Bitcoin's Future: Analyzing The Potential Of A Trump-Fueled Rally To $100,000

Table of Contents

H2: Trump's Economic Policies and their Impact on Bitcoin

A Trump presidency is often associated with specific economic policies that could significantly impact the cryptocurrency market. Understanding these potential impacts is crucial for assessing Bitcoin's future trajectory.

H3: Deregulation and Crypto Adoption

Trump's historically pro-business and deregulation stance could significantly boost cryptocurrency adoption. Less stringent regulations could lead to:

- Increased institutional investment: Larger financial institutions may feel more comfortable investing in Bitcoin with reduced regulatory hurdles.

- Fewer regulatory hurdles for crypto exchanges: This could lead to increased liquidity and accessibility for retail investors.

- Positive sentiment towards innovation: A less interventionist approach from the government might foster a more favorable environment for technological innovation, including cryptocurrencies.

H3: Inflation Hedge and the Dollar's Strength

Bitcoin is often touted as a potential inflation hedge. Trump's economic policies, depending on their implementation, could influence inflation rates and, consequently, the value of the US dollar.

- Potential for increased inflation under certain economic scenarios: If inflation rises, investors might seek alternative assets to preserve their purchasing power, driving demand for Bitcoin.

- Bitcoin's limited supply as a contrasting factor: Bitcoin's fixed supply of 21 million coins makes it a deflationary asset, contrasting with inflationary fiat currencies.

- Investor flight to safety: Economic uncertainty could drive investors towards Bitcoin as a perceived safe haven asset, bolstering its price.

H2: Political Uncertainty and the "Flight to Safety"

Political uncertainty, whether domestic or international, can significantly impact financial markets. This uncertainty could potentially benefit Bitcoin.

H3: Geopolitical Risk and Bitcoin's Safe Haven Status

Geopolitical instability often leads investors to seek safe haven assets, and Bitcoin's decentralized and less regulated nature could make it an attractive option.

- Examples of past geopolitical events impacting Bitcoin's price: Past instances of global crises have demonstrated Bitcoin's ability to act as a safe haven during periods of market turbulence.

- Investor sentiment during times of economic instability: Fear and uncertainty can fuel demand for Bitcoin as investors look for alternatives to traditional markets.

- Bitcoin's perceived resilience to government control: Its decentralized structure makes it less susceptible to government manipulation, making it attractive to those seeking refuge from political or economic instability.

H3: Market Sentiment and Speculative Trading

Market psychology and speculative trading play a significant role in Bitcoin's price volatility. A Trump presidency could significantly influence market sentiment.

- Impact of social media trends and news cycles on Bitcoin's price: Social media hype and news cycles can drive dramatic price swings, irrespective of fundamental factors.

- The role of institutional investors vs. retail traders: The interplay between large institutional investors and smaller retail traders significantly impacts price dynamics.

- Potential for pump and dump schemes: Political uncertainty can increase the risk of manipulative trading practices, adding another layer of complexity to price predictions.

H2: Technological Advancements and Bitcoin's Long-Term Potential

Technological advancements continue to improve Bitcoin's functionality and usability, influencing its long-term potential and price.

H3: The Lightning Network and Scalability

The Lightning Network, a layer-two scaling solution, aims to address Bitcoin's scalability challenges. Its widespread adoption could significantly impact price.

- Increased transaction speed and lower fees: Faster and cheaper transactions make Bitcoin more accessible for everyday use.

- Wider accessibility: Improvements in scalability make Bitcoin more practical for a larger user base.

- Potential for greater use cases beyond investment: Increased usability expands Bitcoin's potential applications beyond simply being a store of value.

H3: Institutional Adoption and ETFs

Growing institutional investment and the potential approval of Bitcoin ETFs are crucial factors influencing Bitcoin's price.

- Grayscale Bitcoin Trust: The success of Grayscale's Bitcoin Trust shows increasing institutional interest.

- Potential for increased liquidity: Increased institutional involvement leads to greater liquidity in the market.

- Regulatory approval as a catalyst for price increase: Regulatory approval of Bitcoin ETFs could further legitimize Bitcoin and attract significant investment.

3. Conclusion

This analysis suggests that a Trump presidency could potentially create conditions favorable for a significant Bitcoin price increase. His economic policies, the resulting political uncertainty, and ongoing technological advancements could all converge to drive demand and push the price towards—or even beyond—$100,000. However, it's crucial to remember that Bitcoin remains a highly volatile asset, and predicting its price with certainty is impossible. Various factors could impact the outcome, including unforeseen global events and regulatory changes. The potential for a "Trump-fueled rally to $100,000" is certainly a possibility, but responsible investment and thorough risk management are paramount. Learn more about Bitcoin's future and the potential for a Trump-fueled rally to $100,000 by [link to relevant resource/further reading]. Remember to always conduct your own research and consider your risk tolerance before investing in any cryptocurrency. Understanding Bitcoin's future requires careful consideration of multiple factors and a comprehensive approach to risk management.

Featured Posts

-

Bitcoins Future Analyzing The Critical Price Levels

May 08, 2025

Bitcoins Future Analyzing The Critical Price Levels

May 08, 2025 -

San Franciscos Anchor Brewing Company Shuts Down A Historic Brewery Closes Its Doors

May 08, 2025

San Franciscos Anchor Brewing Company Shuts Down A Historic Brewery Closes Its Doors

May 08, 2025 -

Is 2025 Stephen Kings Best Year Yet Even If The Monkey Flops

May 08, 2025

Is 2025 Stephen Kings Best Year Yet Even If The Monkey Flops

May 08, 2025 -

Where To Buy A Ps 5 Before A Potential Price Increase

May 08, 2025

Where To Buy A Ps 5 Before A Potential Price Increase

May 08, 2025 -

Analysis 67 M Ethereum Liquidation And The Implications For The Market

May 08, 2025

Analysis 67 M Ethereum Liquidation And The Implications For The Market

May 08, 2025

Latest Posts

-

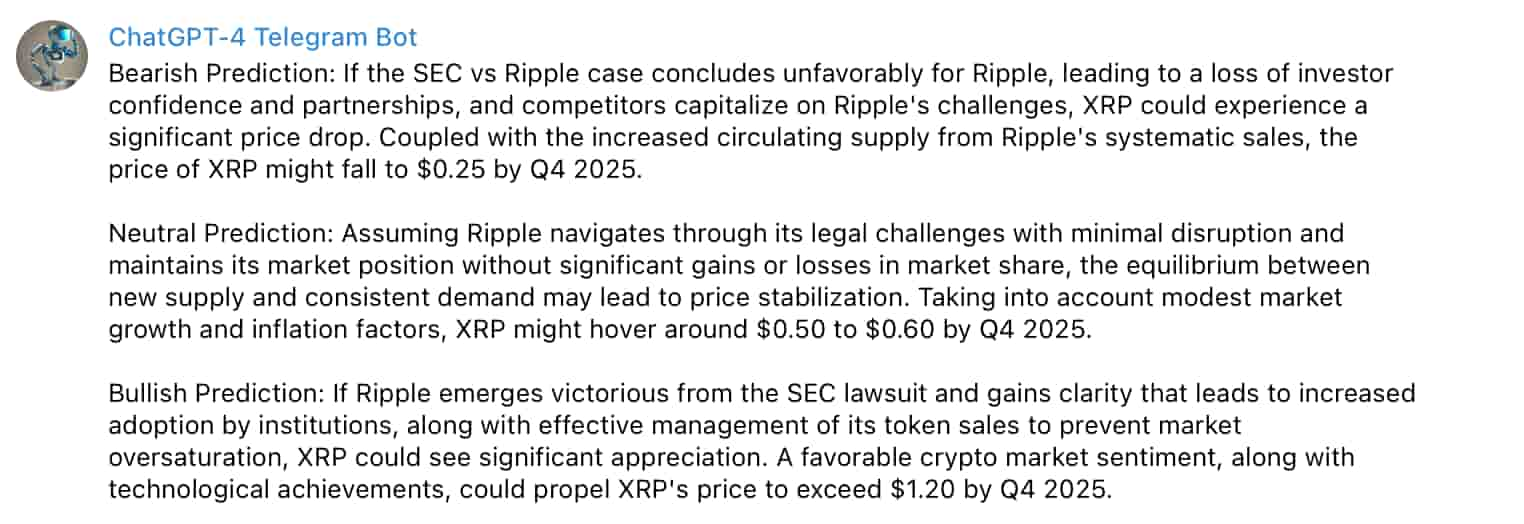

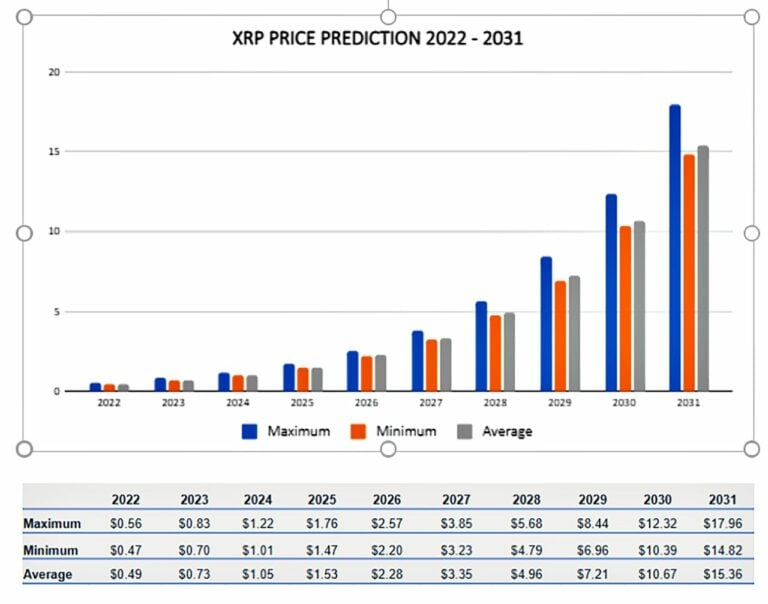

Xrps Surge Outpacing Bitcoin And Other Cryptocurrencies After Secs Grayscale Etf Filing

May 08, 2025

Xrps Surge Outpacing Bitcoin And Other Cryptocurrencies After Secs Grayscale Etf Filing

May 08, 2025 -

Xrp To 5 In 2025 A Comprehensive Look At The Potential

May 08, 2025

Xrp To 5 In 2025 A Comprehensive Look At The Potential

May 08, 2025 -

Will Xrp Hit 5 By 2025 Exploring The Possibilities

May 08, 2025

Will Xrp Hit 5 By 2025 Exploring The Possibilities

May 08, 2025 -

The Secs Stance On Xrp Implications For Investors And The Future Of Crypto

May 08, 2025

The Secs Stance On Xrp Implications For Investors And The Future Of Crypto

May 08, 2025 -

Xrp Price Prediction 2025 Can It Hit 5

May 08, 2025

Xrp Price Prediction 2025 Can It Hit 5

May 08, 2025