ECB's Simkus: Trade Headwinds Could Lead To Two Additional Interest Rate Cuts

Table of Contents

Simkus's Concerns Regarding Global Trade

Šimkus, a prominent figure in the European Central Bank, has voiced serious concerns about the escalating global trade tensions and their detrimental effects on the Eurozone. He highlights the potential for prolonged trade wars and protectionist measures to significantly stifle economic growth. The ongoing US-China trade war, coupled with the lingering uncertainties surrounding Brexit, are prime examples of these trade headwinds impacting the Eurozone's economic stability. These external factors contribute to a less favorable environment for businesses and investors.

- Weakening global demand due to trade uncertainty: The uncertainty surrounding trade policies discourages businesses from making significant investments and reduces consumer confidence, ultimately leading to a decline in overall demand.

- Reduced investment due to trade disputes: Trade disputes create instability, leading businesses to postpone or cancel expansion plans, hindering job creation and overall economic growth.

- Supply chain disruptions affecting Eurozone businesses: Trade wars and protectionist measures disrupt global supply chains, increasing costs and potentially causing shortages for Eurozone businesses.

The Justification for Further Interest Rate Cuts

The projected economic slowdown in the Eurozone necessitates additional interest rate cuts, according to Šimkus's assessment. The ECB's primary mandate is to maintain price stability and support economic growth. With inflation currently below the ECB's target, the interest rate cuts aim to stimulate economic activity. Lower borrowing costs encourage businesses to invest and consumers to spend, countering deflationary pressures and promoting economic expansion.

- Stimulating economic activity through lower borrowing costs: Lower interest rates make borrowing cheaper for businesses and consumers, potentially stimulating investment and consumption.

- Combating deflationary pressures: Interest rate cuts aim to prevent a deflationary spiral, where falling prices discourage spending and investment.

- Encouraging investment and consumption: Lower borrowing costs incentivize businesses to invest in expansion and modernization, while consumers may be more inclined to make larger purchases.

Market Reaction and Analyst Opinions on Potential ECB Interest Rate Cuts

Simkus's statement regarding potential interest rate cuts prompted an immediate reaction in financial markets. While the initial market response was varied, many leading financial analysts believe further interest rate cuts are highly probable. The potential impact of these cuts extends beyond the Eurozone, potentially influencing the Euro exchange rate and global financial markets.

- Stock market response to the news: Stock markets generally reacted positively to the prospect of further stimulus, anticipating increased economic activity.

- Euro exchange rate fluctuations: The Euro's exchange rate is likely to be affected by further interest rate cuts, potentially weakening against other currencies.

- Impact on government bond yields: Lower interest rates typically lead to lower government bond yields, impacting investor returns on government debt.

Alternative Monetary Policy Tools Besides Interest Rate Cuts

If interest rates reach extremely low levels, the ECB may consider alternative monetary policy tools to further stimulate the economy. These tools include quantitative easing (QE) and targeted longer-term refinancing operations (TLTROs).

- Quantitative easing (QE) programs: QE involves the ECB purchasing government bonds and other assets to inject liquidity into the financial system.

- Targeted longer-term refinancing operations (TLTROs): TLTROs provide banks with cheap, long-term loans, encouraging them to lend to businesses and consumers.

- Negative interest rates on commercial banks' deposits: Negative interest rates on commercial banks' deposits incentivize banks to lend rather than hold excess reserves.

Conclusion: The Future of ECB Interest Rate Cuts and Their Implications

Šimkus's prediction of two additional interest rate cuts underscores the ECB's concerns about the Eurozone's economic outlook. The anticipated cuts are primarily driven by the significant impact of trade headwinds and the resulting economic slowdown. These interest rate cuts are expected to have a substantial effect on the Eurozone economy and financial markets.

To stay informed about the future of ECB interest rate cuts and their impact on the Eurozone economy, it's crucial to follow financial news sources for updates on ECB interest rate decisions. Further research into how these interest rate cuts might specifically affect your investments or financial plans is highly recommended. Understanding these developments is key to navigating the evolving economic landscape.

Featured Posts

-

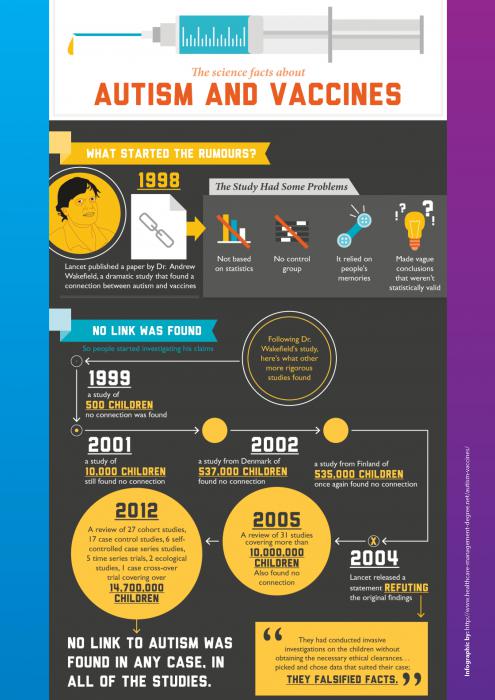

Controversial Autism Study Head An Anti Vaccination Advocate

Apr 27, 2025

Controversial Autism Study Head An Anti Vaccination Advocate

Apr 27, 2025 -

Albertas Oil Industry And The Anti Trump Divide In Canada

Apr 27, 2025

Albertas Oil Industry And The Anti Trump Divide In Canada

Apr 27, 2025 -

Pfcs Action Against Gensol Promoters Eo W Based On Fake Documents

Apr 27, 2025

Pfcs Action Against Gensol Promoters Eo W Based On Fake Documents

Apr 27, 2025 -

Belinda Bencics Post Maternity Wta Victory

Apr 27, 2025

Belinda Bencics Post Maternity Wta Victory

Apr 27, 2025 -

Charleston Open Keys Falls To Kalinskaya In Quarterfinal Thriller

Apr 27, 2025

Charleston Open Keys Falls To Kalinskaya In Quarterfinal Thriller

Apr 27, 2025

Latest Posts

-

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025 -

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025 -

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025 -

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025 -

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025