Palantir Stock Forecast Revised: Understanding The Recent Market Rally

Table of Contents

Analyzing Palantir's Recent Financial Performance

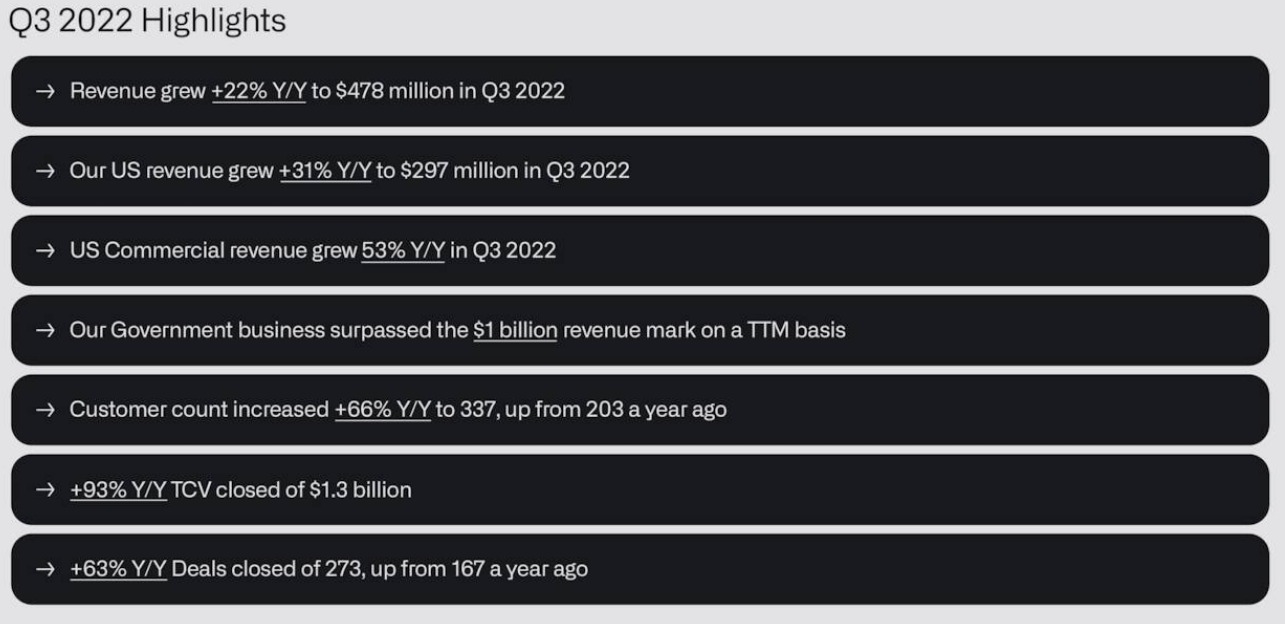

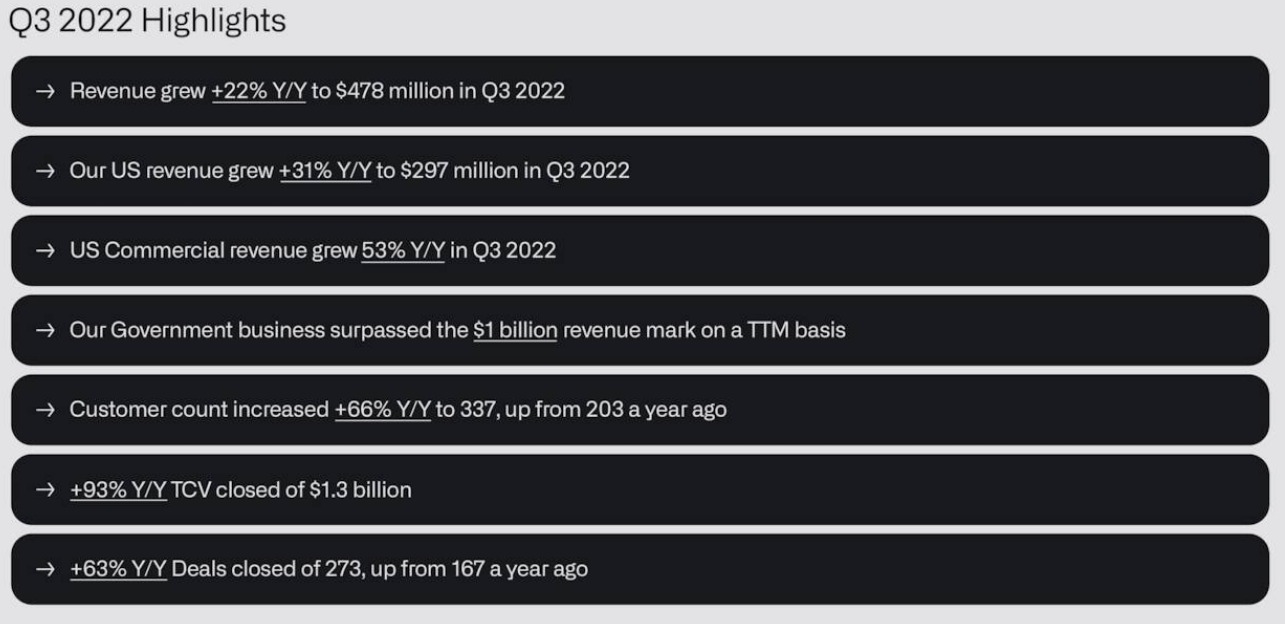

Palantir's recent financial performance has played a pivotal role in the revised Palantir stock forecast. A closer look at key metrics reveals a more optimistic outlook than previously anticipated.

Revenue Growth and Profitability:

Palantir's recent earnings reports showcase impressive growth. While specific numbers fluctuate quarter to quarter, the overall trend indicates a positive trajectory.

- Significant Revenue Growth in Government Sector: Recent government contracts have significantly boosted Palantir's revenue, indicating strong demand for its data analytics solutions in this crucial sector. This consistent revenue stream provides a solid foundation for future growth.

- Expanding Commercial Revenue: The company's commercial sector is also demonstrating promising growth, suggesting successful penetration into new markets and increased adoption of Palantir's platform by private businesses. This diversification reduces reliance on a single revenue source.

- Improving Profit Margins: Palantir has been actively implementing cost-cutting measures and enhancing operational efficiency, leading to an improvement in profit margins. This signifies a move towards greater profitability and long-term sustainability.

Government Contracts and Future Outlook:

Government contracts remain a cornerstone of Palantir's revenue model. The securing of new, large-scale contracts signals continued confidence in Palantir's capabilities.

- Strategic Partnerships: Palantir's strategic partnerships with various government agencies demonstrate its ability to deliver critical solutions for national security and intelligence operations. This reinforces its position as a trusted provider of advanced data analytics.

- Long-Term Contracts: The long-term nature of many government contracts provides Palantir with a predictable revenue stream and reduces uncertainty about future earnings. This stability contributes to increased investor confidence.

Commercial Sector Growth and Expansion:

Palantir's commercial expansion is showing considerable promise, demonstrating the versatility and applicability of its platform across diverse industries.

- Successful Commercial Deployments: The company has achieved successful deployments in various commercial sectors, showcasing the effectiveness of its platform in addressing complex data challenges across different industries.

- Competitive Advantages: Palantir's proprietary technology and expertise provide a significant competitive advantage in the crowded data analytics market. This positions the company for continued market share growth.

Factors Contributing to the Palantir Stock Rally

Several factors have contributed to the recent surge in Palantir's stock price, leading to a revised Palantir stock forecast.

Improved Investor Sentiment:

A significant shift in investor sentiment has positively impacted Palantir's stock price. This improved outlook is driven by several factors.

- Positive Analyst Ratings: Several analysts have upgraded their ratings and price targets for Palantir, reflecting growing confidence in the company's future prospects.

- Increased Media Coverage: Positive media coverage highlighting Palantir's technological advancements and strategic partnerships has helped to improve its public image and attract more investor attention.

Market Conditions and Macroeconomic Factors:

Broader market trends and macroeconomic factors also influence Palantir's stock price.

- Interest Rate Impact: Changes in interest rates can affect investor sentiment towards growth stocks like Palantir. Lower interest rates tend to favor growth investments.

- Sector-Specific Trends: Positive trends within the broader technology sector can provide a tailwind for Palantir's stock price.

Technical Analysis of Palantir Stock:

While we avoid offering financial advice, observing technical indicators such as trading volume and price patterns can offer insights into market sentiment. (Note: This is not financial advice. Consult a financial professional for investment guidance.)

Revised Palantir Stock Forecast and Valuation

Based on the analysis above, several analysts have revised their Palantir stock forecast upward. However, it is important to remember that these are simply predictions and not guarantees.

Analyst Predictions and Price Targets: Analysts' price targets vary significantly, reflecting the uncertainty inherent in predicting future stock performance. (This is not financial advice.)

Risks and Uncertainties:

While the outlook appears positive, several risks could impact Palantir's future performance. These include increased competition, potential economic downturns, and the inherent challenges in predicting the long-term success of a rapidly evolving technology company.

Conclusion:

The recent rally in Palantir stock can be attributed to a combination of factors, including improved financial performance, positive investor sentiment, and broader market trends. While the revised Palantir stock forecast suggests a potentially positive outlook, investors should remain aware of the inherent risks and uncertainties. Remember, this analysis is not financial advice. Stay informed about the evolving Palantir stock forecast by conducting your own thorough research and consulting with a financial advisor before making any investment decisions. Continue monitoring Palantir's performance for future investment strategies.

Featured Posts

-

Surviving The Trade War A Cryptocurrencys Path To Success

May 09, 2025

Surviving The Trade War A Cryptocurrencys Path To Success

May 09, 2025 -

Uk Government Considers Visa Restrictions For Specific Countries

May 09, 2025

Uk Government Considers Visa Restrictions For Specific Countries

May 09, 2025 -

Spring Style Elevated Elizabeth Stewarts Collaboration With Lilysilk

May 09, 2025

Spring Style Elevated Elizabeth Stewarts Collaboration With Lilysilk

May 09, 2025 -

9 Potential Nhl Players To Eclipse Alex Ovechkins Career Goal Total

May 09, 2025

9 Potential Nhl Players To Eclipse Alex Ovechkins Career Goal Total

May 09, 2025 -

Is Bitcoins Rebound Just The Beginning A Comprehensive Analysis

May 09, 2025

Is Bitcoins Rebound Just The Beginning A Comprehensive Analysis

May 09, 2025

Latest Posts

-

Whats App Spyware Litigation Metas 168 Million Penalty And Ongoing Challenges

May 10, 2025

Whats App Spyware Litigation Metas 168 Million Penalty And Ongoing Challenges

May 10, 2025 -

Metas 168 Million Payment In Whats App Spyware Case A Turning Point

May 10, 2025

Metas 168 Million Payment In Whats App Spyware Case A Turning Point

May 10, 2025 -

The Whats App Spyware Case Metas 168 Million Loss And What It Means

May 10, 2025

The Whats App Spyware Case Metas 168 Million Loss And What It Means

May 10, 2025 -

168 Million Judgment Against Meta The Whats App Spyware Case And Its Aftermath

May 10, 2025

168 Million Judgment Against Meta The Whats App Spyware Case And Its Aftermath

May 10, 2025 -

Rethinking Middle Management Their Vital Role In Todays Business Environment

May 10, 2025

Rethinking Middle Management Their Vital Role In Todays Business Environment

May 10, 2025