Recent Ethereum Liquidations: A $67 Million Warning Sign For Investors?

Table of Contents

Understanding Ethereum Liquidations

What are Liquidations in DeFi?

Liquidations in decentralized finance (DeFi) are a critical mechanism designed to protect lenders from borrowers who default on their loans. Within Ethereum's DeFi ecosystem, users often borrow crypto assets by providing collateral, typically other cryptocurrencies like ETH or stablecoins. This collateral acts as security for the loan. The system employs "liquidation thresholds," which represent a percentage drop in the collateral's value. If the collateral's value falls below this threshold, a "margin call" is triggered, and the system automatically liquidates the collateral to repay the loan.

- Definition: A liquidation is the forced sale of collateral to cover a defaulted loan in DeFi.

- Collateral Use: Collateral is deposited to secure a loan, acting as insurance for the lender.

- Liquidation Trigger: A price drop below the defined liquidation threshold initiates the liquidation process.

- Consequences for Borrowers: Borrowers lose their collateral and may face additional penalties.

Analyzing the $67 Million Ethereum Liquidation Event

The Scale and Significance of the Event

The recent $67 million Ethereum liquidation event, spanning several days in [Insert timeframe here], underscores the inherent risks within DeFi. This significant event impacted numerous DeFi lending platforms, causing a ripple effect across the market.

- Total Value: Approximately $67 million worth of assets were liquidated.

- Platforms Affected: [List the key platforms involved].

- Assets Affected: Primarily ETH, with likely involvement of stablecoins like USDC and USDT.

- Potential Causes: A combination of factors, including a sharp downturn in the Ethereum price and potentially cascading liquidations (where one liquidation triggers others), likely contributed to this event.

Potential Causes of Recent Ethereum Liquidations

Market Volatility and Price Swings

The crypto market is notorious for its volatility. Sharp price drops, even within a short timeframe, can easily trigger liquidations, especially for users employing high leverage.

- Volatility's Impact: Sudden price swings can push collateral values below liquidation thresholds.

- Leverage's Role: Using leverage magnifies both profits and losses, increasing the likelihood of liquidations during market downturns.

- Contributing Events: [Mention specific market events like a major sell-off or negative news impacting Ethereum that might have contributed.]

Implications for Ethereum Investors

Assessing the Risks of DeFi Lending and Borrowing

DeFi offers exciting opportunities, but it's essential to understand and manage the risks involved. Liquidations are a significant risk for borrowers.

- Understanding Liquidation Risks: Thoroughly research and understand liquidation mechanisms before engaging in DeFi lending or borrowing.

- Risk Mitigation Strategies: Employ strategies such as using lower leverage, diversifying collateral, and closely monitoring market conditions.

- Reputable Platforms: Prioritize using well-established and audited DeFi platforms to minimize smart contract risks.

Learning from the $67 Million Event: Future Considerations

The $67 million Ethereum liquidation event serves as a valuable lesson for the DeFi ecosystem.

- Improved Risk Management: Borrowers must adopt more sophisticated risk management techniques.

- Transparency: Increased transparency regarding platform vulnerabilities and liquidation processes is crucial.

- Regulation's Role: The role of regulation in mitigating future risks and ensuring greater stability within the DeFi landscape needs to be explored.

Conclusion

The $67 million Ethereum liquidation event serves as a stark reminder of the volatile nature of the cryptocurrency market and the inherent risks within the DeFi ecosystem. Understanding the mechanisms of Ethereum liquidations, assessing risk, and implementing effective risk management strategies are paramount for all investors involved in DeFi. To avoid becoming a statistic in future Ethereum liquidations, proactive risk management is essential. Learn more about managing risk in DeFi, explore diverse collateral strategies, and choose reputable platforms. Don't let unexpected Ethereum liquidations impact your portfolio negatively; take control and safeguard your investments.

Featured Posts

-

Where To Purchase A Ps 5 A Guide Before A Possible Price Rise

May 08, 2025

Where To Purchase A Ps 5 A Guide Before A Possible Price Rise

May 08, 2025 -

Stephen King Praises The Life Of Chuck Official Trailer Released

May 08, 2025

Stephen King Praises The Life Of Chuck Official Trailer Released

May 08, 2025 -

The Long Walk Stephen King Official Trailer Unveiled

May 08, 2025

The Long Walk Stephen King Official Trailer Unveiled

May 08, 2025 -

Analyzing Xrps Price Action Derivatives Market Implications

May 08, 2025

Analyzing Xrps Price Action Derivatives Market Implications

May 08, 2025 -

Inter Milan Stuns Barcelona Reaches Champions League Final

May 08, 2025

Inter Milan Stuns Barcelona Reaches Champions League Final

May 08, 2025

Latest Posts

-

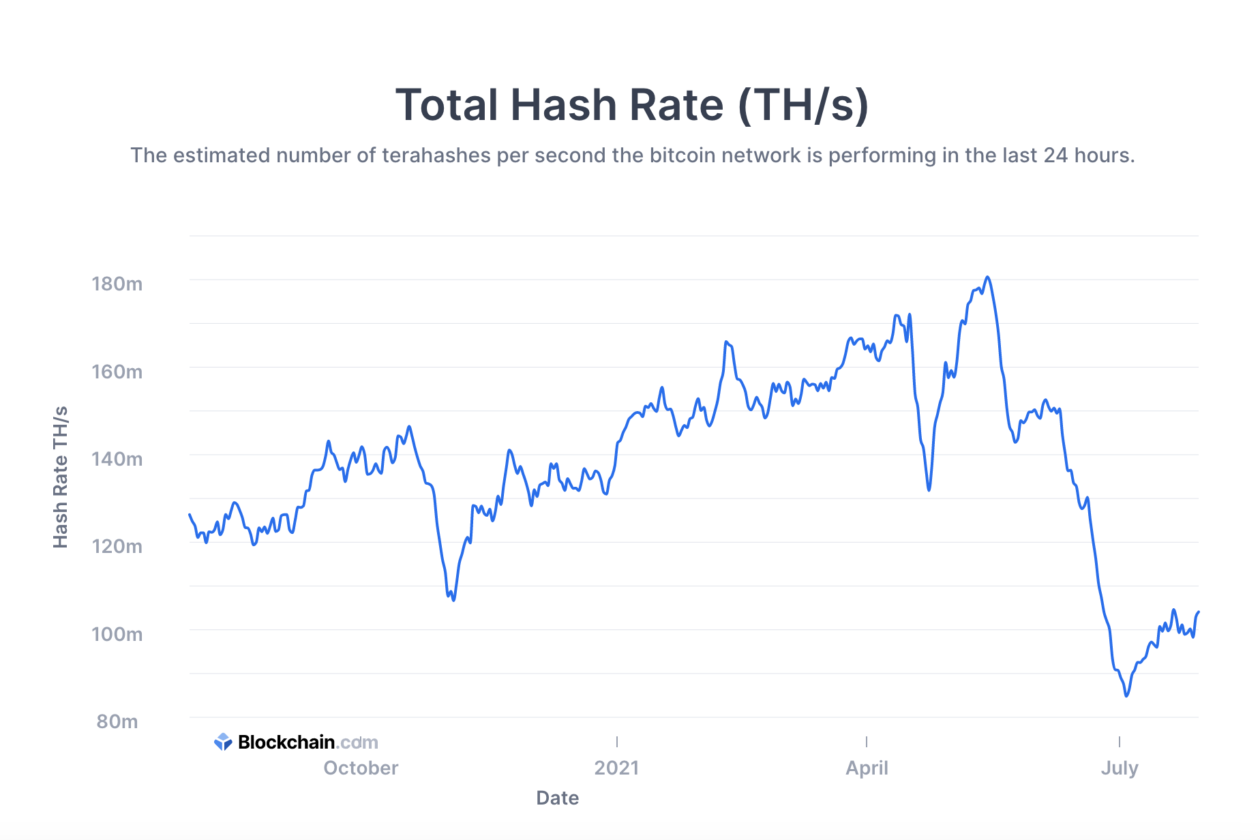

Understanding The Recent Spike In Bitcoin Mining Difficulty And Hashrate

May 08, 2025

Understanding The Recent Spike In Bitcoin Mining Difficulty And Hashrate

May 08, 2025 -

Analysis The Factors Contributing To This Weeks Bitcoin Mining Boom

May 08, 2025

Analysis The Factors Contributing To This Weeks Bitcoin Mining Boom

May 08, 2025 -

Why Did Bitcoin Mining Activity Skyrocket This Week

May 08, 2025

Why Did Bitcoin Mining Activity Skyrocket This Week

May 08, 2025 -

Bitcoin Miner Surge Understanding This Weeks Increase

May 08, 2025

Bitcoin Miner Surge Understanding This Weeks Increase

May 08, 2025 -

Recent Political Developments And The Xrp Price A Correlation Analysis

May 08, 2025

Recent Political Developments And The Xrp Price A Correlation Analysis

May 08, 2025