Simkus Signals Potential For Two More ECB Rate Cuts Due To Trade Impact

Table of Contents

Simkus's Rationale for Predicted ECB Rate Cuts

Simkus's prediction of further European Central Bank rate cuts is rooted in a confluence of factors pointing towards a weakening Eurozone economy and the persistent negative impact of global trade wars.

Weakening Eurozone Economy

The Eurozone economy is showing clear signs of slowing. Key economic indicators paint a concerning picture:

- GDP Growth Forecast: Eurostat's latest projections indicate a significant deceleration in GDP growth for 2023 and 2024, falling below the 1% mark. [Insert link to Eurostat data].

- Inflation Rate: While inflation has eased from its peak, it remains stubbornly above the ECB's target of 2%, indicating continued price pressures. [Insert link to relevant inflation data].

- Unemployment Figures: While unemployment remains relatively low, recent increases suggest a softening labor market, further indicating economic weakness. [Insert link to unemployment data].

These economic indicators collectively point towards a need for further monetary stimulus to prevent a deeper economic downturn.

Impact of Trade Wars

The ongoing trade tensions, particularly the US-China trade war, are significantly impacting Eurozone businesses and consumer confidence.

- Supply Chain Disruptions: Trade tariffs and geopolitical uncertainty have disrupted global supply chains, increasing costs and reducing the availability of goods for European businesses.

- Reduced Business Investment: Uncertainty about future trade policies is discouraging businesses from investing, further dampening economic growth.

- Decline in Trade Volume: Data indicates a noticeable decline in Eurozone trade volume, highlighting the negative impact of trade wars on the region's economy. [Insert link to relevant trade data].

These trade-related challenges are exacerbating the already slowing Eurozone economic slowdown, making further ECB rate cuts more likely.

ECB's Current Monetary Policy Stance

The ECB has already implemented several monetary policy tools, including quantitative easing (QE) programs and historically low interest rates. However, these measures have shown diminishing returns in addressing the current economic challenges.

- Current Interest Rates: The current interest rates are already historically low, leaving limited room for further conventional monetary policy easing.

- Quantitative Easing (QE): While QE programs have been instrumental in providing liquidity, their effectiveness in stimulating growth is debated. [Insert link to relevant ECB policy documents].

- Limitations of Monetary Policy: The current economic slowdown is partly structural and may not be fully addressed solely by monetary policy.

The limitations of current ECB policy tools strengthen the case for further, unconventional measures, such as additional ECB interest rate cuts.

Implications of Further ECB Rate Cuts

Further ECB rate cuts could have both positive and negative consequences for the Eurozone economy.

Potential Benefits

Lower interest rates could provide a much-needed boost to the Eurozone economy:

- Economic Stimulus: Lower borrowing costs for businesses could encourage increased investment and hiring, boosting economic activity.

- Investment Growth: Reduced interest rates can incentivize companies to invest in expansion and innovation, creating jobs and stimulating growth.

- Consumer Spending: Lower borrowing costs can also encourage consumer spending, particularly on big-ticket items like homes and cars.

These benefits could help to mitigate the negative impact of the slowing economy and trade tensions.

Potential Risks and Drawbacks

However, further ECB rate cuts also carry potential risks:

- Inflation Risk: Further reductions in interest rates could exacerbate inflationary pressures if not managed carefully.

- Asset Bubbles: Extremely low interest rates can inflate asset prices, creating the risk of bubbles in the housing market or other asset classes.

- Reduced Effectiveness of Monetary Policy: Repeated rate cuts can diminish the effectiveness of monetary policy over time, leading to diminishing returns.

A careful balancing act is required to maximize the benefits while mitigating the risks associated with additional ECB rate cuts.

Alternative Scenarios and Market Reactions

Simkus's prediction is not universally accepted, and alternative economic forecasts exist.

Alternative Economic Forecasts

Some economists believe that the Eurozone economy will experience a mild recovery without needing further ECB interest rate cuts. Others predict a more severe downturn, necessitating even more aggressive monetary easing. [Insert links to different economic forecasts].

The uncertainty surrounding the economic outlook makes the likelihood of further ECB rate cuts a subject of ongoing debate.

Market Response to Rate Cut Predictions

Financial markets have reacted to Simkus's prediction and the prospect of further ECB rate cuts with a degree of volatility:

- Bond Yields: Government bond yields have generally fallen, reflecting expectations of lower interest rates. [Insert link to relevant bond yield data].

- Stock Market: The stock market's reaction is mixed, with some sectors benefiting from lower borrowing costs while others remain cautious about future economic uncertainty. [Insert link to relevant stock market data].

- Euro Exchange Rate: The Euro's exchange rate has shown some fluctuation in response to the prediction, reflecting market uncertainty. [Insert link to relevant exchange rate data].

The market's response reflects the complexity and uncertainty surrounding the future path of ECB rate cuts and their impact on the Eurozone economy.

Conclusion: The Future of ECB Rate Cuts and the Eurozone Economy

Simkus's prediction of two more ECB rate cuts highlights the growing concerns about the Eurozone's economic outlook. The weakening economy and the persistent negative impact of trade wars are the primary drivers behind this prediction. While further interest rate reductions could provide some economic stimulus, they also carry the risk of increased inflation and asset bubbles. Alternative economic forecasts and market reactions highlight the uncertainty surrounding the future trajectory of the Eurozone economy. To stay informed about the future impact of ECB rate cuts and their implications for the Eurozone, it is crucial to follow reputable financial news sources and analyses. Stay updated on the evolving situation and the decisions made by the ECB. Understanding the dynamics of European Central Bank rate cuts is vital for navigating the current economic landscape.

Featured Posts

-

The Lady Killers Podcast Unraveling The Mystery Of Sister Faith And Sister Chance In Possession

Apr 27, 2025

The Lady Killers Podcast Unraveling The Mystery Of Sister Faith And Sister Chance In Possession

Apr 27, 2025 -

Alterya Acquired By Chainalysis A Strategic Move In Blockchain Technology

Apr 27, 2025

Alterya Acquired By Chainalysis A Strategic Move In Blockchain Technology

Apr 27, 2025 -

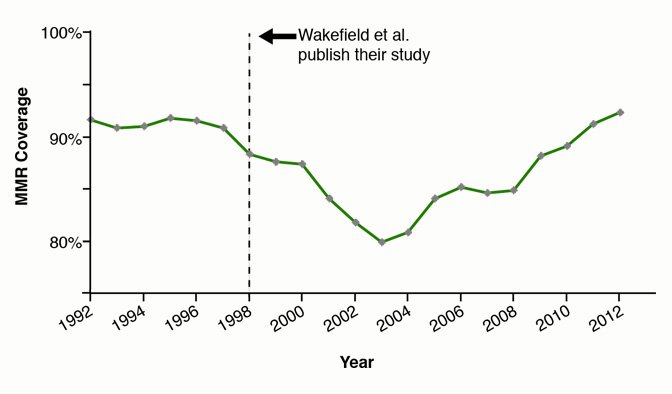

Hhss Controversial Choice Anti Vaccine Advocate To Examine Disproven Autism Vaccine Connection

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Advocate To Examine Disproven Autism Vaccine Connection

Apr 27, 2025 -

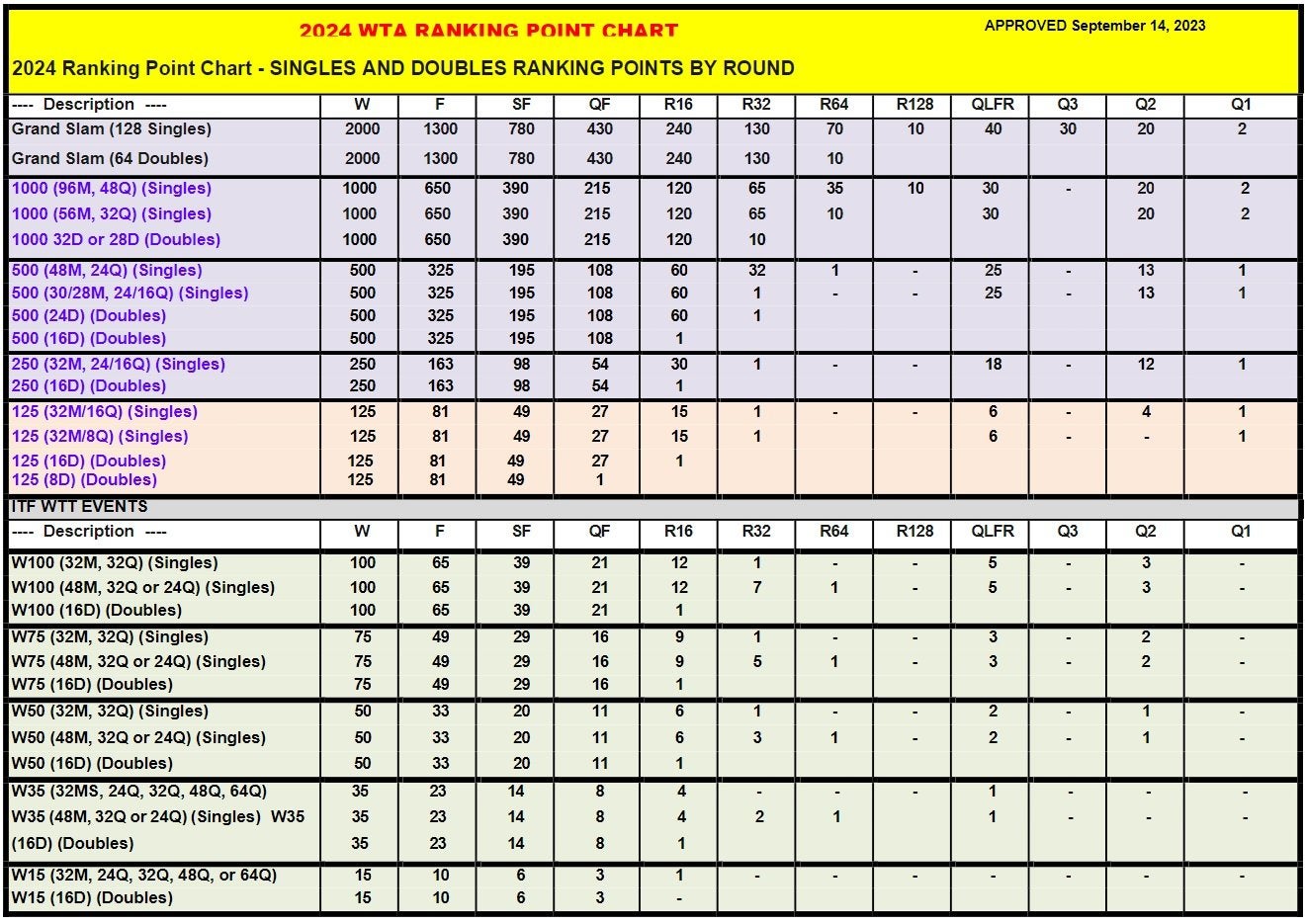

Wta Finals Austria And Singapore Set For Thrilling Showdowns

Apr 27, 2025

Wta Finals Austria And Singapore Set For Thrilling Showdowns

Apr 27, 2025 -

Grand National 2025 Key Runners And Predictions For Aintree

Apr 27, 2025

Grand National 2025 Key Runners And Predictions For Aintree

Apr 27, 2025

Latest Posts

-

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025 -

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025 -

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025 -

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025 -

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025