Autonomous Vehicles And ETFs: Is Uber A Smart Investment?

Table of Contents

The Promise and Challenges of Autonomous Vehicles

The potential benefits of self-driving cars are immense: increased safety, reduced traffic congestion, and improved efficiency. However, significant hurdles remain before widespread adoption becomes a reality.

Technological Hurdles

Developing fully autonomous vehicles is incredibly complex. It requires breakthroughs in several key areas:

- Sensor Fusion: Successfully integrating data from various sensors (LIDAR, radar, cameras) is crucial for accurate environmental perception. Challenges include handling edge cases – unexpected situations the car hasn't encountered during training.

- AI Technology: Sophisticated AI algorithms are needed to process sensor data, make driving decisions, and navigate complex scenarios. Improving the robustness and reliability of these algorithms is paramount.

- High-Definition Mapping: Precise and up-to-date maps are essential for autonomous navigation. Creating and maintaining these maps for global deployment is a significant undertaking.

- Cybersecurity Risks: Autonomous vehicles are vulnerable to hacking, potentially leading to dangerous consequences. Robust cybersecurity measures are vital to protect against malicious attacks.

Regulatory Landscape

The regulatory environment surrounding autonomous vehicles is constantly evolving and differs significantly across regions. This creates uncertainty for investors:

- Government Policies: Governments worldwide are developing varying regulations regarding testing, deployment, and liability for autonomous vehicles.

- Safety Standards: Stringent safety standards are necessary to ensure the safety of autonomous vehicles and their passengers. Meeting these standards is a costly and time-consuming process.

- Liability Issues: Determining liability in the event of an accident involving an autonomous vehicle is a complex legal challenge. Clear legal frameworks are still under development.

Market Adoption and Public Perception

The rate of autonomous vehicle adoption depends on several factors:

- Consumer Acceptance: Public acceptance is crucial. Overcoming concerns about safety, job displacement (for professional drivers), and data privacy is essential for widespread adoption.

- Infrastructure Readiness: Autonomous vehicles require well-maintained infrastructure, including accurate mapping and reliable communication networks. Significant infrastructure investments are needed.

- Ethical Considerations: Addressing ethical dilemmas surrounding autonomous vehicle decision-making in unavoidable accident scenarios is crucial for public trust and acceptance.

ETFs and Investing in the Autonomous Vehicle Sector

Investing in the autonomous vehicle sector can be achieved through diverse ETFs. This offers diversification and reduces reliance on individual companies.

Types of Relevant ETFs

Several ETFs offer exposure to the AV market:

- Technology ETFs: Many technology ETFs hold shares of companies developing key AV technologies like AI, sensors, and software. (Examples: [Insert ETF tickers and links here – e.g., Invesco QQQ Trust (QQQ), Technology Select Sector SPDR Fund (XLK)])

- Robotics ETFs: ETFs focused on robotics and automation often include companies involved in the development of autonomous vehicle components and systems. (Examples: [Insert ETF tickers and links here])

- Autonomous Vehicle Specific ETFs: Some ETFs are specifically designed to invest in companies directly involved in the development and production of autonomous vehicles. (Examples: [Insert ETF tickers and links here – if such ETFs exist. Otherwise, explain the lack of truly dedicated AV ETFs])

Assessing ETF Risk and Return

Investing in AV-related ETFs carries both high risk and high reward potential:

- Market Volatility: The AV market is volatile, susceptible to rapid changes in technology, regulation, and consumer sentiment.

- Technological Disruption: Rapid technological advancements could render existing technologies obsolete, impacting the value of investments.

- Regulatory Uncertainty: Uncertain regulatory landscapes add to the investment risk.

Diversification Strategies

Incorporating AV ETFs into a diversified portfolio can mitigate risk:

- Asset Allocation: AV ETFs should be a part of a well-diversified portfolio, not the sole investment.

- Risk Tolerance: Only invest an amount you are comfortable losing, given the inherent volatility of the sector.

- Long-Term Investment: Consider AV ETFs as a long-term investment, rather than a short-term trading opportunity.

Uber's Position in the Autonomous Vehicle Market

Uber has made significant strides in the autonomous vehicle space, although its path has faced challenges.

Uber's AV Technology and Strategy

Uber's Advanced Technologies Group (ATG) was pivotal in its autonomous driving ambitions. While Uber has scaled back its direct AV development, its past investments and partnerships have shaped its understanding of the space.

- Past Investments: Uber has invested heavily in AV technology, research, and development.

- Partnerships: Collaboration with other companies in the AV sector provided crucial expertise and resources.

- Current Focus: Uber's current strategy might focus less on direct AV development and more on leveraging the technology developed by others, influencing its ride-sharing services.

Uber's Business Model and Risks

The success of autonomous vehicles could significantly impact Uber's business model:

- Driver Employment: Widespread AV adoption would drastically reduce the need for human drivers, impacting Uber's workforce and potentially causing labor disputes.

- Operating Costs: Autonomous vehicles could potentially lower operating costs for Uber, increasing profitability.

- Revenue Generation: The introduction of self-driving vehicles might change Uber's pricing models and revenue streams.

Investing in Uber Through ETFs

Gaining exposure to Uber's potential can be achieved indirectly through ETFs:

- Broad Market ETFs: Many broad market ETFs include Uber in their holdings, offering diversified exposure.

- Technology ETFs: Technology-focused ETFs often include Uber due to its technological involvement and advancements.

Conclusion: Autonomous Vehicles and ETFs: Making Informed Investment Decisions

Investing in the autonomous vehicle sector via ETFs presents both significant opportunities and substantial risks. While the potential for high returns exists, market volatility, technological disruption, and regulatory uncertainty necessitate careful consideration. Uber's role in this evolving landscape is complex and its future is influenced by the overall adoption of AV technology. Whether investing in companies like Uber through ETFs is a "smart" move depends entirely on your individual risk tolerance and investment goals.

Before making any investment decisions concerning autonomous vehicle ETFs, conduct thorough due diligence. Consult with a qualified financial advisor to create a personalized investment strategy that aligns with your risk profile and financial objectives. Staying informed about the ever-changing autonomous vehicle market is crucial for successful investing in this dynamic sector, so continue your research on investing in autonomous vehicle ETFs and autonomous vehicle investment strategies.

Featured Posts

-

Tony Bennett His Career Collaborations And Impact

May 17, 2025

Tony Bennett His Career Collaborations And Impact

May 17, 2025 -

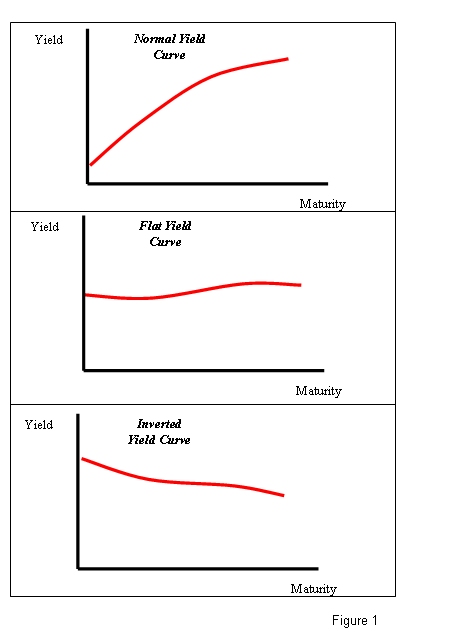

Investor Uncertainty Japans Steep Bond Curve And Its Market Effects

May 17, 2025

Investor Uncertainty Japans Steep Bond Curve And Its Market Effects

May 17, 2025 -

Josh Harts Wifes Reaction To Jaylen Browns Key Game 5 Plays

May 17, 2025

Josh Harts Wifes Reaction To Jaylen Browns Key Game 5 Plays

May 17, 2025 -

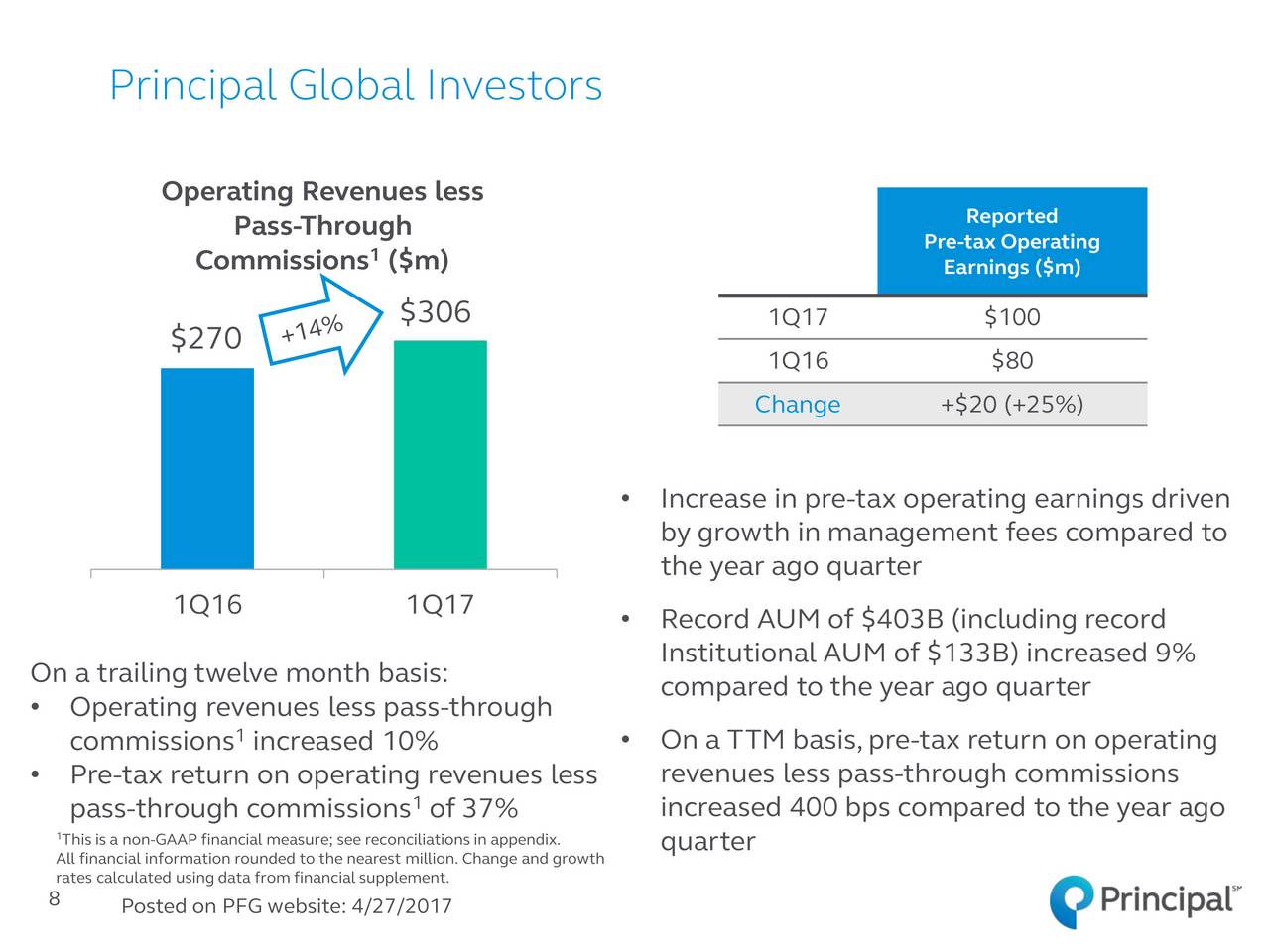

13 Analyst Assessments Of Principal Financial Group Pfg Key Insights

May 17, 2025

13 Analyst Assessments Of Principal Financial Group Pfg Key Insights

May 17, 2025 -

Djokovic In Yasa Meydan Okuyan Basarisi 37 Yasindaki Bir Sampiyon

May 17, 2025

Djokovic In Yasa Meydan Okuyan Basarisi 37 Yasindaki Bir Sampiyon

May 17, 2025

Latest Posts

-

Nba Season Finale Watch Ny Knicks Vs Brooklyn Nets Live Stream Free 4 13 25

May 17, 2025

Nba Season Finale Watch Ny Knicks Vs Brooklyn Nets Live Stream Free 4 13 25

May 17, 2025 -

Free Live Stream Ny Knicks Vs Brooklyn Nets Nba Season Finale On 4 13 25 Time And Channel Info

May 17, 2025

Free Live Stream Ny Knicks Vs Brooklyn Nets Nba Season Finale On 4 13 25 Time And Channel Info

May 17, 2025 -

Victoria De Knicks Sobre 76ers Anunoby Con 27 Puntos Racha Negativa Para Filadelfia

May 17, 2025

Victoria De Knicks Sobre 76ers Anunoby Con 27 Puntos Racha Negativa Para Filadelfia

May 17, 2025 -

Anunoby Brilla Con 27 Puntos En Victoria De Knicks Sobre 76ers

May 17, 2025

Anunoby Brilla Con 27 Puntos En Victoria De Knicks Sobre 76ers

May 17, 2025 -

Ny Knicks Vs Brooklyn Nets Free Live Stream 4 13 25 Time Tv Channel And Nba Season Finale Details

May 17, 2025

Ny Knicks Vs Brooklyn Nets Free Live Stream 4 13 25 Time Tv Channel And Nba Season Finale Details

May 17, 2025