Palantir Stock: Wall Street's Verdict Before May 5th - Should You Invest?

Table of Contents

Palantir's Recent Performance and Financial Projections

Palantir's recent performance has been a mixed bag, showcasing both growth and challenges. Analyzing recent quarterly earnings reports is crucial to understanding the current trajectory of PLTR stock. While revenue growth has generally been positive, demonstrating the increasing demand for Palantir's data analytics platform, profitability remains a key focus for investors.

- Key financial metrics: Examining metrics like Earnings Per Share (EPS), revenue growth year-over-year (YoY), and operating margins provides a clear picture of Palantir's financial health. Closely tracking these figures leading up to May 5th is essential.

- Comparison to industry benchmarks: Comparing Palantir's performance to competitors like Snowflake and Databricks helps gauge its relative success and market positioning within the data analytics sector.

- Analyst ratings and price targets before May 5th: Before making any investment decisions, thoroughly review analyst ratings and price targets from reputable financial institutions. These provide valuable insights into the overall market sentiment towards PLTR stock.

- Impact of government contracts on financial performance: Palantir's significant government contracts play a critical role in its revenue stream. Analyzing the impact of these contracts on financial performance is vital for assessing future stability and growth.

Significant partnerships and contract wins can significantly influence Palantir's stock price. Any such announcements before May 5th should be carefully considered as they can impact investor sentiment and market valuation.

Wall Street Sentiment and Analyst Opinions on Palantir Stock

Wall Street's sentiment regarding PLTR stock is diverse, reflecting the inherent risks and rewards associated with this high-growth company. Understanding the consensus among leading financial analysts is a crucial step in your investment analysis.

- Consensus rating (buy, hold, sell): The overall consensus rating amongst analysts provides a general overview of market sentiment. However, it's important to delve deeper to understand the reasoning behind each rating.

- Price target ranges: Examining the range of price targets from different analysts provides a more nuanced understanding of the potential upside and downside risks associated with investing in Palantir stock.

- Key factors influencing analyst opinions: Analysts' opinions are shaped by various factors, including Palantir's growth potential, the intensity of competition in the data analytics market, overall market conditions, and the company's ability to consistently secure profitable government contracts.

- Divergence of opinions: It's essential to note that not all analysts agree on Palantir's prospects. Understanding the differing perspectives and the rationale behind them provides a more comprehensive view of the investment opportunity.

Remember to consult reputable financial news sources such as the Wall Street Journal, Bloomberg, and Reuters for the most up-to-date information and analyst opinions on Palantir stock.

Risks and Potential Downsides of Investing in Palantir Stock

Investing in Palantir stock, like any other stock, involves inherent risks. A thorough risk assessment is crucial before making any investment decisions.

- High volatility and potential for significant price swings: PLTR stock is known for its volatility. Investors should be prepared for substantial price fluctuations.

- Competition in the data analytics market: Palantir faces intense competition from established players and emerging startups in the rapidly evolving data analytics market.

- Dependence on government contracts: A significant portion of Palantir's revenue comes from government contracts. Changes in government policies or budget cuts could negatively impact the company's financial performance.

- Concerns about profitability and long-term sustainability: While Palantir is showing revenue growth, its path to consistent profitability remains a key concern for many investors.

- Geopolitical risks impacting government contracts: Geopolitical instability and international relations can significantly affect the award and execution of government contracts, impacting Palantir's revenue and profitability.

It is imperative to conduct a thorough risk assessment, considering your personal risk tolerance and investment goals, before investing in Palantir stock.

Comparing Palantir to Competitors in the Data Analytics Sector

Understanding Palantir's competitive landscape is crucial for evaluating its long-term potential. Comparing it to key players in the data analytics sector provides valuable context for your investment decision.

- Key competitors (e.g., Snowflake, Databricks): Palantir competes with several prominent players in the data analytics market, each with its strengths and weaknesses.

- Competitive advantages and disadvantages of Palantir: Palantir's strengths lie in its sophisticated data analytics platform and its strong relationships with government agencies. However, its high price point and dependence on government contracts can be seen as disadvantages.

- Market share and growth potential compared to competitors: Analyzing Palantir's market share and growth trajectory in comparison to its competitors helps assess its competitive strength and future growth potential.

- Analysis of Palantir's unique selling propositions (USPs): Palantir's unique selling propositions, such as its ability to handle complex data sets and its focus on security and privacy, are key differentiators in the market.

Analyzing Palantir's unique selling propositions (USPs) and comparing them to competitors' offerings is vital for understanding its competitive advantage and long-term growth prospects.

Conclusion: Should You Invest in Palantir Stock Before May 5th?

The analysis of Palantir stock before May 5th reveals both significant potential and considerable risks. The company's strong revenue growth and focus on data analytics are positive indicators, while its volatility, dependence on government contracts, and path to profitability remain significant concerns. The upcoming announcements before May 5th could significantly shift the market sentiment.

Before making your investment decision on Palantir stock before May 5th, consider consulting with a financial advisor and conducting your own thorough research. Weigh the potential benefits against the considerable risks, and consider your personal risk tolerance before committing your capital. The upcoming events before May 5th may significantly impact Palantir's stock price – don't miss the opportunity to analyze the situation further. Remember to diversify your portfolio and never invest more than you can afford to lose.

Featured Posts

-

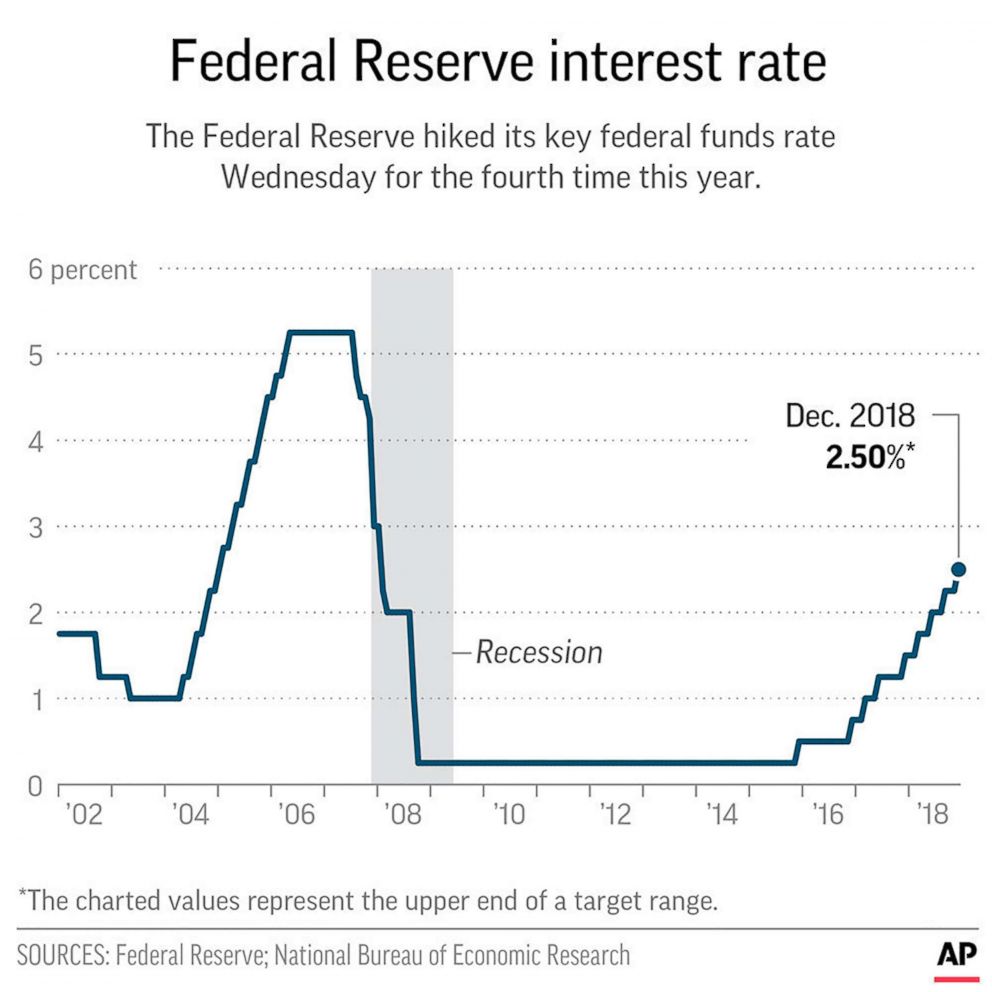

U S Federal Reserve Rate Decision And The Mounting Economic Challenges

May 10, 2025

U S Federal Reserve Rate Decision And The Mounting Economic Challenges

May 10, 2025 -

King Obrushilsya S Kritikoy Na Trampa I Maska

May 10, 2025

King Obrushilsya S Kritikoy Na Trampa I Maska

May 10, 2025 -

Police Misconduct Probe Launched Following Nottingham Attacks

May 10, 2025

Police Misconduct Probe Launched Following Nottingham Attacks

May 10, 2025 -

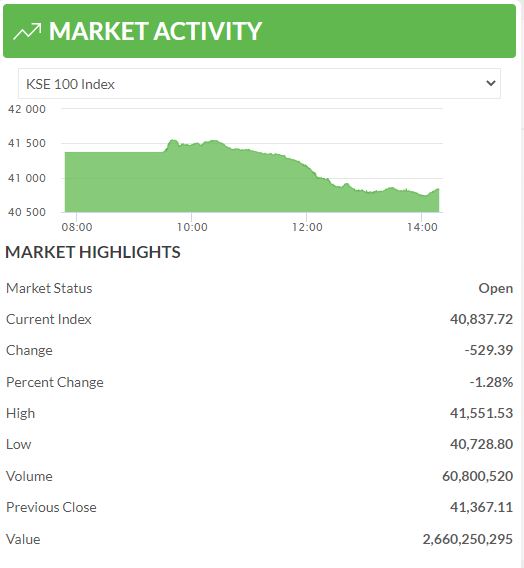

Operation Sindoor Pakistan Stock Market Plunges Kse 100 Halted

May 10, 2025

Operation Sindoor Pakistan Stock Market Plunges Kse 100 Halted

May 10, 2025 -

Concertation Sur Le Tramway A Dijon La Ligne 3 Au Coeur Des Debats

May 10, 2025

Concertation Sur Le Tramway A Dijon La Ligne 3 Au Coeur Des Debats

May 10, 2025