Sensex And Nifty 50 Surge: Understanding The 1,400 And 23,800 Point Rise

Table of Contents

Global Factors Fueling the Sensex and Nifty 50 Rally

Several global factors played a pivotal role in propelling the Sensex and Nifty 50 to record highs. These external influences significantly impacted investor confidence and fueled the market rally.

Positive Global Economic Indicators

Positive global economic news created a ripple effect, influencing the Indian market positively.

- Easing US Inflation: The easing of inflation in the United States, as evidenced by the Consumer Price Index (CPI) reports, instilled greater confidence in global markets. This reduced the pressure on the Federal Reserve to aggressively raise interest rates, easing concerns about a potential global recession.

- Improved Global Growth Forecasts: Several international organizations, including the IMF and World Bank, revised their global growth forecasts upward, signaling a more optimistic outlook for the world economy. This positive sentiment spilled over into emerging markets like India.

- Strengthening US Dollar: While a strong dollar can sometimes negatively impact emerging markets, in this instance, it seemed to have a limited impact, as the overall positive global sentiment outweighed this factor. The positive performance of other major global indices like the Dow Jones and NASDAQ also contributed to investor confidence.

These indicators collectively boosted investor sentiment, leading to increased foreign investment flows into the Indian market.

Foreign Institutional Investor (FII) Investments

Foreign Institutional Investors (FIIs) played a crucial role in driving the market upwards. Their increased investments injected substantial liquidity into the market.

- Significant FII Inflows: Data revealed a substantial surge in FII investments in the Indian stock market during this period. Billions of dollars flowed into various sectors, fueling the upward trend.

- Attractive Sectors: Sectors such as Information Technology (IT), Pharmaceuticals, and Financials attracted significant FII interest, driven by strong fundamentals and growth prospects.

- Increased Confidence in Indian Economy: The increased FII interest reflects a growing confidence in the long-term growth potential of the Indian economy and its resilience to global headwinds.

Domestic Factors Contributing to the Sensex and Nifty 50 Surge

In addition to global factors, several domestic developments contributed significantly to the Sensex and Nifty 50 surge.

Positive Corporate Earnings

Strong corporate earnings for Q[Quarter number] from major companies listed on the Sensex and Nifty 50 boosted investor confidence and fueled the market rally.

- Strong Performance Across Sectors: Companies across various sectors, including IT, FMCG, and Banking, reported robust earnings, surpassing market expectations.

- Examples of High-Performing Companies: [Insert examples of specific companies with strong earnings reports]. Their impressive results showcased the underlying strength of the Indian corporate sector.

- Increased Investor Confidence: These positive earnings reports served as a powerful catalyst, reinforcing investor confidence and attracting further investment.

Government Policies and Initiatives

Supportive government policies and initiatives also contributed significantly to the positive market sentiment.

- Infrastructure Spending: Increased government spending on infrastructure projects boosted investor confidence in the long-term growth prospects of the economy.

- Tax Reforms: Specific tax reforms aimed at simplifying the tax system and boosting investment further enhanced market sentiment.

- Focus on Ease of Doing Business: Government initiatives to improve the ease of doing business in India attracted both domestic and foreign investment.

Falling Inflation

Easing inflation played a vital role in improving investor confidence and market performance.

- Lower Inflation Rates: A decline in inflation rates provided a favorable environment for investment, as it reduced uncertainty and boosted consumer spending.

- Positive Impact on Interest Rates: Lower inflation typically leads to lower interest rates, making borrowing cheaper for businesses and consumers, stimulating economic activity.

- Improved Purchasing Power: Falling inflation enhanced the purchasing power of consumers, leading to increased demand and boosting overall economic growth.

Sector-Specific Performance: Identifying Top Performers

The Sensex and Nifty 50 rise wasn't uniform across all sectors. Certain sectors significantly outperformed others, contributing disproportionately to the overall market surge.

- Top Performing Sectors: [Insert data and examples of top-performing sectors, e.g., IT, Pharma, Financials]. These sectors benefitted from strong domestic and global demand.

- Reasons for Strong Performance: The reasons behind the strong performance of these sectors varied, ranging from favorable regulatory changes to increased global demand.

- Potential for Continued Growth: While the future is inherently uncertain, several of these sectors show considerable promise for continued growth in the coming quarters.

Conclusion: Navigating the Sensex and Nifty 50's upward trajectory

The significant rise in the Sensex and Nifty 50 indices is attributable to a confluence of global and domestic factors, including positive global economic indicators, substantial FII investments, strong corporate earnings, supportive government policies, and falling inflation. This surge has positive implications for the Indian economy, indicating robust growth and investor confidence. However, it's crucial to maintain a cautious outlook, acknowledging the inherent volatility of the stock market. While this upward trend is promising, investors should always be aware of potential risks and market fluctuations. Before making any investment decisions related to the Sensex and Nifty 50, it is highly recommended to consult with a qualified financial advisor for personalized guidance and a thorough understanding of your risk tolerance. Learn more about investing in the Indian stock market and stay updated on Sensex and Nifty 50 performance through reliable financial news sources. Understanding the nuances of Sensex and Nifty 50 movements is key to informed investment decisions.

Featured Posts

-

Epstein Records Concealment Allegation Senate Democrats Target Pam Bondi

May 09, 2025

Epstein Records Concealment Allegation Senate Democrats Target Pam Bondi

May 09, 2025 -

Family Support For Dakota Johnson At Materialist Film Screening

May 09, 2025

Family Support For Dakota Johnson At Materialist Film Screening

May 09, 2025 -

Nyt Strands Game 402 Hints And Solutions For April 9th

May 09, 2025

Nyt Strands Game 402 Hints And Solutions For April 9th

May 09, 2025 -

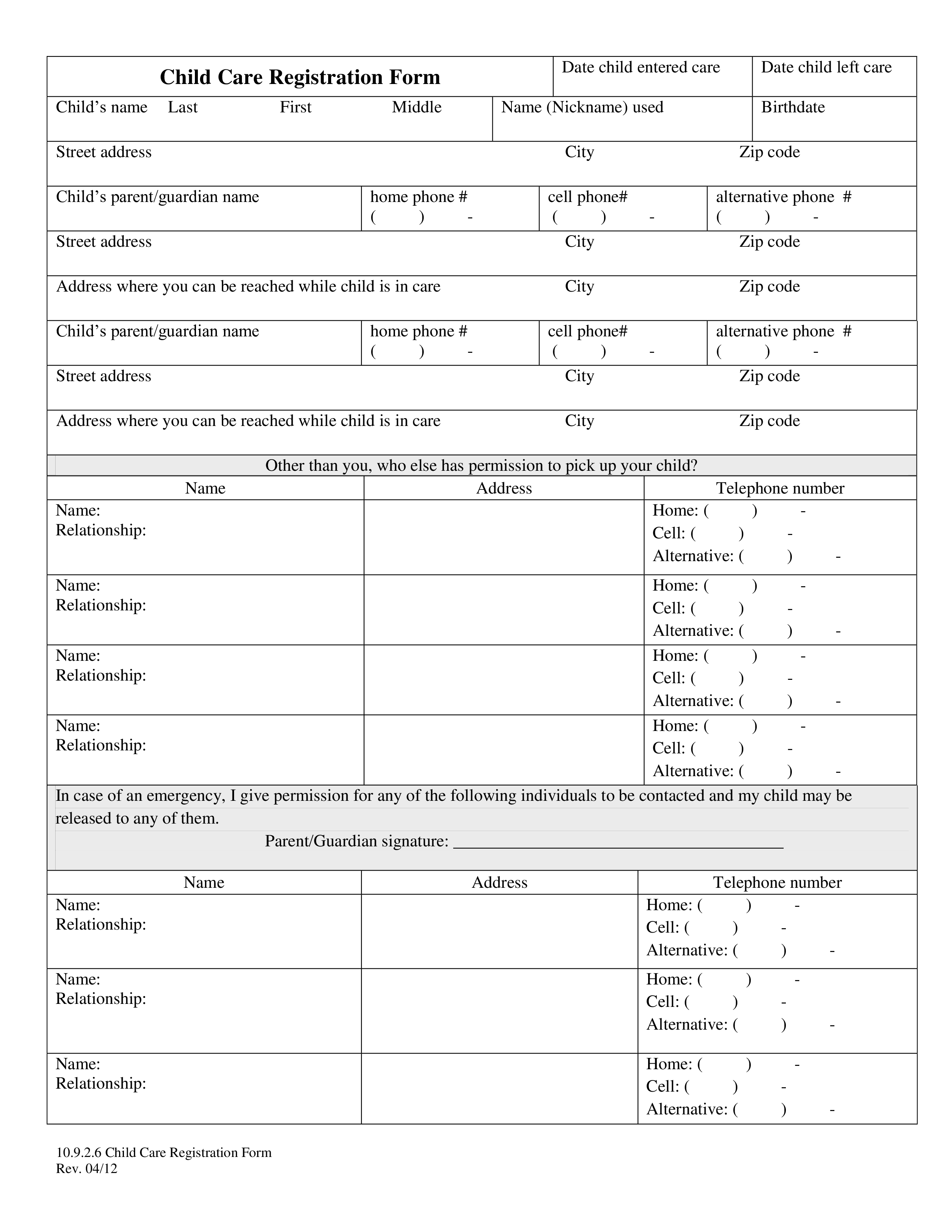

The High Cost Of Childcare A Mans Experience With Babysitting And Daycare

May 09, 2025

The High Cost Of Childcare A Mans Experience With Babysitting And Daycare

May 09, 2025 -

Hkayt Altdkhyn Byn Njwm Krt Alqdm Mn Almady Ila Alhadr

May 09, 2025

Hkayt Altdkhyn Byn Njwm Krt Alqdm Mn Almady Ila Alhadr

May 09, 2025

Latest Posts

-

Indian Insurers Plea For Streamlined Bond Forward Rules

May 10, 2025

Indian Insurers Plea For Streamlined Bond Forward Rules

May 10, 2025 -

Regulatory Changes Urged Indian Insurers And Bond Forward Trading

May 10, 2025

Regulatory Changes Urged Indian Insurers And Bond Forward Trading

May 10, 2025 -

New Rules Sought Indian Insurers Target Bond Forward Market

May 10, 2025

New Rules Sought Indian Insurers Target Bond Forward Market

May 10, 2025 -

Indian Insurers Advocate For Simplified Bond Forward Regulations

May 10, 2025

Indian Insurers Advocate For Simplified Bond Forward Regulations

May 10, 2025 -

Bof As Reassurance Are Stretched Stock Market Valuations A Cause For Concern

May 10, 2025

Bof As Reassurance Are Stretched Stock Market Valuations A Cause For Concern

May 10, 2025