Ethereum Price Forecast: Factors Influencing Future Value And Potential Growth

Table of Contents

Technological Advancements and Upgrades

Ethereum 2.0 and its Impact

The much-anticipated Ethereum 2.0 upgrade is a pivotal factor in any Ethereum price prediction. The shift from a proof-of-work to a proof-of-stake consensus mechanism is a game-changer. The Ethereum 2.0 roadmap promises significant improvements, including sharding, which will drastically enhance scalability. These developments address current limitations, leading to substantial benefits:

- Reduced transaction costs: Lower fees will make Ethereum more accessible to a wider range of users and applications.

- Increased transaction throughput: Faster transaction speeds will improve the user experience and enable more complex applications.

- Enhanced network security: Proof-of-stake is considered more energy-efficient and secure than proof-of-work.

- Improved energy efficiency: A significant reduction in energy consumption contributes to a more sustainable blockchain.

These upgrades are expected to boost investor confidence and fuel increased demand, positively impacting the Ethereum price forecast. The successful implementation of Ethereum 2.0 will likely be a major catalyst for long-term Ethereum growth potential. Understanding the "sharding benefits" and "proof-of-stake advantages" is crucial for predicting future price movements.

Adoption and Ecosystem Growth

DeFi's Expanding Role

The explosive growth of decentralized finance (DeFi) on the Ethereum network is a major driver of its value. The Ethereum DeFi ecosystem continues to thrive, with a constantly expanding array of applications. This rapid expansion fuels increased demand for ETH, impacting the Ethereum future value. Key indicators of this growth include:

- Rising number of DeFi protocols: New projects and innovative applications are constantly emerging.

- Increasing Total Value Locked (TVL) in DeFi: The growing amount of assets locked in DeFi protocols demonstrates increasing confidence and adoption.

- Growth of decentralized exchanges (DEXs): DEXs provide users with alternatives to centralized exchanges, increasing Ethereum's utility.

- Expansion of lending and borrowing platforms: DeFi platforms offer innovative financial services, attracting users and driving up demand for ETH.

The burgeoning "Ethereum DeFi ecosystem" and the increasing number of "DeFi applications" are directly linked to the price of ETH. As more users and capital flow into this space, the upward pressure on the Ethereum price is likely to continue.

Regulatory Landscape and Institutional Investment

Regulatory Scrutiny and its Implications

The regulatory landscape surrounding cryptocurrencies significantly influences the Ethereum price forecast. "Cryptocurrency regulation" varies across jurisdictions, creating uncertainty. However, increasing clarity and stability could boost institutional investor confidence. Conversely, overly strict regulations could stifle growth. Key considerations include:

- Potential for increased clarity and stability: Clear regulatory frameworks can attract institutional investors.

- Risks associated with stricter regulations: Overly restrictive rules could hinder innovation and adoption.

- Growing institutional interest in Ethereum: More and more institutional investors are exploring Ethereum as an asset class.

- Impact of ETF approvals: The approval of Ethereum exchange-traded funds (ETFs) could significantly increase liquidity and demand.

The interplay between "regulatory uncertainty" and "institutional investment in Ethereum" is a critical component of any Ethereum price prediction. Positive regulatory developments and increasing institutional adoption are likely to be significant positive factors for the Ethereum future value.

Market Sentiment and Speculative Trading

Influence of Bitcoin and Overall Crypto Market

The cryptocurrency market is interconnected. The price of Ethereum often correlates with that of Bitcoin, commonly referred to as the "Bitcoin price correlation." The overall "crypto market sentiment" also plays a major role.

- Positive correlation with Bitcoin's price: When Bitcoin's price rises, Ethereum often follows suit.

- Impact of market-wide bull and bear cycles: Broad market trends significantly influence Ethereum's price.

- Influence of social media sentiment and news: News events and social media trends can lead to short-term price volatility.

"Altcoin season," where alternative cryptocurrencies outperform Bitcoin, also influences Ethereum's price. Understanding this "crypto market sentiment" and its effect on short-term fluctuations is vital for navigating the complexities of an Ethereum price prediction. Speculative trading based on market psychology can cause significant short-term price swings.

Ethereum's Utility and Future Use Cases

Beyond DeFi: NFTs and the Metaverse

Ethereum's utility extends far beyond DeFi. The rise of Non-Fungible Tokens (NFTs) and the developing metaverse present exciting new opportunities. Ethereum's role in these emerging technologies contributes to its long-term value proposition.

- Growing NFT market and its impact: The NFT market continues to grow, generating significant demand for Ethereum.

- Ethereum's role in metaverse development: Ethereum's decentralized nature makes it well-suited for metaverse applications.

- Potential for new applications and use cases: The possibilities for future applications and use cases on Ethereum remain vast.

The expansion into new sectors like the "NFT marketplace" and "metaverse development," combined with the exploration of new "Ethereum use cases," solidifies Ethereum's position as a leading blockchain platform and contributes significantly to its long-term Ethereum growth potential.

Conclusion

Several key factors influence the Ethereum price forecast: technological advancements (Ethereum 2.0), ecosystem growth (DeFi), regulatory developments, market sentiment, and future use cases (NFTs and the Metaverse). These factors contribute to both the potential for significant growth and the inherent volatility of the Ethereum price. While the Ethereum future value shows considerable promise, it's essential to remember that the cryptocurrency market remains inherently risky.

Key Takeaways: The Ethereum price prediction is complex, dependent on a confluence of technological, economic, and regulatory factors. While the long-term Ethereum growth potential is high, significant short-term volatility is expected.

Stay informed about the latest developments influencing the Ethereum price forecast and make your own investment decisions based on thorough research. Consider carefully the Ethereum price prediction, Ethereum future value, and Ethereum's potential growth before making any investment decisions.

Featured Posts

-

Sms Dolandiriciligi Sikayetlerinde Artis

May 08, 2025

Sms Dolandiriciligi Sikayetlerinde Artis

May 08, 2025 -

Desetta Pobeda Za Vesprem Vo L Sh Ps Zh Padna Vo Preshburk

May 08, 2025

Desetta Pobeda Za Vesprem Vo L Sh Ps Zh Padna Vo Preshburk

May 08, 2025 -

Angels Victory Over Dodgers Highlights Shortstop Challenges

May 08, 2025

Angels Victory Over Dodgers Highlights Shortstop Challenges

May 08, 2025 -

Wall Street In Kripto Para Yatirimlarindaki Evrimi

May 08, 2025

Wall Street In Kripto Para Yatirimlarindaki Evrimi

May 08, 2025 -

Denver Nuggets Jokic Among Starters Benched After Grueling Game

May 08, 2025

Denver Nuggets Jokic Among Starters Benched After Grueling Game

May 08, 2025

Latest Posts

-

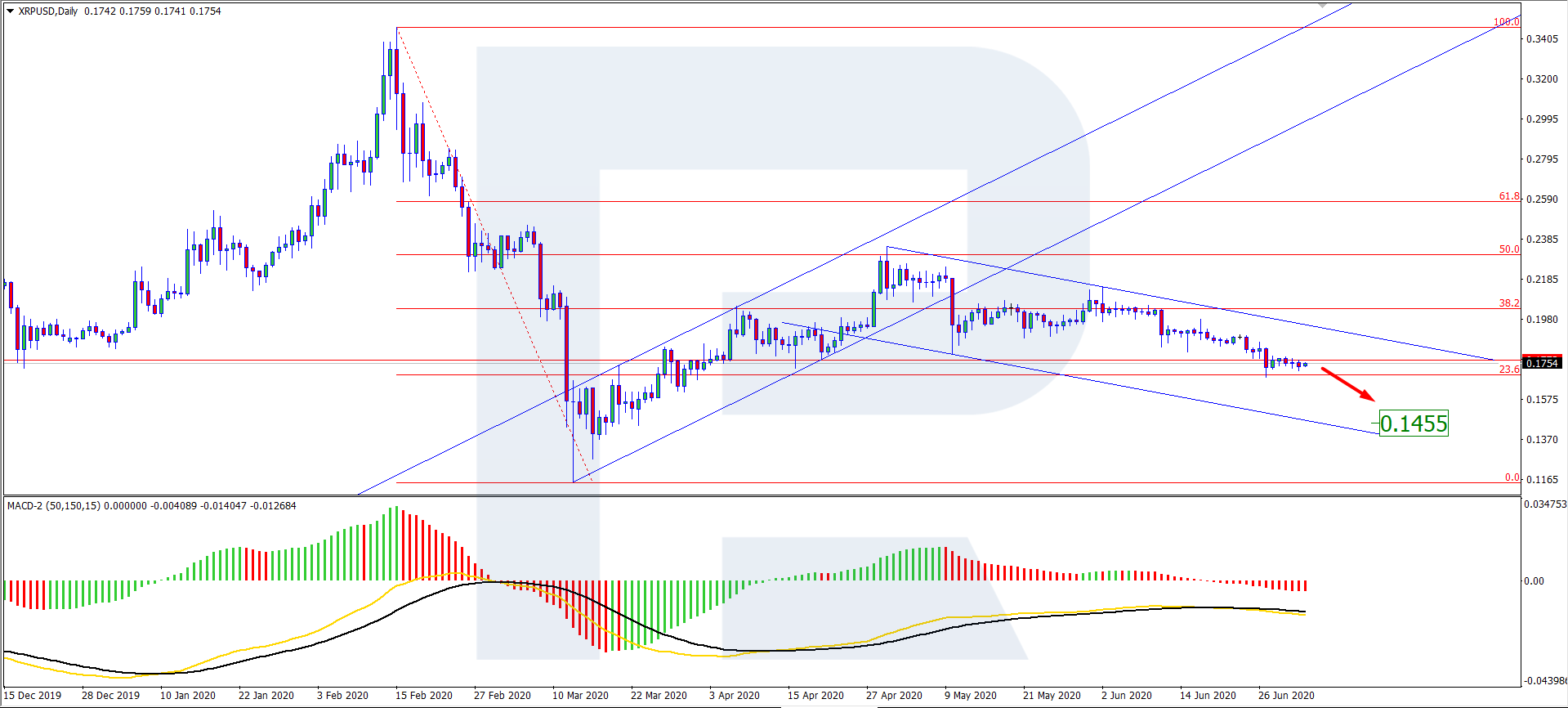

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025 -

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025 -

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025 -

Understanding Xrps 400 Surge Future Price Prospects

May 08, 2025

Understanding Xrps 400 Surge Future Price Prospects

May 08, 2025 -

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025