Mississippi Income Tax Elimination: Hernando's Economic Outlook

Table of Contents

Potential Economic Benefits for Hernando Residents

The elimination of Mississippi's state income tax would directly translate into increased disposable income for Hernando residents. This financial relief could have a ripple effect throughout the community.

Increased Disposable Income

Eliminating state income tax directly boosts residents' take-home pay. This translates to significantly increased spending power.

- Increased spending power: Hernando residents will have more money to spend on goods and services, boosting local businesses.

- Potential for home improvements: More disposable income could lead to increased investment in home renovations and improvements.

- Higher savings rates: Some residents may choose to allocate a portion of their extra income towards savings and investments.

- Enhanced quality of life: Increased financial security can lead to a higher quality of life, with opportunities for leisure activities, education, and personal development.

This direct tax relief, a key aspect of Mississippi tax reform, significantly impacts Hernando residents' financial well-being.

Attracting New Residents

A tax-friendly environment can make Hernando a more attractive place to live and work, potentially leading to significant population growth.

- Increased population growth: The elimination of state income tax could draw new residents seeking lower taxes and a higher quality of life.

- Potential for a stronger local workforce: An influx of new residents could lead to a larger and more diverse workforce, benefiting local businesses.

- Higher property values: Increased demand for housing due to population growth could drive up property values, benefiting existing homeowners.

The appeal of lower taxes is a significant factor in attracting new residents to Mississippi and specifically to Hernando, making it a key element of successful relocation strategies.

Stimulated Local Spending

Increased disposable income among Hernando residents will likely lead to a surge in local spending.

- Boost to local businesses: Increased consumer spending will directly benefit local businesses, leading to increased sales and revenue.

- Increased demand for goods and services: Higher demand will encourage businesses to expand and potentially create new jobs within the community.

- Potential for new business development: The increased consumer spending could create opportunities for entrepreneurs to start new businesses in Hernando, further stimulating the local economy.

This economic stimulus, driven by increased consumer spending, is crucial for the growth and development of Hernando's economy.

Impact on Hernando Businesses

The elimination of Mississippi's income tax could significantly alter the business landscape in Hernando.

Improved Business Climate

A lower tax burden could make Hernando a more attractive location for businesses of all sizes.

- Reduced operating costs for businesses: Eliminating state income tax reduces a significant operating expense for businesses, boosting profitability.

- Increased competitiveness: Lower taxes can enhance Hernando's competitiveness against other locations vying for businesses and investment.

- Potential for attracting new businesses and investment: A more favorable tax climate can attract new businesses and investment, creating jobs and economic growth.

This improved business climate is a direct result of Mississippi tax reform and a significant factor for business investment decisions within the state.

Increased Job Creation

A more attractive business climate often leads to increased job creation.

- Expansion of existing businesses: Businesses with reduced tax burdens may choose to expand their operations, leading to more jobs.

- Attraction of new businesses: The prospect of lower taxes can entice new businesses to relocate to or establish themselves in Hernando.

- Potential for higher wages: Increased competition for employees in a growing economy could potentially lead to higher wages for workers.

Job creation is a critical component of a healthy economy, directly impacting Hernando's economic outlook.

Potential Challenges for Businesses

While the benefits are significant, businesses should also consider potential challenges.

- Potential increase in other taxes: The elimination of income tax might be offset by increases in other taxes, such as property taxes or sales taxes. Careful financial planning is essential.

- Need for careful financial planning by businesses: Businesses need to analyze the overall impact of the tax changes on their financial strategies to ensure long-term success.

This requires a comprehensive understanding of the implications of Mississippi tax reform on specific businesses and industries.

Long-Term Economic Outlook for Hernando

The elimination of Mississippi's income tax has the potential to significantly reshape Hernando's long-term economic outlook.

Sustainable Growth

The increased disposable income and improved business climate could fuel sustainable economic growth in Hernando for years to come.

Infrastructure Development

The influx of new residents and businesses may necessitate increased investment in infrastructure, such as roads, schools, and utilities, to support the growing population.

Potential Drawbacks and Mitigation Strategies

While the overall outlook is positive, potential drawbacks need to be addressed proactively. For example, increased reliance on other tax sources to fund essential services requires careful planning and potential mitigation strategies to avoid placing undue burdens on residents and businesses.

Conclusion

The proposed elimination of Mississippi's income tax presents a significant opportunity for Hernando. While challenges exist, the potential benefits—increased disposable income for residents, a more attractive business climate, and enhanced economic growth—are substantial. Careful planning and proactive measures will be crucial to maximizing the positive effects and mitigating potential drawbacks.

Call to Action: Stay informed about the progress of the Mississippi income tax elimination legislation and its impact on Hernando’s economic future. Understand how the Mississippi Income Tax Elimination could affect your personal finances and business strategies in Hernando, Mississippi. Engage with local government and businesses to shape the future of Hernando’s economic development.

Featured Posts

-

Rafa Nadal Llora La Perdida De Una Leyenda Del Tenis Su Legado Perdurara

May 19, 2025

Rafa Nadal Llora La Perdida De Una Leyenda Del Tenis Su Legado Perdurara

May 19, 2025 -

Taksidi Sta Ierosolyma Gia Tin Kyriaki Toy Antipasxa Organosi Kai Proetoimasia

May 19, 2025

Taksidi Sta Ierosolyma Gia Tin Kyriaki Toy Antipasxa Organosi Kai Proetoimasia

May 19, 2025 -

Urgent Call For Improved School Bus Safety In Collier County After Near Miss

May 19, 2025

Urgent Call For Improved School Bus Safety In Collier County After Near Miss

May 19, 2025 -

Analysis Projected Decline In Maastricht Airport Passengers In Early 2025

May 19, 2025

Analysis Projected Decline In Maastricht Airport Passengers In Early 2025

May 19, 2025 -

Alfonso Arus Critica Duramente A Melody En Arusero Tras Su Eleccion Para Eurovision 2025

May 19, 2025

Alfonso Arus Critica Duramente A Melody En Arusero Tras Su Eleccion Para Eurovision 2025

May 19, 2025

Latest Posts

-

Actor Mark Rylance Speaks Out Against Music Festivals Effect On London Parks

May 19, 2025

Actor Mark Rylance Speaks Out Against Music Festivals Effect On London Parks

May 19, 2025 -

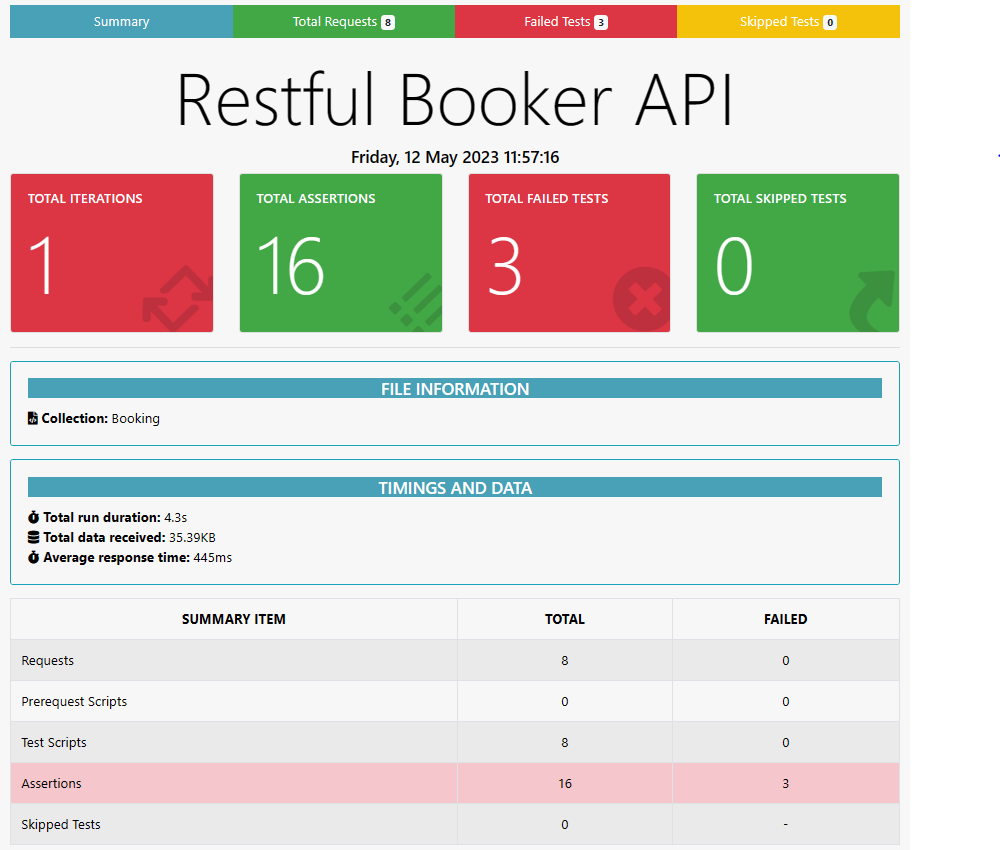

Unlock Postmans Full Potential Expert Tips And Tricks

May 19, 2025

Unlock Postmans Full Potential Expert Tips And Tricks

May 19, 2025 -

Postman Efficiency Tips And Tricks For Faster Workflows

May 19, 2025

Postman Efficiency Tips And Tricks For Faster Workflows

May 19, 2025 -

United Kingdom Festival Under Threat Environmentalists 31 000 Fight

May 19, 2025

United Kingdom Festival Under Threat Environmentalists 31 000 Fight

May 19, 2025 -

Improve Api Testing With These Unknown Postman Features

May 19, 2025

Improve Api Testing With These Unknown Postman Features

May 19, 2025