BofA's View: Why Elevated Stock Market Valuations Are Not A Red Flag For Investors

Table of Contents

BofA's Rationale: Why Current Valuations Are Justified

BofA's optimistic stance on the market, despite elevated valuations, rests on several key pillars. Their analysis points to several fundamental factors that justify the current high valuations.

Strong Corporate Earnings Growth

BofA's research highlights robust corporate earnings growth as a primary justification for higher stock valuations. This strong profitability across various sectors supports the current market levels.

- Technology: The tech sector continues to show impressive earnings growth, driven by cloud computing, artificial intelligence, and software-as-a-service (SaaS) models.

- Healthcare: Innovative pharmaceutical developments and an aging population contribute to significant earnings growth in the healthcare sector.

- Financials: A recovering economy and increased lending activity positively impact the earnings of financial institutions.

BofA's reports project continued positive earnings growth across multiple sectors in the coming years, further bolstering their argument that current stock valuations are sustainable. This continued corporate earnings growth supports higher stock valuation multiples.

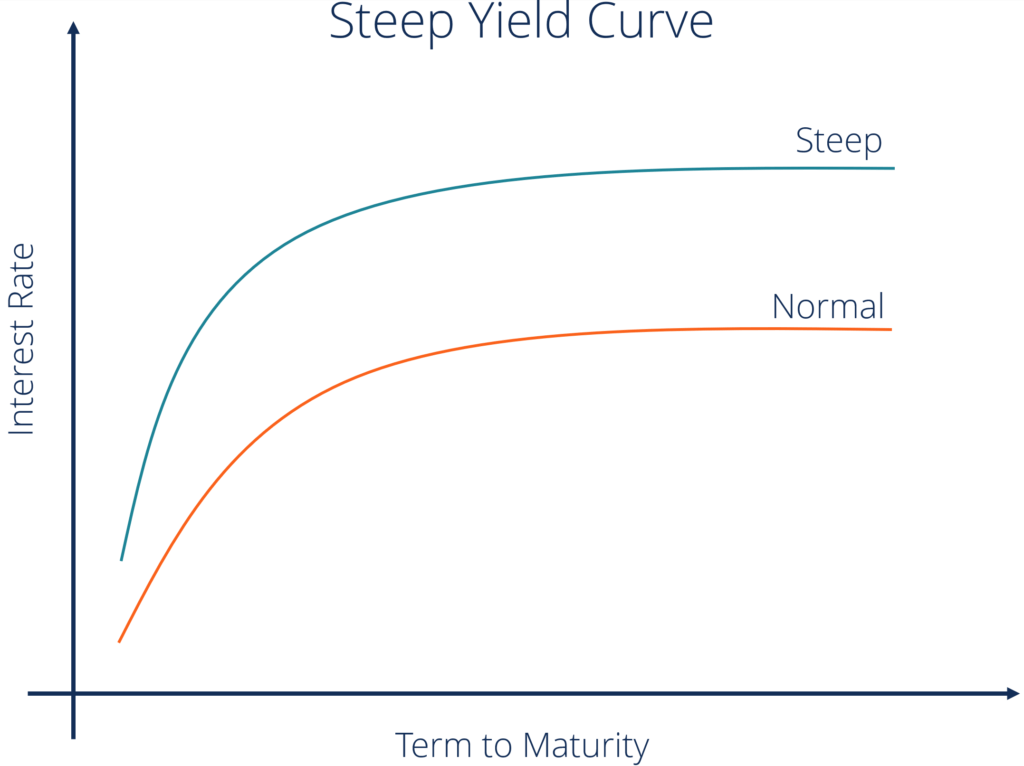

Low Interest Rates and Monetary Policy

The current low-interest-rate environment plays a crucial role in supporting higher stock valuations. Accommodative monetary policies implemented by central banks globally have kept borrowing costs low.

- Lower Discount Rates: Low interest rates directly impact discount rates used in valuation models. Lower discount rates lead to higher present values of future earnings, thus justifying higher stock prices.

- Increased Investor Demand: Low interest rates make bonds less attractive, encouraging investors to seek higher returns in the stock market, increasing demand and driving up prices.

- BofA Forecasts: BofA's forecasts suggest that interest rates will remain relatively low in the near term, continuing to support elevated stock valuations.

Technological Innovation and Long-Term Growth Potential

BofA emphasizes the transformative power of technological innovation as a key driver of long-term economic growth and a justification for higher valuations.

- Disruptive Technologies: Breakthroughs in artificial intelligence, biotechnology, and renewable energy are reshaping industries and creating new growth opportunities.

- Long-Term Growth Potential: BofA projects that these technological advancements will fuel significant long-term growth, justifying premium valuations for companies at the forefront of innovation.

- Future Market Trends: The firm's analysis suggests that companies investing heavily in research and development and adopting innovative technologies will likely experience superior growth and warrant higher valuations.

Addressing Investor Concerns: Countering the Bearish Arguments

While acknowledging the concerns surrounding elevated stock market valuations, BofA addresses common bearish arguments.

Addressing Valuation Metrics

Concerns often center around traditional valuation metrics like the Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller P/E).

- BofA's Interpretation: BofA's analysts point out that while current P/E ratios may appear high compared to historical averages, they are justifiable given the strong earnings growth and low interest rate environment.

- Contextualization: They emphasize the importance of considering these metrics within their broader economic context, accounting for factors like low interest rates and technological innovation.

- Market Multiples: BofA acknowledges that certain market multiples are elevated, but argues that these are supported by the underlying fundamentals and future growth prospects.

The Role of Inflation and Interest Rate Hikes

The potential for increased inflation and subsequent interest rate hikes is a valid concern for investors.

- Inflation Forecasts: BofA's inflation forecasts suggest a manageable level of inflation, which is factored into their valuation models.

- Interest Rate Hike Impact: While interest rate hikes could impact valuations, BofA's analysis suggests the impact will be gradual and manageable, particularly given the strength of corporate earnings.

- Valuation Adjustments: BofA incorporates potential interest rate increases into their valuation models, making adjustments to account for the risk.

Geopolitical and Economic Uncertainty

Geopolitical risks and broader economic uncertainty are inherent in any market outlook.

- Risk Assessment: BofA acknowledges these risks and incorporates them into their comprehensive risk assessment.

- Market Volatility: They expect some level of market volatility but believe the underlying fundamentals support the overall optimistic outlook.

- Risk Management: BofA's analysis incorporates various scenarios to account for potential negative impacts from geopolitical events or unexpected economic downturns.

Conclusion: BofA's View: Why Elevated Stock Market Valuations Shouldn't Deter Investors

In summary, BofA's analysis suggests that while elevated stock market valuations are present, they are not necessarily a cause for alarm. Strong corporate earnings growth, low interest rates, and technological innovation all contribute to justifying these higher valuations. BofA acknowledges the risks associated with inflation, interest rate hikes, and geopolitical uncertainty, but their analysis incorporates these factors into their overall positive outlook. Don't let concerns about elevated stock market valuations deter you. Consider BofA's perspective and build a robust investment strategy based on long-term growth potential. Further research into BofA's reports on current market conditions and their detailed analysis of elevated stock market valuations is recommended for a comprehensive understanding of their viewpoint.

Featured Posts

-

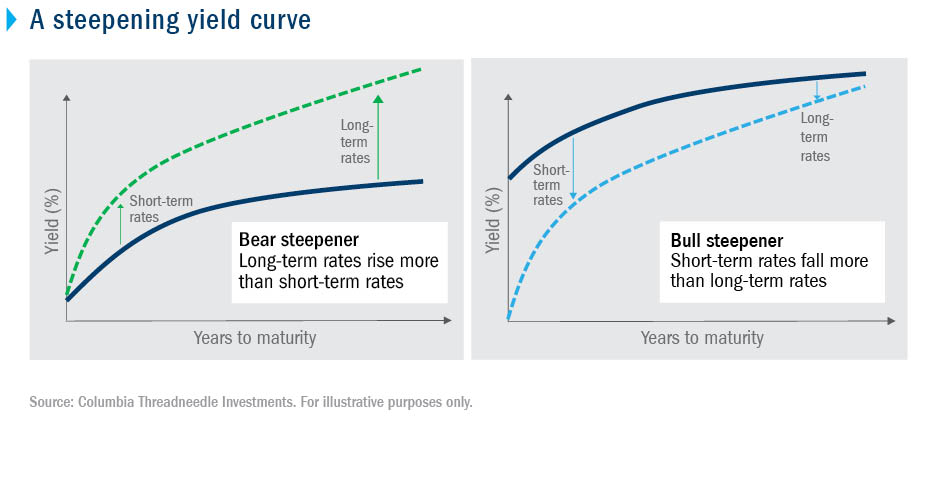

Japans Bond Market Steep Yield Curve Poses Economic Challenges

May 17, 2025

Japans Bond Market Steep Yield Curve Poses Economic Challenges

May 17, 2025 -

Steepening Japanese Bond Yield Curve Investor Divisions And Economic Implications

May 17, 2025

Steepening Japanese Bond Yield Curve Investor Divisions And Economic Implications

May 17, 2025 -

Unexpected Leader After A Difficult Opening Round At The Pga Championship

May 17, 2025

Unexpected Leader After A Difficult Opening Round At The Pga Championship

May 17, 2025 -

Broadcaster Breens Lighthearted Banter With Mikal Bridges

May 17, 2025

Broadcaster Breens Lighthearted Banter With Mikal Bridges

May 17, 2025 -

Tom Thibodeau And Mikal Bridges A Reconciliation After Public Dispute

May 17, 2025

Tom Thibodeau And Mikal Bridges A Reconciliation After Public Dispute

May 17, 2025

Latest Posts

-

Knicks Coach Thibodeau Unhappy With Officiating In Game 2

May 17, 2025

Knicks Coach Thibodeau Unhappy With Officiating In Game 2

May 17, 2025 -

Tom Thibodeaus Pope Joke What Does It Mean For The Knicks

May 17, 2025

Tom Thibodeaus Pope Joke What Does It Mean For The Knicks

May 17, 2025 -

Angel Reeses Beautiful Tribute To Her Mother Angel Webb Reese

May 17, 2025

Angel Reeses Beautiful Tribute To Her Mother Angel Webb Reese

May 17, 2025 -

Thibodeau Blasts Referees After Knicks Game 2 Loss

May 17, 2025

Thibodeau Blasts Referees After Knicks Game 2 Loss

May 17, 2025 -

Analyzing Tom Thibodeaus Joke About The Pope And The Knicks

May 17, 2025

Analyzing Tom Thibodeaus Joke About The Pope And The Knicks

May 17, 2025