Bill Ackman's View: Time Favors The US In Trade Dispute With China

Table of Contents

Ackman's Core Argument: The Long Game Favors the US

Ackman's central thesis rests on the belief that the US possesses inherent advantages that will translate into substantial long-term economic benefits, even amidst the short-term challenges of the trade war. He argues that the US is not just competing; it is strategically positioned to win the long game against China. This perspective is built on several pillars of American strength:

- Superior technological innovation and research capabilities: The US leads in crucial sectors like artificial intelligence, semiconductors, and biotechnology, providing a significant competitive edge.

- Stronger domestic manufacturing capacity and resilience: While outsourcing has been a significant trend, the US is actively working on rebuilding its manufacturing base and reducing its dependence on China.

- A more robust and diversified financial system: The US financial system, despite its challenges, remains the most advanced and liquid globally, attracting investment and supporting economic growth.

- The appeal of the US as a destination for skilled workers and investment: The US continues to attract top talent and investment from around the world, bolstering its innovation and economic capacity. This "brain gain" is a powerful driver of long-term growth.

Analyzing the US Strengths: Technological Superiority and Innovation

The US holds a commanding lead in technological innovation, a critical factor in determining future economic dominance. This advantage is particularly pronounced in sectors poised for explosive growth:

- Artificial Intelligence (AI): US companies are at the forefront of AI research and development, holding a significant lead over Chinese counterparts. This edge translates to advancements in various sectors, from healthcare to finance.

- Semiconductors: The US dominance in semiconductor design and manufacturing is crucial for numerous industries, giving the US leverage in the global tech landscape.

- Biotechnology: American breakthroughs in biotechnology hold immense potential for revolutionizing healthcare and creating new economic opportunities.

This technological superiority allows the US to mitigate the impact of trade tensions by developing and deploying cutting-edge technologies independent of Chinese supply chains. Moreover, continued government investment in research and development further strengthens this strategic advantage.

The Resilience of the US Economy: Domestic Manufacturing and Diversification

The US is actively working to strengthen its domestic manufacturing base and lessen its reliance on Chinese imports. This involves a multi-pronged approach:

- Reshoring and nearshoring: Companies are actively bringing manufacturing back to the US or relocating it to countries closer to home, reducing vulnerability to geopolitical disruptions.

- Government policies supporting domestic industries: Initiatives such as tax incentives and subsidies are designed to encourage domestic production and strengthen key sectors.

- Diversification of supply chains: Companies are actively diversifying their supply chains to reduce their dependence on China and mitigate risks associated with trade disputes.

These efforts, while requiring time and investment, are essential for building a more resilient and self-sufficient US economy, lessening the impact of future trade conflicts with China.

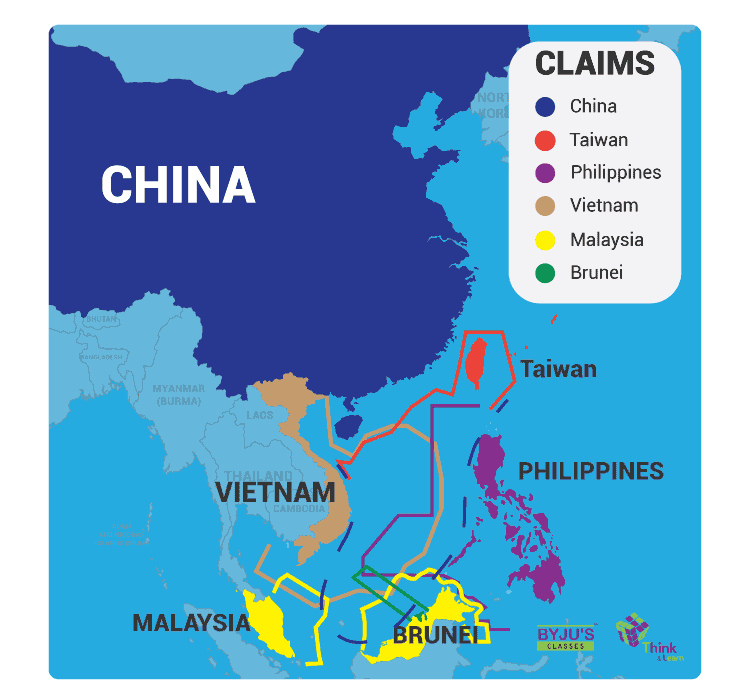

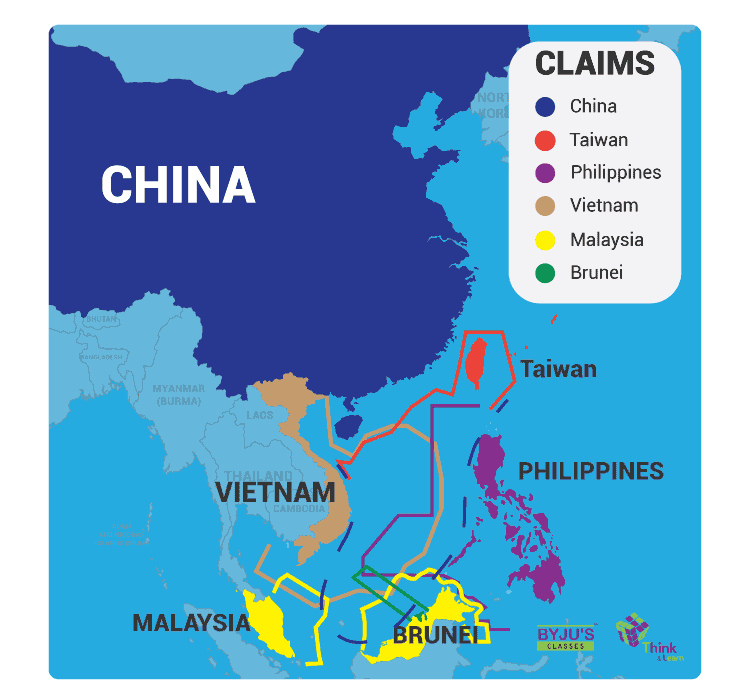

Geopolitical Considerations: The Shifting Global Landscape

The US-China trade dispute is not simply an economic issue; it’s embedded within a larger geopolitical context:

- Concerns about China's economic practices and human rights record: Growing international concern over China's trade practices and human rights record is pushing nations to diversify their partnerships and reduce their reliance on China.

- The role of alliances and international partnerships: The US is strengthening its alliances and partnerships to counterbalance China's growing influence and create a more balanced global economic order.

- Impact on global supply chains and investment flows: The trade war is reshaping global supply chains and investment flows, with many companies re-evaluating their strategies to reduce their exposure to geopolitical risks.

These geopolitical factors contribute to the overall picture, suggesting that the long-term strategic advantage may lie with the US as nations increasingly seek to diversify their economic partnerships away from China.

Counterarguments and Potential Risks

While Ackman's bullish outlook is compelling, it's crucial to acknowledge potential drawbacks:

- Short-term economic pain from trade tariffs: The immediate impact of tariffs can be felt by consumers and businesses, leading to higher prices and reduced economic activity in the short term.

- Unforeseen economic shocks: Global economies are interconnected; unforeseen events could negatively affect the US economy, irrespective of the trade dispute.

- Complexities of global trade relations: Navigating the complexities of international trade requires careful diplomacy and strategic decision-making. Unexpected shifts in global alliances could impact the trade war's trajectory.

These considerations highlight the need for careful risk management and a nuanced approach to investment strategy.

Conclusion

Bill Ackman’s view that time favors the US in its trade dispute with China rests on several strong pillars: the US's technological leadership, economic resilience, and strategic geopolitical positioning. While acknowledging the short-term challenges and potential risks associated with the trade war, the long-term outlook, according to Ackman's assessment, points towards a US economic advantage. A long-term investment strategy focused on US companies and sectors poised to benefit from this evolving landscape aligns with this perspective. However, careful consideration of the complexities of the US-China trade war and a diversification of investment approaches are crucial. Learn more about the intricacies of the US-China trade war and refine your investment strategy accordingly.

Featured Posts

-

Hair And Tattoo Transformations Learning From Ariana Grandes Professional Choices

Apr 27, 2025

Hair And Tattoo Transformations Learning From Ariana Grandes Professional Choices

Apr 27, 2025 -

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Resistance To Ev Mandates Grows Among Car Dealers

Apr 27, 2025

Resistance To Ev Mandates Grows Among Car Dealers

Apr 27, 2025 -

Cannes 2025 Juliette Binoche To Head The Jury

Apr 27, 2025

Cannes 2025 Juliette Binoche To Head The Jury

Apr 27, 2025 -

Belinda Bencic Triumphs First Wta Win After Motherhood

Apr 27, 2025

Belinda Bencic Triumphs First Wta Win After Motherhood

Apr 27, 2025

Latest Posts

-

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025 -

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025 -

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025 -

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025 -

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025