Reliance Shares Surge: Biggest Gain In 10 Months

Table of Contents

Reliance Industries Limited (RIL) stock experienced a phenomenal surge, marking its most significant single-day gain in ten months. This dramatic increase has captivated the Indian stock market, prompting investors to reassess their portfolios and analyze the factors behind this impressive rally. Let's delve into the specifics of this event and explore its potential implications.

The Magnitude of the Reliance Share Surge:

Reliance shares witnessed a staggering 15% increase, closing at ₹2,650 on October 26, 2023. This represents the highest single-day percentage gain in the last 10 months and significantly outperformed major market indices like the Nifty 50 and Sensex. Trading volume also soared, exceeding [insert actual number] shares, indicating intense investor interest and activity.

- Numerical Data: The share price jumped by ₹350, reaching an intraday high of ₹2,675.

- Comparison: This surge represents a 15% increase compared to the previous 10-month low of ₹2,300 on January 10, 2023.

- Market Cap Impact: This rally added approximately ₹2.5 trillion (approximately $30 billion USD) to Reliance's market capitalization, solidifying its position as one of India's most valuable companies.

Underlying Factors Driving the Reliance Share Price Increase:

Several interconnected factors contributed to this remarkable surge in Reliance share prices. Positive investor sentiment, robust financial performance, and favorable industry forecasts played a pivotal role.

- Strong Quarterly Earnings: Reliance's recent quarterly earnings report significantly surpassed analyst expectations, showcasing robust growth across its diverse business segments, including petrochemicals, refining, telecom (Jio), and retail.

- Successful New Ventures: The continued success of Jio's 5G rollout and the expansion of its digital services, coupled with the growth of Reliance Retail's omnichannel strategy, boosted investor confidence.

- Favorable Government Policies: Government initiatives promoting digital infrastructure and domestic manufacturing have created a conducive environment for Reliance's growth. Specific policies like the PLI scheme have directly benefited some of Reliance's ventures.

- Increased Foreign Investment: Increased foreign institutional investor (FII) interest, attracted by Reliance's strong fundamentals and growth prospects, contributed substantially to the share price increase.

Expert Opinions and Market Analysis on Future Reliance Share Performance:

Financial analysts offer diverse perspectives on the future trajectory of Reliance shares. While many maintain a bullish outlook, citing continued growth potential, others advocate caution, highlighting potential risks.

- Analyst Predictions: Leading analyst firm, [Insert Analyst Firm Name], forecasts a further price increase to ₹2,800 within the next quarter, citing strong earnings momentum. However, another firm, [Insert Another Analyst Firm Name], suggests potential short-term consolidation before further upside, noting global economic uncertainties.

- Potential Catalysts: Upcoming projects such as the expansion of Jio's 5G network and the further development of Reliance Retail's new business verticals could act as catalysts for future growth.

- Potential Headwinds: Global economic uncertainties, particularly regarding oil prices and inflation, and potential regulatory changes could pose headwinds.

- Technical Indicators: Technical analysis suggests a strong upward trend, with key indicators like the Relative Strength Index (RSI) showing buying momentum. However, investors should watch for potential resistance levels around ₹2,750.

How the Reliance Share Surge Impacts Investors:

The Reliance share surge presents both significant opportunities and potential challenges for investors. Existing shareholders are reaping substantial gains, while potential investors are carefully weighing the risks and rewards.

- Investment Strategies: Long-term investors with a high risk tolerance might consider holding onto their shares, anticipating further growth. Short-term investors might consider taking partial profits, ensuring they protect their gains.

- Risk Management: Investors should always maintain a well-diversified portfolio, aligning their investments with their individual risk profiles and investment goals.

- Investment Opportunities: This surge presents an attractive entry point for investors who believe in Reliance's long-term growth potential. However, thorough research and due diligence are crucial before making any investment decisions.

Capitalizing on the Reliance Shares Surge – What's Next?

The remarkable surge in Reliance shares underscores the positive investor sentiment, robust financial performance, and promising future outlook for the company. While market volatility remains a factor, understanding the key drivers behind this rally is crucial for investors. Further in-depth research and analysis are essential before making any investment decisions. Remember to conduct thorough due diligence and consider seeking professional financial advice before investing in Reliance shares or any other security. Stay informed about Reliance Industries' performance and market trends to make informed decisions regarding your investment strategy.

Featured Posts

-

Whats Working For Tylor Megill A Deep Dive Into His Mets Performance

Apr 29, 2025

Whats Working For Tylor Megill A Deep Dive Into His Mets Performance

Apr 29, 2025 -

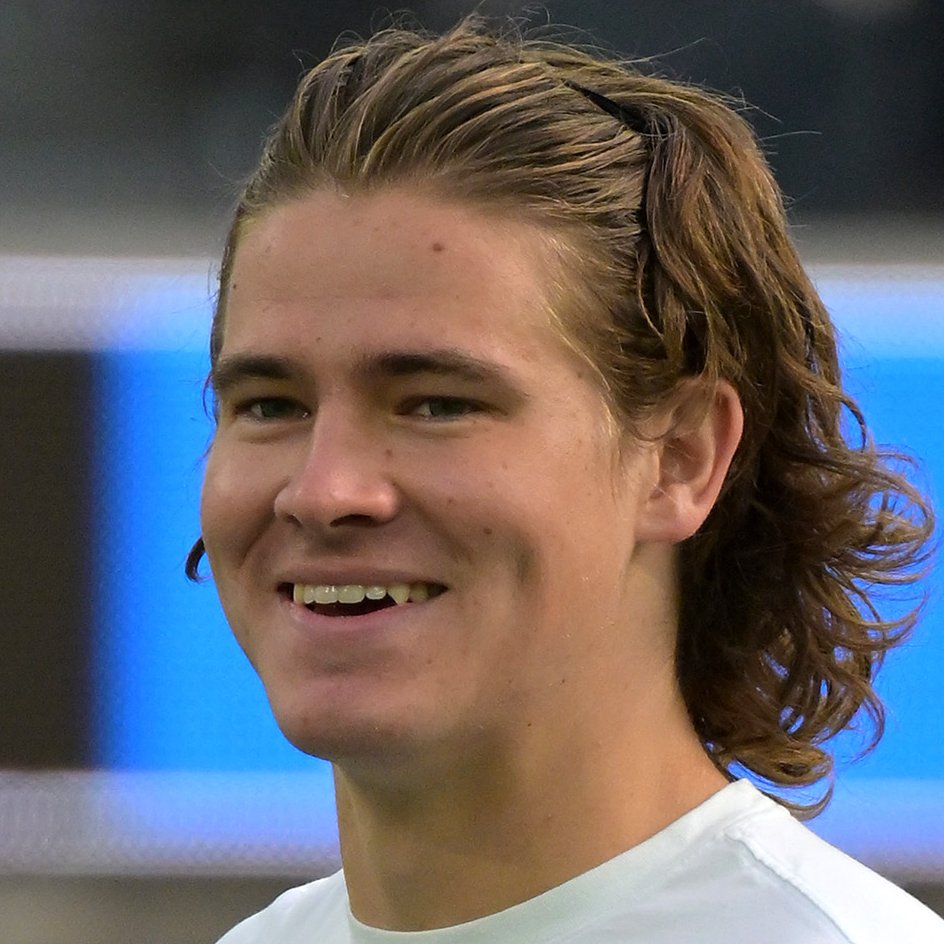

Justin Herbert Chargers 2025 Season Opener In Brazil Confirmed

Apr 29, 2025

Justin Herbert Chargers 2025 Season Opener In Brazil Confirmed

Apr 29, 2025 -

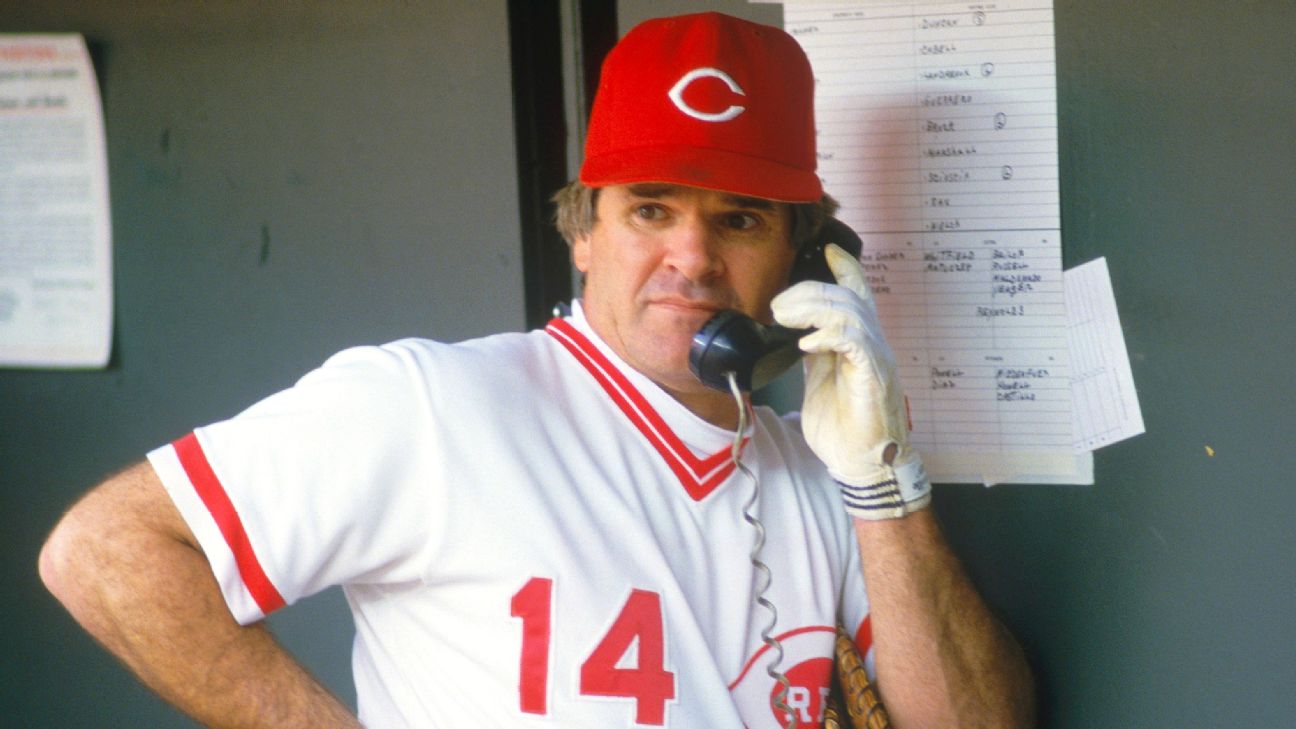

Pete Rose Pardon Trumps Pledge After Baseball Legends Passing

Apr 29, 2025

Pete Rose Pardon Trumps Pledge After Baseball Legends Passing

Apr 29, 2025 -

Justin Herbert Leads Chargers To Brazil For 2025 Season Opener

Apr 29, 2025

Justin Herbert Leads Chargers To Brazil For 2025 Season Opener

Apr 29, 2025 -

Papal Conclave Debate Over Convicted Cardinals Voting Eligibility

Apr 29, 2025

Papal Conclave Debate Over Convicted Cardinals Voting Eligibility

Apr 29, 2025

Latest Posts

-

Conferinta Pw C Romania Schimbari Majore In Taxare In 2025

Apr 29, 2025

Conferinta Pw C Romania Schimbari Majore In Taxare In 2025

Apr 29, 2025 -

Modificari Fiscale 2025 Ce Ne Rezerva Noul An

Apr 29, 2025

Modificari Fiscale 2025 Ce Ne Rezerva Noul An

Apr 29, 2025 -

Analysis Of Pw Cs Departure From Nine African Countries

Apr 29, 2025

Analysis Of Pw Cs Departure From Nine African Countries

Apr 29, 2025 -

Pw Cs Strategic Shift Leaving Nine African Nations

Apr 29, 2025

Pw Cs Strategic Shift Leaving Nine African Nations

Apr 29, 2025 -

The Implications Of Pw Cs Exit From Nine African Countries

Apr 29, 2025

The Implications Of Pw Cs Exit From Nine African Countries

Apr 29, 2025