EU's Planned Phaseout Of Russian Gas: Spot Market In Focus

Table of Contents

The Urgency of Diversification

The EU's heavy reliance on Russian gas exposed its vulnerability to geopolitical pressures. The phaseout necessitates a rapid diversification of supply sources to enhance energy independence and mitigate future risks. This strategic shift involves several key actions:

-

Increased reliance on LNG imports: The EU is actively seeking increased liquefied natural gas (LNG) imports from diverse global sources, including the United States, Qatar, and Australia. This involves significant investment in LNG import terminals and infrastructure.

-

Exploration of alternative pipeline gas suppliers: Diversification efforts extend to exploring alternative pipeline gas suppliers, such as Norway and Azerbaijan. Strengthening existing pipeline connections and developing new ones are crucial components of this strategy.

-

Investment in renewable energy sources: To reduce overall gas demand and lessen dependence on fossil fuels, significant investments are being made in renewable energy sources like solar, wind, and hydropower. This long-term strategy aims to create a more sustainable and resilient energy system.

-

Focus on improving energy efficiency and reducing consumption: The EU is promoting energy efficiency measures across various sectors, reducing overall energy consumption and lessening the reliance on gas imports. This involves implementing stricter building codes, improving industrial processes, and encouraging consumer awareness. This multifaceted approach addresses both supply and demand sides of the equation. The goal is to decrease the overall demand for gas, reducing reliance on volatile spot markets.

The Spot Market's Expanding Role

The spot market, offering short-term gas trading, has become a vital tool for EU countries to secure immediate gas supplies, especially given the uncertainty surrounding long-term contracts. This increased reliance on the spot market, however, presents both opportunities and challenges:

-

Increased price volatility: Spot gas prices are highly volatile, fluctuating significantly based on supply and demand dynamics. Geopolitical events, weather patterns, and unexpected disruptions to supply chains can all contribute to dramatic price swings.

-

The need for sophisticated price hedging strategies: To manage the risk associated with price volatility, EU countries and energy companies are increasingly relying on sophisticated price hedging strategies, such as derivatives and futures contracts. These instruments help mitigate the impact of price fluctuations on their bottom lines.

-

Development and expansion of gas trading hubs: Europe is witnessing the development and expansion of gas trading hubs, facilitating efficient trading and price discovery. These hubs increase market liquidity and transparency.

-

Potential for increased market liquidity: As trading volumes surge in response to the phaseout of Russian gas, the spot market is expected to experience increased liquidity, making it easier for buyers and sellers to find each other and execute transactions.

Challenges of the Spot Market

While the spot market offers flexibility and responsiveness to changing supply conditions, it also presents significant challenges:

-

Risk of price spikes: Periods of high demand or unexpectedly low supply can lead to dramatic price spikes, impacting consumers and businesses alike.

-

Concerns about potential market manipulation: The increased importance of the spot market raises concerns about potential market manipulation and price volatility, requiring robust regulatory oversight.

-

Need for robust regulatory frameworks: Strong regulatory frameworks are essential to ensure market transparency, fairness, and prevent manipulation. This involves establishing clear rules, monitoring trading activity, and addressing potential market abuses.

-

Infrastructure limitations: Handling the increased LNG imports and cross-border gas flows requires significant investment in infrastructure, including new LNG terminals, pipelines, and storage facilities. These investments are crucial to ensuring the smooth functioning of the spot market.

The Impact on Gas Prices

The transition away from Russian gas significantly impacts gas prices in Europe, creating both short-term and long-term consequences:

-

Short-term price volatility: Spot market dynamics directly influence short-term price volatility, leading to periods of high and low prices.

-

Long-term impact on inflation and consumer affordability: Sustained high gas prices contribute to inflation and impact consumer affordability, particularly for households reliant on gas for heating.

-

Consequences for energy-intensive industries and economic growth: High energy prices can harm energy-intensive industries, potentially impacting economic growth and competitiveness.

-

Government interventions to mitigate the impact: Governments are implementing various measures to mitigate the impact of high gas prices on consumers and businesses, including subsidies, price caps, and tax breaks.

Conclusion

The EU's phaseout of Russian gas is forcing a fundamental shift in the European energy market. The spot market is playing an increasingly central role in securing gas supplies, though it also presents considerable challenges. Diversification of energy sources, robust regulatory frameworks, and strategic investments in infrastructure are critical for navigating this transition successfully. Understanding the dynamics of the EU's planned Russian gas phaseout and the crucial role of the spot market is essential for businesses, policymakers, and consumers. Stay informed about developments in the spot gas market and the evolving energy landscape to prepare for the future of energy security in Europe. Learn more about the intricacies of the spot market for gas and its impact on the EU's energy transition.

Featured Posts

-

Bitcoin Btc Rally Trade Easing And Reduced Fed Tension

Apr 24, 2025

Bitcoin Btc Rally Trade Easing And Reduced Fed Tension

Apr 24, 2025 -

Indias Nifty 50 A Deep Dive Into The Current Bull Market

Apr 24, 2025

Indias Nifty 50 A Deep Dive Into The Current Bull Market

Apr 24, 2025 -

Nba

Apr 24, 2025

Nba

Apr 24, 2025 -

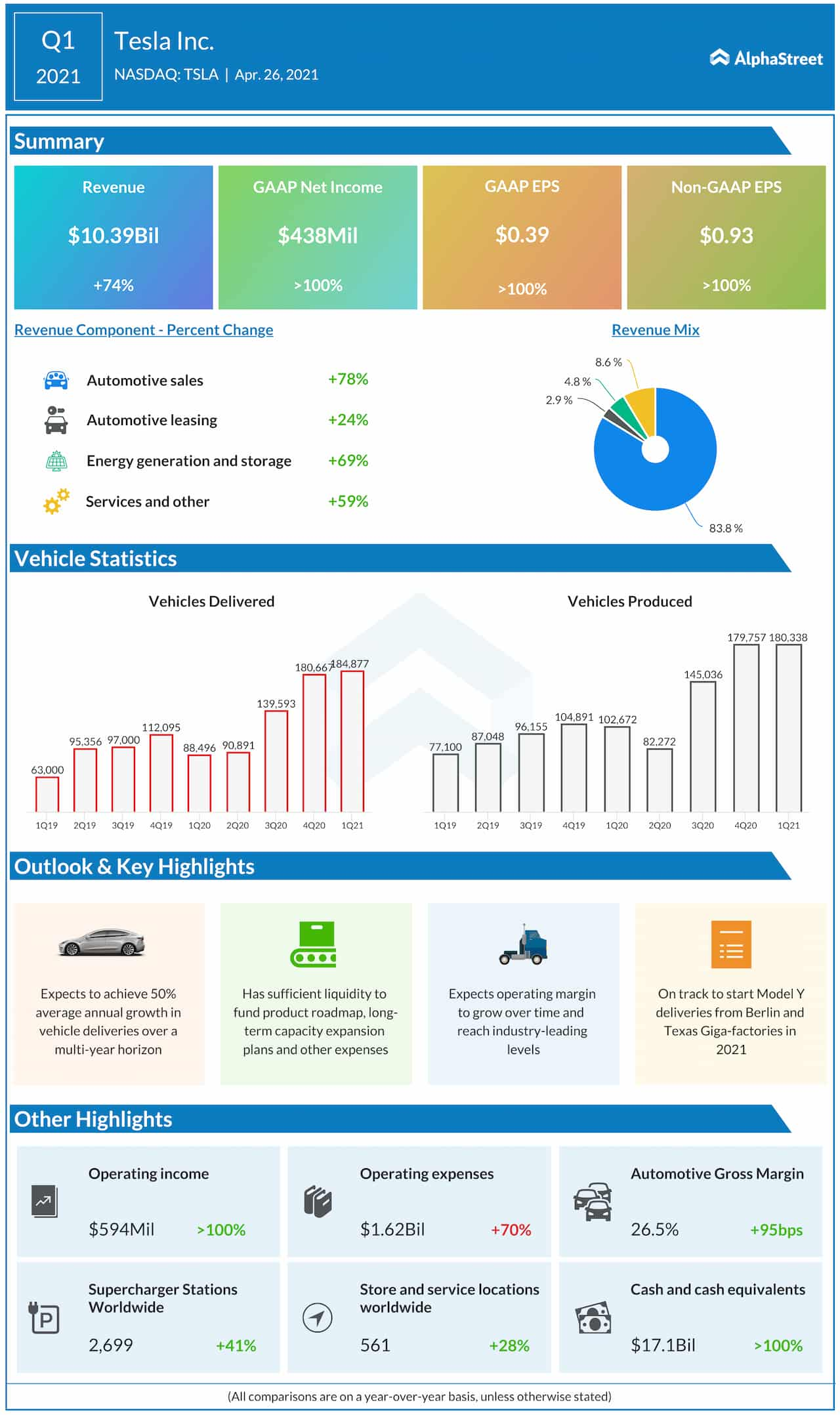

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025 -

Sharp Drop In Teslas Q1 Profit Analysis Of The Contributing Factors

Apr 24, 2025

Sharp Drop In Teslas Q1 Profit Analysis Of The Contributing Factors

Apr 24, 2025