Singapore's DBS Bank And The Green Transition: A Necessary "Breathing Space"?

Table of Contents

DBS Bank's Current Sustainability Initiatives and their Impact

DBS Bank has made significant strides in integrating Environmental, Social, and Governance (ESG) factors into its core business strategy. Their commitment extends beyond mere rhetoric; it's reflected in concrete actions and substantial investments.

ESG Integration and Investment Strategies

DBS has committed to ambitious ESG targets, including significant investments in renewable energy, sustainable infrastructure, and green technologies. This commitment is backed by quantifiable data:

- Renewable Energy Investments: DBS has pledged billions of dollars towards financing renewable energy projects across Asia, significantly contributing to the region's shift away from fossil fuels. Examples include investments in large-scale solar farms and offshore wind projects.

- Sustainable Infrastructure Projects: The bank actively finances projects improving energy efficiency in buildings, sustainable transportation initiatives (e.g., electric vehicle charging infrastructure), and responsible water management systems.

- Green Technology Investments: DBS supports innovative startups and established companies developing groundbreaking green technologies, fostering innovation within the sustainability sector.

DBS has received numerous accolades for its sustainability efforts, including recognitions from leading ESG rating agencies and prestigious awards for its commitment to responsible banking.

Financing Green Projects in Singapore

DBS plays a crucial role in financing major green projects within Singapore, directly contributing to the nation's sustainability goals.

- Green Building Projects: The bank has provided substantial funding for the construction and renovation of green buildings across Singapore, promoting energy efficiency and reduced carbon emissions.

- Sustainable Transportation Initiatives: DBS has supported projects aimed at improving public transportation and promoting the adoption of electric vehicles, reducing reliance on private cars.

- Waste Management and Recycling Infrastructure: The bank has financed projects enhancing Singapore's waste management and recycling capabilities, supporting a circular economy model.

However, challenges remain. Financing large-scale green projects requires significant upfront investment, often necessitating innovative financing solutions and overcoming regulatory hurdles.

Sustainable Finance Products and Services

DBS offers a range of sustainable finance products and services designed to support businesses and individuals in their transition towards more sustainable practices.

- Green Loans: These loans provide financing for environmentally friendly projects, offering competitive interest rates and favorable terms.

- Sustainable Bonds: DBS issues green and social bonds, channeling funds towards projects with positive environmental and social impacts.

- ESG Advisory Services: The bank provides expert advice and guidance to clients seeking to improve their ESG performance and integrate sustainability into their operations.

The uptake of these products is steadily increasing, demonstrating a growing awareness and demand for sustainable financial solutions among both businesses and individuals.

Challenges and Opportunities in Singapore's Green Transition

Singapore's journey towards a sustainable future is paved with both significant opportunities and considerable challenges.

Regulatory Landscape and Government Support

Singapore has established a robust regulatory framework to support its green transition, including various government initiatives and policies.

- Carbon Tax: The carbon tax implemented by the Singaporean government incentivizes businesses to reduce their carbon footprint.

- Green Mark Scheme: This scheme provides a rating system for buildings based on their environmental performance, encouraging sustainable construction practices.

- National Climate Change Secretariat: This body coordinates national efforts towards climate action and sustainable development.

However, further refinements to the regulatory framework might be necessary to accelerate the transition, including stronger incentives for green investments and stricter regulations on carbon emissions.

Technological Advancements and Innovation

Technological advancements are pivotal in accelerating Singapore's green transition.

- Renewable Energy Technologies: Advancements in solar, wind, and other renewable energy technologies are crucial for decarbonizing Singapore's energy sector.

- Smart Grid Technologies: Smart grids can optimize energy distribution and integrate renewable energy sources more effectively.

- Carbon Capture and Storage: Developing and deploying carbon capture and storage technologies is essential for mitigating emissions from hard-to-abate sectors.

Despite the potential, challenges remain regarding the cost-effectiveness and scalability of these technologies.

Public Awareness and Engagement

Raising public awareness and fostering greater engagement are vital for the success of Singapore's green transition.

- Education and Awareness Campaigns: Increased public education on climate change and sustainable practices is essential.

- Community Engagement Initiatives: Involving communities in green initiatives can promote a sense of ownership and responsibility.

- Incentivizing Sustainable Behavior: Government policies and corporate initiatives can incentivize individuals to adopt sustainable lifestyles.

Currently, while awareness is growing, greater effort is needed to engage the wider population actively in sustainable practices.

The "Breathing Space" Concept: A Strategic Approach to the Green Transition

The "breathing space" concept advocates for a period of focused investment and deliberate planning to effectively manage the transition to a sustainable economy. For Singapore, this means strategically allocating resources, fostering innovation, and ensuring a just and equitable transition for all stakeholders.

This requires a collaborative effort between the government, businesses like DBS Bank, and individuals. A well-planned "breathing space" allows for:

- Avoiding rushed decisions: A measured approach prevents hasty and potentially ineffective measures.

- Better resource allocation: Strategic planning optimizes the use of financial and human resources.

- Promoting innovation: A focused period allows for the development and deployment of innovative green technologies and solutions.

The benefits of a "breathing space" far outweigh the costs of a haphazard and rushed transition.

Conclusion: DBS Bank's Role in Shaping Singapore's Green Future

DBS Bank's commitment to sustainability, demonstrated through its various initiatives, is crucial for Singapore's successful green transition. However, challenges remain, particularly in navigating the complexities of financing large-scale green projects and fostering wider public engagement. The strategic adoption of a "breathing space" approach, characterized by deliberate investment and collaborative action, is vital to overcome these hurdles and achieve Singapore's ambitious sustainability goals. The urgency of addressing climate change cannot be overstated, and financial institutions like DBS Bank have a critical role to play in shaping a sustainable future. Learn more about DBS Bank's commitment to a sustainable future and join the movement towards a greener Singapore – let's create a sustainable "breathing space" together!

Featured Posts

-

Easing Trade Tensions Key U S And Chinese Officials To Hold Talks

May 08, 2025

Easing Trade Tensions Key U S And Chinese Officials To Hold Talks

May 08, 2025 -

Angels Powerless Against Twins 13 More Strikeouts Seal Series Loss

May 08, 2025

Angels Powerless Against Twins 13 More Strikeouts Seal Series Loss

May 08, 2025 -

Greenland A New Geopolitical Battleground Between The Us And China

May 08, 2025

Greenland A New Geopolitical Battleground Between The Us And China

May 08, 2025 -

Demolition Makes Way For New Park In Pierce County

May 08, 2025

Demolition Makes Way For New Park In Pierce County

May 08, 2025 -

Brezilya Da Bitcoin Maaslari Avantajlar Dezavantajlar Ve Gelecek

May 08, 2025

Brezilya Da Bitcoin Maaslari Avantajlar Dezavantajlar Ve Gelecek

May 08, 2025

Latest Posts

-

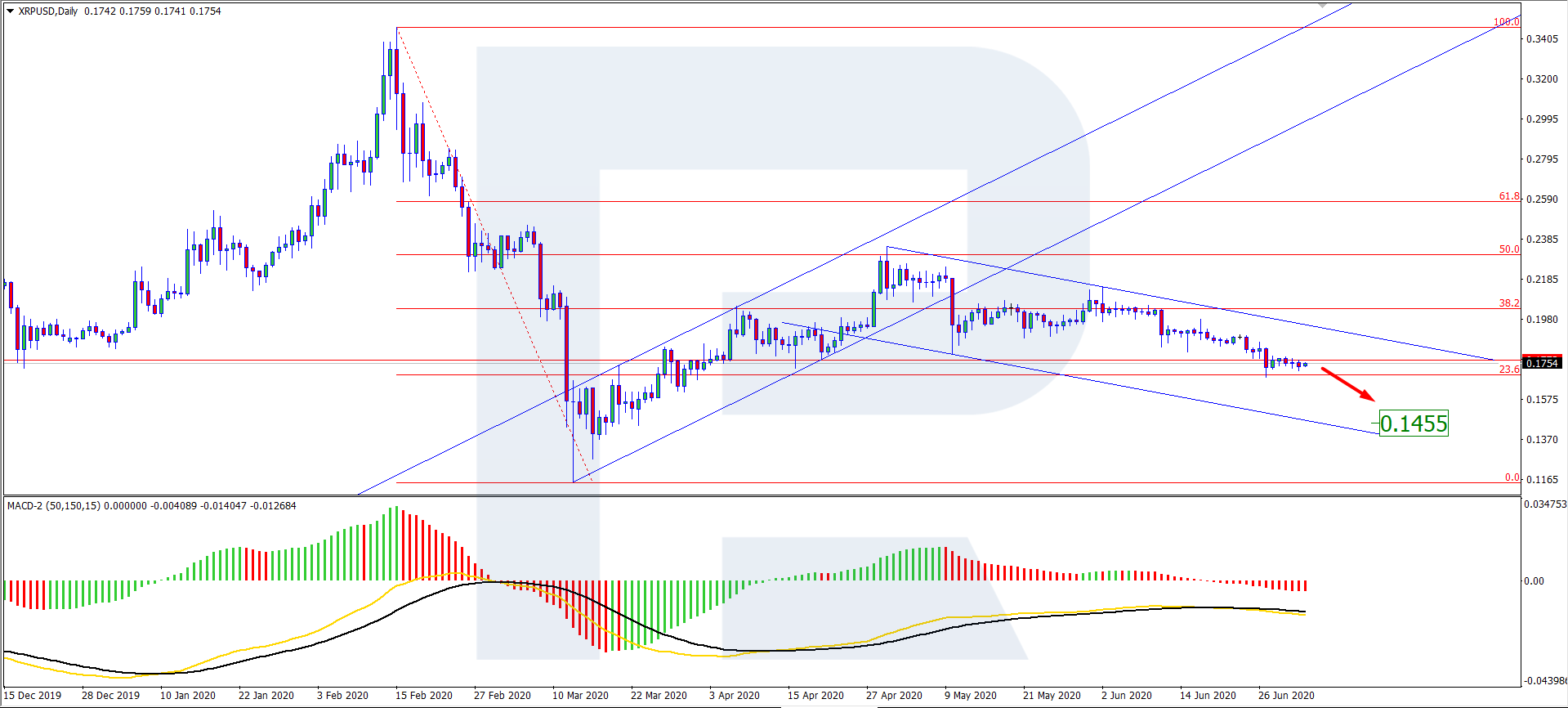

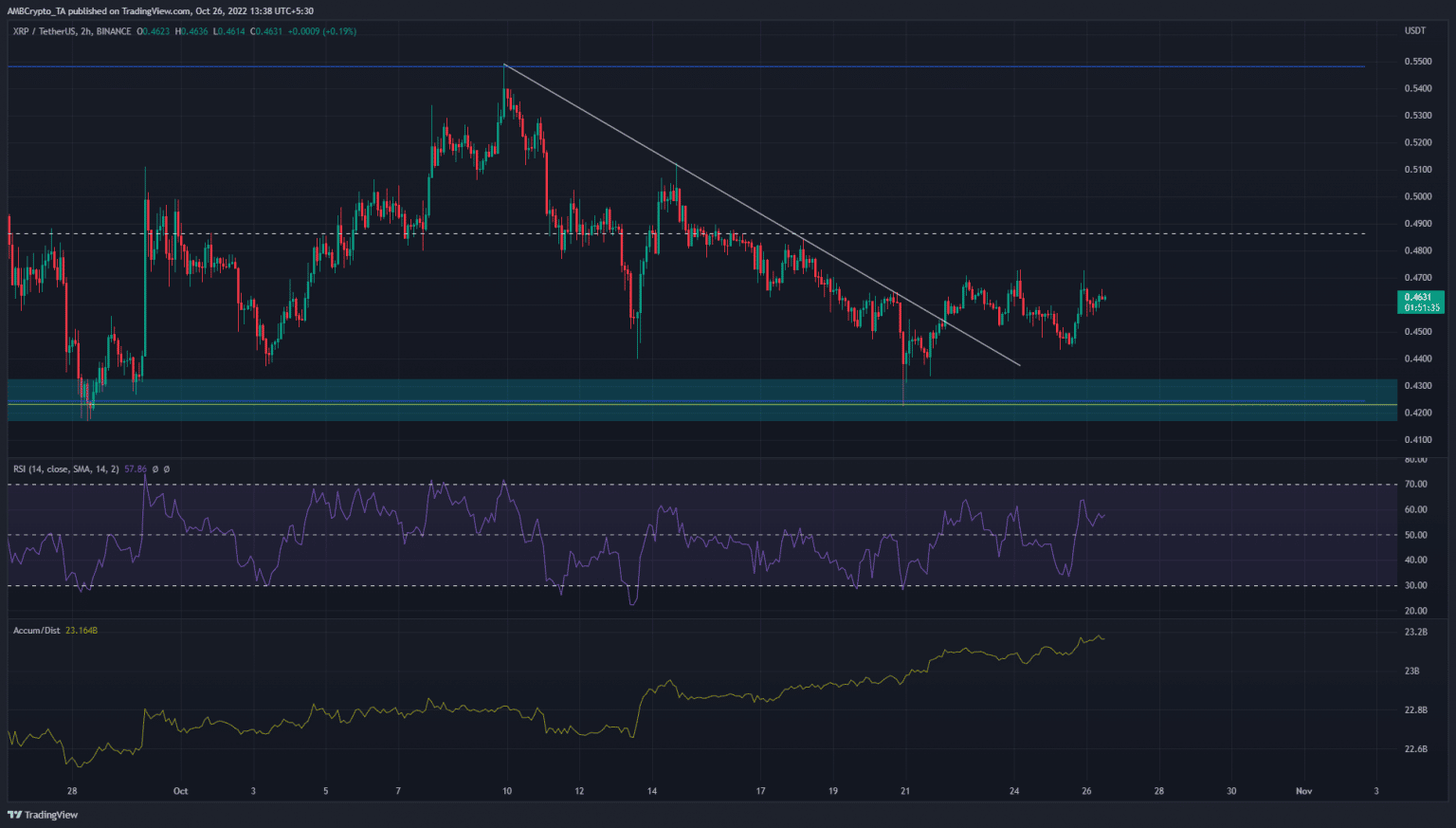

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025 -

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025 -

Understanding Xrps 400 Surge Future Price Prospects

May 08, 2025

Understanding Xrps 400 Surge Future Price Prospects

May 08, 2025 -

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025 -

Is Xrps 400 Rally Sustainable A Look At Future Price Predictions

May 08, 2025

Is Xrps 400 Rally Sustainable A Look At Future Price Predictions

May 08, 2025