ECB Launches Task Force To Streamline Banking Rules

Table of Contents

The Rationale Behind the ECB's Streamlining Effort

The current regulatory environment in the Eurozone presents several significant hurdles for banks. Regulations, often fragmented and overlapping, create an overly complex landscape. This complexity translates into substantial administrative burdens and high compliance costs, diverting resources away from core banking activities like lending and investment. Furthermore, excessive regulatory complexity can stifle innovation, preventing banks from developing new products and services to meet evolving customer needs.

The ECB's overarching goal is to create a more efficient and harmonized regulatory environment. By simplifying existing rules and removing unnecessary burdens, the central bank aims to foster a more dynamic and competitive banking sector within the Eurozone. This streamlining effort is not merely about reducing paperwork; it's about creating a regulatory framework that supports economic growth and stability.

- Reduced compliance costs for banks: Streamlining regulations directly reduces the financial burden on banks, freeing up capital for investment and lending.

- Improved efficiency in banking operations: Simpler rules lead to more efficient internal processes, allowing banks to allocate resources more effectively.

- Enhanced competitiveness within the Eurozone banking sector: A level playing field created by clearer and simpler rules fosters a more competitive landscape.

- Stimulated innovation in financial services: Reduced regulatory burden allows banks to focus on innovation, developing new products and services.

Key Areas Targeted by the ECB Task Force

The ECB task force will meticulously examine various facets of banking regulations, focusing on areas where simplification can yield the greatest benefits. Specific areas ripe for streamlining include:

- Capital adequacy requirements: The task force will review the current capital requirements to ensure they are both effective and proportionate to the risks involved. This includes exploring potential simplifications without compromising financial stability.

- Liquidity coverage ratio (LCR) and Net stable funding ratio (NSFR): These crucial liquidity rules will be scrutinized for potential refinements, aiming to reduce the administrative burden while maintaining the integrity of the liquidity framework.

- Reporting frameworks and data requirements: The ECB will assess the current reporting requirements, aiming to reduce the amount of data banks are required to collect and submit, thereby minimizing administrative costs. This includes exploring opportunities for greater standardization and digitalization.

The task force will adopt a multi-pronged approach. This will involve extensive consultations with banks, stakeholders, and other regulatory bodies to gather input and identify practical solutions. Data analysis will play a crucial role in identifying areas where regulations are overly complex or burdensome.

Expected Outcomes and Timeline for Implementation

The successful implementation of streamlined banking regulations promises several key outcomes.

- Improved financial stability: A more efficient regulatory framework contributes to a more resilient and stable financial system.

- Increased lending to businesses and consumers: Reduced compliance costs and improved operational efficiency will allow banks to increase lending activities, supporting economic growth.

- Reduced administrative burden for banks: Simplification frees up resources, allowing banks to concentrate on their core business activities.

- Faster processing of loan applications: Streamlined procedures will lead to faster processing times for loan applications, benefiting both businesses and consumers.

The exact timeline for the task force's work and the implementation of proposed changes remains to be determined. However, the ECB is committed to a timely and efficient process. Potential challenges could include navigating differing national regulatory frameworks and ensuring the proposed changes align with broader EU legislation.

Conclusion: The Future of Banking Regulation in the Eurozone – Streamlined and Efficient

The ECB's initiative to streamline banking rules represents a significant step towards creating a more efficient and competitive financial sector in the Eurozone. The task force's work promises to reduce the administrative burden on banks, stimulate innovation, and ultimately enhance financial stability. The anticipated benefits include reduced compliance costs, improved operational efficiency, and increased lending activity, all contributing to a healthier and more dynamic economy.

Stay updated on the ECB's initiatives to streamline banking rules and how they will impact your business or personal finances. Learn more about the ECB's efforts to improve banking regulation and follow the ECB's updates on regulatory changes. Understanding these developments is crucial for banks, businesses, and individuals alike.

Featured Posts

-

Hair And Tattoo Transformations Learning From Ariana Grandes Professional Choices

Apr 27, 2025

Hair And Tattoo Transformations Learning From Ariana Grandes Professional Choices

Apr 27, 2025 -

Ohio Train Derailment Toxic Chemical Lingering In Buildings

Apr 27, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings

Apr 27, 2025 -

Juliette Binoche Cannes Film Festival Jury President 2025

Apr 27, 2025

Juliette Binoche Cannes Film Festival Jury President 2025

Apr 27, 2025 -

Novak Djokovics Straight Sets Defeat At Monte Carlo Masters 2025

Apr 27, 2025

Novak Djokovics Straight Sets Defeat At Monte Carlo Masters 2025

Apr 27, 2025 -

Pfc Files Complaint Against Gensol Engineering For Falsified Documents

Apr 27, 2025

Pfc Files Complaint Against Gensol Engineering For Falsified Documents

Apr 27, 2025

Latest Posts

-

A Look Back 2000 Yankees Diary Victory Over The Royals

Apr 28, 2025

A Look Back 2000 Yankees Diary Victory Over The Royals

Apr 28, 2025 -

Yankees 2000 Season A Diary Entry The Royals Game

Apr 28, 2025

Yankees 2000 Season A Diary Entry The Royals Game

Apr 28, 2025 -

2000 Yankees Diary Bombers Defeat Royals In Thrilling Victory

Apr 28, 2025

2000 Yankees Diary Bombers Defeat Royals In Thrilling Victory

Apr 28, 2025 -

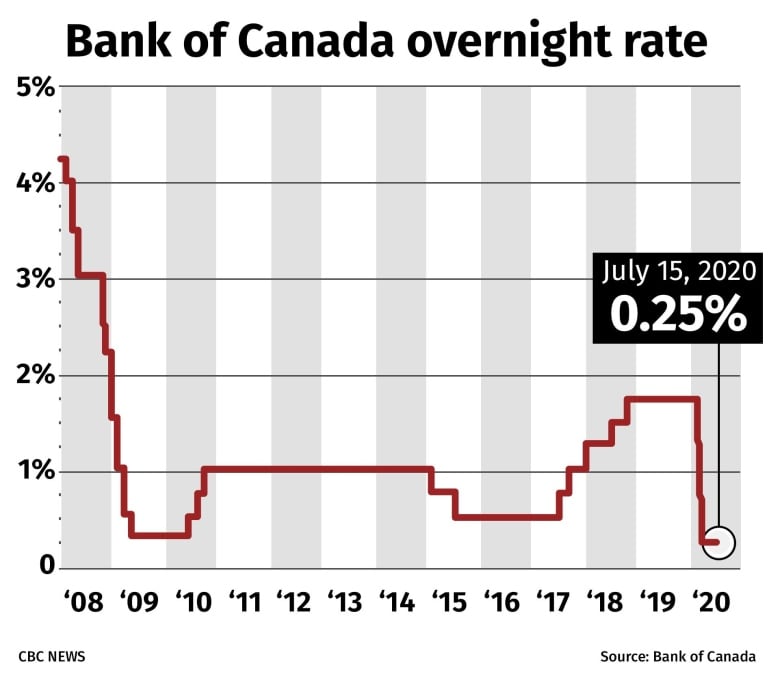

Bank Of Canada Rate Cuts A Response To Dismal Retail Sales Figures

Apr 28, 2025

Bank Of Canada Rate Cuts A Response To Dismal Retail Sales Figures

Apr 28, 2025 -

The Grim Truth About Retail Sales And The Bank Of Canadas Next Move

Apr 28, 2025

The Grim Truth About Retail Sales And The Bank Of Canadas Next Move

Apr 28, 2025