Bitcoin's Potential: A Growth Investor Predicts A 1,500% Increase

Table of Contents

The Investor's Rationale Behind the 1500% Bitcoin Price Prediction

This audacious Bitcoin price prediction isn't based on speculation. The investor, with a proven track record in identifying emerging market trends, points to several converging factors that support this bullish outlook for Bitcoin investment.

Adoption and Institutional Investment

The growing adoption of Bitcoin by institutional investors is a pivotal factor. Giants like MicroStrategy and Tesla have made significant Bitcoin purchases, signaling a shift in perception from a fringe asset to a potential store of value within mainstream financial portfolios.

- Examples: MicroStrategy's multi-billion dollar Bitcoin acquisitions have significantly influenced market sentiment. Tesla's foray into Bitcoin, though later partially reversed, demonstrated a major corporation's willingness to hold Bitcoin as a treasury asset.

- Regulatory Clarity (or Lack Thereof): While regulatory clarity is still evolving globally, the increasing acceptance of Bitcoin by large financial institutions suggests a growing level of comfort with its regulatory status. However, uncertainty in specific jurisdictions remains a potential risk.

- ETFs: The potential approval of Bitcoin ETFs (Exchange-Traded Funds) could significantly boost accessibility and liquidity for mainstream investors, driving further price appreciation. This would make Bitcoin investment significantly easier for many.

Scarcity and Deflationary Nature

Bitcoin's inherent scarcity is a key driver of its potential. Only 21 million coins will ever exist, creating a finite supply. This contrasts sharply with fiat currencies, which are subject to inflationary pressures.

- Comparison to Fiat: Unlike fiat currencies, where central banks can increase the money supply, Bitcoin's fixed supply creates a deflationary pressure, meaning its value could potentially increase over time due to increasing demand.

- Bitcoin Halving Events: The Bitcoin halving, which reduces the rate of new Bitcoin creation, has historically coincided with significant price increases. This predictable event reinforces Bitcoin’s deflationary nature.

- Store of Value: Many see Bitcoin as a potential hedge against inflation and a store of value, similar to gold, further fueling demand and driving up its price.

Technological Advancements and Network Effects

Continuous improvements in Bitcoin's underlying technology enhance its scalability and usability, further boosting its appeal.

- Lightning Network: This layer-2 scaling solution significantly improves transaction speeds and reduces fees, making Bitcoin more practical for everyday transactions.

- Taproot Upgrade: This upgrade enhances privacy and efficiency, making Bitcoin transactions more secure and less expensive.

- Network Effect: As more people adopt Bitcoin, its network effect strengthens, increasing its value and security. A larger network is inherently more resilient and valuable.

Potential Risks and Challenges in Bitcoin Investment

While the potential for growth is substantial, Bitcoin investment carries significant risks. It's crucial to acknowledge these before considering any investment.

Volatility and Market Corrections

Bitcoin is incredibly volatile. Sharp price swings are common, and significant market corrections are a possibility.

- Past Crashes: Bitcoin's history includes dramatic price drops, highlighting the importance of risk management strategies.

- Risk Management: Dollar-cost averaging (DCA), a strategy involving investing smaller amounts regularly regardless of price fluctuations, can mitigate some of the risk. Diversification within your investment portfolio is also crucial.

Regulatory Uncertainty

The regulatory environment surrounding cryptocurrencies is constantly evolving, creating uncertainty for investors.

- Varying Regulations: Different countries have adopted different approaches to regulating cryptocurrencies, creating a fragmented regulatory landscape.

- Government Crackdowns: There's a risk of government crackdowns or bans, which could significantly impact Bitcoin's price.

Security Concerns

Bitcoin investment involves inherent security risks.

- Wallet Security: Losing your private keys means losing access to your Bitcoin. Using secure wallets and exchanges is crucial.

- Scams and Phishing: Be aware of scams and phishing attempts targeting Bitcoin investors. Only use reputable exchanges and wallets.

Strategies for Capitalizing on Bitcoin's Potential Growth

Successfully navigating the Bitcoin market requires a strategic approach.

Long-Term Investment Strategy

Bitcoin's volatility necessitates a long-term investment strategy.

- Dollar-Cost Averaging (DCA): Investing regularly, regardless of price, can mitigate risk and potentially improve returns over the long term.

- Patience: Avoid emotional decision-making and stick to your investment plan, even during market downturns.

Diversification within a Portfolio

Bitcoin should be part of a well-diversified investment portfolio, not your sole investment.

- Asset Allocation: Diversify across different asset classes, such as stocks, bonds, and real estate, to reduce overall portfolio risk.

Due Diligence and Research

Thorough research is paramount before investing in Bitcoin.

- Credible Sources: Consult reputable sources for information about Bitcoin, and understand its technology and associated risks.

Conclusion

The investor's prediction of a 1500% increase in Bitcoin's price is bold, yet supported by a confluence of factors: growing institutional adoption, its inherent scarcity, and ongoing technological advancements. However, Bitcoin investment comes with substantial risk, including price volatility, regulatory uncertainty, and security concerns. It is crucial to approach Bitcoin investment with caution, conducting thorough research, diversifying your portfolio, and employing responsible risk management strategies. Explore Bitcoin investment, but always prioritize a well-informed and cautious approach. Learn more about Bitcoin's potential and consider adding Bitcoin to your portfolio only after careful consideration of your risk tolerance and financial goals. Remember, past performance is not indicative of future results.

Featured Posts

-

Official Play Station Podcast Episode 512 True Blue Key Takeaways And Analysis

May 08, 2025

Official Play Station Podcast Episode 512 True Blue Key Takeaways And Analysis

May 08, 2025 -

Saturday Night Live And Counting Crows A Career Defining Performance

May 08, 2025

Saturday Night Live And Counting Crows A Career Defining Performance

May 08, 2025 -

Analyzing The Impact Of Liberation Day Tariffs On The Stock Market

May 08, 2025

Analyzing The Impact Of Liberation Day Tariffs On The Stock Market

May 08, 2025 -

Comprehensive Ethereum Price Prediction Analyzing Future Trends And Market Dynamics

May 08, 2025

Comprehensive Ethereum Price Prediction Analyzing Future Trends And Market Dynamics

May 08, 2025 -

Mookie Betts Illness Sidelines Him For Freeway Series Game

May 08, 2025

Mookie Betts Illness Sidelines Him For Freeway Series Game

May 08, 2025

Latest Posts

-

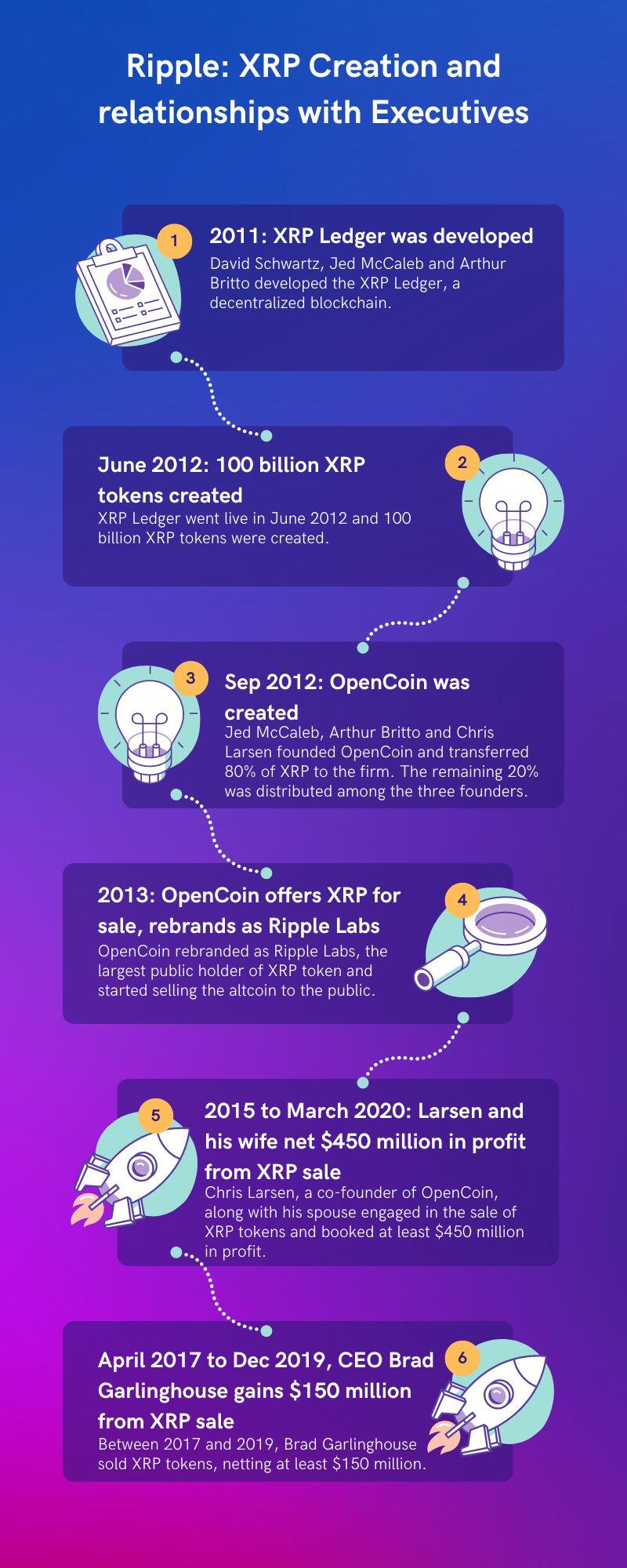

Ripples Xrp Assessing The Likelihood Of A Price Increase To 3 40

May 08, 2025

Ripples Xrp Assessing The Likelihood Of A Price Increase To 3 40

May 08, 2025 -

Is 3 40 A Realistic Price For Xrp Ripples Market Analysis

May 08, 2025

Is 3 40 A Realistic Price For Xrp Ripples Market Analysis

May 08, 2025 -

Xrp Ripple A High Risk High Reward Investment Opportunity

May 08, 2025

Xrp Ripple A High Risk High Reward Investment Opportunity

May 08, 2025 -

Analyzing The Challenges Why Xrp Etfs May Underperform Expectations

May 08, 2025

Analyzing The Challenges Why Xrp Etfs May Underperform Expectations

May 08, 2025 -

Ripple Xrp On The Rise A Look At Its Potential To Hit 3 40

May 08, 2025

Ripple Xrp On The Rise A Look At Its Potential To Hit 3 40

May 08, 2025