Ethereum's Critical Support Level: $1,500 Drop Possible? Price Prediction Analysis

Table of Contents

Analyzing Ethereum's Current Market Conditions

Several indicators suggest a period of uncertainty for Ethereum. Let's examine the key factors influencing the current market conditions and their implications for the $1500 Ethereum support level.

Technical Indicators

Technical analysis provides valuable insights into potential price movements. Currently, we observe the following:

- Relative Strength Index (RSI): A reading below 30 often suggests oversold conditions, potentially signaling a bounce. However, a prolonged stay in oversold territory could indicate further downward pressure. (Insert chart showing RSI for ETH).

- Moving Averages: The 50-day and 200-day moving averages are currently [Insert relationship between moving averages - e.g., crossing, diverging etc.]. This [Insert interpretation of the moving average relationship - e.g., bearish, bullish, neutral] signal could influence the price direction. (Insert chart showing moving averages).

- MACD (Moving Average Convergence Divergence): The MACD is [Insert current state of the MACD - e.g., below the signal line, showing bearish divergence]. This suggests [Insert interpretation of the MACD - e.g., potential for further price decline, weakening bullish momentum]. (Insert chart showing MACD).

On-Chain Metrics

Analyzing on-chain data offers a deeper understanding of market sentiment. Key metrics to consider include:

- Active Addresses: A decline in active addresses might indicate decreasing user engagement and could foreshadow further price drops. (Cite source for data).

- Transaction Volume: Lower transaction volume can suggest reduced trading activity and potentially weaker price support. (Cite source for data).

- Gas Fees: Changes in gas fees can reflect network activity and overall market sentiment. High gas fees might indicate bullish activity, while lower fees could signal the opposite. (Cite source for data).

Macroeconomic Factors

External factors significantly impact cryptocurrency prices. For Ethereum, these include:

- Overall Market Sentiment: A broader downturn in the cryptocurrency market often negatively affects even strong projects like Ethereum.

- Regulatory News: Regulatory developments, both positive and negative, can dramatically impact Ethereum's price. Increased regulatory clarity could be bullish, while stricter regulations could exert downward pressure.

- Bitcoin's Price Movements: Bitcoin often acts as a bellwether for the entire cryptocurrency market. A significant drop in Bitcoin's price can trigger sell-offs in other cryptocurrencies, including Ethereum.

The Significance of the $1,500 Support Level

The $1,500 level holds significant importance for Ethereum's price.

Historical Context

Historically, Ethereum's price has found support around the $1,500 mark on several occasions. (Insert charts illustrating past instances of support at or near $1,500). This historical support suggests a potential psychological barrier that could prevent further significant declines.

Psychological Impact

The $1,500 level has a psychological impact on investors. A break below this level could trigger panic selling, leading to a more substantial price drop. Conversely, holding above this level could bolster confidence and potentially lead to a price recovery.

Technical Analysis of the Support

Technical analysis can help assess the strength of the $1,500 support. Factors to consider include the volume of trading around this level, the presence of strong trendlines, and the behavior of key technical indicators. [Discuss specific technical factors and their implications].

Potential Scenarios and Price Predictions

Based on the current market conditions and analysis, several scenarios are possible:

Bearish Scenario ($1,500 Drop)

A break below $1,500 could be triggered by:

- Negative regulatory news.

- A major market correction in the broader cryptocurrency market.

- Continued weakness in on-chain metrics.

In this scenario, Ethereum's price could potentially drop further to [Insert potential price target - e.g., $1,200 or lower] within [Insert timeframe - e.g., the next few weeks or months].

Bullish Scenario (Holding Above $1,500)

Factors that could prevent a significant drop and lead to a price recovery include:

- Positive regulatory developments.

- Successful completion of major Ethereum upgrades.

- Increased institutional adoption.

If these conditions prevail, Ethereum could potentially rally back towards [Insert potential price target - e.g., $2,000 or higher] within [Insert timeframe - e.g., the next few months].

Neutral Scenario (Consolidation)

A period of price consolidation around the $1,500 level is also possible before a clear trend emerges. This scenario could last for several weeks or even months, depending on the evolving market dynamics.

Risk Management Strategies for Ethereum Investors

Navigating the volatility of the cryptocurrency market requires a robust risk management strategy.

- Diversification: Diversifying your crypto portfolio across different assets is crucial to mitigate risk.

- Stop-Loss Orders: Employing stop-loss orders can help limit potential losses by automatically selling your Ethereum holdings when the price falls below a predetermined level.

- Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of the price. This strategy helps reduce the impact of market volatility.

Conclusion: Navigating Ethereum's Critical Support Level

Ethereum's price is currently facing a crucial test at the $1,500 support level. While a drop below this level is a possibility, driven by various technical, on-chain, and macroeconomic factors, a bullish scenario is also plausible, contingent on positive developments. Careful monitoring of technical indicators, on-chain data, and macroeconomic factors is essential for informed decision-making. By employing sound risk management strategies and conducting thorough research, investors can navigate this uncertain period and make well-informed decisions about their Ethereum holdings. Stay informed about Ethereum's critical support level and make well-informed decisions by continuing your research into Ethereum price prediction and analysis. Subscribe to our newsletter for future updates on Ethereum's price and market trends!

Featured Posts

-

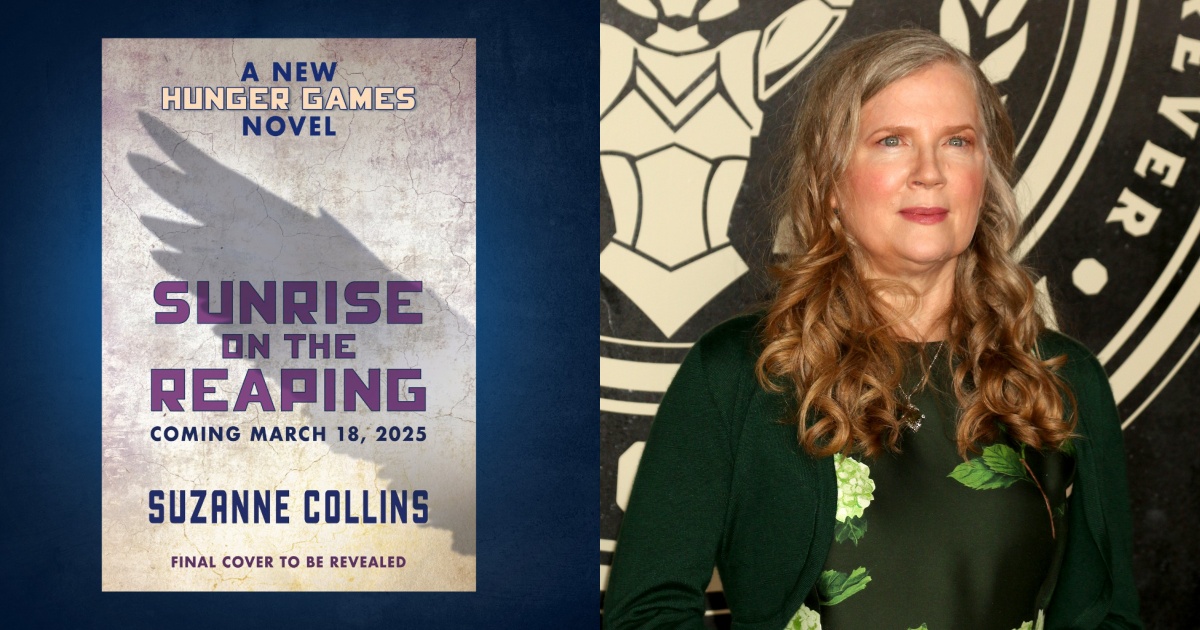

2025 Release Date Announced For Stephen King Adaptation Directed By The Hunger Games Director

May 08, 2025

2025 Release Date Announced For Stephen King Adaptation Directed By The Hunger Games Director

May 08, 2025 -

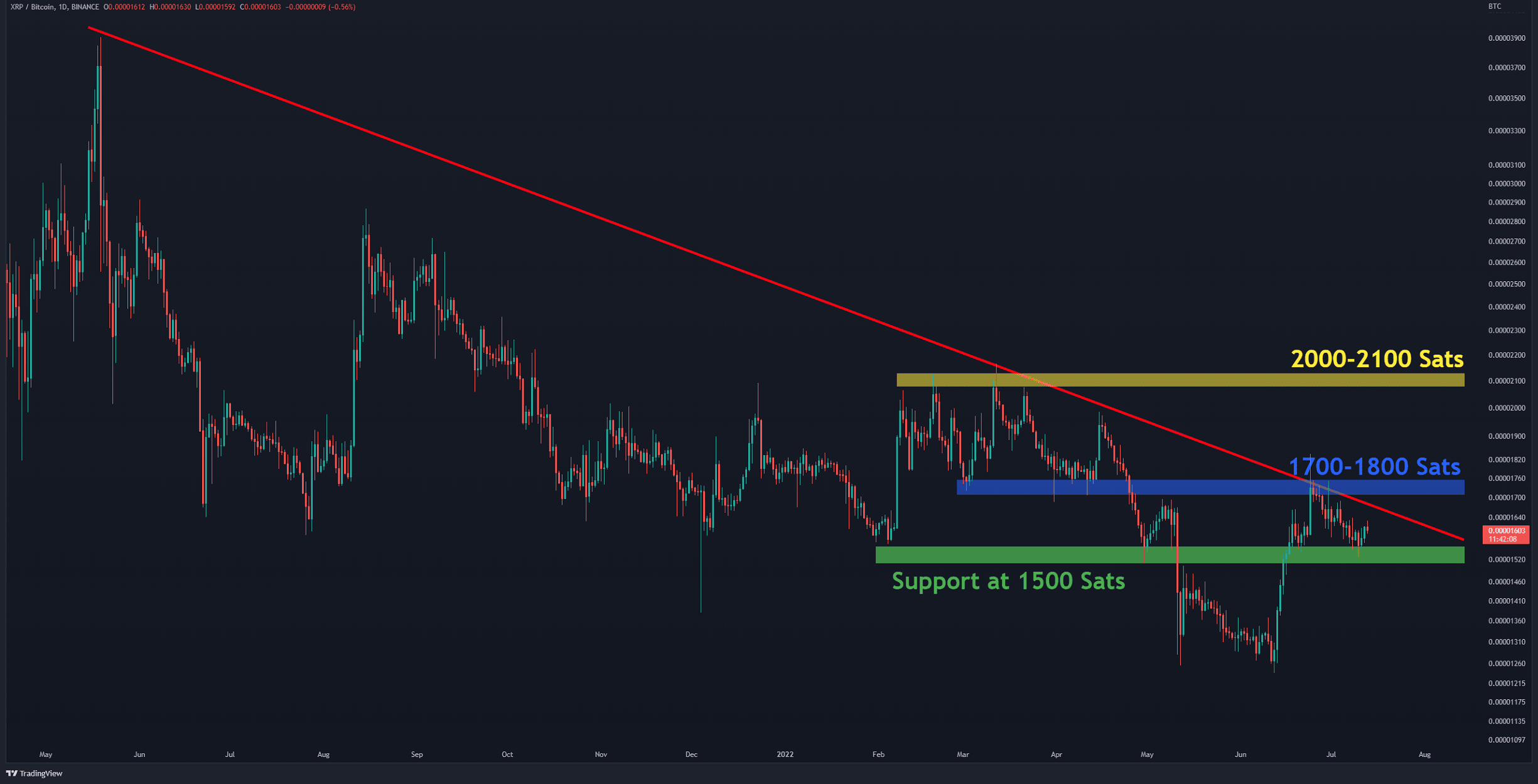

Is Investing In Xrp Ripple Right For You A Financial Analysis

May 08, 2025

Is Investing In Xrp Ripple Right For You A Financial Analysis

May 08, 2025 -

Daily Lotto Results For Tuesday April 15 2025

May 08, 2025

Daily Lotto Results For Tuesday April 15 2025

May 08, 2025 -

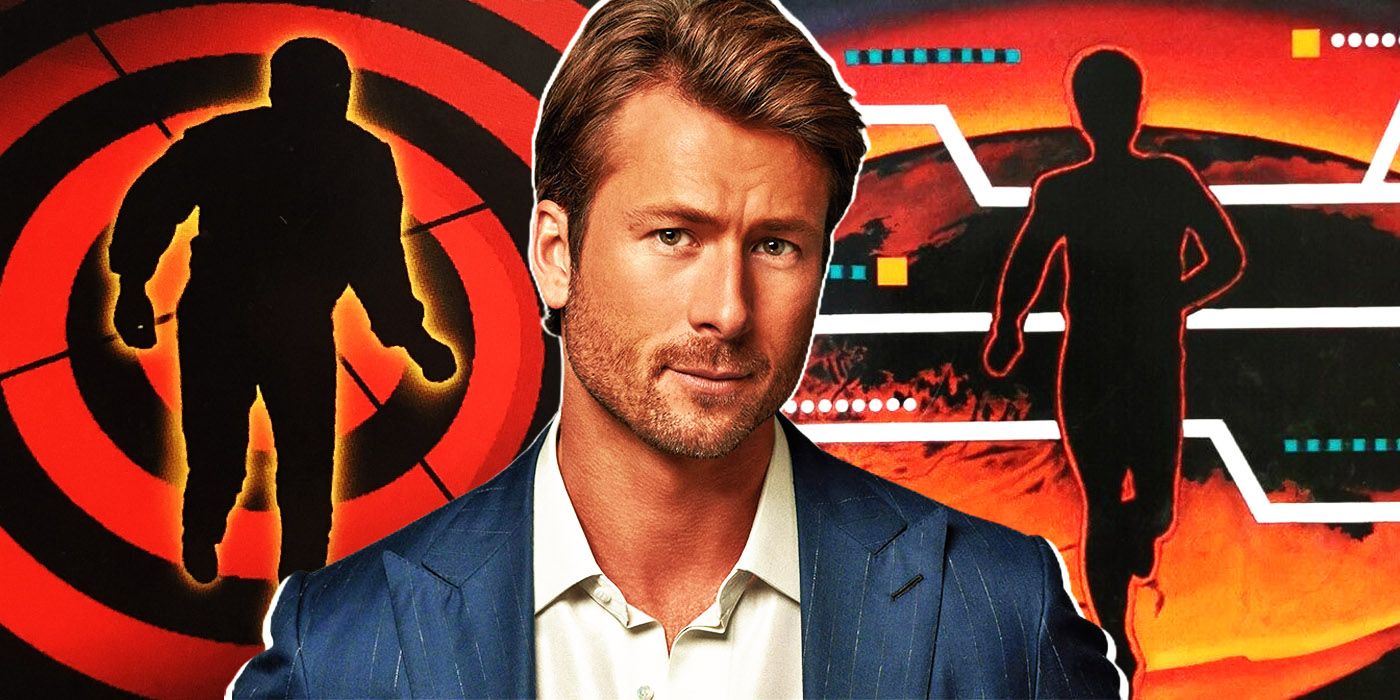

Glen Powells Fitness Regime And Character Development In The Running Man

May 08, 2025

Glen Powells Fitness Regime And Character Development In The Running Man

May 08, 2025 -

Angels Losing Streak Reaches Five As Mike Trout Exits With Knee Issue

May 08, 2025

Angels Losing Streak Reaches Five As Mike Trout Exits With Knee Issue

May 08, 2025

Latest Posts

-

Xrps Future The Impact Of Secs Commodity Debate

May 08, 2025

Xrps Future The Impact Of Secs Commodity Debate

May 08, 2025 -

Daily Lotto Friday 18th April 2025 Results

May 08, 2025

Daily Lotto Friday 18th April 2025 Results

May 08, 2025 -

Winning Numbers Daily Lotto Wednesday April 16 2025

May 08, 2025

Winning Numbers Daily Lotto Wednesday April 16 2025

May 08, 2025 -

The Sec And Xrp Navigating The Uncertainty Around Commodity Classification

May 08, 2025

The Sec And Xrp Navigating The Uncertainty Around Commodity Classification

May 08, 2025 -

Xrp Regulatory Status Latest News And Analysis Of The Secs Position

May 08, 2025

Xrp Regulatory Status Latest News And Analysis Of The Secs Position

May 08, 2025