Recovering Your Credit Score After Student Loan Defaults

Table of Contents

Understanding the Impact of Student Loan Defaults on Your Credit

A student loan default has far-reaching consequences that extend beyond just a lowered credit score. It significantly impacts your financial well-being and future opportunities.

The Severity of the Damage:

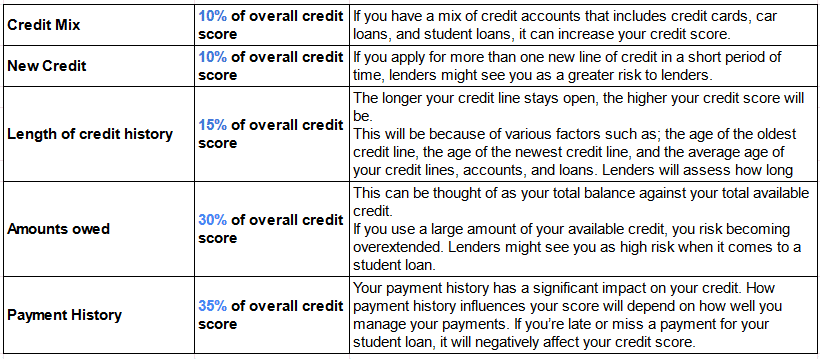

Defaulting on your student loans results in a considerable drop in your credit score, impacting your FICO score and other credit scoring models. This negative mark remains on your credit report for seven years, hindering your ability to access credit during that time.

- Default reported to credit bureaus: Equifax, Experian, and TransUnion will all record the default, negatively affecting your credit profile.

- Significant drop in credit score: Expect a substantial decrease, making it harder to qualify for favorable interest rates on future loans.

- Difficulty obtaining future loans: Securing mortgages, auto loans, and even personal loans becomes significantly more challenging, or even impossible.

- Potential wage garnishment or tax refund offset: The government may garnish your wages or intercept your tax refund to recover the defaulted loan amount.

The negative impact of default on your credit report and credit score is substantial, but understanding the severity is the first step towards addressing the issue and starting your credit score recovery.

Exploring Your Options for Repaying Your Defaulted Student Loans

Repaying your defaulted student loans is crucial to repairing your credit. The Department of Education offers several programs designed to help borrowers overcome defaults.

Student Loan Rehabilitation:

Student loan rehabilitation is a program that allows you to remove the default from your credit report. This is a critical step in credit repair after a student loan default.

- Contact your loan servicer: Reach out to the Department of Education or your private lender to initiate the rehabilitation process.

- Agree to a rehabilitation agreement: You'll agree to a repayment plan, usually involving making nine on-time payments within 20 days of the due date.

- Make nine on-time payments: Consistent and timely payments are essential for successful rehabilitation.

- Removal of the default from your credit report: Once you complete the nine payments, the default is removed from your credit report, providing a significant boost to your credit score. This positive action signals to lenders your commitment to responsible financial management.

Rehabilitation offers a strong path towards credit repair by removing that significant negative mark from your credit history.

Alternative Repayment Plans for Defaulted Student Loans

Beyond rehabilitation, several other repayment options can help manage your defaulted student loans and eventually improve your credit score.

Income-Driven Repayment (IDR) Plans:

IDR plans tie your monthly payments to your income and family size. These include IBR (Income-Based Repayment), PAYE (Pay As You Earn), REPAYE (Revised Pay As You Earn), and ICR (Income-Contingent Repayment). While they don't immediately remove the default, consistent payments under an IDR plan can improve your credit health over time.

Consolidation and other options:

Student loan consolidation combines multiple federal student loans into one, simplifying payments and potentially lowering your monthly payments. However, note that consolidation doesn't remove the default; it simply streamlines the repayment process.

- Income-Driven Repayment (IDR) plans: These plans offer more manageable monthly payments, making it easier to stay current.

- Loan consolidation: Simplifying your payments can lead to better payment adherence and, subsequently, credit score improvement.

- Forbearance and Deferment: These options temporarily suspend payments but don't improve your credit and may negatively impact your credit report. They should only be considered short-term solutions.

Choosing the right repayment plan depends on your individual financial situation. Carefully consider your options and their potential impact on your credit.

Strategies for Rebuilding Your Credit After a Student Loan Default

Even after addressing the default, rebuilding your credit takes time and effort. Consistent positive actions are essential for a successful credit score recovery.

Monitoring Your Credit Report:

Regularly checking your credit report is crucial. You can obtain a free credit report annually from annualcreditreport.com. Monitor for accuracy and dispute any errors immediately.

Building Positive Credit History:

After resolving your default, proactively work on building positive credit history. This involves responsible financial habits that demonstrate creditworthiness.

- Regularly check credit reports for errors: Accuracy is key; disputes can significantly impact your credit score.

- Dispute any inaccurate information with credit bureaus: Don't hesitate to correct any mistakes on your report.

- Open a secured credit card: This requires a security deposit, reducing the lender’s risk and helping you build credit responsibly.

- Become an authorized user on a credit card with a good payment history: This can positively impact your credit score, but only if the primary cardholder maintains a good payment history.

- Pay all bills on time: This single action has the most substantial positive effect on your credit score.

- Maintain low credit utilization: Keep your credit card balances low relative to your credit limit (ideally below 30%).

These strategies, combined with consistent on-time payments on your rehabilitated or consolidated loans, will accelerate your credit score recovery.

Conclusion

Recovering your credit score after student loan defaults is a journey that requires patience, perseverance, and a proactive approach. By understanding the impact of defaults, exploring repayment options like rehabilitation and IDR plans, and implementing credit rebuilding strategies, you can significantly improve your financial situation. Remember, rebuilding credit takes time, but with consistent effort and responsible financial management, you can achieve a healthier credit score and secure a brighter financial future. Start taking control of your financial life today and begin your journey towards recovering your credit score after student loan defaults. Don't let a past mistake define your financial future; take action to repair your credit and build a strong financial foundation.

Featured Posts

-

Chinas Ambassador On Potential Formal Trade Agreement With Canada

May 17, 2025

Chinas Ambassador On Potential Formal Trade Agreement With Canada

May 17, 2025 -

Angel Reeses Dpoy Win Shadowed By Serious Injury

May 17, 2025

Angel Reeses Dpoy Win Shadowed By Serious Injury

May 17, 2025 -

Two Decades On The Continued Impact Of Seattle Mariners Legend Ichiro Suzuki

May 17, 2025

Two Decades On The Continued Impact Of Seattle Mariners Legend Ichiro Suzuki

May 17, 2025 -

Global Oil Market News And Price Analysis May 16 2024

May 17, 2025

Global Oil Market News And Price Analysis May 16 2024

May 17, 2025 -

Uber And Waymos Robotaxi Launch In Austin A New Era Of Ridesharing

May 17, 2025

Uber And Waymos Robotaxi Launch In Austin A New Era Of Ridesharing

May 17, 2025

Latest Posts

-

Uber Stocks Recessionary Performance A Deep Dive

May 17, 2025

Uber Stocks Recessionary Performance A Deep Dive

May 17, 2025 -

Analyzing Ubers Stock Recession Resistance And Future Growth

May 17, 2025

Analyzing Ubers Stock Recession Resistance And Future Growth

May 17, 2025 -

Is Uber Stock Recession Resistant Analyzing The Market

May 17, 2025

Is Uber Stock Recession Resistant Analyzing The Market

May 17, 2025 -

Autonomous Vehicles And Etfs Is Uber A Smart Investment

May 17, 2025

Autonomous Vehicles And Etfs Is Uber A Smart Investment

May 17, 2025 -

Can Uber Stock Survive A Recession Expert Analysis

May 17, 2025

Can Uber Stock Survive A Recession Expert Analysis

May 17, 2025