Stock Market Valuations: BofA's Reassuring Argument For Investors

Table of Contents

BofA's Valuation Methodology and Key Findings

BofA employs a multi-faceted approach to assessing stock market valuations, incorporating various metrics and analytical techniques. Their analysis isn't solely reliant on a single indicator like the price-to-earnings (P/E) ratio but considers a broader picture. They utilize a combination of methods, including:

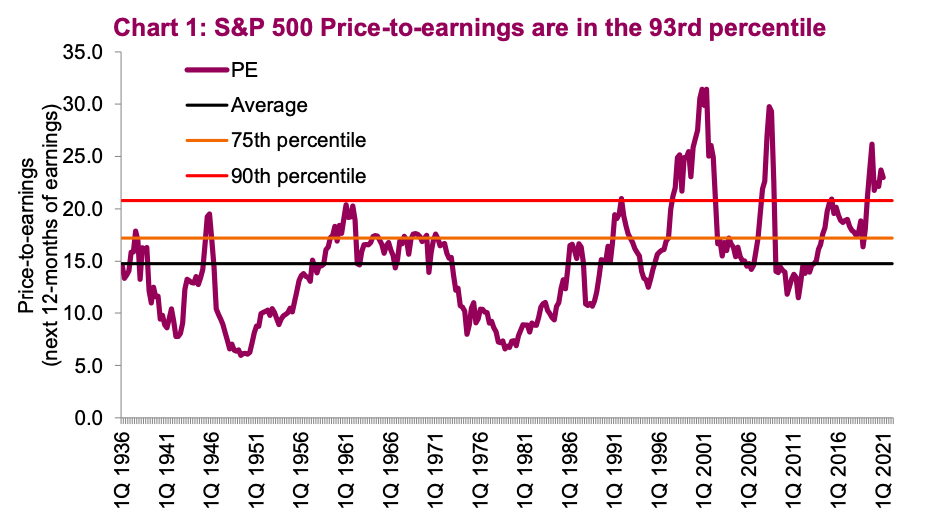

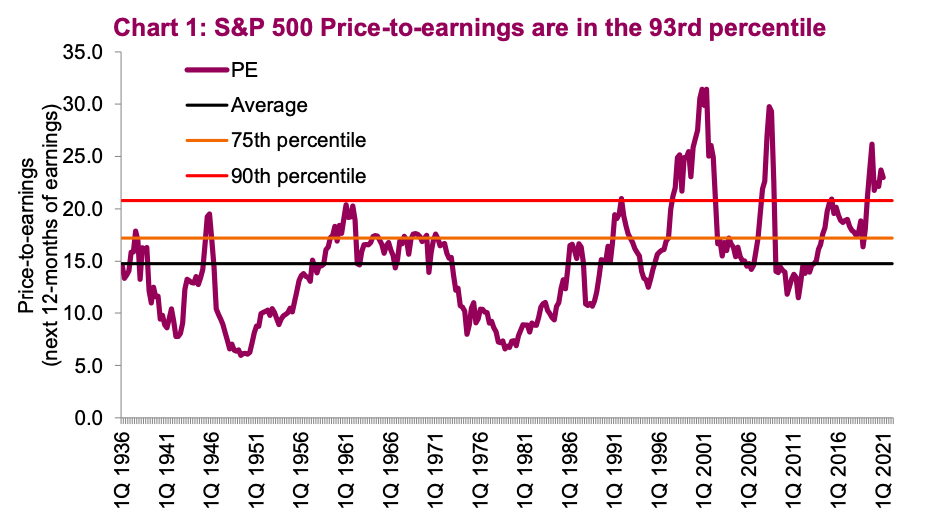

- Price-to-Earnings Ratio (P/E): BofA analyzes both the forward P/E ratio (based on projected earnings) and the trailing P/E ratio (based on past earnings) to gain a comprehensive understanding of market valuation. They compare these ratios to historical averages and industry benchmarks to gauge whether current valuations are expensive, fairly valued, or cheap.

- Shiller P/E (Cyclically Adjusted Price-to-Earnings Ratio): This metric smooths out earnings fluctuations over a longer period (typically 10 years), providing a more stable measure of valuation and helping to account for economic cycles.

- Discounted Cash Flow (DCF) Analysis: BofA likely employs DCF analysis to project future cash flows and discount them back to their present value, providing an intrinsic valuation estimate for companies and the overall market.

Their key findings often suggest that while valuations aren't at historically cheap levels, they also aren't drastically overvalued when considering the broader economic context and projected earnings growth. Specific sectors, like technology or consumer discretionary, might be highlighted as relatively more or less attractive based on their individual valuation metrics and future growth prospects. BofA's reports often include detailed breakdowns of these sector-specific valuations.

Considering the Impact of Interest Rates

Rising interest rates significantly impact stock valuations. BofA acknowledges this, incorporating interest rate predictions into their models. Higher rates increase the cost of borrowing for companies, potentially impacting earnings and reducing future cash flows, which, in turn, decreases valuations calculated using methods like DCF analysis. Conversely, higher rates can make bonds more attractive, potentially diverting investment away from equities.

- BofA's Interest Rate Predictions: Their economists publish regular forecasts, which inform their valuation models. These predictions are influenced by various factors including inflation, economic growth, and central bank policies.

- Impact on Valuation Models: Higher projected interest rates generally lead to lower present values of future cash flows in DCF analyses, resulting in potentially lower valuations.

- Sectoral Differences: Sectors like technology, which are often more sensitive to interest rate changes due to higher leverage and longer time horizons for returns, might be impacted more significantly than sectors like utilities or financials which are often considered more defensive.

The Role of Corporate Earnings Growth

BofA’s analysis heavily emphasizes the role of future corporate earnings growth in justifying current valuations. Strong earnings growth can offset relatively high valuation multiples. Their projections for earnings growth are based on various factors, including macroeconomic conditions and industry-specific trends.

- BofA's Earnings Growth Projections: These projections are usually detailed in their research reports and typically provide a range of possible outcomes reflecting the inherent uncertainty in forecasting.

- Influencing Factors: Factors such as global economic growth, inflation rates, geopolitical risks, and technological advancements all play a crucial role in shaping their earnings growth forecasts.

- Justifying Current Valuations: Robust and sustained earnings growth can support current valuation multiples, even if they appear relatively high compared to historical averages. If companies consistently exceed earnings expectations, it can justify higher P/E ratios.

Addressing the Bearish Arguments

While BofA presents a relatively optimistic outlook, they acknowledge counterarguments suggesting overvaluation. High inflation, geopolitical uncertainty, and potential economic slowdowns are significant concerns. However, BofA often addresses these concerns in their analysis by:

- Specific Bearish Arguments Addressed: This could include concerns about a potential recession, persistent high inflation eroding corporate profits, or escalating geopolitical tensions disrupting supply chains.

- BofA's Counterpoints: They might argue that inflation is transitory, or that the market has already priced in some of these risks. They may highlight specific companies or sectors that are well-positioned to weather economic downturns.

- Caveats and Risk Factors: BofA always includes caveats and risk factors in their analysis, emphasizing that their outlook is not a guarantee of future performance. Market volatility is inherent, and unexpected events can always impact valuations.

Conclusion

BofA's analysis of stock market valuations presents a balanced perspective. While acknowledging the risks associated with high inflation, interest rate hikes, and geopolitical uncertainty, their assessment suggests that current valuations aren't necessarily alarmingly high when considering projected earnings growth and their chosen valuation methodologies. Their approach utilizes a variety of metrics, including P/E ratios, Shiller P/E, and DCF analysis, providing a more nuanced view than relying on a single indicator.

While market fluctuations are inevitable, BofA's analysis provides a reassuring perspective for investors. By carefully considering these insights and conducting your own due diligence, you can make informed decisions about your investment strategy in the current market climate. Understanding stock market valuations is crucial for navigating market uncertainty and making sound investment choices. Learn more about BofA's full report and refine your understanding of stock market valuations today!

Featured Posts

-

Bitcoin Price Prediction 1 500 Growth In 5 Years

May 08, 2025

Bitcoin Price Prediction 1 500 Growth In 5 Years

May 08, 2025 -

Pressure Mounts For Economic Reform Amidst Taiwan Dollars Rise

May 08, 2025

Pressure Mounts For Economic Reform Amidst Taiwan Dollars Rise

May 08, 2025 -

Bitcoins Surge Us China Trade Talks Fuel Crypto Rally

May 08, 2025

Bitcoins Surge Us China Trade Talks Fuel Crypto Rally

May 08, 2025 -

Inter Milan Through To Europa League Last Eight After Feyenoord Win

May 08, 2025

Inter Milan Through To Europa League Last Eight After Feyenoord Win

May 08, 2025 -

Pierce County Homes Transformation From Historic House To Public Park

May 08, 2025

Pierce County Homes Transformation From Historic House To Public Park

May 08, 2025

Latest Posts

-

Should You Buy Xrp Ripple Now Weighing The Risks And Rewards

May 08, 2025

Should You Buy Xrp Ripple Now Weighing The Risks And Rewards

May 08, 2025 -

2000 Xrp

May 08, 2025

2000 Xrp

May 08, 2025 -

Xrp Ripple Investment Potential For Long Term Growth

May 08, 2025

Xrp Ripple Investment Potential For Long Term Growth

May 08, 2025 -

Is Investing In Xrp Ripple Right For You A Financial Analysis

May 08, 2025

Is Investing In Xrp Ripple Right For You A Financial Analysis

May 08, 2025 -

Xrp 2000

May 08, 2025

Xrp 2000

May 08, 2025