Goldman Sachs: CEO's War Against Internal Dissent

Table of Contents

David Solomon's Leadership Style and its Critics

David Solomon's leadership style at Goldman Sachs has become a focal point of the current internal dissent. His approach, characterized by a focus on cost-cutting measures and strategic shifts, has reportedly alienated a significant portion of the workforce. This has created a climate of fear and distrust, hindering open communication and collaboration.

- Controversial Decisions: Solomon's decisions to cut bonuses, restructure divisions, and prioritize certain business lines over others have generated considerable internal opposition. These moves, while aimed at improving profitability, have been perceived by some as short-sighted and damaging to long-term growth.

- Criticism from Insiders: Numerous anonymous sources, including employees and analysts familiar with the situation, have voiced concerns about Solomon’s management style, describing it as autocratic and lacking in empathy. These criticisms highlight a growing disconnect between leadership and the rank and file.

- Communication Breakdown: Solomon's communication style, often perceived as top-down and lacking transparency, has further fueled internal conflict. This lack of open dialogue has prevented the effective addressing of concerns and created an environment where dissent is actively discouraged. The effectiveness of Goldman Sachs management is increasingly being questioned.

The Suppression of Dissenting Voices within Goldman Sachs

Allegations of a systematic suppression of internal dissent within Goldman Sachs have emerged, painting a concerning picture of the firm's internal culture. Reports suggest that employees who express concerns or challenge the CEO's decisions face significant repercussions.

- Retaliation Against Dissenters: Several accounts describe instances where employees voicing concerns about strategy, ethics, or workplace culture have faced demotions, transfers, or even termination. This suggests a culture of fear that actively discourages open and honest communication.

- Intimidation Tactics: Sources suggest that intimidation tactics are employed to silence dissent, creating a toxic work environment where employees are hesitant to express their opinions openly. This undermines the principles of a healthy and productive work culture.

- Ineffective Communication Channels: The firm’s internal communication channels are reportedly ineffective at fostering open dialogue. This lack of transparency breeds suspicion and mistrust, exacerbating the existing internal conflicts within Goldman Sachs culture.

The Impact of Internal Dissent on Goldman Sachs' Performance and Reputation

The ongoing internal conflict at Goldman Sachs is having a tangible impact on the firm's performance and reputation. The negative consequences extend beyond employee morale and productivity, affecting its ability to attract and retain top talent, damage investor confidence, and risk legal and regulatory repercussions.

- Employee Morale and Productivity: The toxic work environment fostered by the suppression of dissent is significantly impacting employee morale and productivity. A decline in both is directly impacting Goldman Sachs performance.

- Talent Retention: Goldman Sachs' ability to attract and retain top talent is severely hampered by its reputation for stifling dissent and retaliating against employees who speak out. This loss of talent further impacts the firm's long-term prospects.

- Reputation Damage and Investor Confidence: The negative publicity surrounding the internal conflicts is damaging Goldman Sachs' reputation and eroding investor confidence. This reputational damage is a serious threat to the firm’s long-term financial stability.

- Legal and Regulatory Ramifications: The alleged suppression of dissent and potential retaliatory actions against employees could lead to significant legal and regulatory ramifications, further compounding the challenges facing Goldman Sachs.

The Role of the Board of Directors

The Goldman Sachs board of directors plays a crucial role in addressing the internal conflicts within the firm. Their response (or lack thereof) to the allegations of internal dissent is vital in determining the future direction of the company.

- Board's Response: The board's response to the allegations has been subject to scrutiny. The degree of their investigation and the actions taken (or not taken) will shape perceptions of their effectiveness in governing the firm.

- Mitigating the Conflict: The board's actions – or lack thereof – to mitigate the conflict will be a key indicator of their commitment to corporate governance best practices and their ability to address internal issues effectively.

- Oversight and Accountability: The effectiveness of the board's oversight of management, and their accountability for addressing the issues raised concerning internal dissent, will be crucial in restoring trust within the firm and among stakeholders.

Conclusion: Understanding the Goldman Sachs Internal Conflict

The internal conflict at Goldman Sachs, fueled by allegations of CEO David Solomon's war against internal dissent, presents a serious challenge to the firm. The suppression of dissenting voices, coupled with a perceived lack of transparency and empathy from leadership, has significantly impacted employee morale, talent retention, and the firm's overall reputation. The board of directors' response to these challenges will be crucial in determining the future trajectory of Goldman Sachs. We encourage readers to continue following this evolving situation and to engage in further discussion surrounding Goldman Sachs internal dissent, CEO leadership, and corporate governance within the financial industry. Share your thoughts in the comments below or on social media using #GoldmanSachsDissent #CEOAccountability #CorporateGovernance.

Featured Posts

-

Understanding The Economic Consequences Of The Student Loan Crisis

May 28, 2025

Understanding The Economic Consequences Of The Student Loan Crisis

May 28, 2025 -

The Future Of Harvard Funding Trumps Trade School Focus

May 28, 2025

The Future Of Harvard Funding Trumps Trade School Focus

May 28, 2025 -

Transferde Son Dakika Gelismeleri Ingiliz Takimi Cok Yakin

May 28, 2025

Transferde Son Dakika Gelismeleri Ingiliz Takimi Cok Yakin

May 28, 2025 -

Doping Ban Behind Him Sinners French Open Preparations

May 28, 2025

Doping Ban Behind Him Sinners French Open Preparations

May 28, 2025 -

Al Nassr Ronaldo Ile 2 Yil Daha Anlasti

May 28, 2025

Al Nassr Ronaldo Ile 2 Yil Daha Anlasti

May 28, 2025

Latest Posts

-

San Diego Soaked Late Winter Storm Brings Heavy Rain

May 30, 2025

San Diego Soaked Late Winter Storm Brings Heavy Rain

May 30, 2025 -

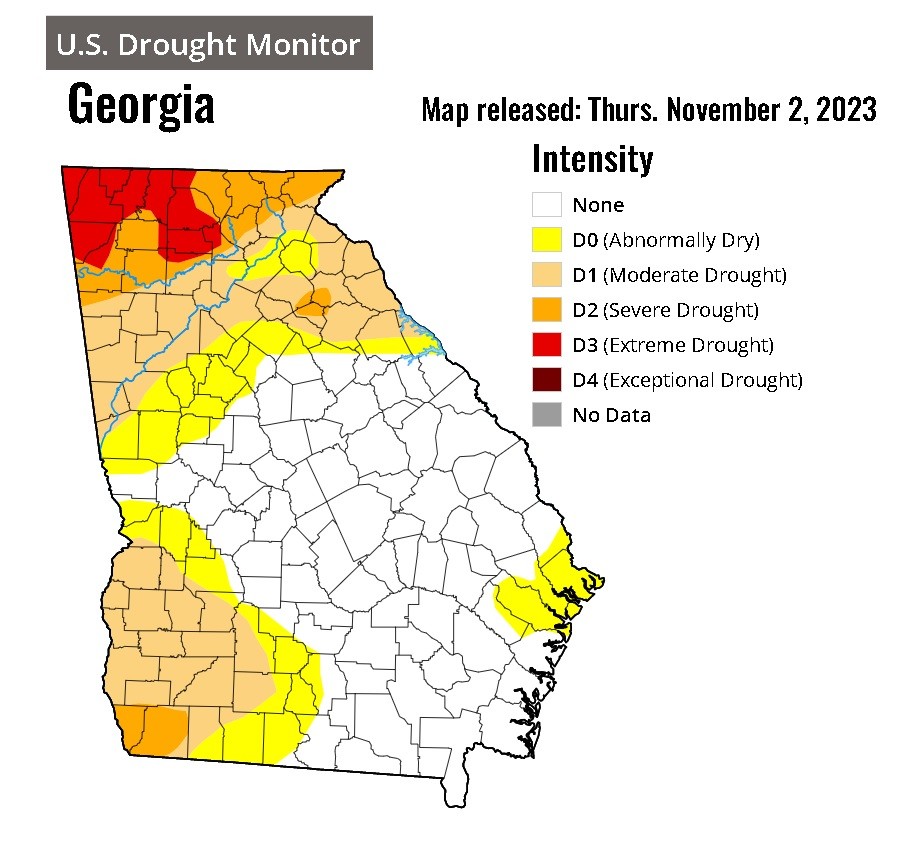

The Impact Of Marchs Rainfall On Existing Water Deficit

May 30, 2025

The Impact Of Marchs Rainfall On Existing Water Deficit

May 30, 2025 -

Insufficient Rainfall In March Water Deficit Continues

May 30, 2025

Insufficient Rainfall In March Water Deficit Continues

May 30, 2025 -

Your Weekend Beach Escape Top San Diego County Beaches

May 30, 2025

Your Weekend Beach Escape Top San Diego County Beaches

May 30, 2025 -

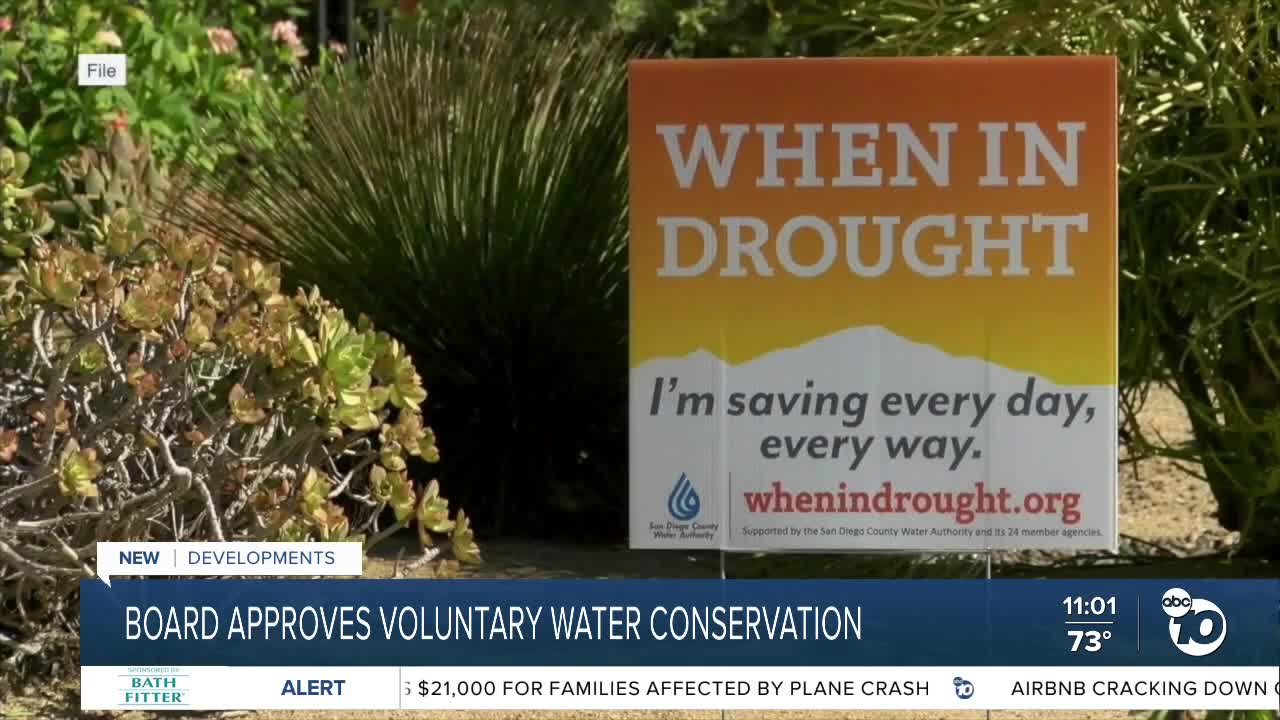

San Diego Water Authority Plans To Sell Surplus Water Reducing Costs For Ratepayers

May 30, 2025

San Diego Water Authority Plans To Sell Surplus Water Reducing Costs For Ratepayers

May 30, 2025