The £3 Billion Question: Why SSE Is Cutting Spending

Table of Contents

SSE's announcement of a £3 billion reduction in its spending plans sent shockwaves through the energy sector. The immediate market reaction highlighted the significance of this decision, leaving investors and analysts scrambling to understand the implications. This article delves into the reasons behind SSE's drastic spending cuts, exploring the potential consequences for the company, the broader energy market, and ultimately, consumers. We will analyze the key factors driving these "SSE spending cuts," examining the impact on SSE investment and the future of renewable energy investment in the UK.

<h2>Shifting Regulatory Landscape and Reduced Profitability</h2>

The energy sector is facing a period of significant upheaval, driven by a rapidly changing regulatory landscape. Government policies aimed at tackling climate change and promoting renewable energy sources have created both opportunities and challenges for companies like SSE. These changes directly impact profitability and necessitate strategic adjustments, including substantial budget cuts.

- Impact of carbon pricing schemes: Increasing carbon prices significantly increase the cost of fossil fuel-based power generation, squeezing profit margins for energy companies reliant on these sources. This directly impacts SSE investment decisions, making certain projects less financially viable.

- Changes in renewable energy subsidies: While subsidies for renewable energy have supported growth in the sector, recent changes in government support mechanisms have reduced the financial incentives for some projects, affecting the return on investment and potentially leading to project delays or cancellations.

- Increased competition in the energy market: The energy market is becoming increasingly competitive, with new players and innovative technologies challenging established companies like SSE. This increased competition puts pressure on pricing and profitability, forcing companies to optimize their spending.

- Pressure from shareholders for improved returns: Shareholders expect a strong return on their investment. With profit margins under pressure, SSE faces increasing pressure to improve efficiency and demonstrate strong financial performance, leading to cost-cutting measures.

<h2>Prioritizing Renewable Energy Investments</h2>

Despite the overall spending reduction, SSE remains committed to its renewable energy strategy. The £3 billion cut reflects a strategic shift in investment priorities, focusing resources on the most promising and profitable renewable energy projects. This prioritization reflects a long-term view, acknowledging the growing importance of sustainable energy sources.

- Focus on wind power projects (onshore and offshore): SSE will continue to invest heavily in wind power, both onshore and offshore, recognizing its potential as a major contributor to the UK's renewable energy targets. This represents a core component of their future SSE investment strategy.

- Investment in energy storage solutions: With the increasing adoption of intermittent renewable energy sources like wind and solar power, efficient energy storage solutions are crucial to ensure a reliable and stable energy supply. SSE is recognizing this and allocating resources to develop these vital technologies.

- Reduced investment in less profitable fossil fuel projects: The shift towards renewable energy is leading to a reduction in investment in less profitable fossil fuel-based projects, reflecting the company's commitment to a low-carbon future and aligning with government policy.

- Strategic partnerships for renewable energy development: Collaborating with other companies and organizations can provide access to new technologies, expertise, and funding, enhancing the success of renewable energy projects and optimizing SSE investment.

<h2>Managing Debt and Improving Financial Stability</h2>

A significant driver behind the SSE spending cuts is the need to manage debt and improve the company's overall financial stability. Maintaining a strong credit rating is crucial for attracting investors and ensuring access to capital for future projects. This focus on financial health is a key element of the long-term strategy.

- SSE's current debt levels and credit rating: Understanding SSE's current debt levels and credit rating provides context for the spending cuts. Reducing debt will strengthen the company's financial position and improve its creditworthiness.

- Strategies for debt reduction: SSE is likely employing various strategies for debt reduction, including asset sales, cost-cutting measures, and potentially delaying or scaling back some projects.

- Impact on dividend payments: The decision to cut spending may affect dividend payments to shareholders, a trade-off necessary for long-term financial health and investor confidence.

- Long-term financial planning: The spending cuts reflect a proactive approach to long-term financial planning, ensuring the sustainability and resilience of the company in a volatile energy market.

<h2>Potential Impact of SSE Spending Cuts on the Broader Energy Sector</h2>

SSE's decision to significantly cut spending will have a ripple effect across the broader energy sector and the UK energy market. The consequences could impact employment, energy infrastructure development, and energy prices for consumers.

- Impact on employment in the energy sector: Reduced investment could lead to job losses within SSE and potentially across the supply chain, impacting the wider UK economy.

- Reduced investment in energy infrastructure projects: The cuts may slow down the development of crucial energy infrastructure, including renewable energy projects, potentially hindering the UK's transition to a low-carbon energy system.

- Increased energy prices for consumers (potential): Depending on the scale and nature of the cuts, there's a potential for increased energy prices for consumers if reduced investment impacts supply.

- Competition within the energy sector: SSE's strategic shift could influence the competitive landscape within the energy sector, leading to further consolidation or driving innovation among other companies.

<h2>Conclusion: Navigating the Future of SSE and Understanding its Spending Cuts</h2>

SSE's £3 billion spending cut is a complex decision driven by a confluence of factors: a shifting regulatory landscape, a renewed focus on renewable energy investments, and the imperative to manage debt and improve financial stability. These "SSE spending cuts" have significant implications for the company, the broader energy sector, and potentially consumers. Understanding the reasons behind these decisions is crucial for investors, policymakers, and consumers alike. To stay abreast of SSE's future investment strategies and the evolving energy landscape, continue monitoring financial news and industry reports analyzing SSE's budget cuts and the future of SSE spending. Further research into the impact of government policies on energy company investment is also recommended.

Featured Posts

-

Eissorten Ranking Nrw Diese Sorte Liegt Vorn

May 24, 2025

Eissorten Ranking Nrw Diese Sorte Liegt Vorn

May 24, 2025 -

You Can Still Negotiate A Best And Final Job Offer

May 24, 2025

You Can Still Negotiate A Best And Final Job Offer

May 24, 2025 -

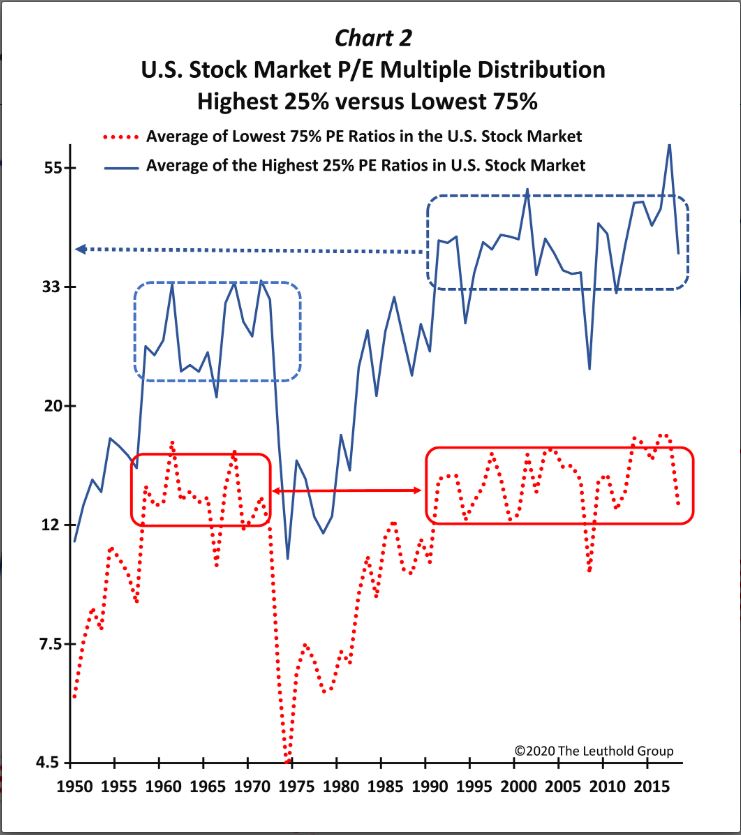

High Stock Valuations Why Bof A Thinks Investors Shouldnt Panic

May 24, 2025

High Stock Valuations Why Bof A Thinks Investors Shouldnt Panic

May 24, 2025 -

Wta Rim Rybakina Preodolela Vtoroy Krug

May 24, 2025

Wta Rim Rybakina Preodolela Vtoroy Krug

May 24, 2025 -

Apple Stock Dan Ives Long Term Bullish Prediction After Price Target Reduction

May 24, 2025

Apple Stock Dan Ives Long Term Bullish Prediction After Price Target Reduction

May 24, 2025