HKD/USD Plummets: Hong Kong Dollar Interest Rate At 2008 Lows Following Intervention

Table of Contents

The Plunge of the HKD/USD Exchange Rate

The HKD/USD exchange rate has recently witnessed a sharp depreciation, marking a significant departure from its historical peg. While the Hong Kong dollar has historically maintained a narrow band against the US dollar (typically between 7.75 and 7.85 HKD per USD), recent fluctuations have pushed the rate beyond this range. For instance, on [Insert Date], the HKD/USD exchange rate reached [Insert Specific Number], a level not seen since [Insert Date/Year] representing a substantial drop compared to the average rate of [Insert Average Rate] observed throughout [Insert Time Period].

- Magnitude of the drop: The recent fall represents a [Percentage]% decrease from the average rate in [Insert Time Period], a considerable shift in the HKD/USD exchange rate.

- Significant fluctuation dates: Key dates marking significant fluctuations include [Insert Dates] highlighting the volatility of the market.

- Comparison to the historical peg: The current rate deviates significantly from the historical peg of approximately 7.8 HKD per USD, raising concerns about the peg's stability and the effectiveness of the HKMA's interventions.

Low Hong Kong Dollar Interest Rates: A 2008 Echo

The current Hong Kong dollar interest rates mirror the low levels observed during the 2008 global financial crisis. The benchmark interest rate is currently at [Insert Current Interest Rate]%, a figure that hasn't been seen since [Insert Year]. This dramatic drop has significant implications for the Hong Kong economy.

- Comparison to 2008 and other periods: Compared to [Insert Interest Rate]% in 2008, and [Insert Interest Rate]% in [Insert Year], the current rate signals a significant easing of monetary policy.

- Connection between interest rates and the HKD/USD exchange rate: Lower interest rates can make the HKD less attractive to foreign investors, leading to capital outflow and downward pressure on the exchange rate.

- Impact on borrowing, investment, and the economy: Low interest rates stimulate borrowing and investment, potentially boosting economic growth, but can also lead to inflation if not managed carefully. This can impact the overall stability of the Hong Kong Dollar.

The HKMA's Intervention and its Effectiveness

In response to the HKD's decline, the HKMA has intervened in the foreign exchange market. The specific measures employed include [Insert Details of HKMA actions, e.g., buying HKD in the open market].

- Specific methods used by the HKMA: The HKMA’s actions aim to increase demand for the HKD, thereby supporting its value against the USD. Details on specific buying amounts and timing are usually not publicly available due to market sensitivity.

- Evaluation of the intervention's success: The effectiveness of the HKMA’s intervention remains to be seen. While it has temporarily stemmed the decline, the exchange rate continues to remain volatile, signifying that a complete stabilization may still require more comprehensive intervention.

- Reasons for limited impact: The limited impact of the intervention could be attributed to several factors, including the strength of the USD in the global market, global economic uncertainty, and large capital outflows from Hong Kong.

Potential Causes of the HKD Decline

Several factors are contributing to the weakening of the HKD.

- Impact of global economic uncertainty: The ongoing global economic uncertainty, including rising US interest rates and inflation, has created a challenging environment for many currencies, including the HKD.

- Influence of capital flows: Significant capital outflows from Hong Kong, driven by various economic and geopolitical factors, put downward pressure on the HKD.

- Role of geopolitical factors: Geopolitical tensions and uncertainty surrounding Hong Kong's relationship with mainland China can influence investor sentiment and capital flows, affecting the HKD.

Implications and Future Outlook for the HKD

The decline of the HKD has several short-term and long-term implications.

- Impact on Hong Kong businesses and consumers: A weaker HKD can increase the cost of imports, impacting inflation and the purchasing power of consumers. Businesses involved in international trade will also experience shifts in their profitability due to currency exchange rate changes.

- Effects on foreign trade and investment: A weaker HKD can make Hong Kong exports more competitive but can also make imports more expensive, influencing the country's overall trade balance. Foreign investors might become hesitant in light of the instability of the HKD/USD exchange rate.

- Potential future scenarios: The future outlook for the HKD/USD exchange rate remains uncertain and depends on various factors, including global economic conditions, HKMA policy, and geopolitical developments. Several scenarios are possible, ranging from a gradual stabilization to further depreciation.

Conclusion

The recent plummet of the HKD/USD exchange rate, coupled with historically low Hong Kong dollar interest rates, marks a significant event with potential far-reaching implications. The HKMA's intervention, while intended to stabilize the currency, has so far yielded limited success. Understanding the interplay of global economic factors, capital flows, and the HKMA's policy responses is crucial to navigating this volatile situation. Stay informed about the evolving dynamics of the Hong Kong Dollar and its implications for your investments and economic planning. Monitor the HKD/USD exchange rate closely for further developments and consider consulting financial experts for personalized advice related to the Hong Kong dollar's future.

Featured Posts

-

Matt Damons Smart Career Moves Ben Afflecks Perspective

May 08, 2025

Matt Damons Smart Career Moves Ben Afflecks Perspective

May 08, 2025 -

Impact Of Tariffs Chinas Policy Response Through Rate Cuts And Lending

May 08, 2025

Impact Of Tariffs Chinas Policy Response Through Rate Cuts And Lending

May 08, 2025 -

See Counting Crows Live This Summer Indianapolis Concert Details

May 08, 2025

See Counting Crows Live This Summer Indianapolis Concert Details

May 08, 2025 -

Crypto Whales Bet Big 5880 Rally Predicted For This Xrp Alternative

May 08, 2025

Crypto Whales Bet Big 5880 Rally Predicted For This Xrp Alternative

May 08, 2025 -

Dojs Proposed Google Changes A Threat To User Trust

May 08, 2025

Dojs Proposed Google Changes A Threat To User Trust

May 08, 2025

Latest Posts

-

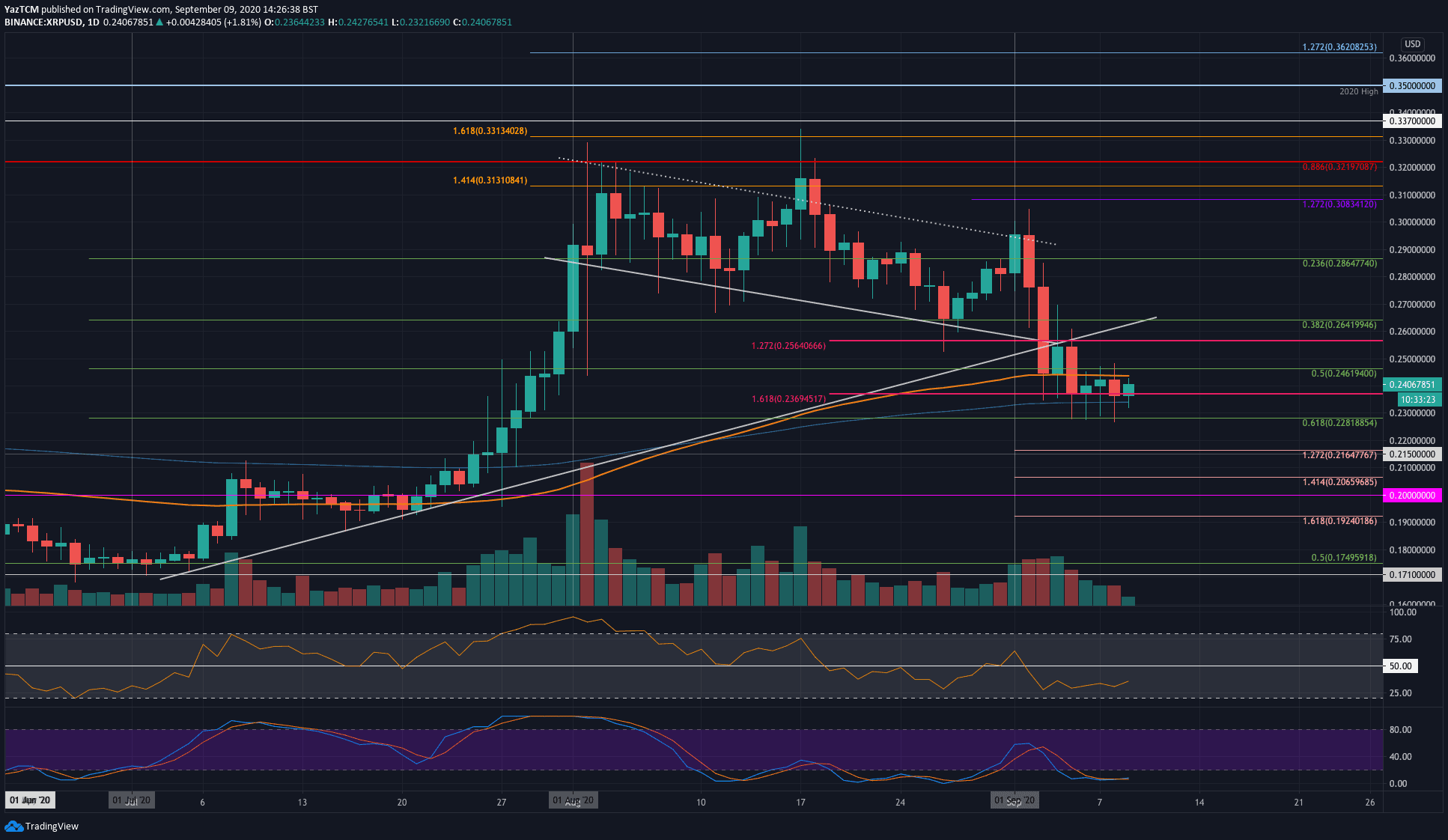

Xrps 400 Jump Whats Next For The Ripple Cryptocurrency

May 08, 2025

Xrps 400 Jump Whats Next For The Ripple Cryptocurrency

May 08, 2025 -

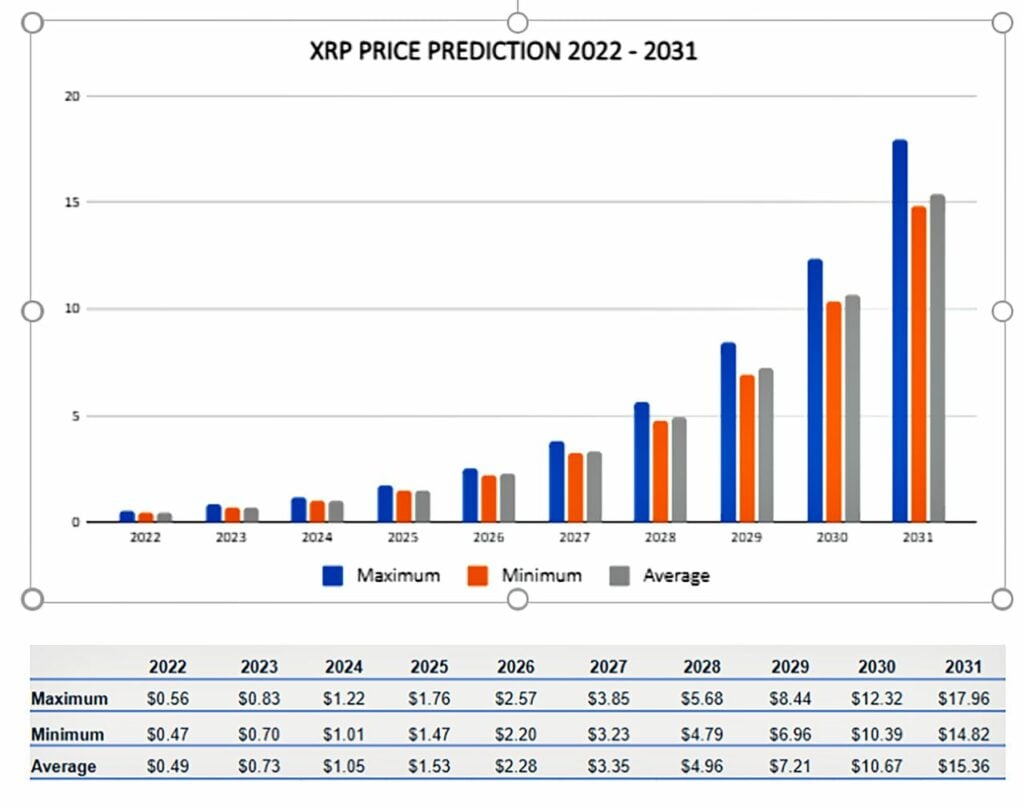

Xrp Future Price Analyzing The Potential For Growth Following The Sec Case

May 08, 2025

Xrp Future Price Analyzing The Potential For Growth Following The Sec Case

May 08, 2025 -

Xrp Price Prediction Can Xrp Rise Further After A 400 Surge

May 08, 2025

Xrp Price Prediction Can Xrp Rise Further After A 400 Surge

May 08, 2025 -

Will Xrp Reach 5 An Xrp Price Prediction Analysis Post Sec Lawsuit

May 08, 2025

Will Xrp Reach 5 An Xrp Price Prediction Analysis Post Sec Lawsuit

May 08, 2025 -

Xrp Price Prediction 5 Target Realistic After Sec Developments

May 08, 2025

Xrp Price Prediction 5 Target Realistic After Sec Developments

May 08, 2025