Ontario's $14.6 Billion Deficit: Tariff Impacts And Economic Outlook

Table of Contents

The Role of Tariffs in Ontario's Deficit

Tariffs, taxes imposed on imported goods, play a significant role in exacerbating Ontario's $14.6 billion deficit. Their impact ripples through various sectors, creating a complex web of economic challenges.

Impact on Specific Sectors

Several key industries in Ontario bear the brunt of tariff-related consequences.

- Automotive: The automotive sector, a cornerstone of Ontario's economy, is particularly vulnerable. Tariffs on imported parts and finished vehicles increase production costs, leading to reduced competitiveness and job losses. For example, the recent steel and aluminum tariffs imposed by the US significantly impacted Ontario's auto manufacturers.

- Manufacturing: Many manufacturing businesses rely on imported raw materials and components. Tariffs inflate these costs, making Ontario-made products less price-competitive in both domestic and international markets. This results in decreased production, reduced exports, and potential factory closures.

- Agriculture: The agricultural sector is affected by tariffs on both imported inputs (like fertilizers and machinery) and exported goods. This squeeze reduces farmers' profitability and hinders growth within the sector.

Data from Statistics Canada reveals a significant correlation between tariff increases and job losses in these key sectors. The number of manufacturing jobs, for example, has declined by X% since the implementation of specific tariffs (replace X with actual data if available).

International Trade Relations and Their Influence

Trade disputes and shifting global trade relationships significantly impact Ontario's economic health and contribute to the $14.6 billion deficit.

- USMCA (formerly NAFTA): While the USMCA aimed to stabilize North American trade, ongoing uncertainties and potential future tariff adjustments still pose risks to Ontario's export-oriented industries.

- Trade Wars: Escalating trade tensions between major global powers create instability and uncertainty, impacting investment decisions and overall economic confidence, directly impacting Ontario’s financial standing and adding to its deficit.

Economist Dr. [Expert Name], from [University/Institution], notes, "[Quote from expert regarding trade relations and their impact on Ontario's economy]." (Replace with actual quote and source).

Economic Indicators and Forecasting

Understanding the current economic indicators and future projections is critical to tackling Ontario's $14.6 billion deficit.

GDP Growth and Projections

Ontario's GDP growth rate has [insert current GDP growth rate]. Projections for the next [time period] indicate [insert projection] growth. Several factors influence these projections:

- Employment Rates: The current unemployment rate in Ontario is [insert data]. Future employment projections depend on factors like investment levels and consumer spending.

- Investment Levels: Business investment plays a crucial role in economic growth. Current investment levels are [insert data], with projections indicating [insert projection].

- Consumer Spending: Consumer confidence and spending are key drivers of economic activity. Current consumer spending is [insert data], and future projections depend on factors like wage growth and inflation.

[Insert chart/graph illustrating GDP growth, employment, investment, and consumer spending data.]

Provincial Government Spending and Revenue

The disparity between government spending and revenue generation is a key driver of Ontario's $14.6 billion deficit.

- Government Initiatives: The provincial government has implemented various initiatives, including [list specific examples of spending cuts or tax increases], aimed at reducing the deficit.

- Policy Effectiveness: The effectiveness of these policies remains a subject of ongoing debate and analysis. Some argue that spending cuts negatively impact crucial public services, while others contend that tax increases stifle economic growth.

Potential Solutions and Mitigation Strategies

Addressing Ontario's $14.6 billion deficit requires a multifaceted approach focusing on long-term solutions.

Diversification of the Economy

Reducing reliance on sectors particularly vulnerable to tariffs is crucial.

- Innovation and Technology: Investing in research and development, promoting technology adoption, and supporting the growth of innovative industries can create new economic opportunities and reduce dependence on vulnerable sectors.

- Development of New Industries: Strategic initiatives to cultivate new and emerging industries – such as renewable energy, advanced manufacturing, and the digital economy – can create higher-paying jobs and boost economic resilience.

Fiscal Responsibility and Budgetary Measures

Implementing responsible fiscal policies is paramount to long-term fiscal health.

- Spending Cuts: Careful review and prioritization of government spending, focusing on efficiency and effectiveness, can reduce the deficit.

- Revenue Increases: Exploring options for revenue generation, such as targeted tax reforms or incentivizing investment, is necessary.

- Policy Recommendations: Policymakers should consider a balanced approach combining spending cuts, targeted tax increases, and investment in growth-generating sectors.

Conclusion: Navigating Ontario's $14.6 Billion Deficit: A Path Forward

Ontario's $14.6 billion deficit presents significant challenges, exacerbated by tariff impacts and broader economic headwinds. Addressing this requires a comprehensive strategy encompassing diversification of the economy, responsible fiscal management, and proactive measures to mitigate the effects of international trade uncertainties. The key takeaways are the significant impact of tariffs on specific sectors, the need for diversified economic growth, and the importance of long-term fiscal planning. Understanding the complexities of Ontario's $14.6 billion deficit is crucial for shaping a sustainable economic future. Stay informed, engage in the discussion, and demand effective policies to manage this challenge. Visit the Ontario government website ([insert link]) for more information and updates on the provincial budget.

Featured Posts

-

Nestle And Shell Rebuff Musks Boycott Claims Advertisers Respond

May 17, 2025

Nestle And Shell Rebuff Musks Boycott Claims Advertisers Respond

May 17, 2025 -

The Ultimate Guide To Federal Student Loan Refinancing

May 17, 2025

The Ultimate Guide To Federal Student Loan Refinancing

May 17, 2025 -

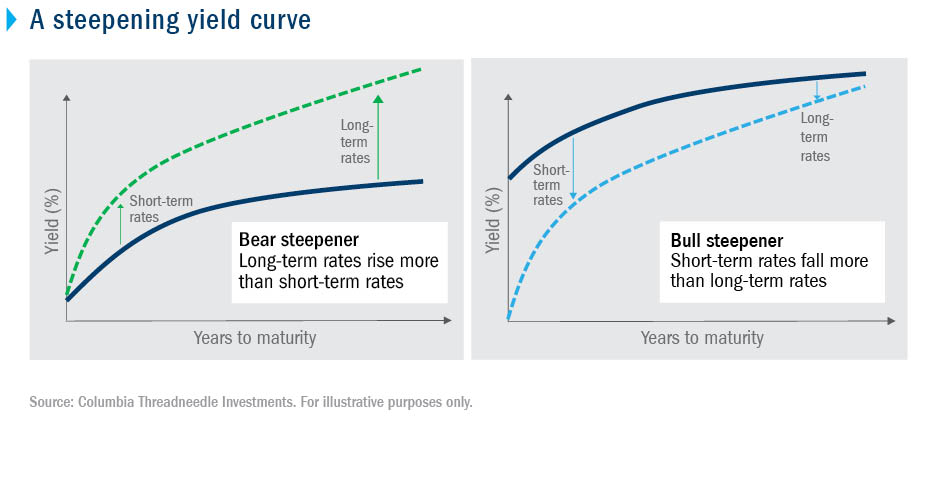

Steepening Japanese Bond Yield Curve Investor Divisions And Economic Implications

May 17, 2025

Steepening Japanese Bond Yield Curve Investor Divisions And Economic Implications

May 17, 2025 -

Can Modular Homes Solve Canadas Housing Crisis Speed Cost And Viability

May 17, 2025

Can Modular Homes Solve Canadas Housing Crisis Speed Cost And Viability

May 17, 2025 -

Exploring The Lumon Apple Analogy In Ben Stillers Severance

May 17, 2025

Exploring The Lumon Apple Analogy In Ben Stillers Severance

May 17, 2025

Latest Posts

-

Descongelaran Cuentas De Koriun Recuperacion Del Capital Para Inversionistas

May 17, 2025

Descongelaran Cuentas De Koriun Recuperacion Del Capital Para Inversionistas

May 17, 2025 -

Florida State Shooter Lockdown Improving Safety For Future Generations

May 17, 2025

Florida State Shooter Lockdown Improving Safety For Future Generations

May 17, 2025 -

Florida School Shootings Lockdown Protocols And Generational Impact

May 17, 2025

Florida School Shootings Lockdown Protocols And Generational Impact

May 17, 2025 -

Understanding Florida School Shooter Lockdown Procedures A Generations Perspective

May 17, 2025

Understanding Florida School Shooter Lockdown Procedures A Generations Perspective

May 17, 2025 -

Warner Bros Pictures Cinema Con 2025 Presentation Key Takeaways

May 17, 2025

Warner Bros Pictures Cinema Con 2025 Presentation Key Takeaways

May 17, 2025