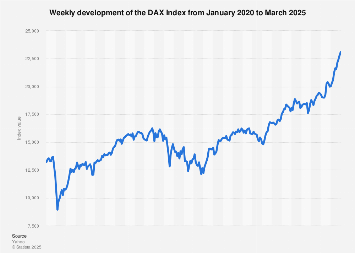

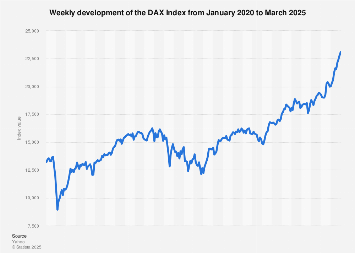

Dax Performance: The Impact Of German Politics And Business Sentiment

Table of Contents

The Influence of German Politics on Dax Performance

German politics wield considerable influence over the DAX, impacting investor confidence and market volatility. Understanding the political climate is key to predicting Dax trends.

Coalition Governments and Market Volatility

The formation of coalition governments in Germany often leads to periods of uncertainty. Negotiations can be lengthy and complex, creating instability that affects investor confidence. This uncertainty can translate into increased market volatility and fluctuations in the DAX.

- Examples: The formation of the "Grand Coalition" in 2013, while initially stabilizing, also saw periods of internal friction reflected in market fluctuations. Conversely, the more stable Merkel-led governments generally saw periods of greater market stability.

- Policy Impacts: Fiscal policy decisions, such as tax reforms or government spending initiatives, directly impact business profitability and investor sentiment. For instance, significant tax cuts can boost corporate profits, leading to a positive impact on the DAX. Conversely, increases in corporate taxes can negatively affect the index.

- Data Point: Historical data could show a statistically significant difference in average DAX performance during periods of single-party government versus coalition governments, highlighting the impact of political stability on market confidence. (Note: Actual data analysis would need to be included here.)

Election Cycles and Market Expectations

Election cycles significantly influence market expectations and Dax trends. The lead-up to an election sees heightened market sensitivity to polls and policy pronouncements from competing parties.

- Pre-election Behavior: Markets often display increased volatility in the months leading up to an election, as investors anticipate potential policy changes. A clear indication of the winning party's likely policies is crucial in predicting the subsequent Dax direction.

- Election Manifestos: The manifestos of major political parties are carefully scrutinized by investors. Promises regarding tax policy, environmental regulations, and social welfare programs all impact investor sentiment and influence investment decisions. Specific proposals that would impact particular sectors (like automotive manufacturing or renewable energy) can drive sector-specific movements within the DAX.

- Policy Shifts: Changes in government policy, especially those affecting major industries represented in the DAX, have a direct and often substantial impact on the index. For example, changes to environmental regulations could significantly impact automotive manufacturers listed on the DAX.

Geopolitical Factors and Their Ripple Effect on the Dax

Germany's interconnectedness with the global economy means that international events and relations have a direct impact on its domestic economy, and thus, the Dax.

- EU Policies: Decisions made within the European Union significantly affect Germany's economy. Changes to trade agreements or regulations can impact German businesses and, consequently, the DAX.

- Trade Wars: Global trade disputes can negatively impact German exports, particularly impacting export-oriented companies listed on the DAX.

- Global Crises: Major global events, like financial crises or pandemics, invariably impact the German economy and the DAX, often leading to significant market downturns. The interconnected nature of global markets means that a crisis in one region can rapidly spread, affecting even robust economies like Germany's.

Business Sentiment and its Correlation with Dax Performance

Business sentiment in Germany is strongly correlated with Dax performance. Key economic indicators and business surveys provide valuable insights into market trends.

The Role of Key Economic Indicators

Several key economic indicators directly influence Dax performance:

- GDP Growth: Strong GDP growth generally indicates a healthy economy, boosting investor confidence and leading to a rise in the DAX. Conversely, slow or negative GDP growth can signal economic weakness, negatively affecting the index.

- Inflation: High inflation erodes purchasing power and can negatively impact consumer spending and business investment, potentially leading to a decline in the DAX. Moderate inflation, however, is generally considered healthy for economic growth.

- Unemployment: Low unemployment rates suggest a strong labor market and healthy economic conditions, generally contributing to a positive Dax performance. High unemployment, on the other hand, can signal economic weakness.

- Consumer Confidence: High consumer confidence indicates optimism about the economy, driving consumer spending and boosting business activity, positively affecting the DAX. Low consumer confidence points to economic uncertainty.

Business Surveys and Confidence Levels

Surveys like the Ifo Business Climate Index provide valuable insights into the overall business sentiment in Germany.

- Ifo Index: The Ifo Index gauges the mood of German businesses regarding their current situation and expectations for the future. A rising Ifo Index suggests increasing optimism, typically correlating with a positive Dax trend, while a falling index indicates pessimism, potentially leading to a decline.

- Sector-Specific Confidence: These surveys often provide sector-specific data, allowing for a more granular analysis of market sentiment within different industries represented in the DAX. For instance, a decline in confidence within the automotive sector could negatively affect the automotive companies listed on the DAX, even if overall business sentiment remains relatively positive.

Corporate Earnings and Profitability

The financial performance of individual DAX companies significantly impacts the overall index.

- Earnings Reports: Strong earnings reports generally lead to an increase in stock prices, positively influencing the DAX. Conversely, weak earnings reports can lead to price drops.

- Profitability: High profitability across DAX companies reflects a strong economic environment and is typically correlated with a healthy Dax performance. Factors such as global market demand, input costs, and competition all influence profitability and thus impact the DAX.

Conclusion

The Dax performance is significantly shaped by the interwoven influences of German politics and business sentiment. Understanding the interplay between coalition governments, election cycles, geopolitical events, key economic indicators, business surveys, and corporate earnings is crucial for informed investment decisions. Monitoring these factors allows investors to better anticipate market trends and adjust their strategies accordingly.

Call to Action: Understanding the dynamic interplay between German politics, business sentiment, and Dax performance is vital for investors. Stay informed on these key indicators to make strategic decisions and navigate the complexities of the German stock market. Continue your research into Dax performance and its influencing factors to optimize your investment strategies and achieve your financial goals.

Featured Posts

-

Pago Por Licencia De Maternidad Para Tenistas De La Wta Un Adelanto Mundial

Apr 27, 2025

Pago Por Licencia De Maternidad Para Tenistas De La Wta Un Adelanto Mundial

Apr 27, 2025 -

Nfl Players Find Second Chances Thanks To Mc Cook Jeweler

Apr 27, 2025

Nfl Players Find Second Chances Thanks To Mc Cook Jeweler

Apr 27, 2025 -

Jugadoras De La Wta Recibiran Pagos Por Licencia De Maternidad

Apr 27, 2025

Jugadoras De La Wta Recibiran Pagos Por Licencia De Maternidad

Apr 27, 2025 -

Ariana Grandes Transformation Professional Expertise In Hair And Tattoo Art

Apr 27, 2025

Ariana Grandes Transformation Professional Expertise In Hair And Tattoo Art

Apr 27, 2025 -

Subsystem Issue Forces Blue Origin To Cancel Rocket Launch

Apr 27, 2025

Subsystem Issue Forces Blue Origin To Cancel Rocket Launch

Apr 27, 2025

Latest Posts

-

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025 -

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025 -

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025 -

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025 -

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025