Ethereum Price Prediction 2024 And Beyond: A Comprehensive Analysis

Table of Contents

Analyzing Current Market Trends and Ethereum's Position

Understanding Ethereum's current market position is crucial for any Ethereum price prediction. Several key factors are at play:

Ethereum's Technological Advancements

Ethereum 2.0, with its implementation of sharding, is a game-changer. Sharding significantly improves scalability by dividing the network into smaller, more manageable parts, leading to faster transaction processing and lower fees. This directly impacts the Ethereum price prediction 2024, as improved scalability attracts more users and developers.

- Ethereum 2.0 price impact: The successful rollout of Ethereum 2.0 is expected to positively impact the price, making it more attractive for mainstream adoption.

- Sharding benefits: Reduced congestion, faster transactions, and lower gas fees are expected to boost Ethereum's utility and appeal.

- Ethereum scalability: Improved scalability addresses one of Ethereum's major limitations, opening the door for wider adoption and potentially driving up the price.

- Increased security and energy efficiency through proof-of-stake also contribute to a more sustainable and robust network, making it more attractive for long-term investment.

Adoption and Usage Growth

The burgeoning decentralized finance (DeFi) ecosystem built on Ethereum is a major driver of its growth. The proliferation of DeFi applications, from lending and borrowing platforms to decentralized exchanges, continues to fuel demand for ETH.

- DeFi on Ethereum: The DeFi sector's growth is inextricably linked to Ethereum's success, creating a positive feedback loop.

- NFT market growth: The explosive growth of the NFT (non-fungible token) market, largely based on Ethereum, continues to contribute to its price.

- Ethereum enterprise adoption: Increasing adoption by enterprises for supply chain management and other solutions adds further legitimacy and potential for future growth. This increased usage contributes positively to the Ethereum future price.

Regulatory Landscape and its Influence

The regulatory environment surrounding cryptocurrencies is constantly evolving, and this significantly impacts Ethereum price prediction. Governments worldwide are grappling with how to regulate digital assets, and the outcome will have a substantial impact on the market.

- Crypto regulation: Clear and consistent regulations could boost investor confidence, while overly restrictive rules could stifle innovation and negatively impact the Ethereum price.

- Ethereum regulatory outlook: The regulatory landscape remains uncertain, creating both opportunities and risks for investors.

- Government impact on Ethereum price: Government policies regarding taxation, security, and licensing will directly influence the price of Ethereum.

Factors Influencing Ethereum Price Prediction 2024

Predicting the price of Ethereum in 2024 requires considering several interacting factors:

Macroeconomic Conditions

Global economic factors, such as inflation, recessionary pressures, and interest rate hikes, significantly influence cryptocurrency prices, including Ethereum. A strong correlation exists between traditional markets and the crypto market.

- Bitcoin price correlation: Bitcoin's price often moves in tandem with Ethereum's, indicating a degree of interconnectedness.

- Macroeconomic factors affecting Ethereum: Economic uncertainty can lead to increased investment in "safe haven" assets, potentially decreasing Ethereum's value. Conversely, periods of economic growth can stimulate investment in riskier assets like cryptocurrencies.

- Inflation and Ethereum: High inflation can push investors towards alternative assets, potentially increasing demand for Ethereum.

Competitor Analysis

Ethereum faces competition from other layer-1 blockchains like Solana and Cardano. These competitors offer varying strengths in speed, scalability, and functionality. This competitive landscape directly impacts Ethereum price prediction.

- Ethereum vs Solana: Solana's faster transaction speeds present a challenge to Ethereum.

- Ethereum competitors: The success of competing platforms can affect Ethereum's market share and, consequently, its price.

- Altcoin market impact: The performance of other altcoins impacts the overall cryptocurrency market sentiment, indirectly influencing Ethereum’s price.

Developer Activity and Community Engagement

The vibrancy of Ethereum's development community and the level of network engagement are crucial indicators of its long-term prospects. A strong, active developer community is crucial for continued innovation and improvement.

- Ethereum developer activity: High developer activity indicates ongoing innovation and improvements to the platform.

- Community growth: A large and engaged community fosters support, adoption, and resilience in the face of challenges.

- Ethereum network effect: The larger the network, the more valuable it becomes, reinforcing a positive feedback loop.

Ethereum Price Prediction 2024 and Beyond: Potential Scenarios

Predicting the future price of Ethereum is inherently speculative. However, we can explore potential scenarios based on the factors discussed above:

Bullish Scenario

A bullish scenario would involve sustained technological advancements, widespread adoption of DeFi and NFTs, positive regulatory developments, and strong macroeconomic conditions. This could lead to a significant price surge.

Bearish Scenario

A bearish scenario might include regulatory crackdowns, significant competition from rival blockchains, a prolonged period of economic downturn, and a general loss of investor confidence in the cryptocurrency market. This could lead to a substantial price decline.

Neutral Scenario

A more neutral scenario would see moderate growth driven by continued technological improvements and gradual adoption, balanced by potential regulatory challenges and macroeconomic uncertainty.

Disclaimer: All price predictions are speculative and involve significant risk. This analysis should not be considered financial advice.

Conclusion: Making Informed Decisions on Ethereum Price Prediction 2024

Ethereum's price is influenced by a complex interplay of technological advancements, adoption rates, regulatory changes, and macroeconomic conditions. The potential scenarios presented—bullish, bearish, and neutral—highlight the inherent uncertainty involved in any Ethereum price prediction 2024.

Remember, conducting thorough research is paramount before making any investment decisions. Stay informed about market trends, technological developments, and regulatory changes to make educated choices regarding Ethereum price prediction 2024 and beyond. Continue learning about Ethereum price prediction to navigate the dynamic crypto landscape successfully.

Featured Posts

-

Xrp Investment Surge Trumps Influence And Institutional Adoption

May 08, 2025

Xrp Investment Surge Trumps Influence And Institutional Adoption

May 08, 2025 -

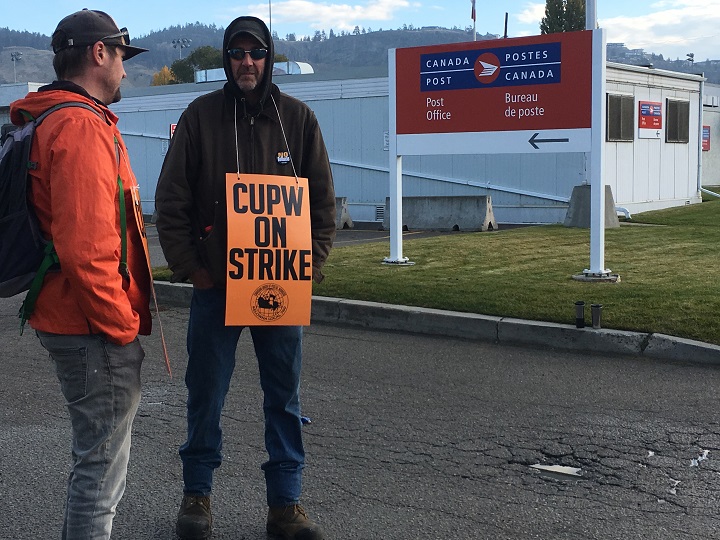

Canada Post Workers Could Walk Out Impact On Mail Delivery

May 08, 2025

Canada Post Workers Could Walk Out Impact On Mail Delivery

May 08, 2025 -

Bitcoins Price Surge Understanding The Factors Driving The Rebound

May 08, 2025

Bitcoins Price Surge Understanding The Factors Driving The Rebound

May 08, 2025 -

Coming Soon Your Guide To The European Digital Identity Wallet

May 08, 2025

Coming Soon Your Guide To The European Digital Identity Wallet

May 08, 2025 -

Is This Bitcoin Rebound A Sign Of Things To Come

May 08, 2025

Is This Bitcoin Rebound A Sign Of Things To Come

May 08, 2025

Latest Posts

-

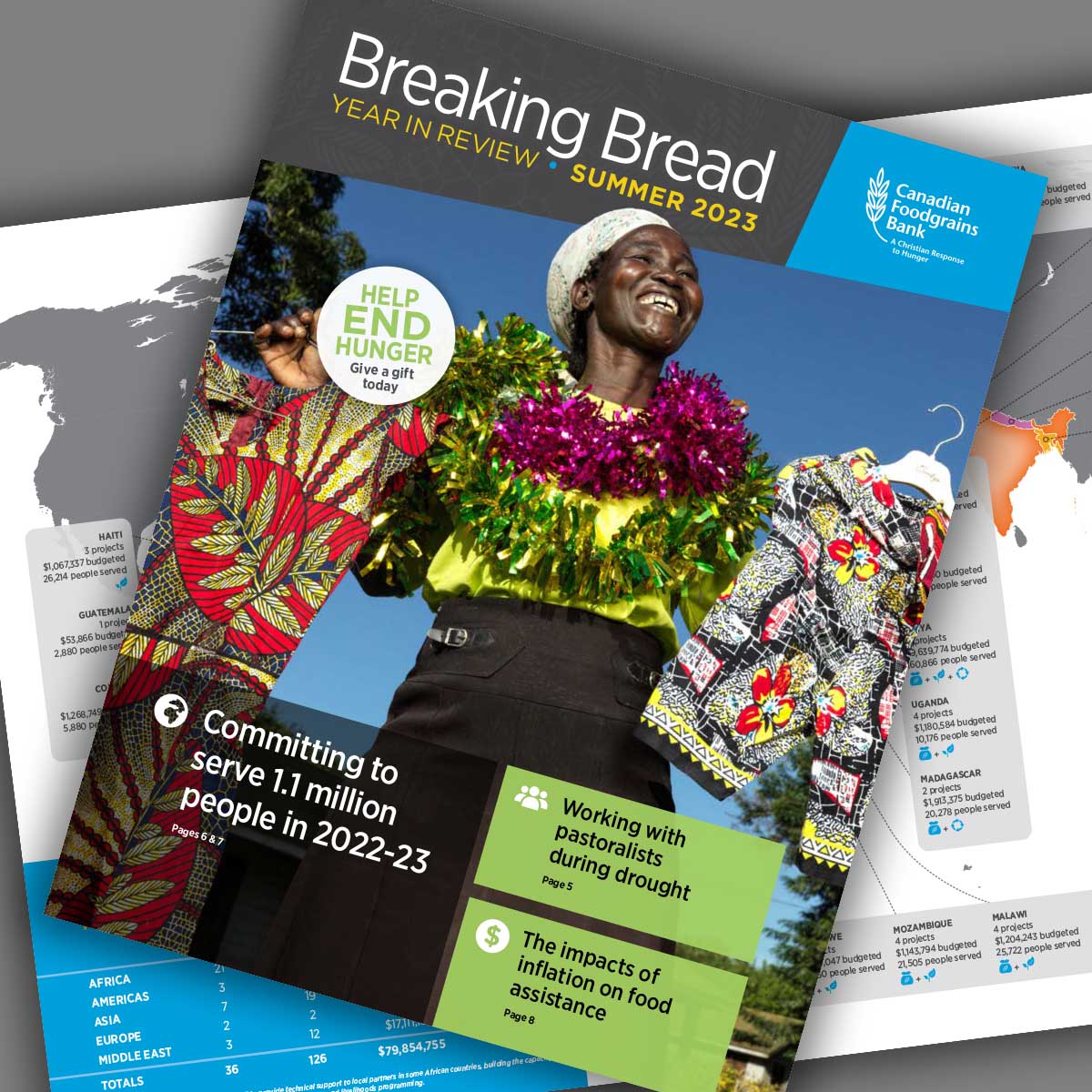

How To Break Bread With Scholars Tips For Effective Academic Engagement

May 08, 2025

How To Break Bread With Scholars Tips For Effective Academic Engagement

May 08, 2025 -

Breaking Bread With Scholars Strategies For Successful Academic Networking

May 08, 2025

Breaking Bread With Scholars Strategies For Successful Academic Networking

May 08, 2025 -

Meaningful Dialogue Breaking Bread With Scholars In Academia

May 08, 2025

Meaningful Dialogue Breaking Bread With Scholars In Academia

May 08, 2025 -

Breaking Bread With Scholars A Guide To Meaningful Academic Discussion

May 08, 2025

Breaking Bread With Scholars A Guide To Meaningful Academic Discussion

May 08, 2025 -

Pakistan Super League 10 Ticket Information And Purchase

May 08, 2025

Pakistan Super League 10 Ticket Information And Purchase

May 08, 2025