Considerable US Growth Slowdown Predicted By Deloitte

Table of Contents

Key Factors Contributing to the Predicted US Growth Slowdown

Several interconnected factors have led Deloitte to predict a considerable US growth slowdown. These include persistent inflation, the Federal Reserve's tight monetary policy, and significant global economic uncertainty.

Inflation's Persistent Impact

High inflation significantly erodes purchasing power, impacting both consumer spending and business investment. The persistent rise in prices, as measured by key metrics like the Consumer Price Index (CPI) and the Producer Price Index (PPI), is squeezing household budgets and reducing consumer confidence.

- CPI increases: Sustained increases in the CPI directly reduce disposable income, forcing consumers to cut back on non-essential spending.

- PPI pressure: Rising Producer Price Index indicates increased costs for businesses, leading to reduced profit margins and impacting investment decisions.

- Reduced consumer spending: Lower consumer spending translates to decreased demand, impacting businesses' growth and profitability.

- Dampened business investment: Uncertainty around future inflation discourages businesses from investing in expansion and hiring.

The Federal Reserve's Tight Monetary Policy

The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, are another significant contributor to the predicted slowdown. Higher interest rates increase borrowing costs for businesses and consumers, dampening economic activity.

- Increased borrowing costs: Higher interest rates make it more expensive for businesses to borrow money for investments and expansion, leading to reduced capital expenditures.

- Reduced consumer borrowing: Higher interest rates discourage consumers from taking out loans for large purchases like homes and cars, impacting demand.

- Impact on mortgages and other loans: Rising interest rates increase mortgage payments and other loan repayments, further reducing disposable income and consumer spending.

- Fed's rate hikes: The recent series of interest rate increases by the Federal Reserve is a direct response to high inflation, but this has a ripple effect across the entire economy.

Global Economic Uncertainty

The US economy is not isolated from global events. The ongoing war in Ukraine, persistent supply chain disruptions, and increasing geopolitical instability all contribute to economic uncertainty and weigh down US growth prospects.

- Geopolitical risks: The war in Ukraine and other geopolitical tensions create uncertainty and disrupt global trade, impacting supply chains and commodity prices.

- Supply chain bottlenecks: Ongoing supply chain disruptions continue to contribute to higher prices and reduced availability of goods.

- Energy price volatility: Fluctuations in global energy prices further exacerbate inflationary pressures and impact business costs.

- Global recessionary risks: The possibility of a global recession adds another layer of uncertainty and could significantly impact the US economy.

Potential Impacts of the Predicted Slowdown

Deloitte's prediction of a considerable US growth slowdown has significant implications across various sectors.

Job Market Implications

A slower economy often translates to a weaker job market. The predicted slowdown could lead to slower job growth or even job losses in some sectors. This could increase the unemployment rate and impact consumer confidence.

Consumer Confidence and Spending

Reduced economic growth directly impacts consumer confidence. As concerns about job security and future income rise, consumers are likely to cut back on spending, further weakening economic activity. This is likely to be reflected in a decline in the Consumer Confidence Index and Retail Sales figures.

Impact on Businesses and Investments

Businesses are likely to scale back investment plans in response to a slower economy. Reduced consumer demand, higher borrowing costs, and increased uncertainty will make businesses more cautious about capital expenditures and expansion projects. Corporate profits could also be affected.

Deloitte's Recommendations and Mitigation Strategies

While Deloitte's report highlights the challenges, it likely also offers recommendations to mitigate the impact of the predicted slowdown. These could include:

- Strategic fiscal policy adjustments: Government spending could be used to stimulate demand and support struggling sectors.

- Targeted monetary policy measures: The Federal Reserve might need to adjust its approach to monetary policy to balance inflation control with the need to support economic growth.

- Focus on supply chain resilience: Initiatives to strengthen domestic supply chains and reduce dependence on foreign sources could help mitigate inflationary pressures.

Conclusion: Navigating the Predicted Considerable US Growth Slowdown

Deloitte's prediction of a considerable US growth slowdown is a serious concern. The key factors driving this prediction – persistent inflation, tight monetary policy, and global economic uncertainty – are interconnected and present significant challenges. The potential impacts on the job market, consumer confidence, and business investment are substantial. Understanding Deloitte's prediction of a considerable US growth slowdown is crucial for businesses and investors to adapt their strategies and navigate this challenging economic landscape. Stay informed about further economic forecasts and develop proactive plans to mitigate potential risks. Careful monitoring of key economic indicators like CPI, PPI, and the unemployment rate will be essential in the coming months.

Featured Posts

-

Simkus Signals Potential For Two More Ecb Rate Cuts Due To Trade Impact

Apr 27, 2025

Simkus Signals Potential For Two More Ecb Rate Cuts Due To Trade Impact

Apr 27, 2025 -

Betting On Natural Disasters The Los Angeles Wildfires And The Changing Landscape Of Gambling

Apr 27, 2025

Betting On Natural Disasters The Los Angeles Wildfires And The Changing Landscape Of Gambling

Apr 27, 2025 -

Wildfire Betting Exploring The Moral And Societal Implications Of The Los Angeles Fires

Apr 27, 2025

Wildfire Betting Exploring The Moral And Societal Implications Of The Los Angeles Fires

Apr 27, 2025 -

Chargers To Kick Off 2025 Season In Brazil Justin Herbert Leads The Charge

Apr 27, 2025

Chargers To Kick Off 2025 Season In Brazil Justin Herbert Leads The Charge

Apr 27, 2025 -

Indian Wells 2024 Eliminacion De Favorita Genera Controversia

Apr 27, 2025

Indian Wells 2024 Eliminacion De Favorita Genera Controversia

Apr 27, 2025

Latest Posts

-

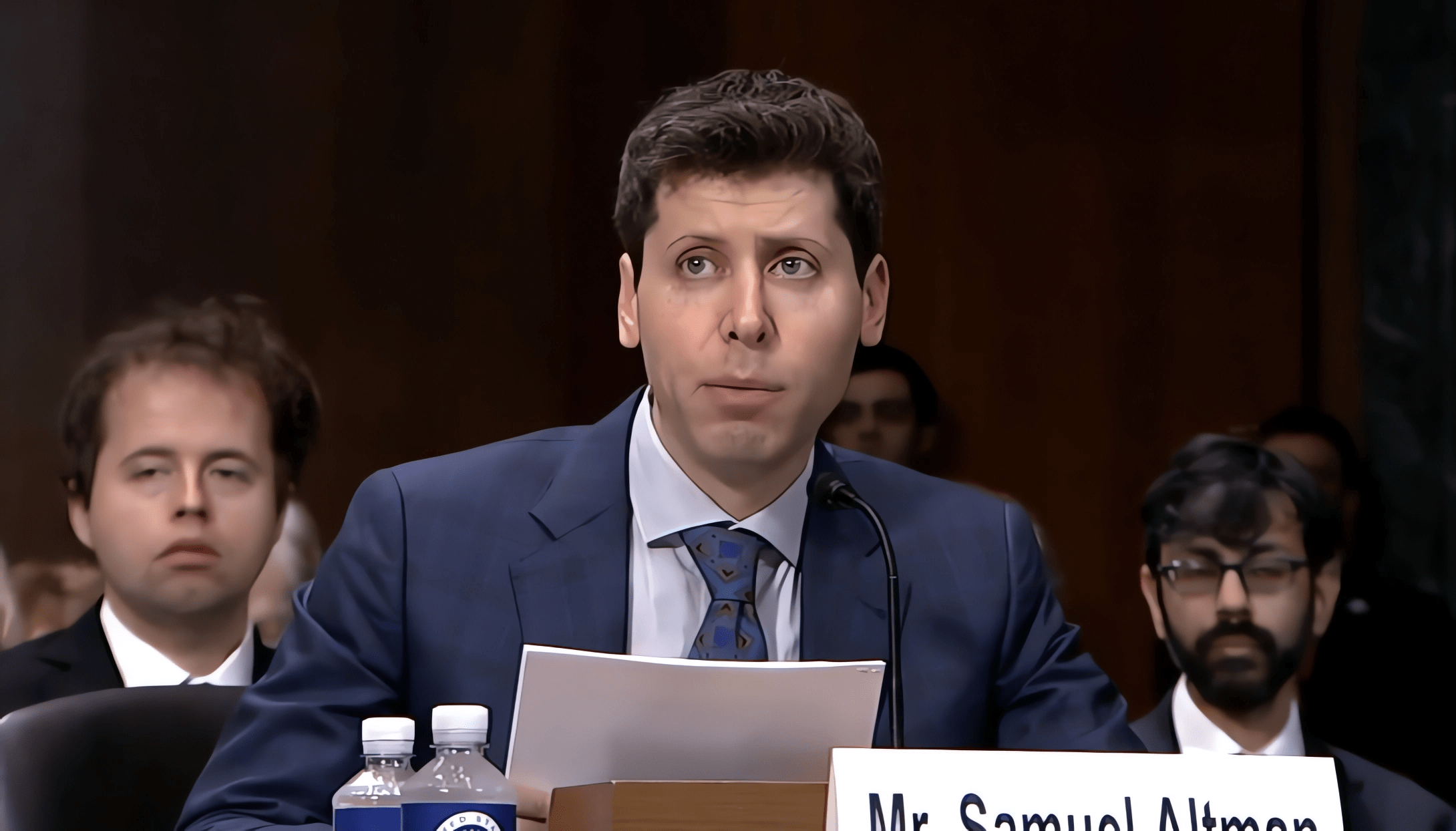

Open Ais Chat Gpt An Ftc Investigation And Its Potential Consequences

Apr 28, 2025

Open Ais Chat Gpt An Ftc Investigation And Its Potential Consequences

Apr 28, 2025 -

Chat Gpt Developer Open Ai Faces Ftc Investigation

Apr 28, 2025

Chat Gpt Developer Open Ai Faces Ftc Investigation

Apr 28, 2025 -

Ftc Investigates Open Ais Chat Gpt What It Means For Ai Development

Apr 28, 2025

Ftc Investigates Open Ais Chat Gpt What It Means For Ai Development

Apr 28, 2025 -

Jan 6 Witness Cassidy Hutchinson To Publish Memoir This Fall

Apr 28, 2025

Jan 6 Witness Cassidy Hutchinson To Publish Memoir This Fall

Apr 28, 2025 -

Cassidy Hutchinson Plans Memoir A Look Inside The January 6th Hearings

Apr 28, 2025

Cassidy Hutchinson Plans Memoir A Look Inside The January 6th Hearings

Apr 28, 2025