Miami Hedge Fund Executive Banned: Immigration Fraud Claims

Table of Contents

The Allegations Against the Miami Hedge Fund Executive

The Miami hedge fund executive, whose name is currently being withheld pending further legal proceedings, is accused of a complex immigration fraud scheme. The allegations center around the misuse of investor visas and the potential employment of undocumented workers within the hedge fund's operations. Authorities allege that false statements were made on multiple visa applications, misleading immigration officials about the executive's true intentions and the nature of the employment offered.

Evidence presented by the authorities includes sworn testimonies from former employees, internal documents from the hedge fund, and records from various financial institutions detailing suspicious transactions. These documents reportedly detail a pattern of deliberate misrepresentation and concealment designed to circumvent immigration laws.

- Type of visa involved: The investigation reportedly focuses on EB-5 investor visas, suggesting the alleged fraud involves misuse of the program designed to attract foreign investment to the United States.

- Specific laws violated: The charges include perjury, conspiracy to commit fraud, and violations of the Immigration and Nationality Act (INA), specifically sections related to visa fraud and employment of unauthorized aliens.

- Timeline of events: The investigation began approximately six months ago, following an anonymous tip. The ban was issued last week following a lengthy investigation and a formal hearing.

Impact on the Hedge Fund and the Financial Industry

The allegations against the Miami hedge fund executive have sent shockwaves through the financial industry. The hedge fund itself faces significant repercussions, including:

- Potential loss of assets under management: Investors are likely to withdraw their funds, leading to a substantial decrease in assets under management and impacting the fund's overall viability.

- Impact on fund performance: The negative publicity and uncertainty surrounding the case will undoubtedly affect the fund's performance, potentially leading to significant losses for remaining investors.

- Regulatory actions: The Securities and Exchange Commission (SEC) and other regulatory bodies are expected to launch their own investigations, potentially leading to further penalties and restrictions on the hedge fund's operations.

The effect on investor confidence is considerable. The case underscores the risk associated with investing in firms that may not adhere to strict legal and ethical standards. This situation could lead to a broader reassessment of due diligence practices among investors in the Miami financial community.

Wider Implications for Immigration Laws in the US

This case highlights the critical importance of robust immigration laws in maintaining fairness and order within the United States. The allegations underscore the potential vulnerabilities in the current immigration system, particularly concerning the potential for fraud within investor visa programs. The case may prompt increased scrutiny of financial institutions’ immigration compliance procedures.

- Similar cases and outcomes: This is not an isolated incident. Several high-profile cases involving immigration fraud within the financial sector have surfaced recently, resulting in substantial fines and imprisonment.

- Potential legislative changes: This case may catalyze calls for stricter enforcement and potential legislative changes to tighten regulations surrounding investor visas and improve oversight of financial institutions' immigration compliance.

- Increased Scrutiny: Expect heightened regulatory scrutiny of financial institutions’ hiring practices and compliance with immigration laws in the wake of this case.

Legal Ramifications and Potential Penalties

The legal proceedings against the Miami hedge fund executive are still ongoing. The executive is facing a complex array of charges, each carrying significant penalties.

- Specific charges: The charges currently include multiple counts of immigration fraud, perjury, and conspiracy.

- Potential prison sentences: Depending on the severity of the charges and the outcome of the trial, the executive could face a substantial prison sentence.

- Financial penalties: Significant fines and forfeiture of assets are highly likely, considering the magnitude of the alleged fraud.

The executive's legal team is actively defending their client, exploring all available legal options to mitigate the potential consequences. The case highlights the importance of obtaining competent legal representation when facing serious immigration charges.

Conclusion

The "Miami Hedge Fund Executive Banned" case serves as a stark reminder of the severe consequences associated with immigration fraud. The allegations against this prominent executive have far-reaching implications, impacting not only the individual but also the reputation and stability of the Miami financial sector. The case underscores the need for strict adherence to immigration laws and robust internal compliance programs within financial institutions. This case highlights the importance of due diligence and thorough vetting processes for both individuals and organizations operating within the US financial system. For individuals and businesses operating in Miami's dynamic financial sector, understanding and complying with immigration regulations is paramount to mitigate risk and maintain a strong ethical and legal standing. Stay informed on updates concerning this case and other relevant immigration laws to ensure compliance. Learn more about immigration law and compliance by [link to relevant resource].

Featured Posts

-

F1 Hamilton Och Leclercs Kontroversiella Diskvalifikation

May 20, 2025

F1 Hamilton Och Leclercs Kontroversiella Diskvalifikation

May 20, 2025 -

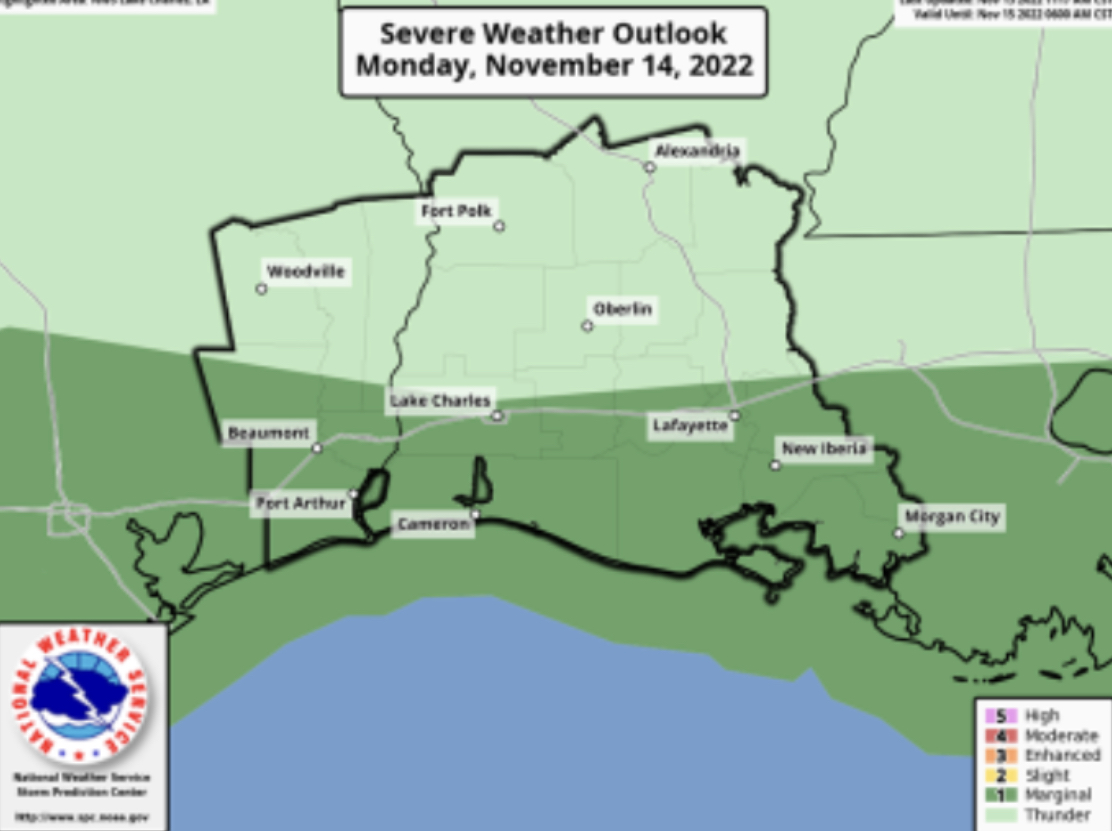

Increased Storm Risk Overnight Severe Weather Potential Monday

May 20, 2025

Increased Storm Risk Overnight Severe Weather Potential Monday

May 20, 2025 -

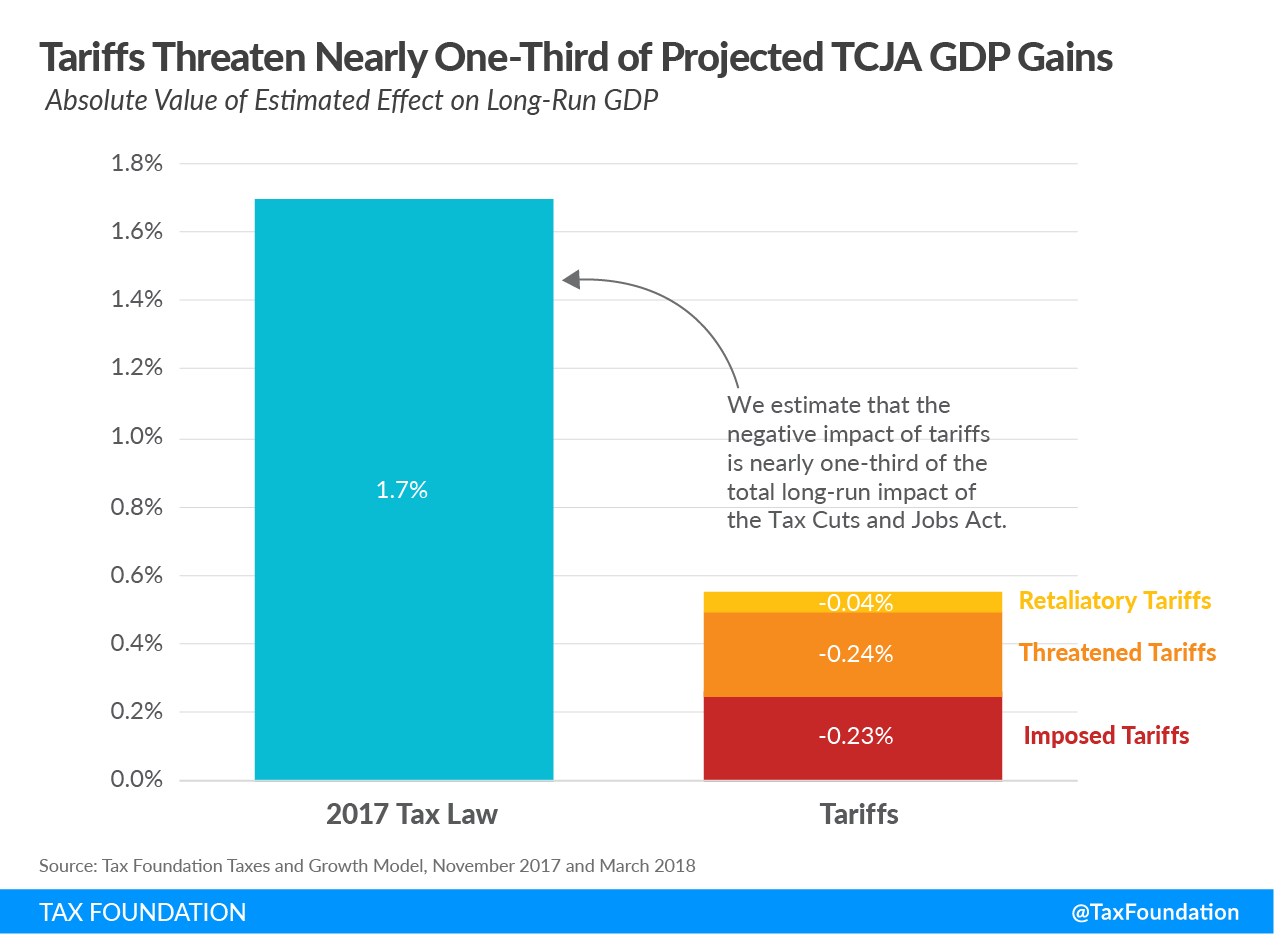

Canada Defends Tariff Policy Oxford Report Challenged

May 20, 2025

Canada Defends Tariff Policy Oxford Report Challenged

May 20, 2025 -

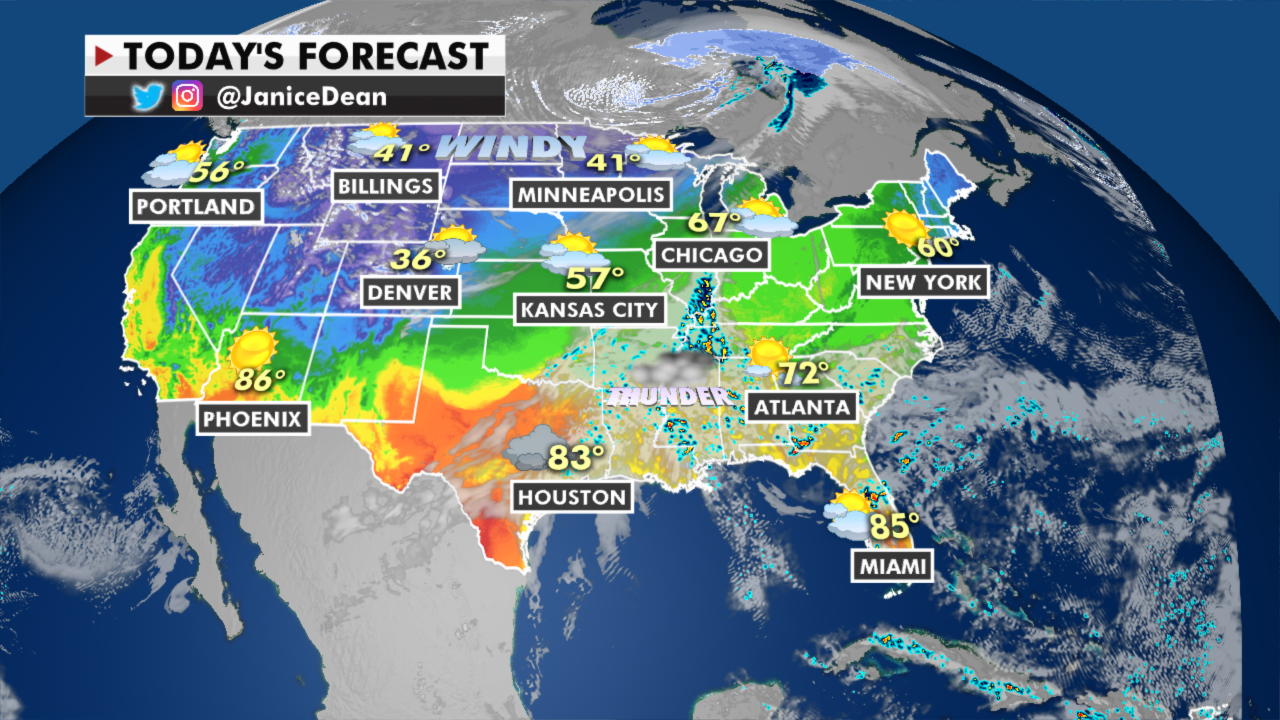

Updated Rain Forecast Check The Latest Predictions

May 20, 2025

Updated Rain Forecast Check The Latest Predictions

May 20, 2025 -

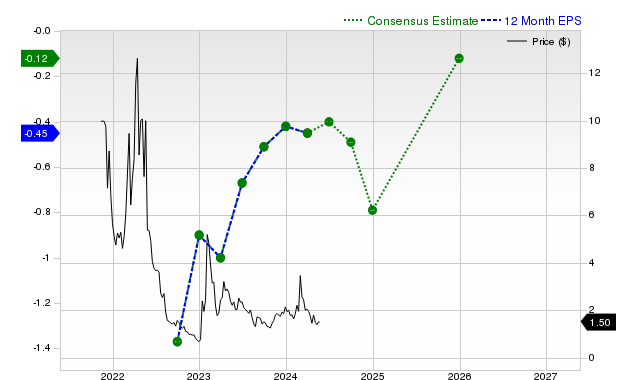

Securities Lawsuit Targets Big Bear Ai Holdings Inc

May 20, 2025

Securities Lawsuit Targets Big Bear Ai Holdings Inc

May 20, 2025