential to reshape the future of Japanese trading houses and potentially catalyze further foreign investment in the Japanese economy.

Stay informed on the evolving landscape of Berkshire Hathaway's investment and the future of Japanese trading houses by following [link to relevant resource or blog]. The significance of this investment and its potential to redefine the future of Japanese trading houses cannot be overstated.

Featured Posts

-

Sonos And Ikeas Symfonisk Speakers The End Of An Era

May 08, 2025

Sonos And Ikeas Symfonisk Speakers The End Of An Era

May 08, 2025 -

9 4000 2 360

May 08, 2025

9 4000 2 360

May 08, 2025 -

Stephen King Praises The Life Of Chuck Official Trailer Released

May 08, 2025

Stephen King Praises The Life Of Chuck Official Trailer Released

May 08, 2025 -

Cantina Canalla Malaga El Restaurante Mexicano De Moda

May 08, 2025

Cantina Canalla Malaga El Restaurante Mexicano De Moda

May 08, 2025 -

De Andre Carter Chicago Bears Free Agent Joins Cleveland Browns

May 08, 2025

De Andre Carter Chicago Bears Free Agent Joins Cleveland Browns

May 08, 2025

Latest Posts

-

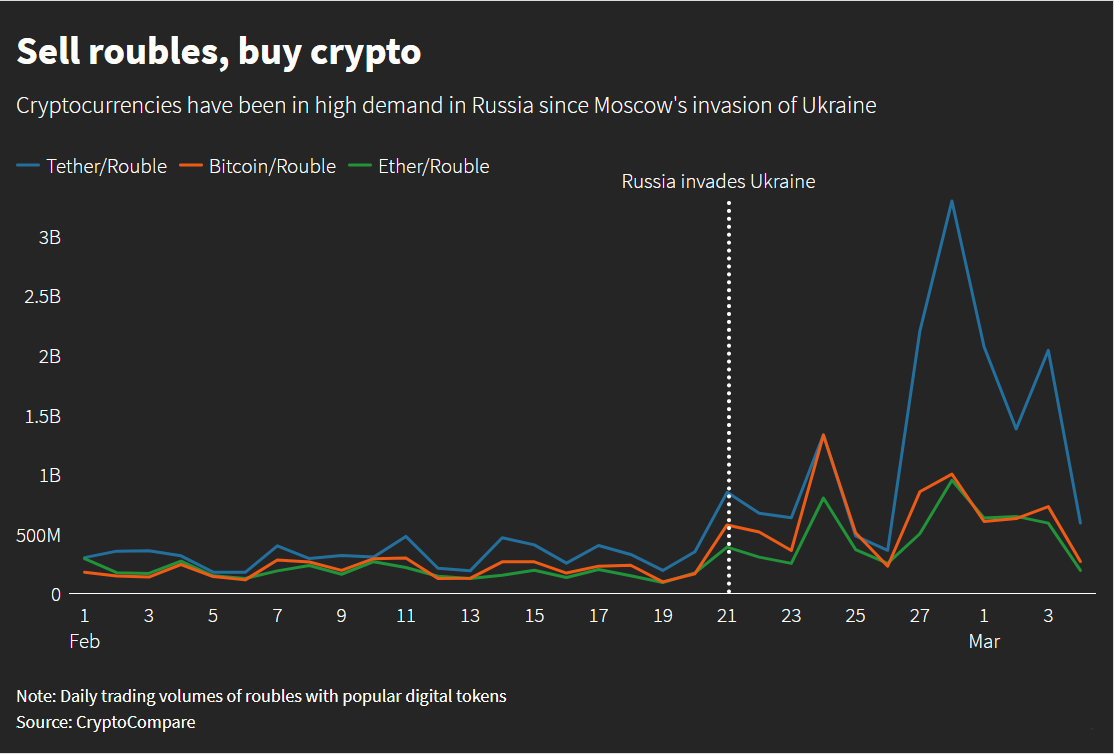

One Cryptocurrency Thriving Despite The Trade War

May 08, 2025

One Cryptocurrency Thriving Despite The Trade War

May 08, 2025 -

Is The Bitcoin Rebound Sustainable Experts Weigh In

May 08, 2025

Is The Bitcoin Rebound Sustainable Experts Weigh In

May 08, 2025 -

110 Potential Return Billionaire Investors Are Betting Big On This Black Rock Etf

May 08, 2025

110 Potential Return Billionaire Investors Are Betting Big On This Black Rock Etf

May 08, 2025 -

Bitcoin Price Rebound Analyzing The Potential For Further Growth

May 08, 2025

Bitcoin Price Rebound Analyzing The Potential For Further Growth

May 08, 2025 -

Trade Wars And Crypto Identifying A Winning Cryptocurrency

May 08, 2025

Trade Wars And Crypto Identifying A Winning Cryptocurrency

May 08, 2025