DBS On Polluter Reform: A Balanced Approach To Environmental Sustainability?

Table of Contents

DBS's Current Environmental Sustainability Policies

DBS, a leading bank in Asia, has publicly committed to environmental sustainability through various initiatives woven into its Environmental, Social, and Governance (ESG) policies. These policies aim to integrate sustainability considerations into its business operations and financing activities. The bank's rationale emphasizes its role in facilitating a transition to a low-carbon economy and its recognition of the long-term risks associated with climate change.

- Specific examples of initiatives: DBS actively finances green projects, including renewable energy infrastructure and sustainable transportation. They have set ambitious carbon reduction targets for their own operations and are actively engaging their clients to reduce their carbon footprint.

- Frameworks and standards: DBS adheres to various international frameworks and standards, including the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and the United Nations Sustainable Development Goals (SDGs).

- Key Performance Indicators (KPIs): DBS uses several KPIs to track progress towards its sustainability goals, including financed emissions, renewable energy investments, and the percentage of green loans in its portfolio. These metrics allow for transparent monitoring and reporting to stakeholders. The emphasis on measurable progress underpins DBS's commitment to accountable sustainability.

Analyzing DBS's Approach to Polluter Reform

DBS's engagement with polluting industries is a critical aspect of its polluter reform strategy. The bank's approach involves a complex balancing act between supporting economic growth and driving the transition towards a low-carbon economy.

- Divestment from high-emission sectors: While DBS hasn't completely divested from all high-emission sectors, it has significantly reduced its exposure to coal financing and is increasingly prioritizing investments in renewable energy sources. They are actively reviewing their investments in other high-emission sectors, aiming to align their portfolio with the Paris Agreement goals.

- Financing decarbonization: DBS actively provides financing to companies demonstrably committed to decarbonization efforts. This includes providing loans and other financial instruments to support energy efficiency improvements, the adoption of cleaner technologies, and the development of green supply chains. Examples include providing financing for the development of solar farms and wind power projects.

- Incentivizing sustainable practices: DBS incentivizes polluters to adopt sustainable practices through various mechanisms. For instance, it offers preferential lending rates and other financial incentives to clients who commit to ambitious emissions reduction targets and implement sustainable business practices. This demonstrates a clear financial incentive to engage in responsible environmental practices. The effectiveness of these incentives is a subject of ongoing discussion and assessment.

The stringency of DBS's approach remains a subject of debate. While progress has been made, critics argue that the pace of change needs to accelerate to effectively address the climate crisis. Limitations include the continued involvement in some high-emission sectors, albeit with decreasing exposure, and the challenges of accurately measuring and verifying the environmental impact of financed projects.

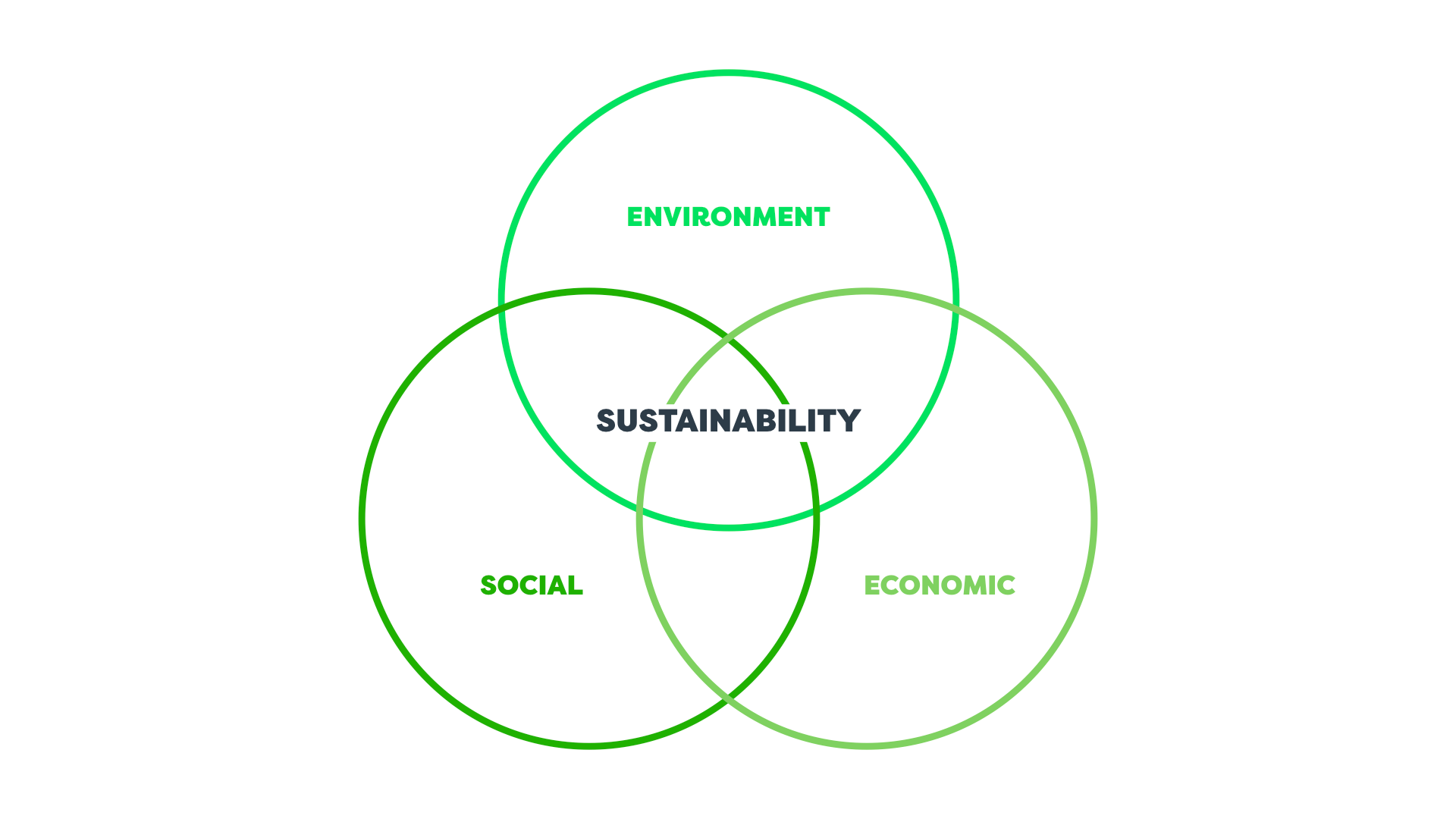

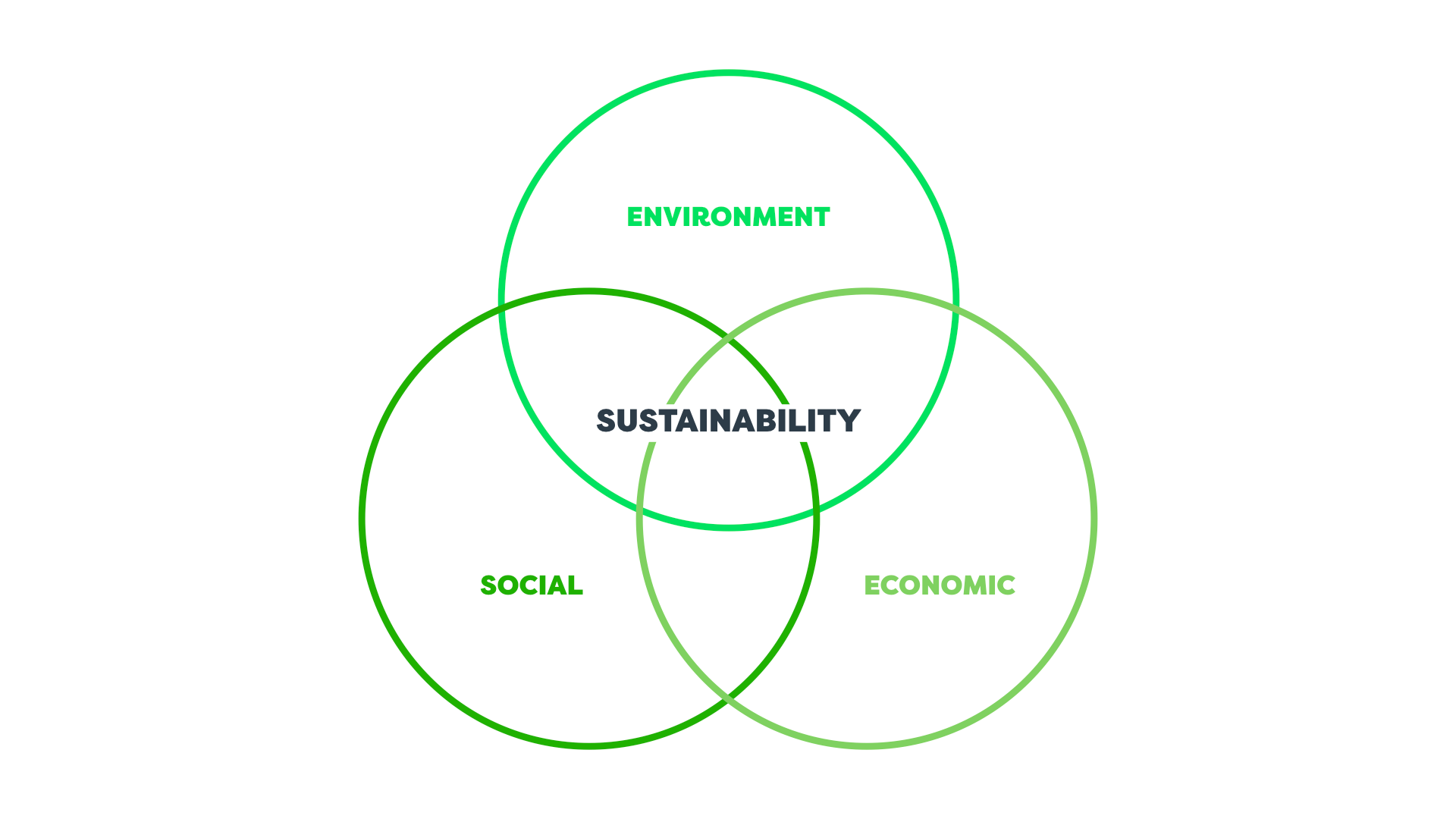

The Balanced Approach: Economic Growth vs. Environmental Protection

DBS's approach to polluter reform highlights the inherent tension between economic growth and environmental protection. Balancing these competing priorities is a major challenge for financial institutions globally.

- Potential economic consequences: Stricter polluter reform measures could have short-term economic consequences for certain industries and companies. Job losses and economic disruptions are potential concerns, especially in heavily polluting sectors undergoing transition.

- Potential benefits of a stricter approach: A more stringent approach to polluter reform could yield significant long-term benefits, including a reduction in greenhouse gas emissions, improved public health, and increased investment in cleaner technologies. These broader societal benefits must be considered alongside immediate economic concerns.

- Balancing competing interests: DBS attempts to balance these competing interests by engaging in a gradual but continuous transition. Their strategy includes providing financial support for businesses committed to sustainable development alongside gradually reducing exposure to high-emission sectors. The effectiveness of this gradual approach remains a point of discussion.

Whether DBS's approach is truly "balanced" is a matter of ongoing evaluation. Some argue it leans too heavily on economic considerations, while others praise its measured approach, recognizing the practical challenges of rapid decarbonization.

Stakeholder Engagement and Transparency

Effective stakeholder engagement and transparency are crucial for building trust and promoting sustainable practices.

- Transparency: DBS publishes regular sustainability reports, detailing its environmental impact and progress towards its goals. However, the level of transparency can be improved further, particularly regarding the detailed environmental impact assessment of individual projects.

- Engagement with stakeholders: DBS engages with NGOs, environmental groups, and other stakeholders to seek input and feedback on its environmental policies. However, consistent, proactive engagement and open dialogue remain crucial for enhancing this aspect of their approach.

- Responding to criticism: DBS's response to criticism regarding its environmental policies varies. While they have publicly addressed concerns in some cases, better mechanisms for addressing stakeholder feedback and integrating it into policy development are important.

DBS's stakeholder engagement strategy requires further improvement to fully support sustainable practices and ensure accountability. Open communication and collaborative efforts will strengthen its influence in promoting sustainable finance and mitigating the negative environmental impacts of their activities.

Conclusion

This analysis of DBS's approach to polluter reform reveals a complex interplay between economic considerations and environmental sustainability. While DBS has taken significant steps to integrate sustainability into its operations and financing activities, challenges remain in achieving a truly balanced approach. The stringency of its polluter reform measures, the transparency of its reporting, and the effectiveness of its stakeholder engagement are all areas for ongoing evaluation and improvement.

This analysis of DBS's approach to polluter reform provides a crucial lens through which to assess the complexities of environmental sustainability in the financial sector. Further research and critical discussion are needed to evaluate the effectiveness of DBS’s and other financial institutions' strategies for achieving meaningful DBS polluter reform and ultimately, a more sustainable future. We encourage readers to delve deeper into the available data and engage in the ongoing conversation surrounding DBS polluter reform and responsible banking practices.

Featured Posts

-

Catholic Church Conclave A New Pope To Be Chosen

May 08, 2025

Catholic Church Conclave A New Pope To Be Chosen

May 08, 2025 -

Top Cryptocurrency Investment Van Ecks 185 Prediction

May 08, 2025

Top Cryptocurrency Investment Van Ecks 185 Prediction

May 08, 2025 -

Xrp Price Prediction 5 Target Realistic After Sec Developments

May 08, 2025

Xrp Price Prediction 5 Target Realistic After Sec Developments

May 08, 2025 -

Trump Media And Crypto Coms Etf Partnership A Detailed Look At Cro

May 08, 2025

Trump Media And Crypto Coms Etf Partnership A Detailed Look At Cro

May 08, 2025 -

Tuerkiye Deki Kripto Piyasasi Bakan Simsek In Goeruesleri Ve Etkileri

May 08, 2025

Tuerkiye Deki Kripto Piyasasi Bakan Simsek In Goeruesleri Ve Etkileri

May 08, 2025

Latest Posts

-

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025 -

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025 -

Understanding Xrps 400 Surge Future Price Prospects

May 08, 2025

Understanding Xrps 400 Surge Future Price Prospects

May 08, 2025 -

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025 -

Is Xrps 400 Rally Sustainable A Look At Future Price Predictions

May 08, 2025

Is Xrps 400 Rally Sustainable A Look At Future Price Predictions

May 08, 2025