BofA On Stock Market Valuations: Reasons For Investor Calm

Table of Contents

BofA's Valuation Assessment: Why Stocks Aren't Overvalued (Yet)

BofA employs a multi-faceted approach to assessing stock valuations, incorporating various metrics. Their methodology includes a rigorous examination of price-to-earnings ratios (P/E), discounted cash flow (DCF) analysis, and comparative valuations across different sectors. This comprehensive analysis helps them gauge whether current market prices accurately reflect underlying company performance and future growth potential.

- Historically High, But Not Excessively So: While valuations are higher than historical averages in some sectors, BofA's analysis doesn't indicate extreme overvaluation across the board. The extent of this increase varies significantly depending on the sector and specific company.

- Mitigating Factors: Several factors are currently mitigating the perceived risk of overvaluation. These include robust corporate earnings growth, historically low interest rates (until recently), and strong performance in specific technology and healthcare sectors.

- Sector-Specific Insights: BofA's report highlights certain sectors as being particularly well-valued, while others show signs of potential overvaluation. For example, the technology sector, while showing robust growth, may warrant closer scrutiny compared to more stable sectors with lower valuations. Detailed sector breakdowns are available in BofA's full report.

The Role of Corporate Earnings in Maintaining Investor Confidence

Strong corporate earnings are a crucial pillar supporting current stock market valuations. BofA's analysis emphasizes the significance of consistent earnings growth in justifying current market prices.

- Strong Performers: BofA highlights several sectors showing exceptional earnings growth, including technology companies benefiting from digital transformation and healthcare companies capitalizing on an aging population. Specific company examples are detailed in their full report.

- Earnings Growth Projections: Positive earnings growth projections for the coming quarters contribute significantly to investor confidence. However, the report also acknowledges the possibility of slower growth in certain sectors.

- Concerns Regarding Future Growth: While current earnings are strong, BofA acknowledges potential headwinds, including rising inflation and supply chain disruptions, that could impact future earnings growth. This tempered optimism is a key aspect of their analysis.

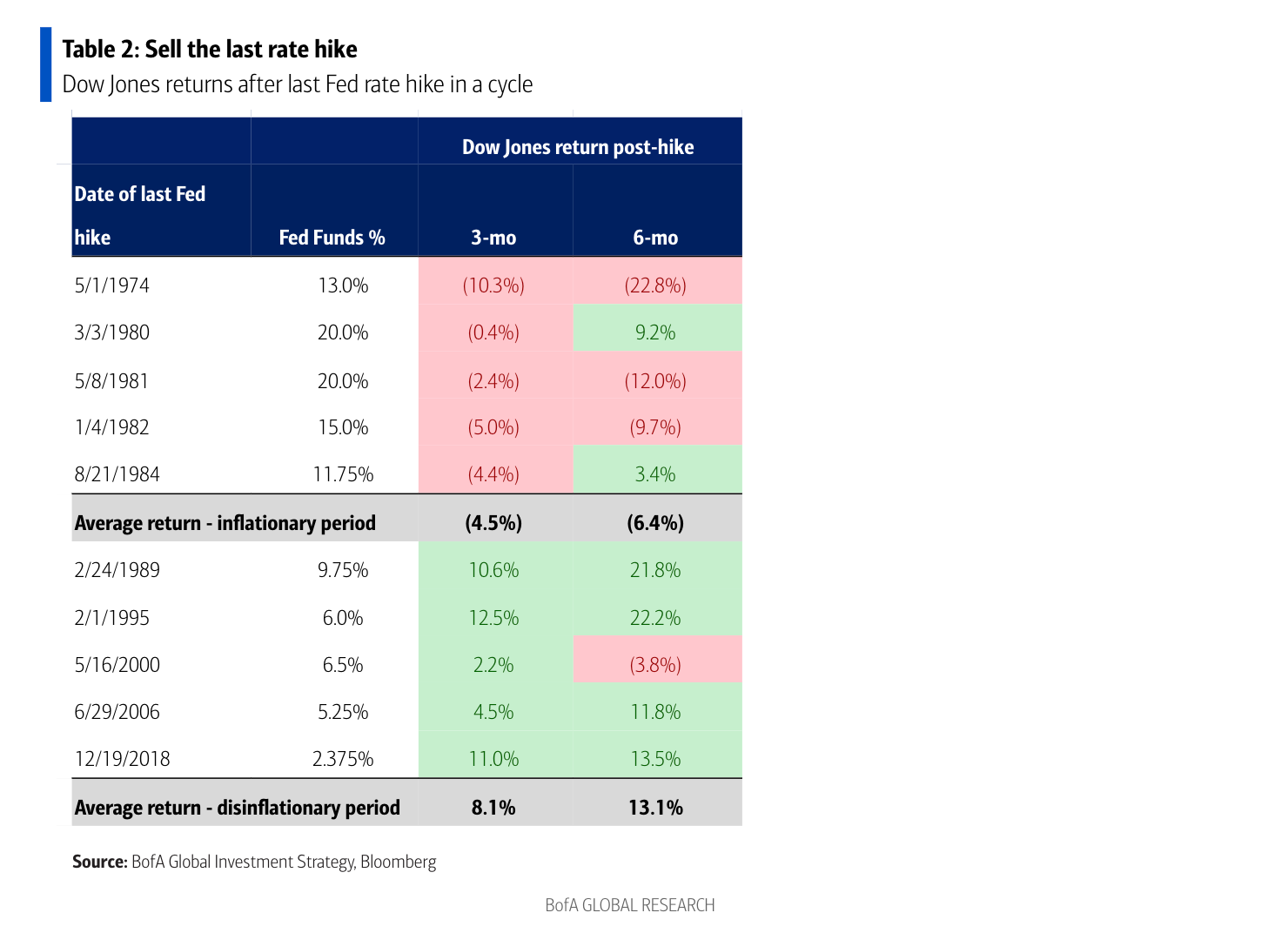

Interest Rates and Their Influence on Stock Market Valuations

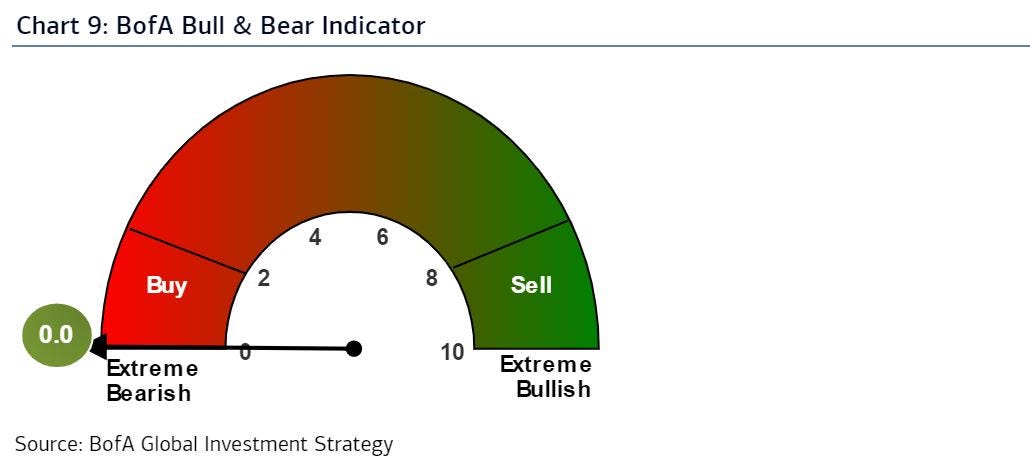

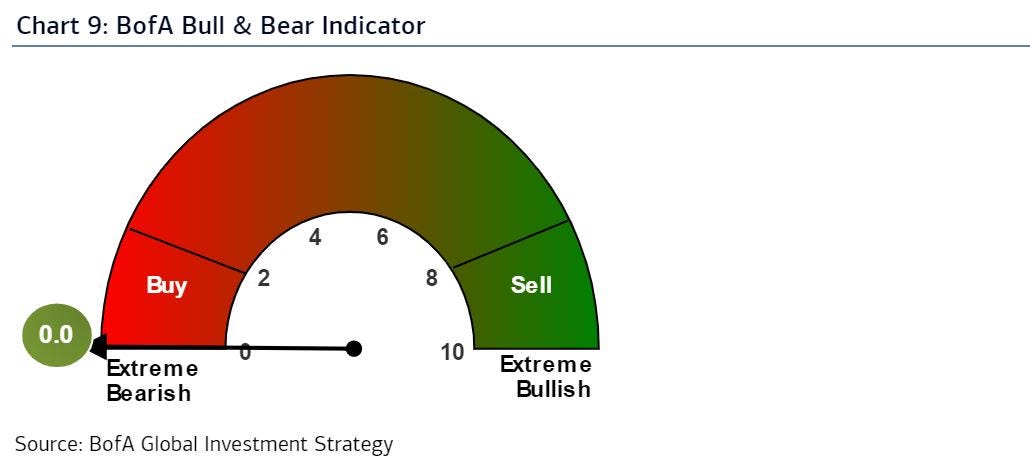

Interest rate policies, particularly those implemented by the Federal Reserve, significantly influence stock market valuations. BofA analyzes the current interest rate environment and its implications for investor behavior.

- Interest Rate Predictions: BofA's report includes predictions on future interest rate movements, which are crucial for evaluating the potential impact on stock valuations. These predictions are based on various macroeconomic indicators and models.

- Impact on Valuations: Rising interest rates generally lead to higher borrowing costs for companies, potentially slowing down growth and reducing stock valuations. Conversely, lower interest rates can boost investment and fuel stock market growth.

- Bond Yields and Stock Valuations: The relationship between bond yields and stock valuations is a critical factor in BofA's analysis. Higher bond yields can make bonds more attractive relative to stocks, potentially impacting stock valuations.

Other Factors Contributing to Investor Calm: A Diversified Perspective

BofA's analysis extends beyond valuations, earnings, and interest rates to encompass a wider range of factors contributing to investor calm.

- Geopolitical Factors: Global political stability (relative to recent years), while always subject to change, currently appears to be a supporting factor for investor confidence.

- Technological Advancements: Technological innovation continues to drive growth in specific sectors, contributing to overall market optimism. However, the rapid pace of technological change presents both opportunities and risks.

- Macroeconomic Trends: BofA incorporates broader macroeconomic trends into its analysis, considering factors such as inflation, employment levels, and consumer spending. These trends are interconnected and influence each other.

Conclusion: Understanding BofA's Perspective on Stock Market Valuations

BofA's analysis reveals a nuanced picture of current stock market valuations. While valuations are higher than historical averages in certain sectors, strong corporate earnings, relatively low (until recently) interest rates, and other contributing factors have fostered a sense of calm among investors. However, the report also highlights potential risks and uncertainties. Understanding BofA's stock market valuation insights is crucial for navigating the complexities of the current market. For a complete understanding of their analysis and to stay informed about market trends, we encourage you to delve into BofA's full report and follow their future publications on BofA's stock market valuation insights.

Featured Posts

-

Emergency In Beirut Israeli Airstrike And Evacuation Order

Apr 29, 2025

Emergency In Beirut Israeli Airstrike And Evacuation Order

Apr 29, 2025 -

Lynas Rare Earths Texas Refinery Project A Plea For Us Financial Aid

Apr 29, 2025

Lynas Rare Earths Texas Refinery Project A Plea For Us Financial Aid

Apr 29, 2025 -

Should Investors Worry About Current Stock Market Valuations Bof As View

Apr 29, 2025

Should Investors Worry About Current Stock Market Valuations Bof As View

Apr 29, 2025 -

The High Cost Of Making An All American Product

Apr 29, 2025

The High Cost Of Making An All American Product

Apr 29, 2025 -

Chainalysis Acquisition Of Alterya A Strategic Move In Ai And Blockchain

Apr 29, 2025

Chainalysis Acquisition Of Alterya A Strategic Move In Ai And Blockchain

Apr 29, 2025

Latest Posts

-

Willie Nelson Releases 77th Solo Album Before Turning 92

Apr 29, 2025

Willie Nelson Releases 77th Solo Album Before Turning 92

Apr 29, 2025 -

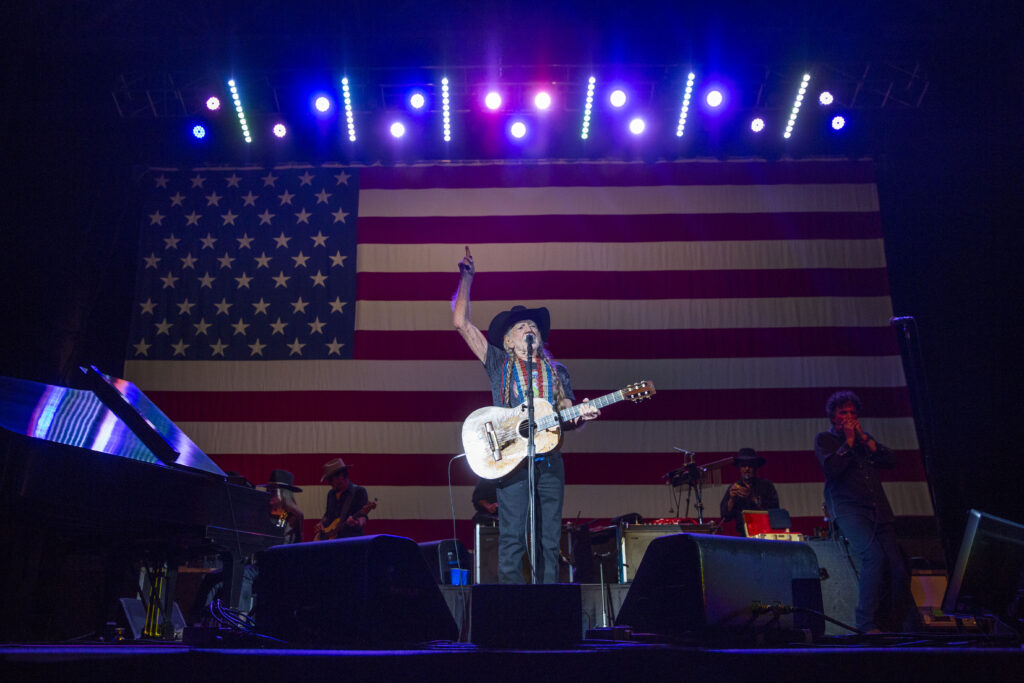

Willie Nelsons 4th Of July Picnic Returns To Texas

Apr 29, 2025

Willie Nelsons 4th Of July Picnic Returns To Texas

Apr 29, 2025 -

Analysis Of Musks X Debt Sale And Shifting Financial Landscape

Apr 29, 2025

Analysis Of Musks X Debt Sale And Shifting Financial Landscape

Apr 29, 2025 -

Understanding Willie Nelson A Collection Of Fast Facts

Apr 29, 2025

Understanding Willie Nelson A Collection Of Fast Facts

Apr 29, 2025 -

Hear Willie Nelsons Latest Oh What A Beautiful World Album Review

Apr 29, 2025

Hear Willie Nelsons Latest Oh What A Beautiful World Album Review

Apr 29, 2025