Should You Refinance Federal Student Loans With A Private Lender?

Table of Contents

Understanding the Differences Between Federal and Private Student Loans

Before deciding whether to refinance, it's crucial to understand the key distinctions between federal and private student loans.

Benefits of Federal Student Loans

Federal student loans offer several significant advantages:

- Government Protections: These loans come with crucial borrower protections, including income-driven repayment plans (IDR), which adjust your monthly payments based on your income and family size. They also offer deferment and forbearance options, allowing temporary pauses in payments during financial hardship.

- Loan Forgiveness Programs: Certain federal student loan programs, like Public Service Loan Forgiveness (PSLF), may offer complete loan forgiveness after 10 years of qualifying payments in public service. This is a significant benefit often lost upon refinancing.

- Fixed Interest Rates: Federal student loans typically offer fixed interest rates, providing predictability and stability in your monthly payments. These rates are often lower than those offered by private lenders.

Benefits of Private Student Loans (After Refinancing)

Refinancing your federal student loans with a private lender might offer some advantages:

- Potentially Lower Interest Rates: If you have a strong credit score and qualify for a favorable interest rate, refinancing could result in lower monthly payments and less interest paid over the life of the loan.

- Simplified Repayment: Consolidating multiple federal loans into a single private loan simplifies repayment, reducing administrative hassle with just one monthly payment.

- Shorter Repayment Terms: A shorter repayment term can lead to significant savings on interest over the life of the loan, although this increases your monthly payment.

Drawbacks of Refinancing Federal Student Loans

While refinancing can be appealing, it's vital to acknowledge the potential downsides:

- Loss of Federal Student Loan Benefits: The most significant drawback is the loss of federal protections and benefits, including IDR plans, deferment, forbearance, and loan forgiveness programs like PSLF. Once you refinance, you forfeit these valuable options.

- Higher Interest Rates (in some cases): While refinancing can lower your interest rate, it's not guaranteed. Borrowers with poor credit scores may find themselves with higher interest rates than their existing federal loans.

- Riskier for Borrowers with Poor Credit: Individuals with less-than-stellar credit scores may face difficulties securing approval for refinancing or may receive less favorable terms.

Factors to Consider Before Refinancing

Several crucial factors must be carefully weighed before deciding to refinance your federal student loans.

Your Credit Score and History

Your creditworthiness significantly impacts your eligibility for refinancing and the interest rate you'll receive. A higher credit score typically translates to lower interest rates and better loan terms. Check your credit report before applying to understand your standing.

Current Interest Rates on Your Federal Loans

Carefully compare the interest rates on your current federal student loans to those offered by private lenders. Only refinance if you can secure a significantly lower interest rate that offsets the loss of federal benefits.

Your Financial Situation and Repayment Plan

Thoroughly assess your current income, expenses, and financial goals. Consider your long-term financial implications. Will a shorter repayment term with higher monthly payments be manageable? Can you afford potential higher payments if rates increase?

The Potential for Loan Forgiveness

If you qualify for or anticipate qualifying for a federal loan forgiveness program, such as PSLF, refinancing will eliminate this possibility. This loss could cost you tens of thousands of dollars over the life of the loan.

Fees and Other Charges

Be aware of all associated fees, including origination fees, prepayment penalties, and any other charges. These fees can impact the overall cost of refinancing and should be factored into your decision.

Alternatives to Refinancing Federal Student Loans

Before jumping into refinancing, explore alternative options for managing your federal student loans:

Income-Driven Repayment Plans (IDRs)

IDRs adjust your monthly payments based on your income and family size, making them more manageable during periods of financial hardship.

Deferment and Forbearance

These options provide temporary pauses in your loan repayments, offering short-term relief during financial difficulty. However, interest may still accrue during these periods.

Consolidation

Consolidating multiple federal loans into a single federal loan simplifies repayment and might offer a lower fixed interest rate. This is a good option before considering private refinancing.

Conclusion

Deciding whether to refinance federal student loans with a private lender requires a thorough evaluation of your individual circumstances. Key factors include your credit score, the interest rates offered by private lenders, the potential loss of federal loan forgiveness programs, and any associated fees. Refinancing is not always the best option and should be carefully considered. Carefully weigh the pros and cons before making a decision. Research different private lenders, compare their offerings, and consult with a financial advisor to determine if refinancing your federal student loans is the right choice for your specific financial situation.

Featured Posts

-

Canada China Trade Relations Ambassadors Remarks On Formal Trade Deal

May 17, 2025

Canada China Trade Relations Ambassadors Remarks On Formal Trade Deal

May 17, 2025 -

Best Online Casinos New Zealand Expert Reviews And Ratings

May 17, 2025

Best Online Casinos New Zealand Expert Reviews And Ratings

May 17, 2025 -

Mhrjan Aljzayr Alsynmayy Yukrm Almkhrj Allyby Sbry Abwshealt

May 17, 2025

Mhrjan Aljzayr Alsynmayy Yukrm Almkhrj Allyby Sbry Abwshealt

May 17, 2025 -

Trumps 30 Tariffs On China An Extended Forecast Through 2025

May 17, 2025

Trumps 30 Tariffs On China An Extended Forecast Through 2025

May 17, 2025 -

Live Stream Seattle Mariners Vs Chicago Cubs Spring Training Game Today Free

May 17, 2025

Live Stream Seattle Mariners Vs Chicago Cubs Spring Training Game Today Free

May 17, 2025

Latest Posts

-

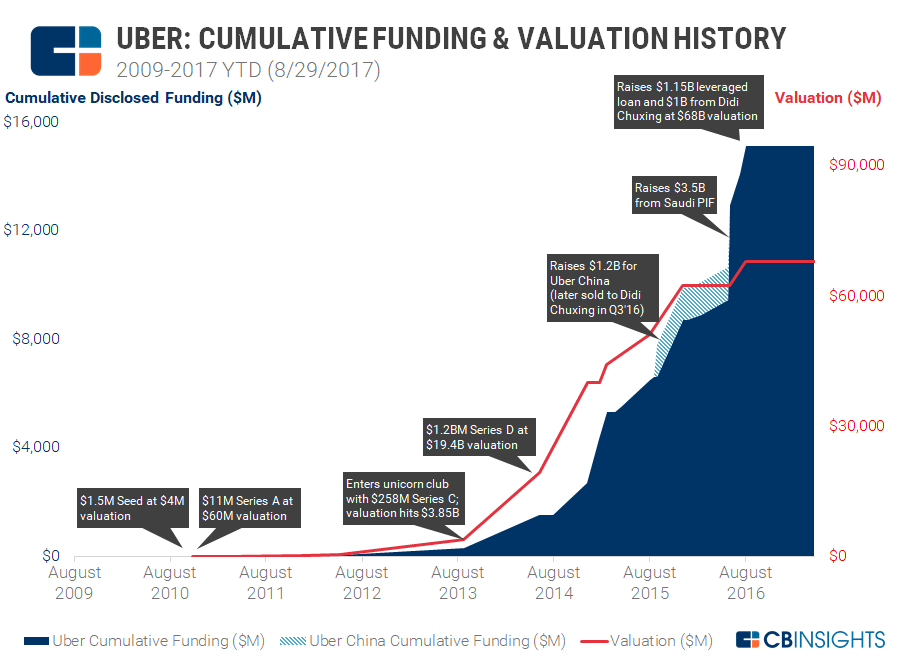

The Promise Of Driverless Cars Exploring Uber And Related Etfs

May 17, 2025

The Promise Of Driverless Cars Exploring Uber And Related Etfs

May 17, 2025 -

Uber Stock Recession Proof Analyst Insights

May 17, 2025

Uber Stock Recession Proof Analyst Insights

May 17, 2025 -

Investing In Ubers Autonomous Driving Tech Through Etfs

May 17, 2025

Investing In Ubers Autonomous Driving Tech Through Etfs

May 17, 2025 -

Etfs And The Autonomous Vehicle Revolution Is Uber The Key

May 17, 2025

Etfs And The Autonomous Vehicle Revolution Is Uber The Key

May 17, 2025 -

Ubers Self Driving Technology A Look At Potential Etf Investments

May 17, 2025

Ubers Self Driving Technology A Look At Potential Etf Investments

May 17, 2025