Hengrui Pharma's Hong Kong IPO: Regulatory Approval Granted

Table of Contents

Regulatory Approval Details and Timeline

The Hong Kong Stock Exchange's Role

The Hong Kong Stock Exchange (HKEX) plays a crucial role in ensuring the integrity and transparency of its listed companies. Hengrui Pharma's successful navigation of the HKEX's rigorous approval process underscores its commitment to compliance and its strong financial standing. The HKEX's stringent regulations, covering aspects like financial reporting, corporate governance, and listing requirements, were meticulously met by Hengrui Pharma. This rigorous vetting process instills confidence in potential investors.

- Specific date of regulatory approval announcement: [Insert Date – replace bracketed information with the actual date]

- Key regulatory bodies involved in the approval process: The Securities and Futures Commission (SFC) of Hong Kong, alongside the HKEX itself, were key players in the approval process.

- Details about the listing application and its successful completion: Hengrui Pharma submitted a comprehensive listing application detailing its financials, business model, and future growth plans. This application was thoroughly reviewed and ultimately approved.

- Any conditions attached to the approval: [Insert details of any conditions, if applicable. If no conditions, state “No conditions were attached to the approval.”]

Financial Implications and Investor Interest

Expected IPO Size and Valuation

The Hengrui Pharma Hong Kong IPO is expected to be a substantial event, raising a significant amount of capital for the company. The precise valuation and fundraising target remain subject to market conditions, but early estimates suggest a considerable sum. The strong investor interest already witnessed points towards a successful IPO.

- Estimated IPO fundraising amount: [Insert estimated amount – replace bracketed information with the most up-to-date estimate]

- Price range per share (if available): [Insert price range per share, if available – replace bracketed information with the actual price range]

- Key investors and their anticipated participation: [Include information about any anchor investors or significant institutional investors, if known.]

- Potential market capitalization post-IPO: [Insert estimated market capitalization post-IPO – replace bracketed information with the most up-to-date estimate]

Attractiveness to Investors

Hengrui Pharma presents a compelling investment opportunity due to several factors. Its robust research and development pipeline, coupled with its established market position in key therapeutic areas, positions it for continued growth. The company's strong competitive advantages, including a diversified product portfolio and a commitment to innovation, further enhance its attractiveness to investors seeking exposure to the growing Asian pharmaceutical market.

Hengrui Pharma's Business Overview and Future Prospects

Company Profile and Market Position

Hengrui Pharma is a leading innovator in the pharmaceutical industry, focusing on the research, development, manufacturing, and commercialization of innovative drugs. Its diverse portfolio spans various therapeutic areas, giving it a strong foothold in the market.

- Key therapeutic areas and flagship products: [List key therapeutic areas and flagship products of Hengrui Pharma.]

- Market leadership in specific segments: [Highlight specific segments where Hengrui Pharma holds market leadership.]

- Research and development pipeline and future prospects: [Discuss the company's R&D pipeline and future prospects, including any promising new drug candidates.]

- Expansion plans and international presence: [Discuss Hengrui Pharma's expansion plans and current international presence.]

Growth Strategy and Long-Term Vision

Hengrui Pharma's long-term growth strategy centers on innovation, expansion into new markets, and strategic acquisitions. The funds raised through the Hong Kong IPO will likely be utilized to further these goals, bolstering R&D efforts and facilitating global expansion. The company envisions itself as a global leader in the pharmaceutical industry, committed to providing innovative treatments to patients worldwide.

Impact on the Hong Kong Stock Market and the Pharmaceutical Sector

Market Reaction and Analyst Opinions

The Hengrui Pharma Hong Kong IPO is anticipated to generate considerable excitement in the Hong Kong stock market and boost investor sentiment towards the Asian pharmaceutical sector. Analysts predict a positive market reaction, with potential for increased trading volume and a positive impact on related stock indices.

- Potential increase in trading volume: [Discuss potential increase in trading volume on the HKEX.]

- Expected impact on related stock indices: [Discuss the expected impact on related stock indices such as the Hang Seng Index.]

- Analyst predictions regarding future stock performance: [Summarize analyst predictions regarding the future stock performance of Hengrui Pharma.]

- Comparisons to other recent major pharmaceutical IPOs in Hong Kong: [Compare this IPO to other recent major pharmaceutical IPOs in Hong Kong, highlighting similarities and differences.]

Conclusion

The regulatory approval for Hengrui Pharma's Hong Kong IPO is a momentous occasion, signifying a significant step for the company and a potential catalyst for the Hong Kong stock market. The substantial fundraising potential, combined with Hengrui Pharma's strong business fundamentals and growth prospects, makes this IPO highly attractive to investors. The impact on the broader Asian pharmaceutical sector is likely to be substantial, stimulating further investment and innovation within the industry. To stay updated on the latest developments regarding the Hengrui Pharma Hong Kong IPO, including the listing date and share price, follow reputable financial news sources and track the company's announcements closely. Stay informed about this landmark Hengrui Pharma Hong Kong IPO.

Featured Posts

-

China Approves Hengrui Pharmas Hong Kong Stock Listing

Apr 29, 2025

China Approves Hengrui Pharmas Hong Kong Stock Listing

Apr 29, 2025 -

Akeso Plunges Cancer Drug Trial Disappoints

Apr 29, 2025

Akeso Plunges Cancer Drug Trial Disappoints

Apr 29, 2025 -

Shooting At North Carolina University One Dead Six Injured

Apr 29, 2025

Shooting At North Carolina University One Dead Six Injured

Apr 29, 2025 -

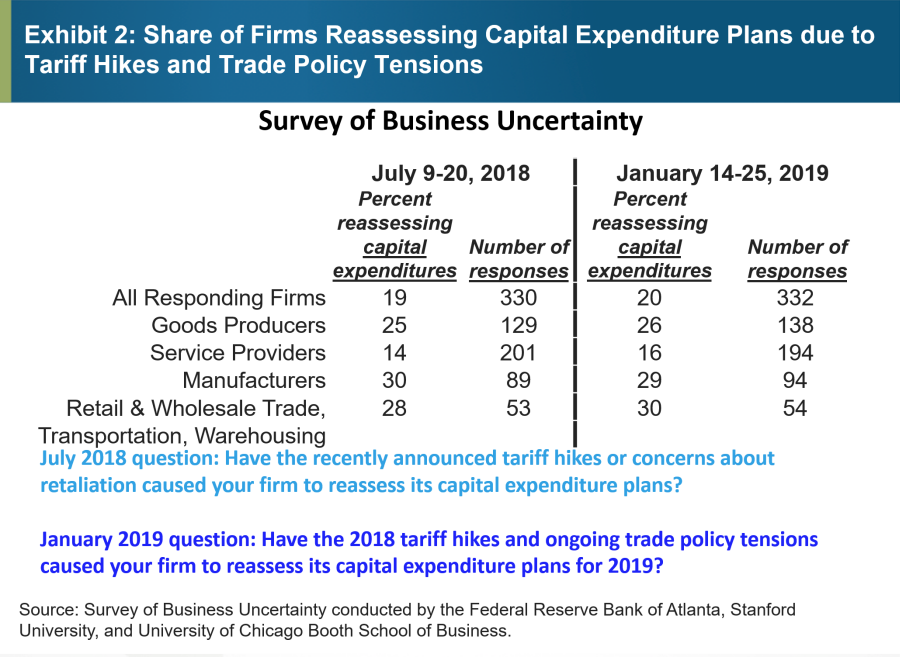

The Impact Of Tariff Uncertainty On U S Company Spending

Apr 29, 2025

The Impact Of Tariff Uncertainty On U S Company Spending

Apr 29, 2025 -

Trumps China Tariffs Higher Prices And Empty Shelves The Impact On The Us Economy

Apr 29, 2025

Trumps China Tariffs Higher Prices And Empty Shelves The Impact On The Us Economy

Apr 29, 2025

Latest Posts

-

Nine Fatalities Reported After Vehicle Strikes Crowd At Vancouvers Filipino Festival

Apr 29, 2025

Nine Fatalities Reported After Vehicle Strikes Crowd At Vancouvers Filipino Festival

Apr 29, 2025 -

Car Plows Into Crowd At Vancouver Filipino Festival Leaving Nine Dead

Apr 29, 2025

Car Plows Into Crowd At Vancouver Filipino Festival Leaving Nine Dead

Apr 29, 2025 -

Vancouver Filipino Festival Tragedy Nine Dead After Car Incident

Apr 29, 2025

Vancouver Filipino Festival Tragedy Nine Dead After Car Incident

Apr 29, 2025 -

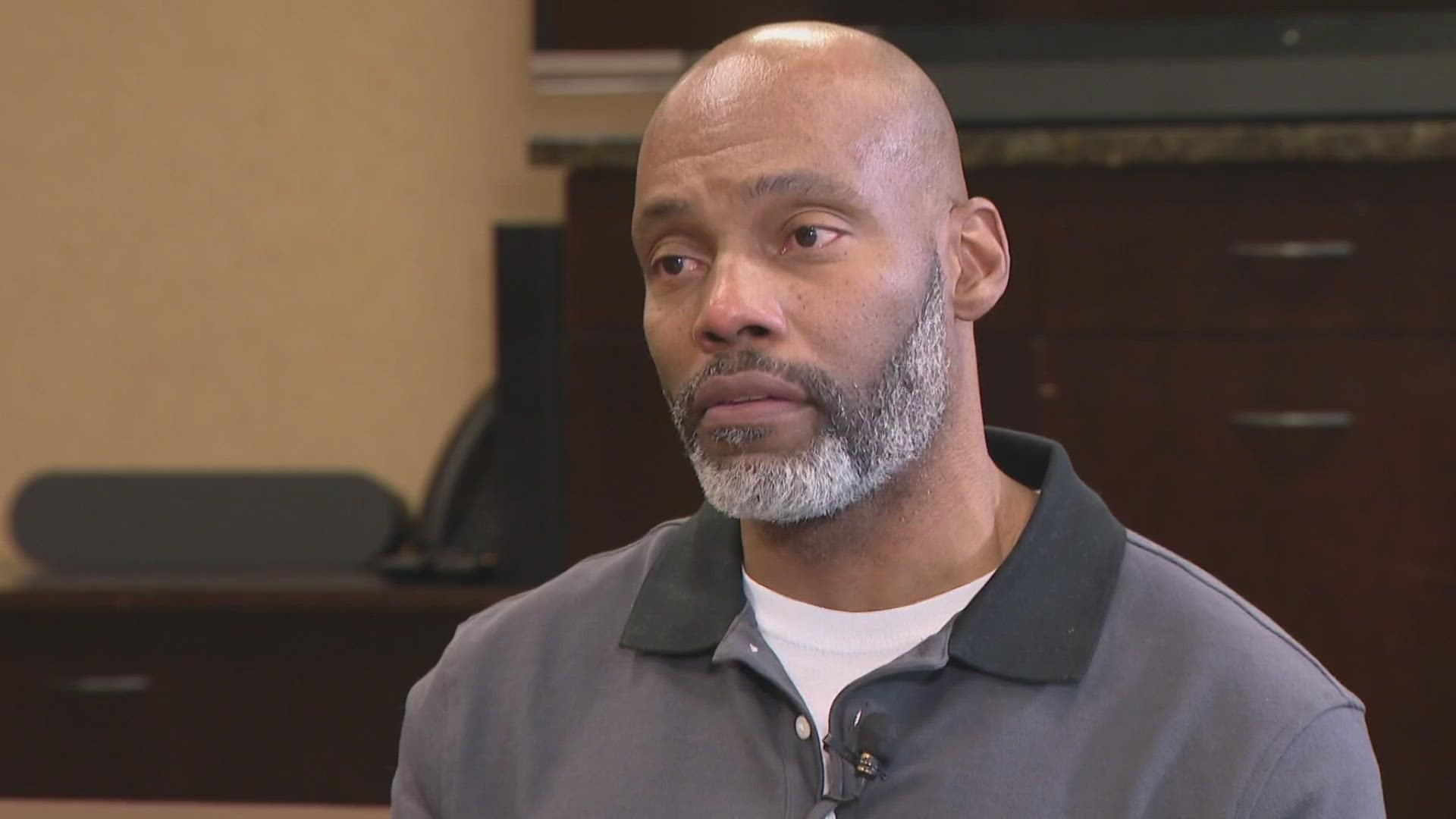

Ohio Doctors Murder Conviction Sons Emotional Journey Before Parole Decision

Apr 29, 2025

Ohio Doctors Murder Conviction Sons Emotional Journey Before Parole Decision

Apr 29, 2025 -

Parole Hearing Looms For Ohio Doctor Convicted Of Killing Wife 36 Years Ago

Apr 29, 2025

Parole Hearing Looms For Ohio Doctor Convicted Of Killing Wife 36 Years Ago

Apr 29, 2025