Dax: Bundestag Elections And Economic Indicators – A Complex Relationship

Table of Contents

Pre-Election Volatility and Investor Uncertainty

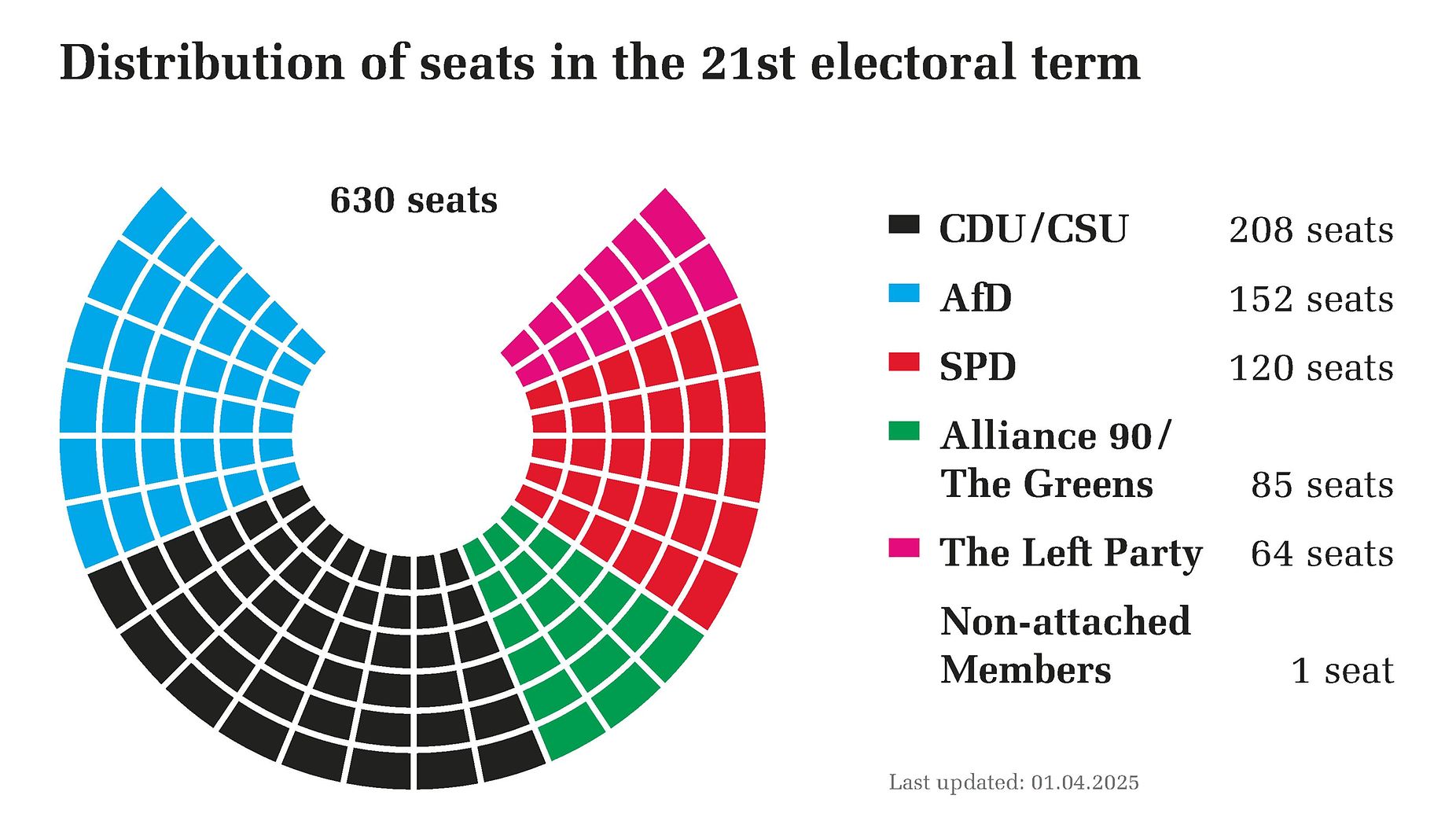

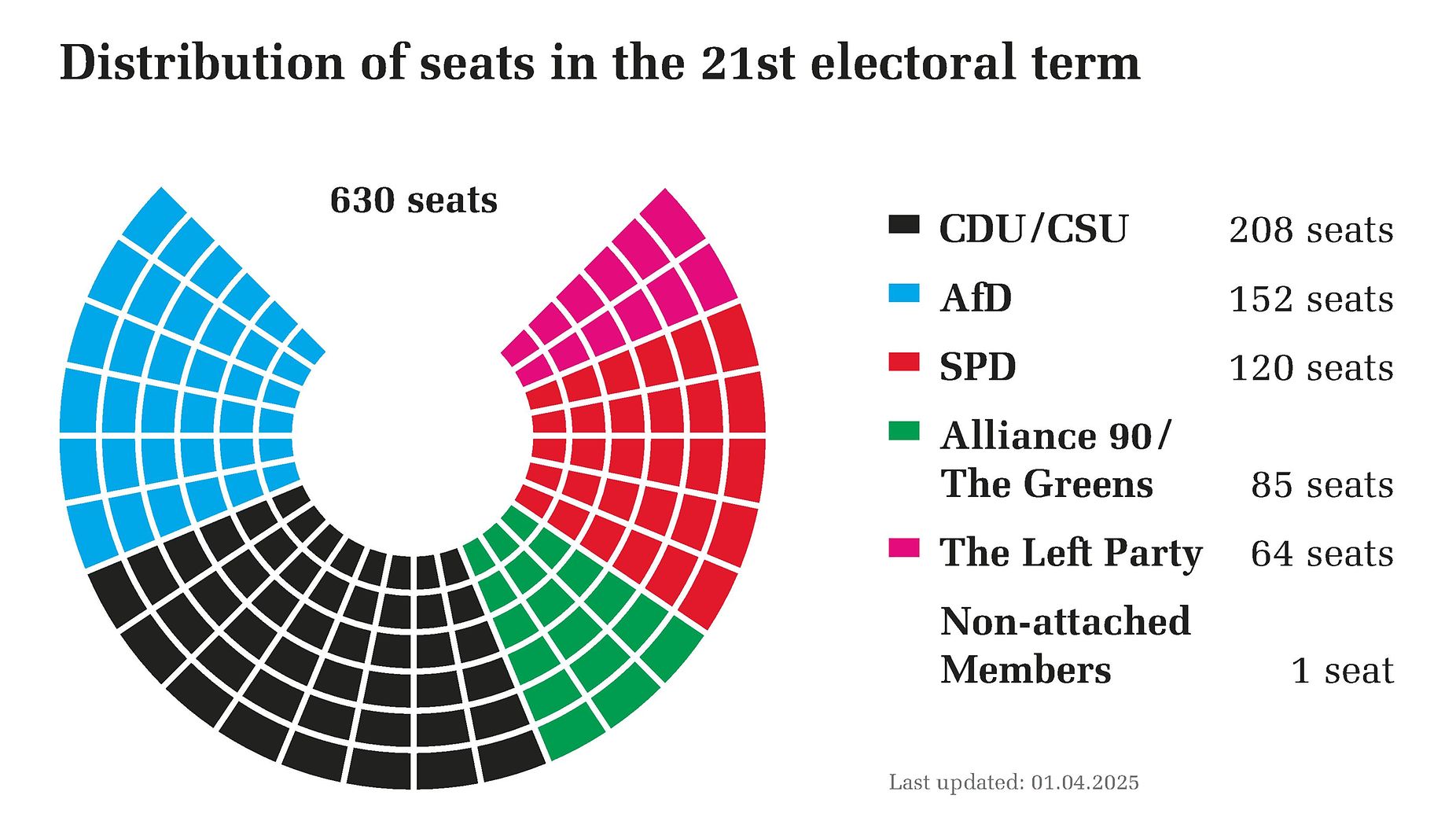

The period leading up to Bundestag elections often witnesses increased volatility in the DAX. Uncertainty regarding the outcome and potential policy shifts under different governing coalitions creates a climate of risk aversion among investors. This pre-election uncertainty translates into a tangible "political risk premium," impacting the DAX's performance.

- Fluctuations in the DAX often correlate with shifts in election polling data. As public opinion sways, so too does investor sentiment, leading to noticeable market fluctuations. A sudden surge in support for a particular party with potentially disruptive economic policies could trigger a sell-off.

- Increased political risk premiums are typically observed as election day approaches. Investors demand higher returns to compensate for the perceived increased risk associated with the election outcome. This can be seen in higher borrowing costs for companies and a general decline in investment activity.

- Investors may adopt a "wait-and-see" approach, delaying major investment decisions. The uncertainty surrounding the election outcome can lead to a period of inaction, reducing overall trading volume and potentially dampening economic growth. This "wait-and-see" approach can exacerbate the pre-election volatility in the DAX.

Post-Election Market Reactions and Policy Impacts

The composition of the new government significantly impacts the DAX's trajectory. The specific policies enacted – particularly concerning fiscal and regulatory measures – directly affect investor confidence and business sentiment. Post-election analysis often reveals a strong correlation between policy announcements and DAX performance.

- Coalition negotiations and the resulting government platform influence market expectations. The formation of a stable coalition government generally calms market nerves, while protracted negotiations or unexpected alliances can create further uncertainty. The specific policy proposals outlined in the coalition agreement will be closely scrutinized by investors.

- Announcements regarding fiscal stimulus, tax reforms, or regulatory changes trigger immediate market responses. Positive news, such as planned infrastructure spending or tax cuts for businesses, tends to boost the DAX. Conversely, announcements of increased regulations or austerity measures can negatively impact the index.

- Changes in monetary policy by the European Central Bank (ECB) also play a crucial role, often influenced by the broader political landscape. The ECB's decisions on interest rates and quantitative easing can significantly impact the Eurozone economy, including Germany, and consequently the DAX. A new government's stance on European integration can influence the ECB's actions.

Specific Economic Indicators and their Correlation with the DAX

Examining the correlation between key economic indicators and the DAX post-election provides a clearer picture of the government's impact on the German economy. This correlation analysis allows for a more nuanced understanding of the relationship between political decisions and market performance.

- Strong GDP growth generally correlates with a rising DAX. A healthy economy, reflected in strong GDP growth, typically translates into increased corporate profits and higher investor confidence, driving up the DAX.

- High inflation rates or rising unemployment can negatively impact the DAX. These factors signal economic weakness and can erode investor confidence, putting downward pressure on the DAX. Central bank responses to inflation also play a key role.

- Positive shifts in consumer confidence and industrial production tend to boost the DAX. These indicators reflect the overall health of the German economy and are closely watched by investors. A robust consumer market and thriving industrial sector are generally positive for the DAX. The Purchasing Managers' Index (PMI) is a key indicator frequently analyzed in this context.

Long-Term Trends and the Impact of Bundestag Elections

Analyzing the long-term performance of the DAX across multiple election cycles reveals broader trends regarding the relationship between political stability and economic growth in Germany. This historical perspective offers valuable insights for forecasting future market reactions.

- Periods of sustained political stability often correlate with stronger long-term DAX performance. A predictable and stable political environment fosters investor confidence and encourages long-term investment, contributing to sustained economic growth and a rising DAX.

- Successful implementation of structural reforms post-election can lead to sustained economic growth. Reforms aimed at improving efficiency and competitiveness can have a long-term positive impact on the German economy and the DAX.

- Analyzing historical data allows for better prediction of potential market reactions to future Bundestag elections. By studying past election cycles, investors and analysts can identify patterns and anticipate potential market responses to future political developments.

Conclusion

The DAX index and Bundestag elections are intricately linked. Pre-election uncertainty often results in DAX volatility, while post-election policy decisions directly influence investor sentiment and the market's trajectory. Analyzing key economic indicators alongside historical election data provides crucial insights into this complex relationship. Understanding the interplay between political developments and economic performance is essential for investors seeking to navigate the German market effectively. Stay informed about upcoming Bundestag elections and their potential impact on the Dax to make informed investment decisions. Further research into the specific policies of different political parties and their potential effects on the Dax is highly recommended.

Featured Posts

-

Political Polarization In Canada Albertas Unique Stance On Trump

Apr 27, 2025

Political Polarization In Canada Albertas Unique Stance On Trump

Apr 27, 2025 -

Detour Recommendation Nosferatu The Vampyre Now Toronto

Apr 27, 2025

Detour Recommendation Nosferatu The Vampyre Now Toronto

Apr 27, 2025 -

Forgotten Role Patrick Schwarzenegger In Ariana Grandes Music Video And White Lotus

Apr 27, 2025

Forgotten Role Patrick Schwarzenegger In Ariana Grandes Music Video And White Lotus

Apr 27, 2025 -

Canadian Auto Industry Faces Posthaste Job Losses Amidst Trumps Tariff Threats

Apr 27, 2025

Canadian Auto Industry Faces Posthaste Job Losses Amidst Trumps Tariff Threats

Apr 27, 2025 -

Mc Cook Community Rallies Jeweler Aids Nfl Players Redevelopment

Apr 27, 2025

Mc Cook Community Rallies Jeweler Aids Nfl Players Redevelopment

Apr 27, 2025

Latest Posts

-

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025 -

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025 -

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025 -

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025 -

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025