Pound Strengthens After UK Inflation Report, BOE Rate Cut Expectations Fade

Table of Contents

UK Inflation Report: Key Findings and Market Reaction

The recent UK inflation report revealed figures that significantly impacted market sentiment and the Pound Sterling's trajectory.

Lower-Than-Expected Inflation Figures

The reported inflation figures were lower than most market forecasts had predicted, sparking a wave of optimism.

- Consumer Price Index (CPI): The CPI, a key measure of inflation, came in at [Insert Actual CPI Figure]% for [Insert Month/Period], compared to the predicted [Insert Predicted CPI Figure]%.

- Retail Price Index (RPI): The RPI, another significant inflation metric, showed a similar trend, registering at [Insert Actual RPI Figure]% against a predicted [Insert Predicted RPI Figure]%.

- Significance of Deviation: This deviation from predictions is significant because it suggests that inflationary pressures in the UK might be easing more quickly than anticipated. The drop is largely attributed to falling energy prices and a moderation in the cost of goods.

- Contributing Factors: Easing energy prices, driven by decreased global demand and increased supply, played a major role in the lower-than-expected inflation. Other contributing factors might include [mention specific factors, e.g., supply chain improvements, changes in consumer spending].

Impact on BOE Monetary Policy Expectations

The unexpectedly low inflation figures significantly altered expectations surrounding the Bank of England's monetary policy.

- Shift in Market Sentiment: The market's previously held belief in an imminent rate cut was considerably weakened by this data. Traders had anticipated a more dovish approach from the BOE to combat stubbornly high inflation.

- Implications of a Less Dovish BOE: A less dovish stance by the BOE, meaning less inclination towards further interest rate cuts, is generally positive for the Pound. Investors view this as a sign of economic strength and stability.

- BOE Statements and Economist Opinions: [Insert any relevant statements from the BOE or expert opinions commenting on the report and its implications for interest rates]. These statements further solidified the market's shift in perspective.

Pound Sterling's Performance Against Major Currencies

The Pound Sterling's strength following the inflation report was evident in its performance against several key currencies.

GBP/USD Exchange Rate Movement

The GBP/USD exchange rate experienced a noticeable uptick following the inflation report's release.

- Specific Figures: The GBP/USD rate rose from approximately [Insert Previous Rate] to [Insert Post-Report Rate], demonstrating a [Insert Percentage Change]% increase in the Pound's value against the US dollar.

- Contributing Factors: This movement was primarily driven by the improved outlook for the UK economy suggested by the lower inflation figures, reducing the likelihood of further BOE rate cuts and boosting investor confidence in the GBP.

GBP Performance Against Other Currencies (EUR, JPY etc.)

The Pound's strengthening wasn't limited to the US dollar; it exhibited broader gains against other major currencies.

- Comparative Data: The GBP also appreciated against the Euro (EUR) [Insert Percentage Change]% and the Japanese Yen (JPY) [Insert Percentage Change]%, indicating a general strengthening of the Pound in the foreign exchange market.

- Regional Economic Factors: The relative strength of the GBP against other currencies can also be partially attributed to [mention any specific regional economic factors affecting those currencies].

Implications for the UK Economy

The strengthening Pound has significant implications for various aspects of the UK economy.

Impact on Imports and Exports

A stronger Pound directly affects the UK's trade balance.

- Impact on Imports: A stronger GBP makes imports cheaper for UK consumers and businesses, potentially leading to lower prices for goods and services.

- Impact on Exports: Conversely, a stronger Pound makes UK exports more expensive for international buyers, potentially impacting the competitiveness of UK businesses in the global market. This could lead to decreased export volumes.

Effect on Economic Growth and Investment

The positive economic news surrounding lower inflation and a stronger Pound can foster a more optimistic economic outlook.

- Increased Investor Confidence: The improved economic data is likely to boost investor confidence, potentially attracting greater foreign investment into the UK.

- Impact on Future Inflation and Interest Rates: While the current data suggests easing inflationary pressures, the BOE will continue to monitor economic indicators to make informed decisions about future interest rates. The strength of the Pound might influence these decisions.

Conclusion

In summary, the lower-than-expected UK inflation figures released in the recent report led to a reduced expectation of a Bank of England rate cut. This, in turn, resulted in a significant strengthening of the Pound Sterling against major global currencies. The implications for the UK economy are multifaceted, affecting imports, exports, investment, and the overall economic outlook. A stronger Pound can benefit consumers through lower import prices, but it could negatively impact UK businesses reliant on exports.

Call to Action: Stay informed on the latest developments affecting the Pound Sterling and UK economy by regularly checking reputable financial news sources for updates on UK inflation reports, BOE interest rate decisions, and GBP exchange rate movements. Understanding the factors that influence the Pound Sterling is crucial for investors and businesses operating in or with the UK. Monitor the GBP/USD and GBP/EUR exchange rates closely to make informed financial decisions.

Featured Posts

-

Addressing Investor Concerns Bof As Take On High Stock Market Valuations

May 24, 2025

Addressing Investor Concerns Bof As Take On High Stock Market Valuations

May 24, 2025 -

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 24, 2025

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 24, 2025 -

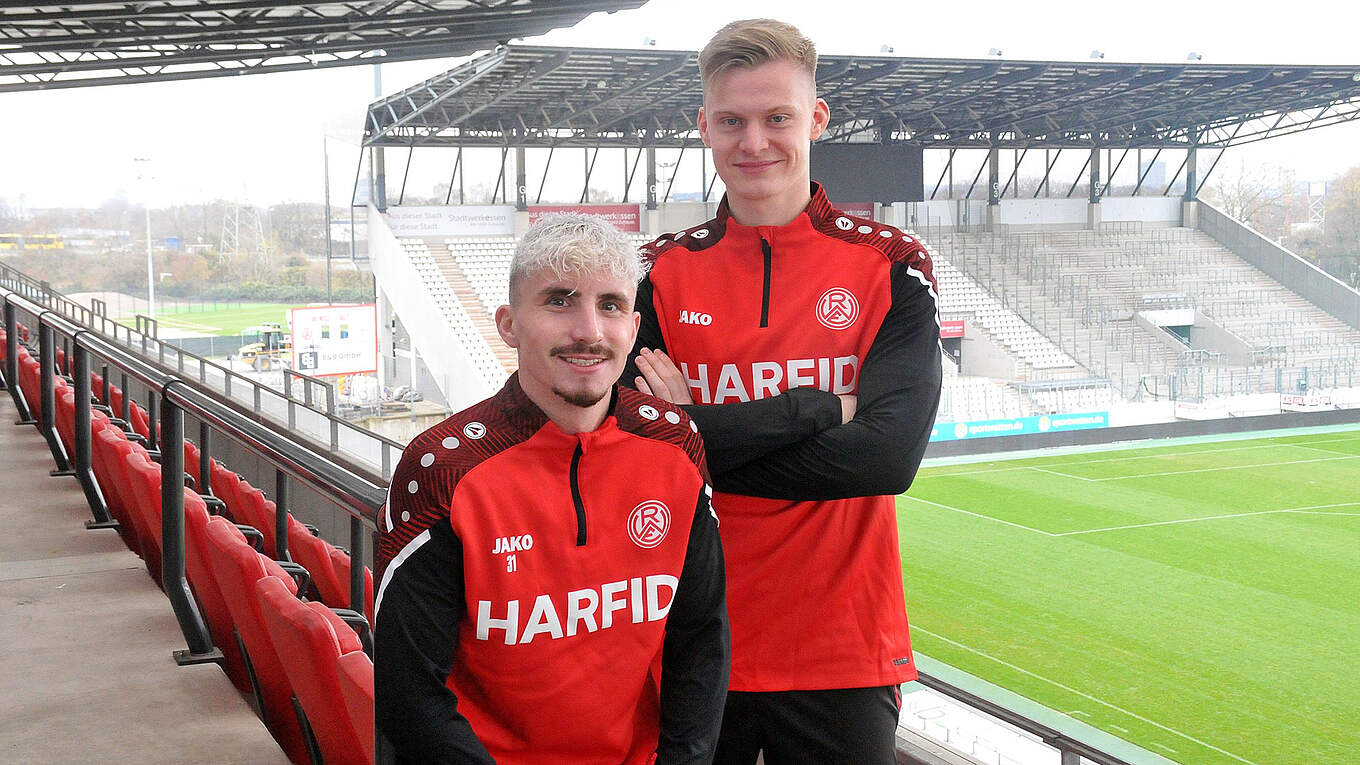

Golz Und Brumme Erfolgreiche Essener Leistungstraeger

May 24, 2025

Golz Und Brumme Erfolgreiche Essener Leistungstraeger

May 24, 2025 -

Memorial Day Weekend 2025 Flights Understanding Peak Travel Times

May 24, 2025

Memorial Day Weekend 2025 Flights Understanding Peak Travel Times

May 24, 2025 -

Could Jonathan Groffs Just In Time Performance Secure A Tony Award Triumph

May 24, 2025

Could Jonathan Groffs Just In Time Performance Secure A Tony Award Triumph

May 24, 2025