Federal Student Loan Refinancing: Pros And Cons

Table of Contents

Potential Pros of Federal Student Loan Refinancing

Refinancing your federal student loans can offer several significant advantages, but it's crucial to understand the full picture before making a move.

Lower Interest Rates

One of the most attractive benefits of refinancing is the potential for significantly lower interest rates. A lower interest rate translates to substantial savings over the life of your loan. However, it's vital to compare interest rates from multiple lenders to secure the best possible deal. Don't just settle for the first offer you receive!

- Potential for lower monthly payments: A reduced interest rate can lead to lower monthly payments, easing the financial burden.

- Faster loan payoff due to reduced interest: Less money going towards interest means more going towards your principal, leading to faster loan payoff.

- Access to better loan terms (e.g., shorter repayment periods): Refinancing can allow you to negotiate a shorter repayment term, resulting in even greater savings on interest.

Simplified Repayment

Managing multiple federal student loans can be a logistical nightmare. Refinancing consolidates your various loans into a single, streamlined payment.

- Easier budgeting and tracking of payments: Instead of juggling multiple payments and statements, you'll have one simple monthly payment to manage.

- Elimination of juggling multiple loan servicers: Dealing with a single lender simplifies communication and simplifies the overall repayment process.

- Potential for a more manageable monthly payment amount (though this may lengthen the repayment period): While a lower monthly payment can be attractive, remember that extending the repayment term will typically result in paying more interest overall.

Access to Different Repayment Plans

Refinancing can unlock access to diverse repayment options tailored to your specific financial situation.

- Potential for choosing a shorter repayment term to save on interest: This option allows for quicker debt elimination, despite potentially higher monthly payments.

- Option to extend the repayment term for lower monthly payments: This can offer immediate relief but will increase the total interest paid over the loan's life.

- Flexibility to adapt to changing financial circumstances: Life throws curveballs. Refinancing allows you some flexibility to adjust your repayment plan if your financial situation changes.

Potential Cons of Federal Student Loan Refinancing

While refinancing offers appealing benefits, it's essential to be aware of the potential drawbacks.

Loss of Federal Student Loan Benefits

This is perhaps the most significant drawback. By refinancing your federal student loans into a private loan, you permanently lose access to several crucial federal benefits.

- Inability to access income-driven repayment plans: Income-driven repayment (IDR) plans are designed to make payments more manageable based on your income. These are unavailable with private loans.

- Forfeiture of potential loan forgiveness programs (e.g., Public Service Loan Forgiveness): Programs like Public Service Loan Forgiveness (PSLF) are only available for federal loans. Refinancing eliminates your eligibility.

- Loss of federal protections for borrowers: Federal loans come with consumer protections that private loans may not offer.

Risk of Higher Interest Rates (in certain situations)

While refinancing often leads to lower interest rates, this isn't guaranteed. Your credit score and financial health play a significant role in determining the interest rate you qualify for.

- Need for excellent credit to qualify for the best rates: A poor credit score can result in higher interest rates, negating the benefits of refinancing.

- Risk of a higher interest rate if the borrower's financial situation has deteriorated: If your financial circumstances have worsened since taking out your original loans, you may not qualify for a better rate.

- Importance of carefully reviewing loan offers before signing: Shop around and compare offers from multiple lenders before making a decision.

Prepayment Penalties (rare but possible)

Though uncommon, some lenders may impose prepayment penalties if you pay off your loan early.

- Carefully review loan terms for any prepayment penalties: Look for clauses related to early repayment fees.

- Compare lenders' policies regarding prepayment penalties: Choose a lender that doesn't charge such fees.

Potential for Increased Overall Interest Paid (in certain situations)

Extending your loan term to lower your monthly payments will generally lead to a higher total interest paid over the life of the loan. Carefully consider the long-term implications.

Making the Right Choice with Federal Student Loan Refinancing

Federal student loan refinancing presents a complex decision. This article has highlighted the significant potential advantages, such as lower interest rates and simplified repayment, alongside the crucial disadvantages, including the loss of federal benefits and the risk of higher interest rates. Before making a decision about federal student loan refinancing, carefully weigh the pros and cons and consider consulting with a financial advisor. Thoroughly research different lenders and compare their offerings to find the best option for your specific financial circumstances and long-term goals. Learn more about the specifics of federal student loan refinancing and find the best option for your needs.

Featured Posts

-

2024 25 High School Confidential Key Events Of Week 26

May 17, 2025

2024 25 High School Confidential Key Events Of Week 26

May 17, 2025 -

Is Creatine Safe And Effective A Detailed Look

May 17, 2025

Is Creatine Safe And Effective A Detailed Look

May 17, 2025 -

Did Kevin Durant Just Confirm A Relationship With Angel Reese A New Twist On The Dating Rumors

May 17, 2025

Did Kevin Durant Just Confirm A Relationship With Angel Reese A New Twist On The Dating Rumors

May 17, 2025 -

New West Valley Hospital And Health Campus A 75 Million Investment From The Eccles Foundation To The U Of U

May 17, 2025

New West Valley Hospital And Health Campus A 75 Million Investment From The Eccles Foundation To The U Of U

May 17, 2025 -

How Trump Tariffs Increased My Phone Battery Replacement Costs

May 17, 2025

How Trump Tariffs Increased My Phone Battery Replacement Costs

May 17, 2025

Latest Posts

-

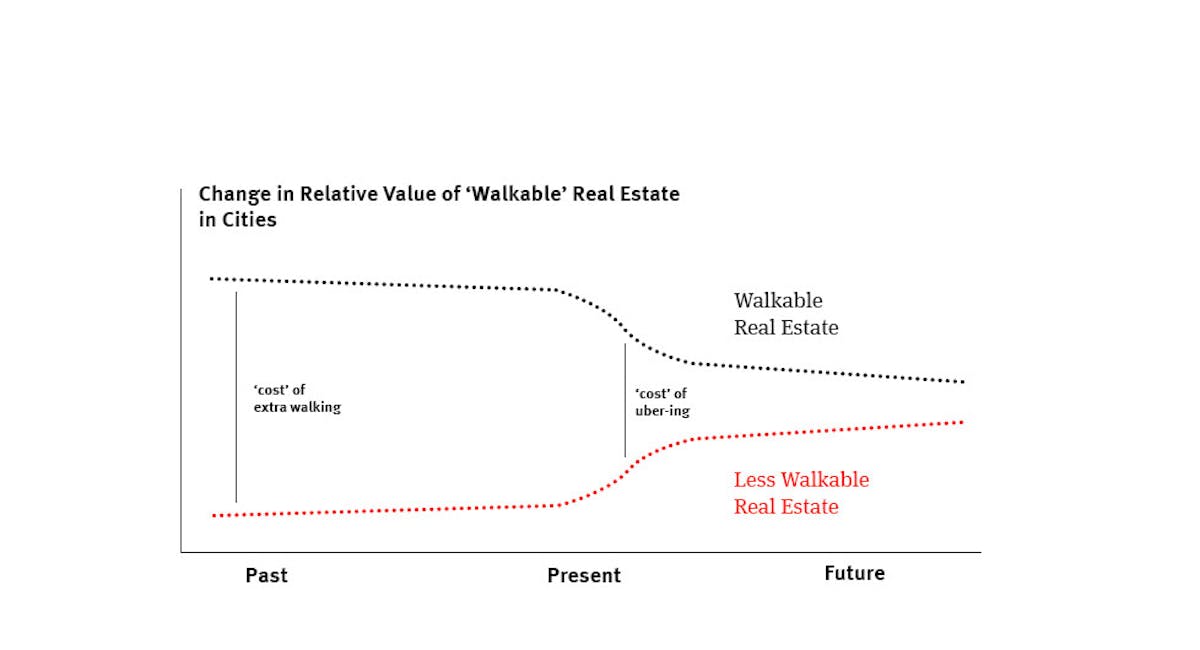

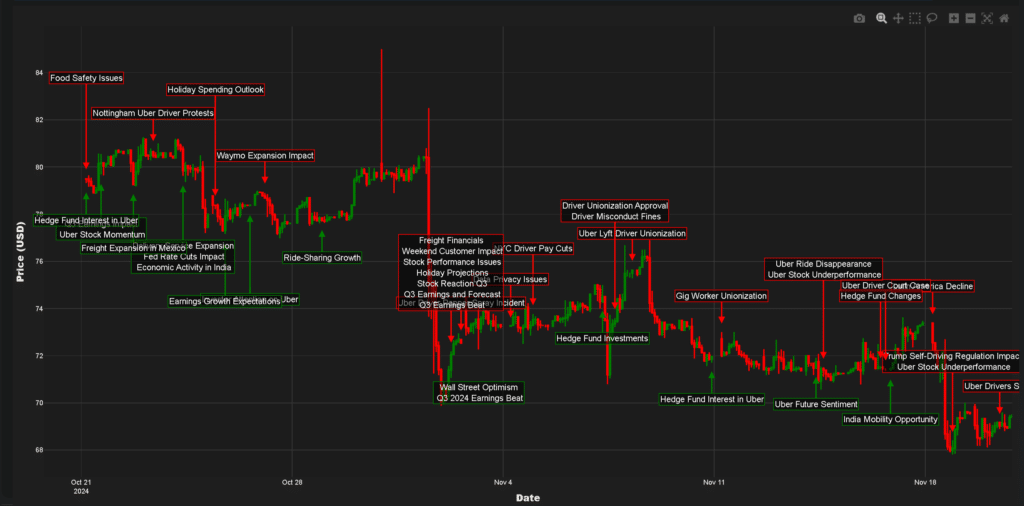

Analyzing Ubers Stock Recession Resistance And Future Growth

May 17, 2025

Analyzing Ubers Stock Recession Resistance And Future Growth

May 17, 2025 -

Is Uber Stock Recession Resistant Analyzing The Market

May 17, 2025

Is Uber Stock Recession Resistant Analyzing The Market

May 17, 2025 -

Autonomous Vehicles And Etfs Is Uber A Smart Investment

May 17, 2025

Autonomous Vehicles And Etfs Is Uber A Smart Investment

May 17, 2025 -

Can Uber Stock Survive A Recession Expert Analysis

May 17, 2025

Can Uber Stock Survive A Recession Expert Analysis

May 17, 2025 -

The Promise Of Driverless Cars Exploring Uber And Related Etfs

May 17, 2025

The Promise Of Driverless Cars Exploring Uber And Related Etfs

May 17, 2025