Sharp Drop In Tesla's Q1 Profit: Analysis Of The Contributing Factors

Table of Contents

Price Wars and Reduced Margins

Tesla's aggressive pricing strategies played a major role in the Tesla Q1 profit drop. The company's decision to significantly reduce vehicle prices to boost sales volume directly impacted profit margins.

Aggressive Pricing Strategies

Tesla implemented substantial price cuts across multiple models, including the Model 3 and Model Y. This move was partly a response to increased competition in the burgeoning EV market and the pressure to maintain its dominant market share.

- Price cuts across multiple Tesla models: Significant reductions were seen globally, impacting profitability per unit.

- Increased competition in the EV market: Rivals like Ford, GM, and numerous Chinese manufacturers are aggressively expanding their EV offerings, creating a more competitive pricing landscape.

- Pressure to maintain market share: Tesla's decision to prioritize volume over margin suggests a strategic focus on maintaining its position as a market leader.

Impact on Revenue and Profitability

While the price cuts led to increased unit sales, the lower profit margins per vehicle resulted in a net decrease in overall profitability for the quarter. This illustrates the delicate balancing act between volume and profitability inherent in the automotive industry.

- Analysis of revenue figures versus unit sales: Although sales volume increased, the revenue growth did not offset the margin compression.

- Comparison of Q1 profit margins to previous quarters: A direct comparison reveals a substantial drop in profitability compared to previous quarters.

- Discussion of the long-term implications of price wars: Sustaining price wars could negatively impact long-term profitability unless Tesla can achieve significant economies of scale.

Increased Production Costs and Supply Chain Disruptions

The Tesla Q1 profit drop was also significantly impacted by rising production costs and ongoing supply chain disruptions.

Rising Raw Material Prices

Fluctuations in the prices of crucial raw materials, particularly lithium and nickel – key components in EV batteries – significantly increased Tesla's manufacturing costs. These increases weren't entirely absorbed by price adjustments.

- Specific examples of raw material price increases: Data on the percentage increase in lithium and nickel prices throughout Q1 should be included here, illustrating the direct impact.

- Impact on battery production costs: A detailed breakdown of how raw material price increases translated into higher battery production costs.

- Analysis of Tesla's raw material sourcing strategies: Evaluating Tesla’s efforts to secure raw materials and potentially diversify its supply chains.

Global Supply Chain Challenges

Persistent global supply chain issues, including logistics bottlenecks and component shortages, further exacerbated production costs and potentially led to production delays.

- Examples of specific supply chain disruptions: Detailing specific instances of delayed shipments or component shortages.

- Impact on production targets and delivery timelines: Analyzing the effect on Tesla’s ability to meet its production goals and customer delivery schedules.

- Strategies employed by Tesla to mitigate supply chain risks: Highlighting Tesla's efforts to diversify suppliers, improve logistics, and build resilience into its supply chain.

Increased Competition and Market Saturation

The intensifying competition within the EV market and evolving consumer preferences contributed to the Tesla Q1 profit drop.

Growing Number of EV Competitors

The electric vehicle market is experiencing explosive growth, with numerous established and new players vying for market share. This intensified competition puts immense pressure on pricing and profitability.

- List of key competitors and their market strategies: Including companies like Ford, GM, Rivian, and BYD, along with their respective market strategies.

- Analysis of the competitive landscape: A detailed analysis of the competitive dynamics and market share of key players.

- Discussion of Tesla's market positioning: Assessing Tesla's strategic position within this evolving landscape.

Shifting Consumer Demand

Changes in consumer preferences and market trends may be impacting Tesla's sales and its ability to maintain premium pricing.

- Analysis of shifting consumer demand patterns: Examining shifts in demand for specific EV features, sizes, or price points.

- Impact on Tesla's sales forecasts: Analyzing how changing consumer preferences affected Tesla's sales projections.

- Potential adjustments to product strategy: Discussing potential strategic adjustments Tesla might make to address shifting consumer demand.

Conclusion

The sharp drop in Tesla's Q1 profit is a multifaceted issue with several interconnected contributing factors. Aggressive pricing strategies, escalating production costs, supply chain disruptions, and increased competition all played significant roles in this downturn. Understanding these factors is crucial for investors and industry analysts. While the immediate future remains uncertain, Tesla's long-term prospects will depend on its ability to navigate these challenges effectively. Further analysis of the Tesla Q1 profit drop and its long-term effects is essential for a comprehensive understanding of the company's trajectory. Stay informed on the latest developments regarding the Tesla Q1 profit drop and its future performance.

Featured Posts

-

The Bold And The Beautiful Next 2 Weeks Hope Liam And Steffys Explosive Storylines

Apr 24, 2025

The Bold And The Beautiful Next 2 Weeks Hope Liam And Steffys Explosive Storylines

Apr 24, 2025 -

Teslas Q1 Financial Results 71 Net Income Decline Explained

Apr 24, 2025

Teslas Q1 Financial Results 71 Net Income Decline Explained

Apr 24, 2025 -

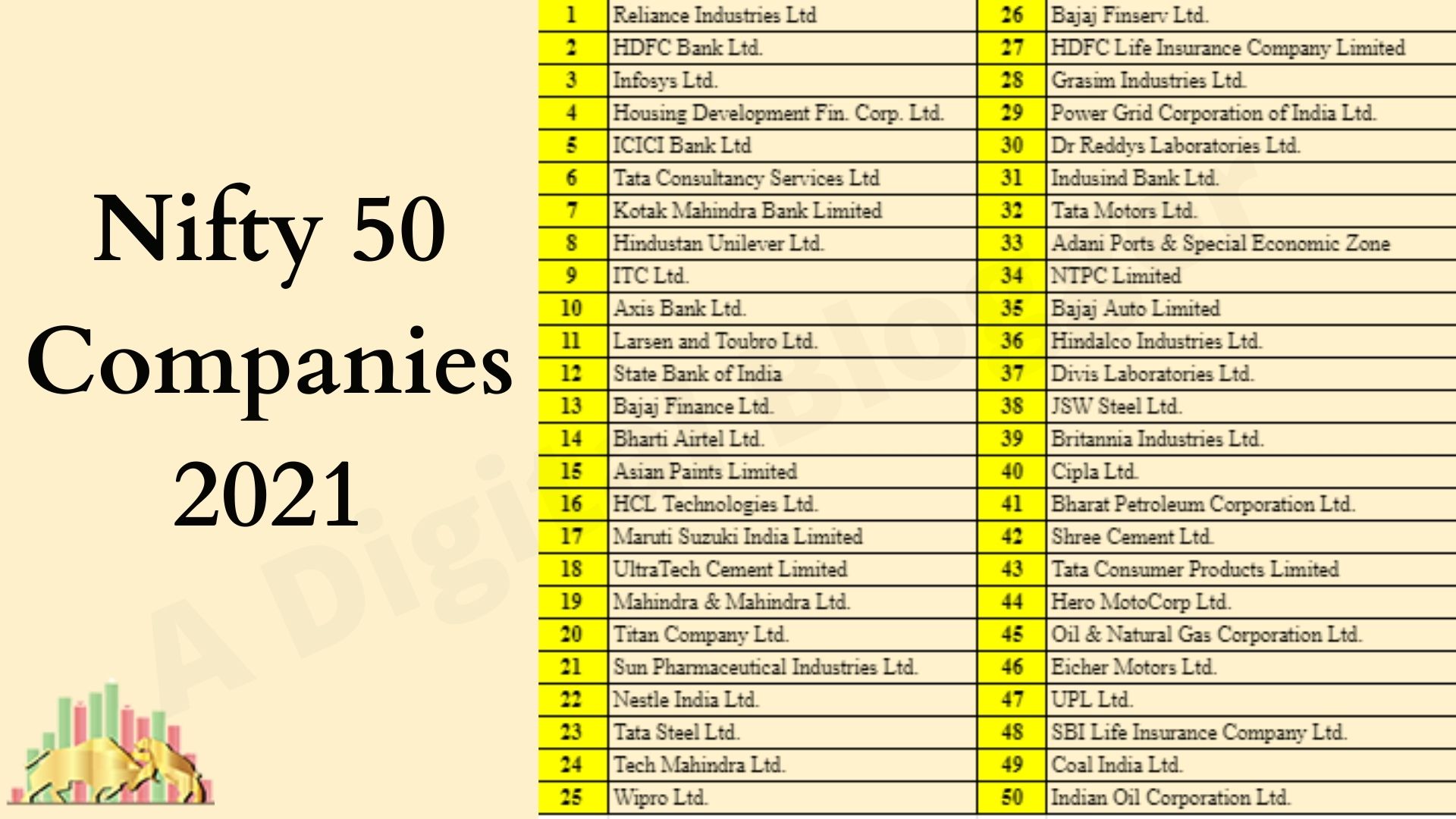

Positive Market Sentiment Indias Nifty 50 Experiences Strong Growth

Apr 24, 2025

Positive Market Sentiment Indias Nifty 50 Experiences Strong Growth

Apr 24, 2025 -

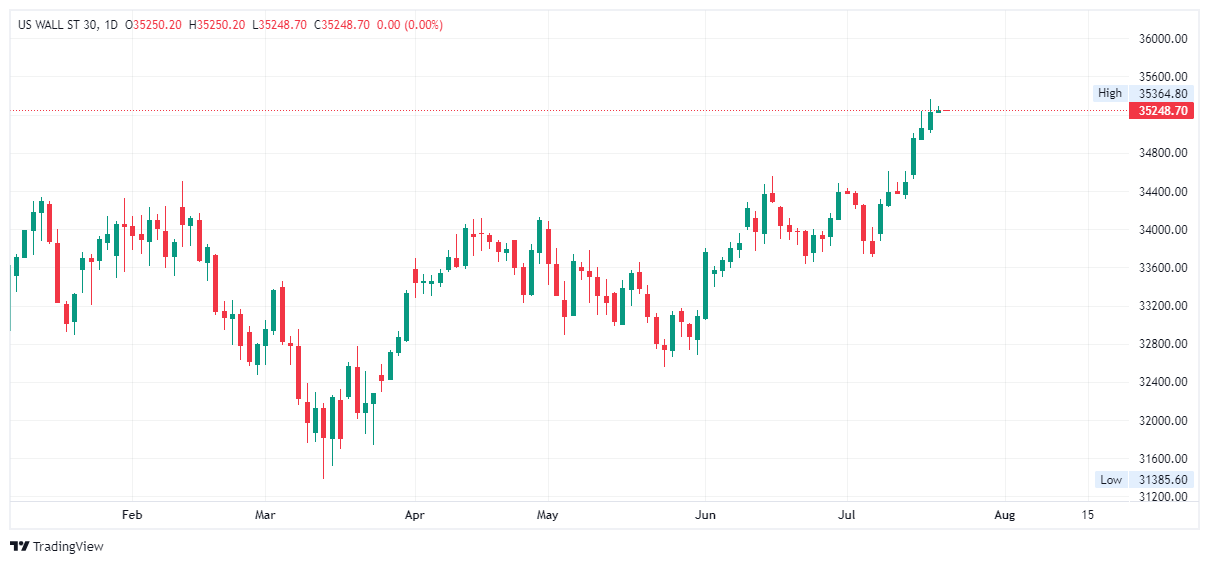

Market Rally 1000 Point Dow Jump Sparks Investor Optimism

Apr 24, 2025

Market Rally 1000 Point Dow Jump Sparks Investor Optimism

Apr 24, 2025 -

Metas Future Under The Trump Administration Zuckerbergs Challenges

Apr 24, 2025

Metas Future Under The Trump Administration Zuckerbergs Challenges

Apr 24, 2025