Bitcoin's Recent Rebound: What It Means For Investors

Table of Contents

Analyzing the Drivers Behind Bitcoin's Recent Rebound

Several key factors have likely contributed to Bitcoin's recent rebound. Let's delve into the most significant drivers:

Institutional Investment and Adoption

Institutional interest in Bitcoin has steadily increased over the past few years. Large corporations and investment funds are increasingly viewing Bitcoin as a viable asset class, leading to significant capital inflows.

- Examples: Several publicly traded companies, such as MicroStrategy and Tesla, have made substantial Bitcoin purchases, signaling a growing acceptance within the corporate world. Furthermore, the ongoing discussion surrounding Bitcoin ETFs (Exchange Traded Funds) could further drive institutional adoption.

- Impact: This increased institutional investment provides a level of stability and legitimacy, attracting a broader range of investors and potentially reducing volatility in the long run. The flow of institutional capital can significantly influence Bitcoin's price, pushing it upwards as demand increases. Keywords: Institutional Bitcoin investment, Bitcoin ETF, corporate Bitcoin adoption.

Macroeconomic Factors and Inflation

Global macroeconomic conditions play a significant role in Bitcoin's price fluctuations. Periods of economic uncertainty, high inflation, and weakening traditional markets often see increased interest in Bitcoin as a potential hedge against inflation.

- Bitcoin as a Hedge: Bitcoin's limited supply and decentralized nature make it an attractive alternative to traditional fiat currencies, especially during times of high inflation where the value of traditional assets erodes.

- Correlation: We've seen a historical correlation between periods of economic instability and a rise in Bitcoin's price, as investors seek alternative stores of value. Analyzing macroeconomic indicators like inflation rates and interest rates can offer insights into potential future Bitcoin price movements. Keywords: Bitcoin inflation hedge, macroeconomic factors Bitcoin, Bitcoin and inflation.

Regulatory Developments and Legal Clarity

Regulatory clarity and positive developments concerning Bitcoin's legal status can significantly impact investor confidence and price. Increased regulatory certainty often leads to increased institutional investment and broader adoption.

- Positive Developments: While regulatory landscapes vary globally, some jurisdictions are increasingly clarifying Bitcoin's regulatory status, leading to greater investor confidence. Positive regulatory announcements can boost market sentiment and drive price increases.

- Impact: Greater legal clarity reduces uncertainty for investors, attracting more capital and potentially lessening the volatility associated with the cryptocurrency market. Keywords: Bitcoin regulation, cryptocurrency regulation, Bitcoin legal status.

Evaluating the Risks Associated with Bitcoin's Rebound

While the recent rebound is promising, it's crucial to acknowledge the inherent risks associated with Bitcoin investment.

Volatility and Price Fluctuations

Bitcoin's price is notoriously volatile, subject to significant short-term fluctuations.

- Risk: Rapid price swings can lead to substantial losses for investors who aren't prepared for sudden market corrections. Short-term trading in Bitcoin carries significant risk.

- Long-Term Strategy: A long-term investment strategy, combined with robust risk management, is crucial to mitigate these risks. Keywords: Bitcoin volatility risk, Bitcoin price prediction, cryptocurrency risk.

Market Manipulation and Speculation

The Bitcoin market is susceptible to manipulation and speculation, factors that can significantly influence price movements.

- Risk: Large-scale manipulation or coordinated speculative trading can artificially inflate or deflate the price, leading to significant losses for unsuspecting investors.

- Due Diligence: Thorough research and due diligence are essential to avoid falling victim to market manipulation or speculative bubbles. Keywords: Bitcoin market manipulation, Bitcoin speculation, cryptocurrency scams.

Security Risks and Hacks

Security breaches and hacks targeting cryptocurrency exchanges and wallets pose a significant risk to Bitcoin holders.

- Risk: The loss of private keys or exchange hacks can result in the loss of funds.

- Mitigation: Employing secure storage solutions, such as hardware wallets, and selecting reputable exchanges are crucial steps in mitigating these risks. Keywords: Bitcoin security, cryptocurrency security, Bitcoin wallet security.

Investment Strategies for Navigating Bitcoin's Rebound

Investors need a sound strategy to navigate the complexities of Bitcoin's price fluctuations.

Diversification and Risk Management

Diversification is paramount in any investment portfolio, including one holding cryptocurrencies.

- Strategy: Don't put all your eggs in one basket. Diversify your investment across various asset classes, including other cryptocurrencies and traditional investments like stocks and bonds.

- Risk Management: Implement stop-loss orders and other risk management tools to limit potential losses. Keywords: Bitcoin portfolio diversification, risk management Bitcoin, cryptocurrency portfolio.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) is a proven strategy for mitigating risk in volatile markets.

- How it Works: DCA involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This reduces the risk of investing a large sum at a market peak.

- Benefits: It helps smooth out price volatility and reduces the impact of short-term price swings. Keywords: Bitcoin DCA, dollar cost averaging Bitcoin, long-term Bitcoin investment.

Long-Term vs. Short-Term Investing

The choice between long-term and short-term strategies depends on your risk tolerance and financial goals.

- Long-Term: Long-term investors generally have a higher risk tolerance and are less concerned with short-term price fluctuations. They aim to benefit from Bitcoin's potential long-term growth.

- Short-Term: Short-term trading involves frequent buying and selling, seeking to profit from short-term price movements. This approach carries significantly higher risk. Keywords: Long-term Bitcoin investment, short-term Bitcoin trading, Bitcoin investment strategy.

Conclusion: Understanding Bitcoin's Recent Rebound for Informed Investment Decisions

Bitcoin's recent rebound is driven by a combination of institutional adoption, macroeconomic factors, and regulatory developments. However, inherent risks such as volatility, market manipulation, and security concerns remain. Careful analysis, robust risk management, and a long-term perspective are crucial for navigating this dynamic market. Before investing in Bitcoin, conduct thorough research and consider your risk tolerance. Understanding these factors allows for informed investment decisions. For further reading on effective Bitcoin investment strategies and a deeper understanding of the cryptocurrency market outlook, explore reputable financial resources and Bitcoin analysis websites. Make informed decisions about your Bitcoin investment strategy. Learn more about effective Bitcoin analysis techniques to better understand the future of Bitcoin and the broader cryptocurrency market.

Featured Posts

-

Bitcoin Investment Exploring A Potential 1 500 Return

May 08, 2025

Bitcoin Investment Exploring A Potential 1 500 Return

May 08, 2025 -

Sommers Thumb Injury A Setback For Inter In Serie A And Champions League

May 08, 2025

Sommers Thumb Injury A Setback For Inter In Serie A And Champions League

May 08, 2025 -

Dwp Benefit Scrapped Thousands Affected By April 5th Changes

May 08, 2025

Dwp Benefit Scrapped Thousands Affected By April 5th Changes

May 08, 2025 -

Dbs On Polluter Reform A Balanced Approach To Environmental Sustainability

May 08, 2025

Dbs On Polluter Reform A Balanced Approach To Environmental Sustainability

May 08, 2025 -

Hollywood Shut Down Writers And Actors On Strike What It Means For Film And Tv

May 08, 2025

Hollywood Shut Down Writers And Actors On Strike What It Means For Film And Tv

May 08, 2025

Latest Posts

-

Uber Kenyas New Program Cashback For Riders Increased Orders For Drivers And Couriers

May 08, 2025

Uber Kenyas New Program Cashback For Riders Increased Orders For Drivers And Couriers

May 08, 2025 -

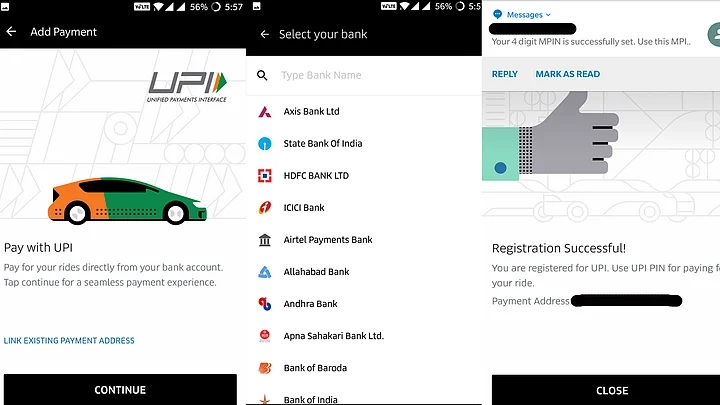

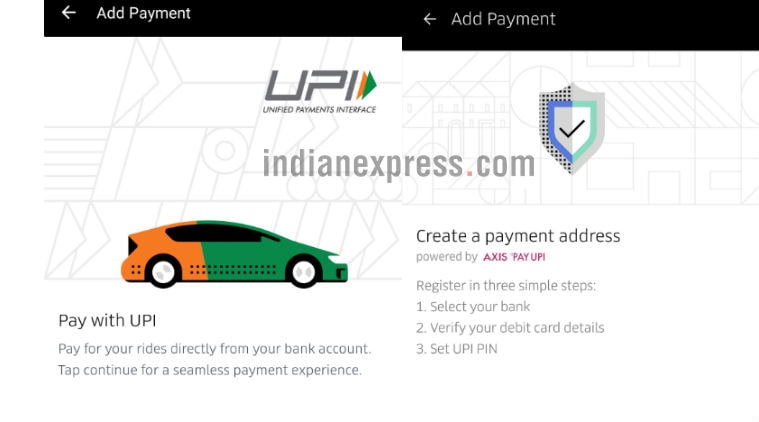

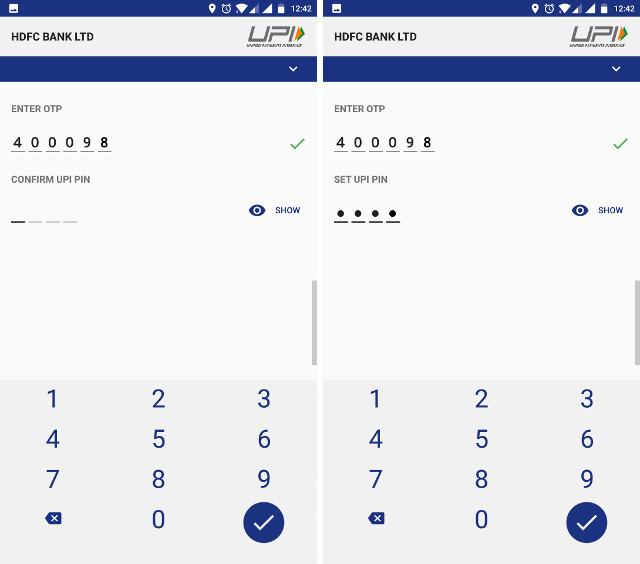

Is Upi Payment Still Available For Uber Auto Rides

May 08, 2025

Is Upi Payment Still Available For Uber Auto Rides

May 08, 2025 -

Uber Auto Payment Options Upi And Beyond

May 08, 2025

Uber Auto Payment Options Upi And Beyond

May 08, 2025 -

Uber Kenya Boosts Customer Rewards And Driver Courier Earnings

May 08, 2025

Uber Kenya Boosts Customer Rewards And Driver Courier Earnings

May 08, 2025 -

No More Cash On Uber Auto Upi Payments Explained

May 08, 2025

No More Cash On Uber Auto Upi Payments Explained

May 08, 2025