Should You Refinance Your Federal Student Loans?

Table of Contents

Understanding Federal Student Loan Refinancing

Refinancing federal student loans means replacing your existing federal loans with a new private loan from a lender. This process essentially consolidates your multiple federal loans into a single private loan, often with potentially more favorable terms.

- Replacing your existing federal loans with a new private loan: This simplifies your repayment process into one monthly payment instead of several.

- Potential for lower interest rates and monthly payments: A lower interest rate translates to substantial savings over the life of the loan.

- Loss of federal student loan benefits: This is a crucial point and will be discussed in detail later. Federal benefits are often lost when refinancing.

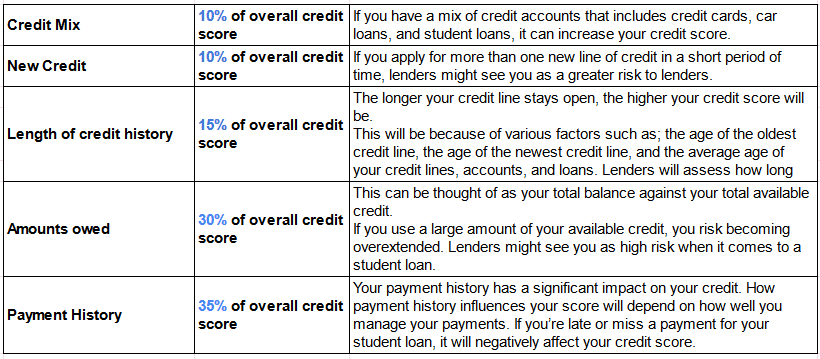

- Impact on credit score: A successful refinancing application can improve your credit score, but a poor credit score will likely lead to higher interest rates or even rejection.

Advantages of Refinancing Federal Student Loans

Refinancing can offer significant advantages, particularly for borrowers with good credit and stable finances.

- Lower interest rates resulting in significant savings over the loan term: For example, refinancing a $50,000 loan from 7% to 5% interest could save you thousands of dollars over the repayment period. The exact savings depend on your loan amount, interest rate reduction, and loan term.

- Reduced monthly payments, making budgeting easier: A lower interest rate often translates to smaller monthly payments, making your budget more manageable. For instance, a lower interest rate could decrease your monthly payment by hundreds of dollars, freeing up cash flow for other financial goals.

- Shorter repayment terms leading to faster debt elimination: Refinancing can allow you to pay off your debt faster by choosing a shorter repayment term, even though your monthly payments might be slightly higher. This will reduce the total interest paid over the life of the loan.

- Simplified repayment with a single loan servicer: Instead of juggling multiple loan servicers and payment deadlines, you'll have a single point of contact for all your repayment needs.

Disadvantages of Refinancing Federal Student Loans

While refinancing offers potential benefits, it's essential to understand the drawbacks.

- Loss of federal student loan benefits: This is a major consideration. By refinancing, you lose access to crucial federal programs like:

- Income-driven repayment plans: These plans adjust your monthly payment based on your income and family size.

- Deferment and forbearance: These options allow temporary pauses in your payments during financial hardship.

- Loan forgiveness programs: Some federal programs offer partial or complete loan forgiveness after a certain period of public service or under specific circumstances. These are typically unavailable with private loans.

- Higher interest rates for borrowers with poor credit: If your credit score is low, you may not qualify for a lower interest rate, potentially negating any benefit of refinancing.

- Potential penalties for early repayment: Some private lenders impose penalties if you repay your loan early.

- Increased risk of default if unable to maintain payments: Missing payments can severely damage your credit score and lead to legal action.

Who Should Refinance Federal Student Loans?

Refinancing federal student loans isn't for everyone. Ideal candidates typically possess the following characteristics:

- Borrowers with good or excellent credit scores: Lenders generally offer the most favorable interest rates to borrowers with a strong credit history.

- Those who qualify for significantly lower interest rates: The interest rate reduction must be substantial enough to outweigh the loss of federal benefits.

- Individuals with a stable income and secure employment: A steady income ensures you can consistently meet your repayment obligations.

- Borrowers who don't need federal loan benefits (e.g., loan forgiveness programs): If you are not eligible for or do not need federal loan forgiveness programs, refinancing might be a suitable option.

How to Refinance Your Federal Student Loans

Refinancing involves several steps:

- Research and compare lenders: Use reputable online resources and comparison tools to find lenders offering competitive interest rates and terms. Consider checking reviews and comparing offers from multiple lenders.

- Check your credit score and improve it if needed: A higher credit score can significantly improve your chances of securing a favorable interest rate.

- Gather necessary documents: This typically includes income verification, employment history, and details about your existing federal student loans.

- Apply for refinancing and choose the best option: Carefully review the terms and conditions of each offer before making a decision.

- Understand the terms and conditions carefully before signing: Ensure you fully understand the interest rate, repayment terms, fees, and any penalties before committing to a loan.

Conclusion

Refinancing federal student loans can be a beneficial strategy for some borrowers, offering potential savings on interest and monthly payments. However, it’s crucial to carefully weigh the advantages against the loss of valuable federal student loan benefits. Consider your credit score, income stability, and long-term financial goals before making a decision.

Call to Action: Before you refinance your federal student loans, thoroughly research your options and understand the implications. Use this guide to help you make an informed choice about whether refinancing is the right step for your financial future. Remember to carefully compare different lenders and their offerings before making a decision on federal student loan refinancing.

Featured Posts

-

Recovering Your Credit Score After Student Loan Defaults

May 17, 2025

Recovering Your Credit Score After Student Loan Defaults

May 17, 2025 -

Private Lender Refinancing A Guide To Federal Student Loans

May 17, 2025

Private Lender Refinancing A Guide To Federal Student Loans

May 17, 2025 -

Giants Vs Mariners Injury Report April 4 6 Series

May 17, 2025

Giants Vs Mariners Injury Report April 4 6 Series

May 17, 2025 -

Fortnite Icon Skin A Closer Look At The New Collaboration

May 17, 2025

Fortnite Icon Skin A Closer Look At The New Collaboration

May 17, 2025 -

13 Injured After Car Plows Into Crowd Outside Barcelona Football Match

May 17, 2025

13 Injured After Car Plows Into Crowd Outside Barcelona Football Match

May 17, 2025

Latest Posts

-

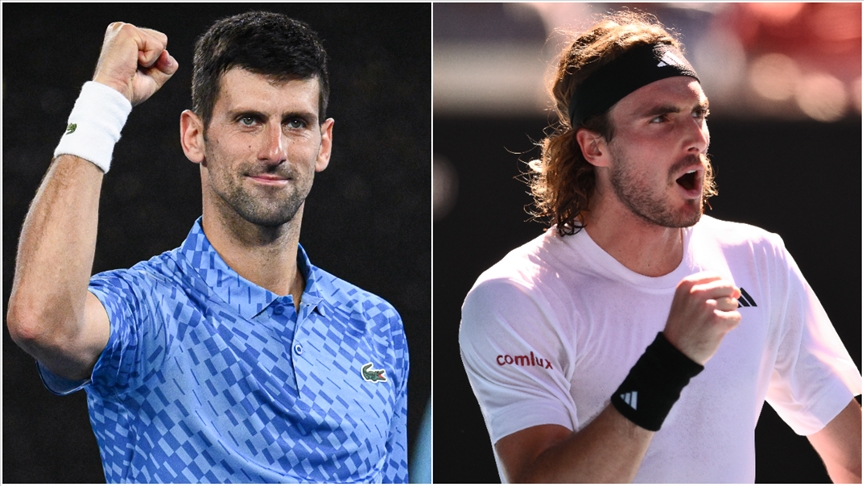

Djokovic Miami Acik Ta Finale Cikti Bueyuek Final Maci Bekleniyor

May 17, 2025

Djokovic Miami Acik Ta Finale Cikti Bueyuek Final Maci Bekleniyor

May 17, 2025 -

Miami Acik Djokovic Finale Yuekseldi

May 17, 2025

Miami Acik Djokovic Finale Yuekseldi

May 17, 2025 -

Djokovic Miami Acik Finalini Kapti

May 17, 2025

Djokovic Miami Acik Finalini Kapti

May 17, 2025 -

Novak Djokovic Miami Acik Finaline Yuekseldi Rakipleri Ve Yolculugu

May 17, 2025

Novak Djokovic Miami Acik Finaline Yuekseldi Rakipleri Ve Yolculugu

May 17, 2025 -

Novak Djokovic Miami Acik Ta Finalde

May 17, 2025

Novak Djokovic Miami Acik Ta Finalde

May 17, 2025