DSP India Fund: Top Performance, Cautious Outlook, Cash Increase

Table of Contents

Outstanding Performance of the DSP India Fund

Strong Returns and Outperformance Benchmarks

The DSP India Fund has delivered impressive returns, significantly outperforming key benchmarks. In the last [Insert Time Period, e.g., year], the fund achieved a return of [Insert Percentage]% compared to the Nifty 50's [Insert Percentage]% and the Sensex's [Insert Percentage]%. This strong performance is attributed to several key factors:

- Strategic Stock Selection: The fund managers' expertise in identifying undervalued and high-growth companies has been a significant contributor to the fund's success.

- Sector Allocation: A well-diversified portfolio across various promising sectors within the Indian economy has mitigated sector-specific risks.

- Effective Market Timing: The fund's management team has demonstrated a skill in adapting its strategy in response to market fluctuations, capitalizing on opportunities and mitigating potential losses.

- Successful Investments: Specific investments in [mention 1-2 successful sectors or companies, if possible and publicly available, e.g., technology companies or specific companies within the healthcare sector] have significantly boosted the fund's overall performance.

Analyzing the Fund Manager's Strategy

The DSP India Fund's success is rooted in the expertise of its fund manager(s), who possess extensive experience in the Indian market. Their investment philosophy emphasizes [mention the investment style, e.g., a blend of value and growth investing], focusing on companies with strong fundamentals and long-term growth potential.

- Investment Style: The fund typically invests in a diversified portfolio of large-cap and mid-cap companies.

- Risk Tolerance: While aiming for long-term growth, the fund maintains a measured approach to risk management.

- Adaptability: The fund managers have demonstrated an ability to adapt their strategy during periods of market volatility, adjusting their portfolio to navigate challenging economic conditions. For example, [mention a specific example if possible, such as adjusting sector allocation or increasing cash holdings during a period of uncertainty].

Cautious Outlook for the Indian Equity Market

Macroeconomic Factors Affecting the DSP India Fund

Despite the recent strong performance, the fund managers maintain a cautious outlook on the Indian equity market. Several macroeconomic factors contribute to this perspective:

- Inflation: Persistent inflationary pressures could impact consumer spending and corporate profitability.

- Interest Rates: Rising interest rates increase borrowing costs for businesses, potentially slowing down economic growth.

- Global Economic Uncertainty: Geopolitical risks and global economic slowdown pose challenges to the Indian economy.

- Geopolitical Factors: The ongoing global geopolitical landscape, including [mention specific geopolitical events impacting India, if relevant], introduces uncertainty into the market.

Valuation Concerns and Potential Corrections

Current valuations of Indian equities are considered by some analysts to be somewhat high relative to historical averages. This raises concerns about the potential for market corrections.

- Overvaluation Concerns: Certain sectors may be overvalued, increasing the risk of price declines.

- Potential for Corrections: The fund managers are anticipating the possibility of short-term market corrections.

- Cautious Stance: The cautious approach aims to mitigate potential losses during periods of market volatility.

Increased Cash Position: A Strategic Defensive Move

Reasons for the Increased Cash Allocation

The DSP India Fund's recent increase in its cash allocation is a strategic defensive move designed to mitigate risks in the current volatile market.

- Risk Reduction: Holding cash reduces the fund's exposure to market fluctuations.

- Capital Preservation: A higher cash position helps preserve capital during potential market downturns.

- Future Opportunities: Increased cash provides the flexibility to capitalize on attractive investment opportunities that may emerge in the future.

Implications for Investors

The increased cash position may lead to lower short-term returns compared to a fully invested portfolio. However, this strategy prioritizes capital preservation and risk mitigation.

- Risk Tolerance: This approach is suitable for investors with a moderate to conservative risk tolerance.

- Long-Term Perspective: The strategic cash allocation reflects a long-term investment horizon, prioritizing capital preservation over short-term gains.

Conclusion: Investing in the DSP India Fund – A Balanced Approach

The DSP India Fund's recent performance has been commendable, showcasing the fund manager's expertise. However, the current market conditions necessitate a cautious approach, reflected in the strategic increase in cash reserves. This balanced approach seeks to protect capital while remaining positioned to benefit from future opportunities within the Indian equity market. This strategy suggests a focus on long-term growth and capital preservation, making it a suitable consideration for investors with a moderate to conservative risk tolerance. Learn more about the DSP India Fund and how it can fit into your diversified investment strategy for a balanced approach to Indian equity exposure.

Featured Posts

-

Anthony Edwards Injury Status Latest News On Timberwolves Guard

Apr 29, 2025

Anthony Edwards Injury Status Latest News On Timberwolves Guard

Apr 29, 2025 -

Middle Management Their Value In Driving Company Performance And Employee Growth

Apr 29, 2025

Middle Management Their Value In Driving Company Performance And Employee Growth

Apr 29, 2025 -

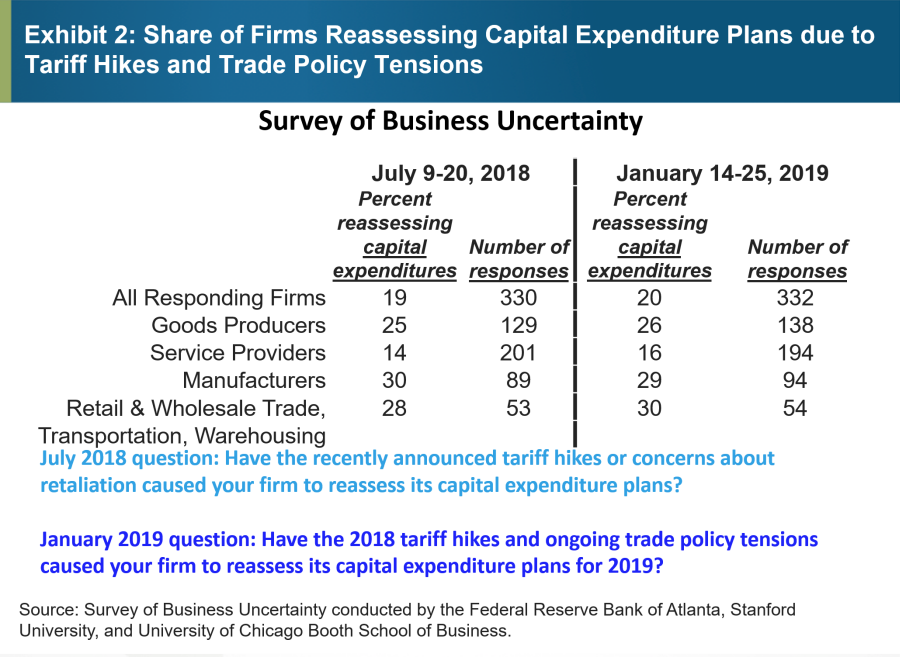

The Impact Of Tariff Uncertainty On U S Company Spending

Apr 29, 2025

The Impact Of Tariff Uncertainty On U S Company Spending

Apr 29, 2025 -

Will Minnesota Film Tax Credits Attract More Productions

Apr 29, 2025

Will Minnesota Film Tax Credits Attract More Productions

Apr 29, 2025 -

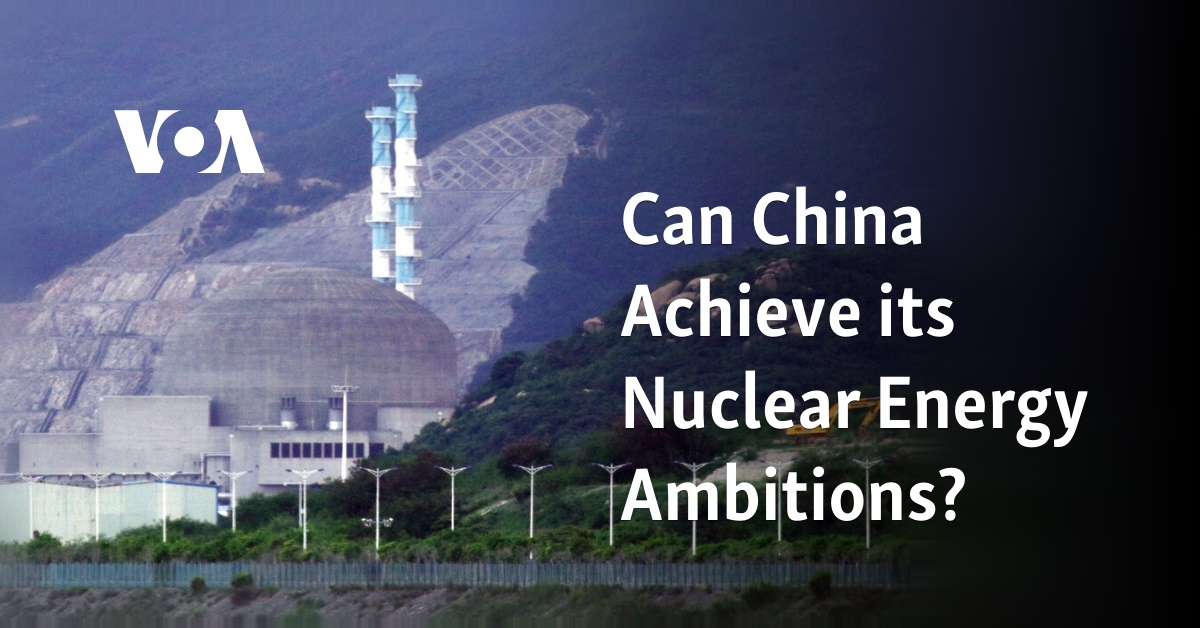

China Greenlights 10 New Nuclear Reactors Fueling Energy Growth

Apr 29, 2025

China Greenlights 10 New Nuclear Reactors Fueling Energy Growth

Apr 29, 2025

Latest Posts

-

Republican Divisions Could Determine Fate Of Trumps Tax Plan

Apr 29, 2025

Republican Divisions Could Determine Fate Of Trumps Tax Plan

Apr 29, 2025 -

Can Trump Overcome Republican Opposition To His Tax Bill

Apr 29, 2025

Can Trump Overcome Republican Opposition To His Tax Bill

Apr 29, 2025 -

The Fight Within The Gop Trumps Tax Plan In Jeopardy

Apr 29, 2025

The Fight Within The Gop Trumps Tax Plan In Jeopardy

Apr 29, 2025 -

Analysis Trumps Tax Bill Faces Significant Republican Opposition

Apr 29, 2025

Analysis Trumps Tax Bill Faces Significant Republican Opposition

Apr 29, 2025 -

Key Republican Groups Oppose Trumps Big Beautiful Tax Cuts

Apr 29, 2025

Key Republican Groups Oppose Trumps Big Beautiful Tax Cuts

Apr 29, 2025