Fluctuations In Elon Musk's Net Worth: A Look At US Economic Factors

Table of Contents

The Role of Tesla's Stock Performance

Elon Musk's net worth is intrinsically linked to Tesla's stock performance. As one of Tesla's largest shareholders, owning a significant portion of the company's shares, the value of his holdings directly reflects Tesla's market capitalization. Any change in Tesla's stock price, therefore, translates into a proportional change in his net worth.

Market Sentiment and Investor Confidence:

Tesla's share price is highly sensitive to market sentiment and investor confidence. Positive news, strong quarterly earnings reports, and optimistic economic forecasts generally boost investor confidence, driving up demand for Tesla shares and increasing their price. Conversely, negative news, such as production setbacks, supply chain disruptions, or pessimistic economic outlooks, can trigger sell-offs, pushing the stock price down and consequently impacting Musk's net worth. For example, interest rate hikes by the Federal Reserve can dampen investor enthusiasm for growth stocks like Tesla, leading to price declines.

Technological Advancements and Competition:

Tesla's stock price is also influenced by technological advancements and competition within the electric vehicle (EV) market. The successful launch of innovative products, like new vehicle models or advancements in battery technology, can significantly enhance Tesla's market valuation. However, increasing competition from other EV manufacturers, such as Rivian, Lucid Motors, and established automakers investing heavily in EVs, can put downward pressure on Tesla's stock price and subsequently Musk's net worth.

Regulatory Changes and Government Policies:

Government policies and regulations play a crucial role in shaping the EV industry's landscape. Changes in environmental regulations, tax incentives for EVs, and government subsidies can significantly influence Tesla's profitability and its stock price. Favorable government policies can boost Tesla's sales and profitability, while stricter regulations or reduced subsidies can negatively affect its financial performance.

The Influence of SpaceX and Other Ventures

While Tesla is the primary driver of Elon Musk's net worth, the success of his other ventures, particularly SpaceX, contributes significantly, albeit less directly. SpaceX, a private aerospace manufacturer and space transportation services company, has not yet gone public. However, its increasing valuation through successful funding rounds and lucrative contracts significantly contributes to Musk's overall financial picture. A future SpaceX IPO would undoubtedly have a massive impact on his net worth.

Other ventures, like The Boring Company (focused on infrastructure development) and Neuralink (developing neural implant technology), though currently less impactful than Tesla and SpaceX, have the potential to become significant wealth generators in the future. Successful funding rounds and technological breakthroughs in these companies can add substantially to Musk's overall net worth.

Macroeconomic Indicators and Their Impact

Elon Musk's net worth isn't immune to broader US macroeconomic factors. The overall health of the US economy significantly influences investor sentiment and market valuations, impacting Tesla's stock price and, consequently, Musk's wealth.

Inflation and Interest Rates:

Rising inflation and interest rate hikes often lead to a more cautious investor environment. Investors might shift their investments towards safer assets, leading to a decrease in demand for growth stocks like Tesla. This can negatively impact Tesla's stock price and Musk's net worth.

Consumer Spending and Demand:

Consumer spending plays a significant role in the demand for electric vehicles. A strong economy with high consumer confidence typically translates to increased demand for luxury goods, including Tesla vehicles, which benefits Tesla's sales and stock price. Conversely, economic downturns or reduced consumer confidence can significantly impact demand, hurting Tesla's sales and potentially impacting the stock price.

Global Economic Growth and Uncertainty:

Global economic growth and uncertainty significantly impact the stock market. During periods of global economic uncertainty or downturns, investors often sell off stocks, seeking safety in less volatile assets. Such sell-offs can trigger substantial drops in Tesla's stock price and significantly impact Musk's net worth.

The Psychology of Market Fluctuations and Musk's Public Persona

Market fluctuations are not solely driven by rational economic factors; investor sentiment and market psychology play a crucial role. Elon Musk's public statements and actions can profoundly influence investor confidence and market reactions. His tweets, pronouncements on Tesla's future, and even his personal activities often trigger significant market volatility.

Social media and news coverage play a significant role in shaping public perception of Musk and Tesla. Positive news coverage can boost investor confidence, while negative news or controversies can lead to sell-offs. The amplification effect of social media can exacerbate these reactions, leading to even more dramatic fluctuations in Tesla's stock price and, consequently, Musk's net worth.

Conclusion: Navigating the Complex Relationship Between Elon Musk's Net Worth and US Economic Factors

This article highlights the complex interplay between Elon Musk's net worth and US economic factors. Tesla's stock performance, driven by factors like market sentiment, technological advancements, and government policies, is the primary determinant of his wealth. However, the success of SpaceX and other ventures, along with broader macroeconomic indicators like inflation, consumer spending, and global economic uncertainty, also play a significant role. Finally, the psychology of the market and Musk's public persona contribute to the volatility of his net worth. Understanding these interconnected elements is crucial for comprehending the dynamics of modern wealth creation and its relationship to the larger economic landscape. Continue researching the dynamics of Elon Musk's net worth and its relationship to broader US economic trends. Explore resources on macroeconomic indicators and their impact on stock markets to further your understanding of this fascinating interplay.

Featured Posts

-

Federal Investigation Millions Stolen Through Executive Office365 Compromises

May 09, 2025

Federal Investigation Millions Stolen Through Executive Office365 Compromises

May 09, 2025 -

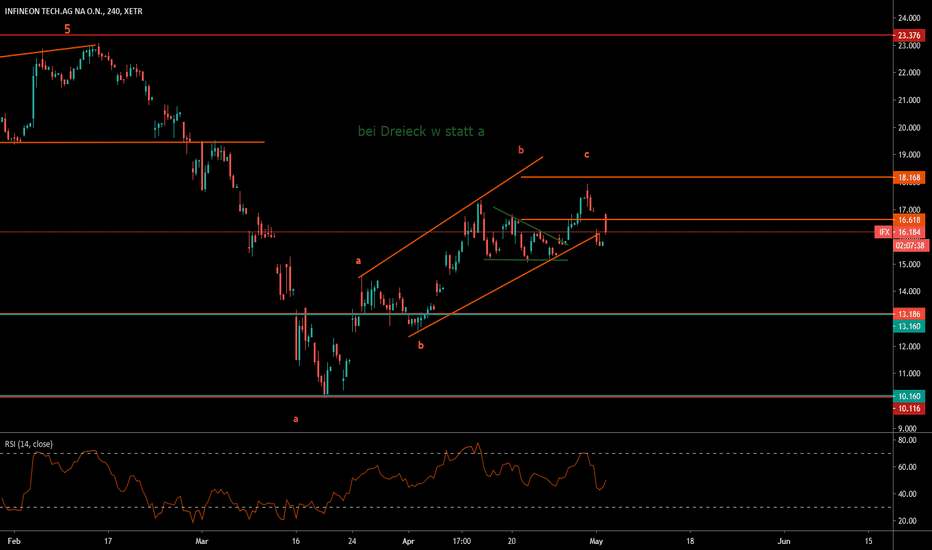

Analysis Infineon Ifx Sales Guidance And The Trump Tariff Factor

May 09, 2025

Analysis Infineon Ifx Sales Guidance And The Trump Tariff Factor

May 09, 2025 -

One Crypto Winner Amidst The Trade War Chaos

May 09, 2025

One Crypto Winner Amidst The Trade War Chaos

May 09, 2025 -

Dakota Johnsons Career Path The Chris Martin Factor

May 09, 2025

Dakota Johnsons Career Path The Chris Martin Factor

May 09, 2025 -

Sno Og Vanskelige Kjoreforhold Viktig Informasjon For Sor Norge

May 09, 2025

Sno Og Vanskelige Kjoreforhold Viktig Informasjon For Sor Norge

May 09, 2025

Latest Posts

-

Dozens Of Cars Broken Into Elizabeth City Apartment Complex Crime Spree

May 09, 2025

Dozens Of Cars Broken Into Elizabeth City Apartment Complex Crime Spree

May 09, 2025 -

Elizabeth City Police Investigate String Of Car Break Ins At Apartment Complexes

May 09, 2025

Elizabeth City Police Investigate String Of Car Break Ins At Apartment Complexes

May 09, 2025 -

Multiple Car Break Ins Reported At Elizabeth City Apartments

May 09, 2025

Multiple Car Break Ins Reported At Elizabeth City Apartments

May 09, 2025 -

Bbc Strictly Come Dancing Wynne Evans Clarifies Return Rumours

May 09, 2025

Bbc Strictly Come Dancing Wynne Evans Clarifies Return Rumours

May 09, 2025 -

Maldives Vacation Elizabeth Hurleys Bikini Style

May 09, 2025

Maldives Vacation Elizabeth Hurleys Bikini Style

May 09, 2025