Broadcom's VMware Acquisition: AT&T Highlights Extreme Price Surge

Table of Contents

The VMware Acquisition: A Brief Overview

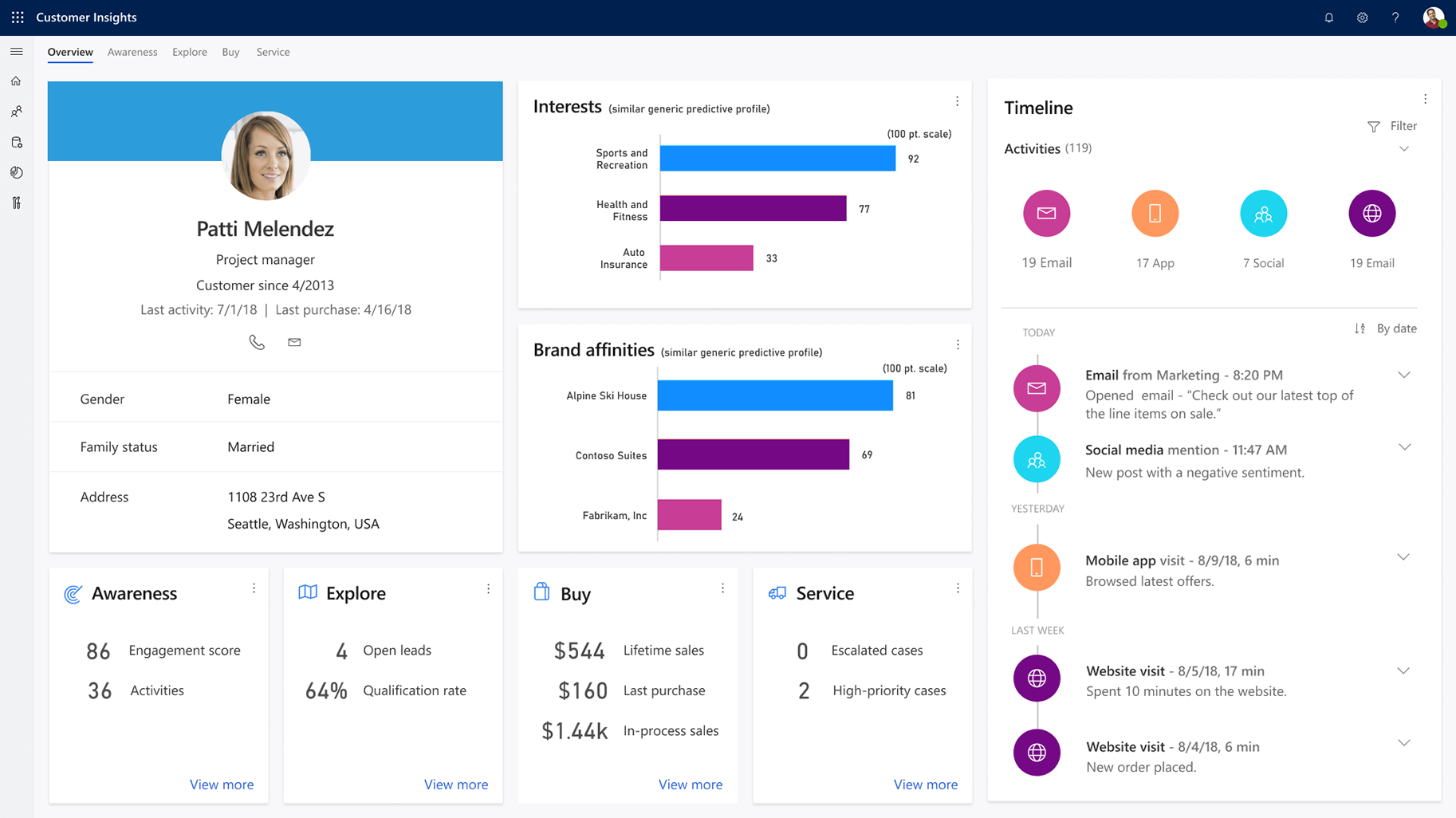

Broadcom's acquisition of VMware, finalized in November 2022, was a monumental deal valued at approximately $61 billion. VMware, a leading provider of virtualization and cloud computing software, holds a significant market share in the enterprise software market. Its virtualization technologies are integral to many organizations' IT infrastructures, allowing them to consolidate and manage their computing resources efficiently. The acquisition raised significant concerns regarding market consolidation and reduced competition within the enterprise software sector. The potential for increased pricing power for Broadcom, post-merger, became a major point of discussion among industry analysts and regulators.

- Acquisition completion date: November 2022

- Acquisition cost: Approximately $61 billion

- VMware's market share in virtualization and cloud computing: A substantial and leading position

- Potential antitrust concerns: The merger faced scrutiny from regulatory bodies due to concerns about monopolistic practices.

AT&T's Dependence on VMware and the Subsequent Price Surge

AT&T, like many large telecommunications companies, heavily relies on VMware solutions for its network infrastructure and operations. VMware's virtualization technology is crucial for managing AT&T's complex network of servers, applications, and data centers. Following Broadcom's acquisition, AT&T, along with many other VMware customers, has reported significant price increases for VMware licensing and support contracts. These increases are impacting AT&T's operational costs and profitability, forcing them to reassess their IT budget and potentially explore alternative solutions.

- Specific VMware products used by AT&T: Likely includes vSphere, vCenter, and other VMware cloud management solutions.

- Percentage increase in licensing and support costs: Reports suggest substantial double-digit percentage increases, although exact figures remain confidential.

- Potential impact on AT&T's bottom line: Increased operational costs directly impacting profitability and shareholder value.

- AT&T's response to the price surge: Details of AT&T’s response are largely undisclosed, but it's highly likely they are exploring cost-cutting measures and alternative solutions.

Broader Implications for the Tech Industry

The price surge experienced by AT&T isn't an isolated incident. Many businesses that rely heavily on VMware products are facing similar pressures. The Broadcom-VMware merger has created a ripple effect, raising concerns about the potential for industry-wide price increases for enterprise software. This is particularly troubling for smaller and medium-sized businesses (SMBs) that may have less negotiating power and fewer resources to explore alternatives. The situation puts significant pressure on these organizations to evaluate their dependence on VMware and consider migrating to alternative software solutions. This could trigger a significant shift in the cloud computing landscape, potentially accelerating the adoption of competing platforms.

- Potential for industry-wide price increases: A very real possibility, depending on Broadcom's pricing strategy.

- Impact on small and medium-sized businesses: SMBs could face disproportionately higher costs and reduced competitiveness.

- Increased pressure on businesses to explore alternative software solutions: This will likely lead to increased market competition among VMware competitors.

- Potential for increased cloud computing adoption: Businesses may shift towards cloud-based alternatives to reduce their reliance on on-premise VMware infrastructure.

Alternatives to VMware in the Post-Acquisition Landscape

Businesses facing exorbitant price increases are actively seeking alternatives to VMware. Several strong competitors offer comparable virtualization and cloud computing solutions. These include, but aren't limited to, Microsoft Azure, Amazon Web Services (AWS), Google Cloud Platform (GCP), and open-source solutions like Proxmox VE. Migrating from VMware can be a complex undertaking, requiring careful planning and potentially significant investment in training and infrastructure. However, the long-term cost savings and increased flexibility offered by these alternatives might outweigh the initial transition costs.

- List of key VMware competitors: Microsoft Azure, Amazon Web Services (AWS), Google Cloud Platform (GCP), Proxmox VE, and others.

- Comparison table of features and pricing: This would require detailed market research and analysis beyond the scope of this article.

- Potential challenges of migrating from VMware: Data migration, compatibility issues, staff retraining, and potential downtime.

Conclusion

The Broadcom acquisition of VMware has had a profound and immediate impact on businesses like AT&T, leading to significant price increases for essential software. This case highlights the potential risks associated with major mergers and acquisitions in the tech industry and underscores the need for businesses to carefully consider their reliance on specific vendors and explore alternative solutions to mitigate future price shocks. The extreme price surge experienced by AT&T serves as a cautionary tale for others. Understanding the implications of the Broadcom-VMware acquisition is crucial for all businesses. Don't let your company become another victim of unexpected price increases. Research alternative solutions and proactively manage your technology infrastructure to avoid a similar Broadcom VMware price surge.

Featured Posts

-

Ariana Grandes Drastic Hair Transformation Exploring The Professional Help Behind The Look

Apr 27, 2025

Ariana Grandes Drastic Hair Transformation Exploring The Professional Help Behind The Look

Apr 27, 2025 -

The Role Of Human Creativity In The Age Of Ai Insights From Microsoft

Apr 27, 2025

The Role Of Human Creativity In The Age Of Ai Insights From Microsoft

Apr 27, 2025 -

Justin Herbert Leading The Chargers To Brazil For 2025 Season Opener

Apr 27, 2025

Justin Herbert Leading The Chargers To Brazil For 2025 Season Opener

Apr 27, 2025 -

La Gran Sorpresa De Indian Wells Fin Del Reinado De

Apr 27, 2025

La Gran Sorpresa De Indian Wells Fin Del Reinado De

Apr 27, 2025 -

Cybercriminals Office365 Exploit Millions In Losses Federal Charges Filed

Apr 27, 2025

Cybercriminals Office365 Exploit Millions In Losses Federal Charges Filed

Apr 27, 2025

Latest Posts

-

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025 -

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025 -

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025 -

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025 -

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025