Bitcoin Rebound: Is This The Start Of A New Bull Run?

Table of Contents

Analyzing the Recent Bitcoin Price Surge

The recent increase in Bitcoin's price warrants a thorough examination to determine its sustainability. Let's look at several key indicators.

Technical Indicators

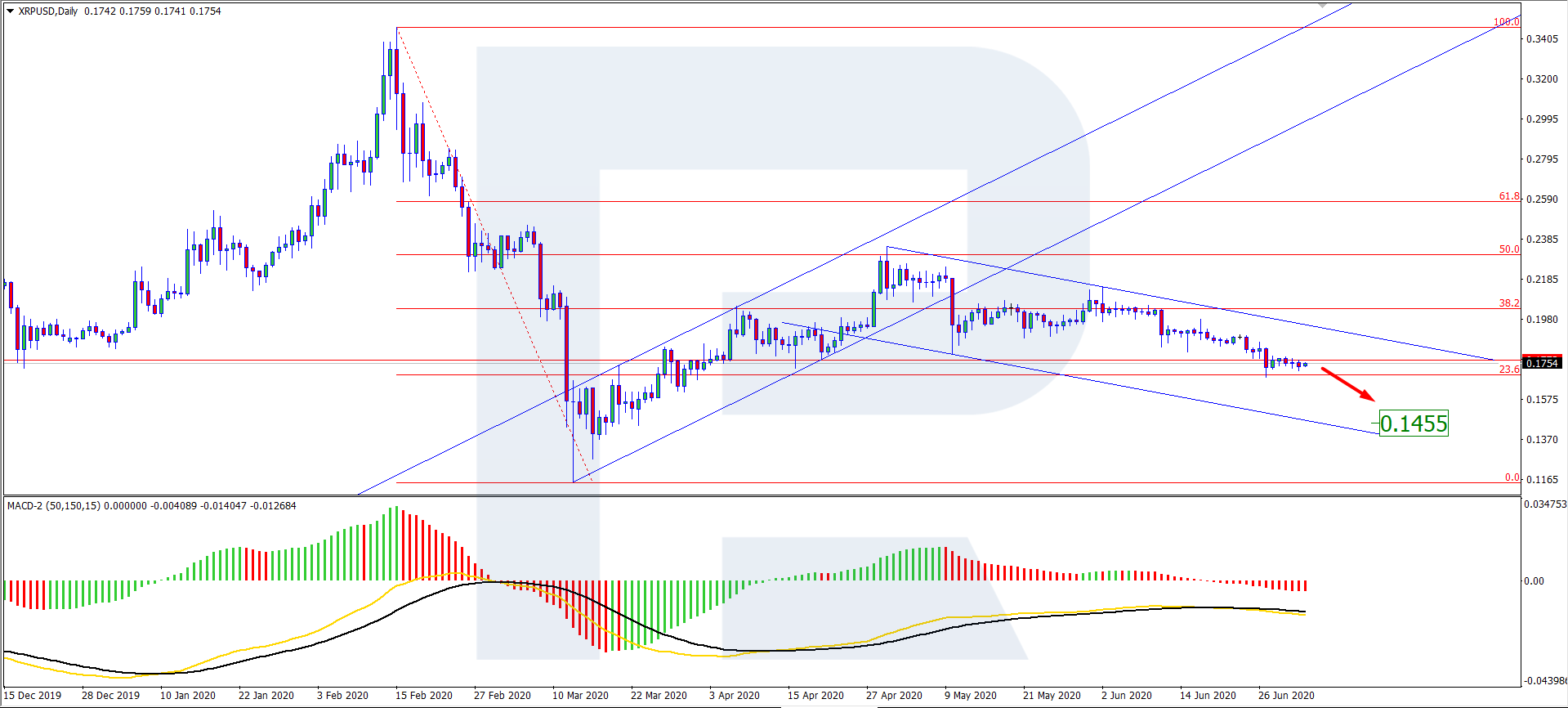

Technical analysis provides valuable insights into potential price movements. Several key indicators suggest a possible shift in market momentum:

- Relative Strength Index (RSI): A reading above 70 often signals overbought conditions, suggesting a potential correction. However, sustained periods above this level can indicate strong bullish momentum. Analyzing the RSI in conjunction with other indicators is crucial.

- Moving Averages: The crossing of short-term moving averages (e.g., 50-day) above long-term moving averages (e.g., 200-day) can be a bullish signal, signifying a potential trend reversal. Conversely, a bearish crossover suggests a weakening trend.

- MACD (Moving Average Convergence Divergence): A bullish crossover (MACD line crossing above the signal line) can suggest a potential upswing. The divergence between price action and the MACD can also provide early warning signs of a potential trend reversal.

(Insert chart visualizing these indicators here)

On-Chain Data

Examining on-chain metrics provides a deeper understanding of market activity and investor behavior.

- Transaction Volume: A significant increase in transaction volume often accompanies price rallies, indicating heightened activity and investor interest.

- Active Addresses: A rise in the number of active Bitcoin addresses suggests growing participation and adoption of the cryptocurrency.

- Mining Difficulty: Changes in mining difficulty reflect the network's computational power and can indirectly influence the Bitcoin price. Increased difficulty often suggests a healthy and robust network.

Analyzing these on-chain metrics in relation to past bull runs helps to assess the current market's strength and potential for sustained growth.

Market Sentiment and Media Coverage

The overall sentiment surrounding Bitcoin plays a crucial role in price movements.

- Social Media Trends: A surge in positive social media sentiment, coupled with reduced fear, uncertainty, and doubt (FUD), can fuel price increases. Conversely, widespread FUD can trigger sell-offs.

- News Coverage: Positive news coverage, such as institutional adoption or regulatory clarity, can boost market confidence and drive prices higher. Negative news, however, can lead to price drops.

- Fear of Missing Out (FOMO): As the Bitcoin price rises, FOMO can lead to increased buying pressure, further driving up the price.

Factors That Could Fuel a Bitcoin Bull Run

Several factors could contribute to a sustained Bitcoin bull run.

Institutional Adoption

The growing acceptance of Bitcoin by institutional investors is a significant catalyst for price appreciation.

- Corporate Investments: Major corporations adding Bitcoin to their treasury reserves demonstrate confidence in the asset's long-term value.

- Hedge Fund Investments: Increased allocations by hedge funds signal a growing belief in Bitcoin's potential for significant returns.

- Impact on Market Cap: Large institutional investments directly influence Bitcoin's market capitalization and indirectly influence its price.

Regulatory Clarity (or Lack Thereof)

Regulatory developments significantly impact Bitcoin's price.

- Positive Regulatory Actions: Clear, favorable regulations in key jurisdictions can boost investor confidence and attract more investment.

- Negative Regulatory Actions: Conversely, restrictive or unclear regulations can create uncertainty and lead to price volatility or decline.

- Global Regulatory Landscape: The evolving regulatory landscape globally needs careful monitoring for its impact on Bitcoin's price.

Macroeconomic Factors

Macroeconomic conditions significantly influence Bitcoin's performance.

- Inflation: High inflation can drive investors towards Bitcoin as an inflation hedge.

- Interest Rates: Changes in interest rates can affect the attractiveness of Bitcoin relative to other investment options.

- Global Economic Uncertainty: Periods of global economic uncertainty can increase demand for Bitcoin as a safe-haven asset.

Factors That Could Hinder a Bitcoin Bull Run

Despite the positive indicators, several factors could hinder a sustained Bitcoin bull run.

Potential Market Corrections

Short-term price corrections are a normal part of any market cycle.

- Profit-Taking: After significant price increases, profit-taking by investors can trigger temporary price declines.

- Regulatory Uncertainty: Unclear or negative regulatory developments can lead to market corrections.

- Market Volatility: The inherent volatility of the cryptocurrency market means sudden price swings are common.

Bitcoin's Energy Consumption Debate

Concerns about Bitcoin's energy consumption remain a significant challenge.

- Environmental Impact: The environmental impact of Bitcoin mining is a subject of ongoing debate and potential regulatory scrutiny.

- Sustainable Mining Practices: The adoption of more sustainable mining practices is crucial to address these concerns.

- Public Perception: Negative public perception related to energy consumption can affect Bitcoin's adoption and price.

Competition from Altcoins

The emergence of other cryptocurrencies poses a competitive threat to Bitcoin's dominance.

- Altcoin Innovation: Innovation in the altcoin space can attract investment away from Bitcoin.

- Market Share: The potential loss of market share to altcoins can put downward pressure on Bitcoin's price.

- Diversification: Investors might diversify their portfolios, reducing their exposure to Bitcoin.

Conclusion

The recent Bitcoin rebound presents a compelling case for a potential bull run, supported by positive technical indicators, increasing institutional adoption, and macroeconomic factors. However, potential market corrections, concerns about energy consumption, and competition from altcoins could hinder sustained growth. Analyzing the Bitcoin rebound requires a balanced assessment of these factors. This Bitcoin price prediction remains uncertain, highlighting the need for careful consideration and diversification within any investment strategy. To navigate this exciting market and potentially capitalize on the Bitcoin rebound, stay informed on the latest Bitcoin developments and make informed decisions. Keep up with the latest news to understand the Bitcoin rebound and its potential impact on your investment strategy.

Featured Posts

-

The Sonos Ikea Partnership A Retrospective And Whats Next

May 08, 2025

The Sonos Ikea Partnership A Retrospective And Whats Next

May 08, 2025 -

Assassins Creed Shadows Of Mordor Ps 5 Pro Enhanced Visuals With Ray Tracing

May 08, 2025

Assassins Creed Shadows Of Mordor Ps 5 Pro Enhanced Visuals With Ray Tracing

May 08, 2025 -

Historical Universal Credit Refunds Find Out If You Re Entitled

May 08, 2025

Historical Universal Credit Refunds Find Out If You Re Entitled

May 08, 2025 -

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025 -

Play Station Podcast 512 A Deep Dive Into True Blue

May 08, 2025

Play Station Podcast 512 A Deep Dive Into True Blue

May 08, 2025

Latest Posts

-

The Andor Season 2 Trailer Delay A Deep Dive Into Fan Reactions And Predictions

May 08, 2025

The Andor Season 2 Trailer Delay A Deep Dive Into Fan Reactions And Predictions

May 08, 2025 -

Andor Season 2 Delayed Trailer Ignites Fan Speculation And Anxiety

May 08, 2025

Andor Season 2 Delayed Trailer Ignites Fan Speculation And Anxiety

May 08, 2025 -

Andor Season 2 Trailer Delay Fueling Fan Frustration And Theories

May 08, 2025

Andor Season 2 Trailer Delay Fueling Fan Frustration And Theories

May 08, 2025 -

Andor Season 1 Where To Stream Episodes 1 3 Hulu And You Tube

May 08, 2025

Andor Season 1 Where To Stream Episodes 1 3 Hulu And You Tube

May 08, 2025 -

Andors First Look Everything We Hoped For And More In The Star Wars Universe

May 08, 2025

Andors First Look Everything We Hoped For And More In The Star Wars Universe

May 08, 2025