Climate Risk And Your Home Loan: Understanding The Credit Score Impact

Table of Contents

How Climate Change Affects Property Values

Climate change significantly impacts property values, creating both immediate and long-term financial consequences. Understanding this impact is crucial for anyone considering purchasing a home or refinancing their mortgage.

Increased Risk of Natural Disasters

The correlation between climate change and increased frequency of extreme weather events is undeniable. More frequent and intense floods, wildfires, hurricanes, and droughts directly decrease property values.

- Examples of vulnerable locations: Coastal communities facing sea-level rise, areas prone to wildfires in the western United States, and regions susceptible to severe flooding in the Midwest.

- Direct impact on property: Damage from natural disasters can lead to significant repair costs, rendering properties uninhabitable, or even completely destroying them. This directly reduces their market value.

- Increased insurance costs: Properties in high-risk areas face substantially higher insurance premiums, making them less attractive to buyers and impacting their perceived worth. Data shows a clear trend of property value depreciation in high-risk areas, reflecting this increased risk.

Long-Term Climate Projections and Investment Risk

Lenders are increasingly incorporating long-term climate projections into their risk assessments. Future projections of sea-level rise, wildfire risk, and extreme weather events influence loan approvals and interest rates.

- Climate risk assessment models: Lenders use sophisticated models to assess the long-term climate vulnerability of properties, factoring in factors like proximity to floodplains, wildfire risk, and projected changes in temperature and precipitation.

- Flood zones and loan terms: Properties located in designated flood zones often face stricter lending requirements, including higher down payments and increased interest rates. Loans may even be denied altogether.

- Long-term investment implications: Investing in properties located in areas with high climate risk carries significant financial uncertainty, potentially impacting future resale value and overall return on investment.

The Impact on Your Credit Score

The effects of climate risk extend beyond property values; they directly impact your credit score. Understanding this connection is vital for maintaining your financial health.

Loan Denials and Higher Interest Rates

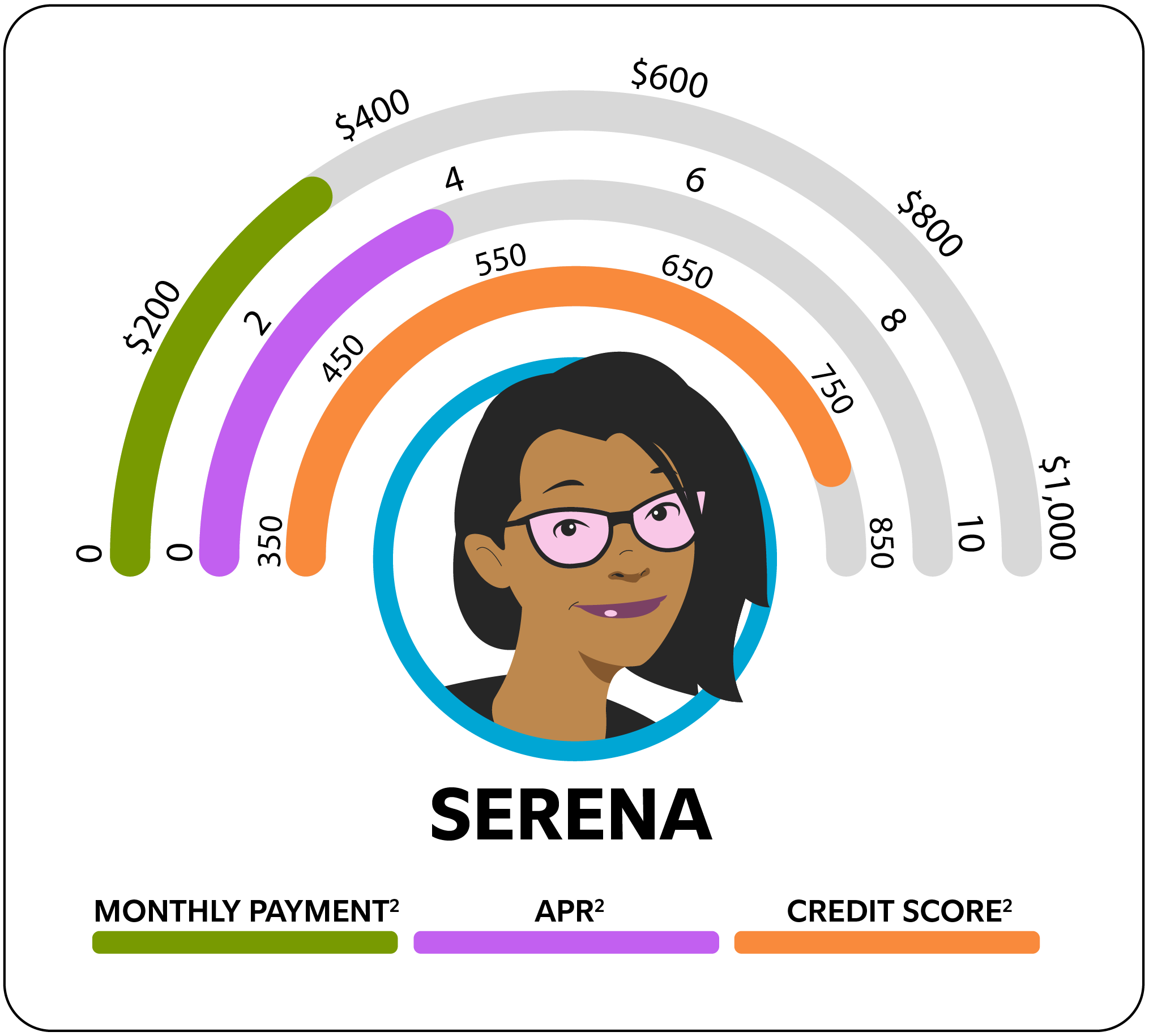

Climate risk assessments can lead to loan denials or significantly higher interest rates, making homeownership less accessible or more expensive.

- Factors considered by lenders: Lenders consider proximity to floodplains, wildfire risk, historical flood damage, and projected climate impacts when assessing risk.

- Increased interest rates: Higher interest rates dramatically increase monthly mortgage payments, potentially straining household budgets.

- Impact on financial health: Higher loan costs can significantly impact overall financial health, hindering long-term financial goals.

Insurance Premiums and Credit Reports

Rising insurance premiums due to increased climate risk can indirectly impact your credit score. Difficulty paying these premiums can lead to late payments and negatively affect your credit history.

- Impact of high insurance premiums: The cost of insurance in high-risk areas can be prohibitive, making it challenging to stay current on payments.

- Insurance claims and credit reports: While not directly reported, frequent insurance claims for weather-related damage might raise concerns for lenders, impacting loan approval.

- Mitigation strategies: Budgeting carefully, exploring insurance options, and proactively addressing potential climate-related damage to your property are vital strategies to mitigate negative impacts on your credit.

Mitigating Climate Risk in Your Home Loan Application

Proactive measures can significantly reduce climate risk and improve your chances of securing favorable loan terms.

Proactive Measures

Taking steps to minimize your property's vulnerability to climate-related events can demonstrate responsible homeownership to lenders.

- Home improvements: Investing in flood barriers, fire-resistant roofing materials, and other upgrades can reduce your risk profile.

- Professional climate risk assessment: Obtaining a professional assessment provides concrete data to share with lenders, showing your awareness and proactive approach to risk management.

- Transparent disclosure: Openly discussing potential climate risks with your lender builds trust and demonstrates your understanding of the situation.

Choosing the Right Lender

Selecting a lender who understands and addresses climate risk is crucial.

- Questions to ask lenders: Inquire about their climate risk assessment policies, their experience with properties in high-risk areas, and their commitment to sustainable lending practices.

- Researching lenders: Explore lenders known for their expertise in high-risk areas, demonstrating their understanding of the specific challenges and preparedness to handle such loans.

- Green mortgages: Consider green mortgages or other sustainable lending options, which may offer more favorable terms for properties with energy-efficient upgrades and reduced environmental impact.

Conclusion

Climate change is significantly impacting home loan applications, property values, and credit scores. Lenders are increasingly incorporating climate risk assessments into their decision-making processes. Understanding the impact of climate risk on your home loan is crucial. Take steps to mitigate these risks and secure a favorable mortgage by researching lenders, investing in home improvements, and understanding your property's climate vulnerability. Don't let climate risk negatively impact your chances of securing a fair home loan. Proactive planning and informed decision-making are key to navigating this evolving landscape.

Featured Posts

-

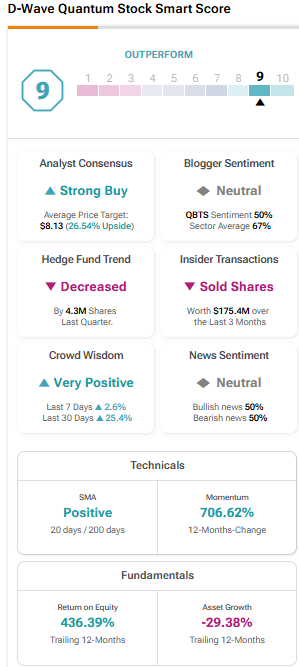

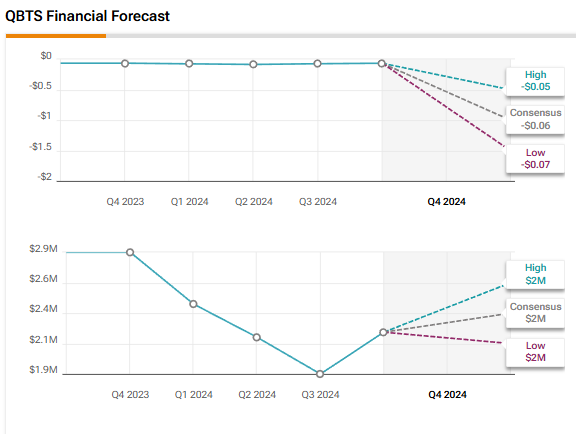

The D Wave Quantum Qbts Stock Market Crash On Monday Causes And Effects

May 21, 2025

The D Wave Quantum Qbts Stock Market Crash On Monday Causes And Effects

May 21, 2025 -

Analyzing The Friday Jump In D Wave Quantum Qbts Share Price

May 21, 2025

Analyzing The Friday Jump In D Wave Quantum Qbts Share Price

May 21, 2025 -

Oneiriki Prokrisi I Kroyz Azoyl Toy Giakoymaki Ston Teliko Champions League

May 21, 2025

Oneiriki Prokrisi I Kroyz Azoyl Toy Giakoymaki Ston Teliko Champions League

May 21, 2025 -

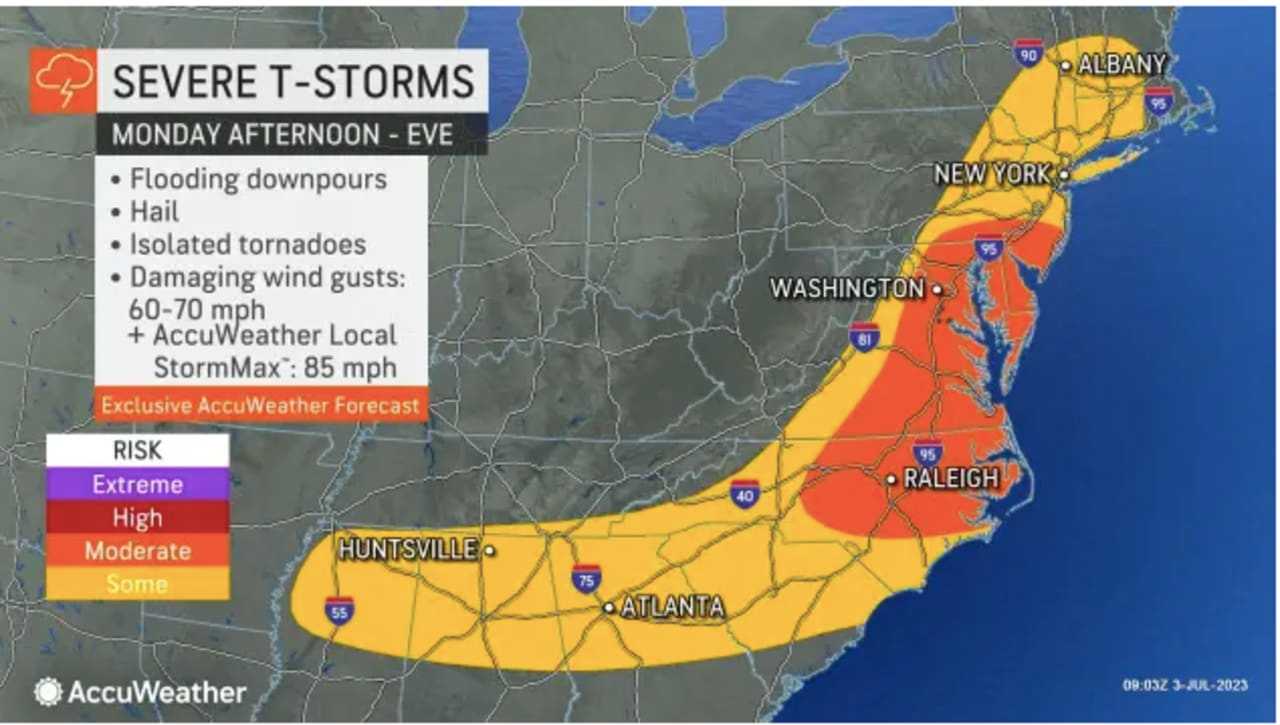

Current Rain Forecast Updated Timing For Showers And Storms

May 21, 2025

Current Rain Forecast Updated Timing For Showers And Storms

May 21, 2025 -

Sydney Sweeneys Next Role After Echo Valley And The Housemaid A Busy Actresss New Film Project

May 21, 2025

Sydney Sweeneys Next Role After Echo Valley And The Housemaid A Busy Actresss New Film Project

May 21, 2025