The $67 Million Ethereum Liquidation: Causes And Potential Consequences

Table of Contents

Understanding Ethereum Liquidations

Before analyzing the specific $67 million Ethereum liquidation, it's crucial to understand the concept of liquidation within the context of DeFi and Ethereum. Liquidation, in this context, refers to the forced selling of an asset to cover losses incurred by a trader using leverage. In the world of decentralized finance, this often happens through margin trading.

Margin trading allows traders to borrow funds to amplify their potential profits. However, this also significantly increases their risk. If the price of the asset they've leveraged moves against their position, they risk losing more than their initial investment. This is where smart contracts come into play.

Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. These contracts automatically trigger liquidations when a trader's collateral falls below a certain threshold, often determined by a liquidation price. This automated process is designed to protect lenders from significant losses.

Several scenarios can lead to Ethereum liquidations:

- High leverage increases the risk of liquidation. The higher the leverage, the smaller the price movement needed to trigger a liquidation.

- Sudden price drops can trigger mass liquidations. Sharp market downturns can lead to a cascade of liquidations as multiple traders are simultaneously forced to sell their assets.

- Smart contracts execute liquidations automatically. There's no human intervention; the liquidation is triggered automatically when predefined conditions are met.

- Insufficient collateral leads to forced selling. If the value of a trader's collateral falls below the required level, the smart contract automatically liquidates their position.

Causes of the $67 Million Ethereum Liquidation

The specific causes behind the $67 million Ethereum liquidation are likely multifaceted. We can analyze contributing factors under several key areas:

Market Volatility and External Factors

The cryptocurrency market is notoriously volatile, influenced heavily by macroeconomic news and broader market trends. Regulatory announcements, significant sell-offs in other asset classes, and general market sentiment all play a substantial role in price fluctuations. The correlation between Bitcoin's price movements and Ethereum's is also significant; a sharp drop in Bitcoin often triggers a corresponding drop in Ethereum, potentially causing liquidations.

- Negative news often leads to sell-offs. Uncertainty surrounding regulations or negative news about a specific project can cause widespread selling pressure.

- Market sentiment plays a crucial role. Fear, uncertainty, and doubt (FUD) can create a downward spiral in the market, leading to liquidations.

- External factors can significantly impact crypto prices. Global economic events, geopolitical instability, and even social media trends can influence cryptocurrency prices.

Over-Leveraging and Risk Management

A major contributing factor to many crypto liquidations, including the $67 million Ethereum event, is likely over-leveraging. Traders who utilize excessive leverage amplify their potential gains but also significantly increase their exposure to losses. Poor risk management practices, such as failing to adequately assess the potential risks associated with high leverage or neglecting diversification strategies, exacerbate this vulnerability.

- High leverage magnifies both profits and losses. While potentially lucrative, it also drastically increases the chance of liquidation.

- Proper risk assessment is vital for avoiding liquidation. Traders should carefully consider their risk tolerance and use appropriate leverage levels.

- Diversification can help mitigate risk. Spreading investments across different assets can help reduce the impact of any single asset's price decline.

Technical Glitches or Smart Contract Vulnerabilities

While less common, technical glitches or vulnerabilities in the smart contracts governing lending and borrowing platforms can also contribute to significant liquidations. Bugs in smart contract code could lead to unexpected liquidations, highlighting the importance of thorough audits and rigorous testing before deployment.

- Bugs in smart contracts can lead to unexpected liquidations. Thorough audits and testing are crucial to prevent such occurrences.

- Regular audits are essential for security. Independent audits by reputable firms can help identify and mitigate potential vulnerabilities.

- Transparency is key in identifying and resolving issues. Open-source smart contracts allow for community scrutiny and faster identification of potential problems.

Potential Consequences of the $67 Million Ethereum Liquidation

The $67 million Ethereum liquidation has several potential consequences, both short-term and long-term.

Impact on Ethereum Price and Market Sentiment

Large-scale liquidations often lead to temporary price drops in the affected asset. The $67 million liquidation likely contributed to a short-term dip in Ethereum's price. Moreover, such events can negatively impact investor confidence, potentially causing further sell-offs and exacerbating market volatility. The possibility of cascading liquidations, where one liquidation triggers a chain reaction, also presents a serious risk.

- Large liquidations can cause temporary price drops. The immediate impact is often a sharp decline in the asset's value.

- Market sentiment can quickly shift. Negative news can spread fear and uncertainty, leading to more selling.

- Negative news can spread fear and uncertainty. This can lead to a self-fulfilling prophecy of further price declines.

Implications for the DeFi Ecosystem

The incident highlights the inherent risks within the still-evolving DeFi ecosystem. The potential for increased regulatory scrutiny following such a significant liquidation event is also a significant concern. The incident underscores the need for robust risk management frameworks within DeFi protocols to enhance stability and prevent future crises.

- DeFi is still relatively young and prone to volatility. Large-scale events can shake confidence in the entire ecosystem.

- Regulation might increase in response to large liquidations. Regulatory bodies may seek to implement stricter rules and oversight.

- Improved risk management practices are crucial. DeFi protocols need to prioritize robust risk management and transparency to build trust and stability.

Conclusion

The $67 million Ethereum liquidation serves as a stark reminder of the risks inherent in the volatile world of cryptocurrencies and decentralized finance. Understanding the interplay of market volatility, over-leveraging, and potential technical vulnerabilities is crucial for navigating this complex landscape. By carefully considering these factors and implementing robust risk management strategies, investors can better protect themselves from the devastating consequences of future Ethereum liquidations and similar events. Stay informed on market trends and continue to research the dynamics of Ethereum liquidations to make well-informed investment decisions.

Featured Posts

-

Kryptos Starring Role A Look At The New Superman Film Footage

May 08, 2025

Kryptos Starring Role A Look At The New Superman Film Footage

May 08, 2025 -

6aus49 Lottozahlen Ergebnis Der Ziehung Am 12 April 2025

May 08, 2025

6aus49 Lottozahlen Ergebnis Der Ziehung Am 12 April 2025

May 08, 2025 -

Inter Milan Goalkeeper Yann Sommer Suffers Thumb Injury

May 08, 2025

Inter Milan Goalkeeper Yann Sommer Suffers Thumb Injury

May 08, 2025 -

Bitcoin Price Soars Trumps Crypto Expert Issues Surprise Forecast

May 08, 2025

Bitcoin Price Soars Trumps Crypto Expert Issues Surprise Forecast

May 08, 2025 -

1 1 Psg Nantes Macinda Suerpriz Beraberelik

May 08, 2025

1 1 Psg Nantes Macinda Suerpriz Beraberelik

May 08, 2025

Latest Posts

-

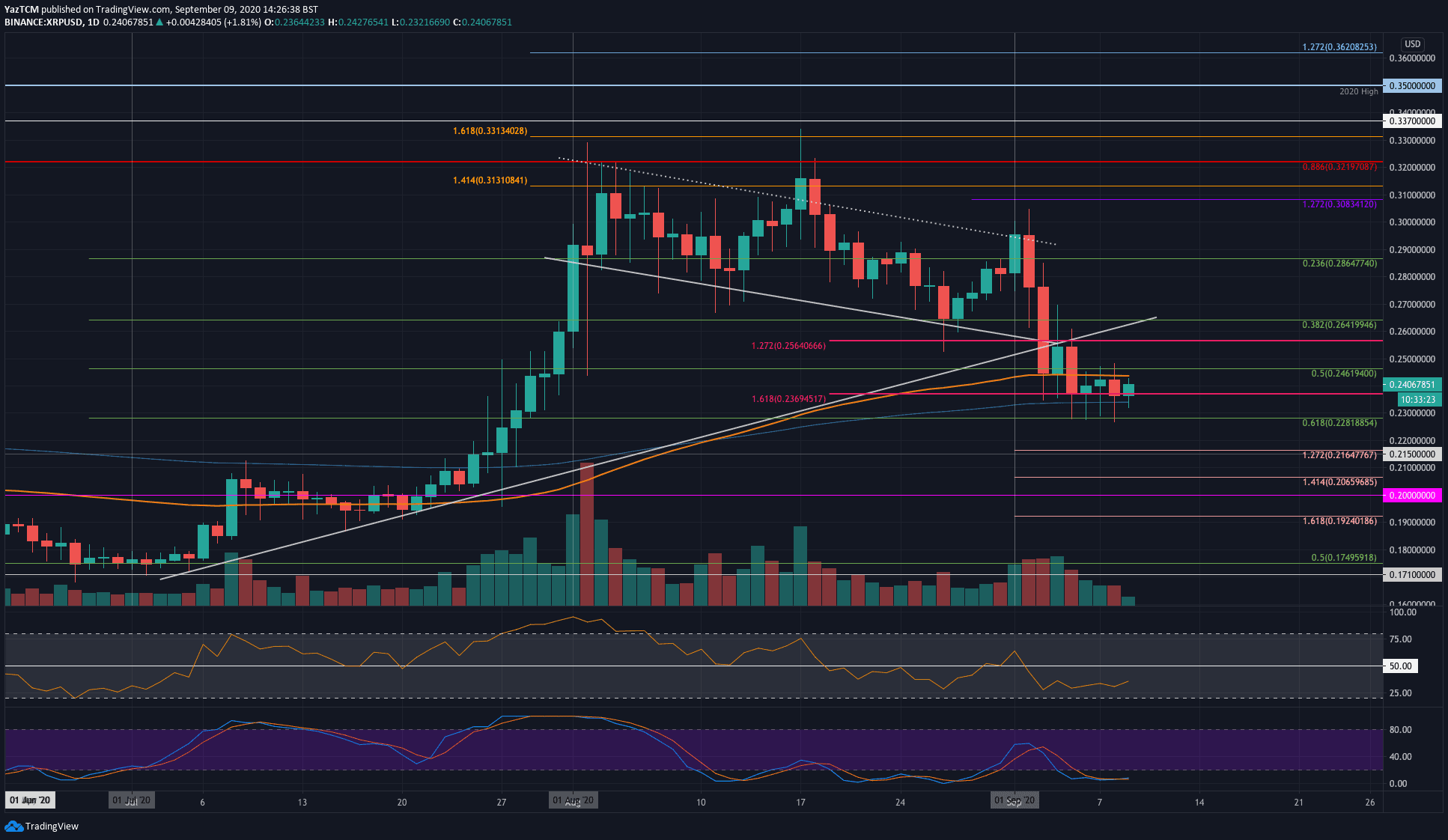

Xrps 400 Jump Whats Next For The Ripple Cryptocurrency

May 08, 2025

Xrps 400 Jump Whats Next For The Ripple Cryptocurrency

May 08, 2025 -

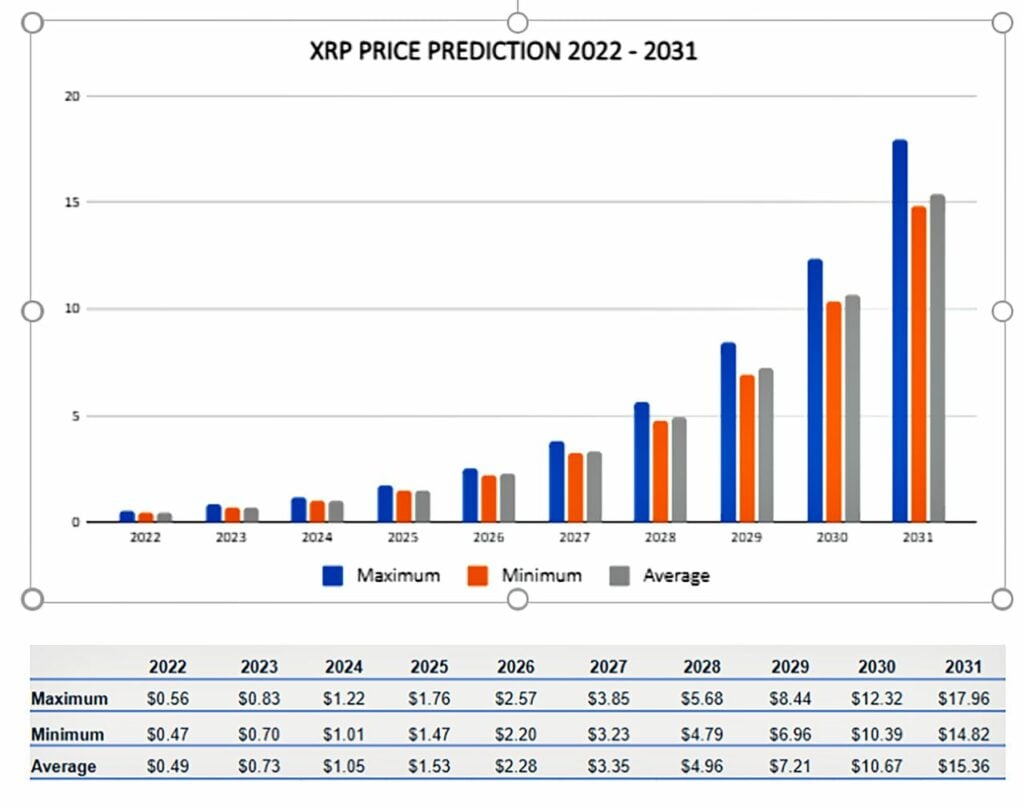

Xrp Future Price Analyzing The Potential For Growth Following The Sec Case

May 08, 2025

Xrp Future Price Analyzing The Potential For Growth Following The Sec Case

May 08, 2025 -

Xrp Price Prediction Can Xrp Rise Further After A 400 Surge

May 08, 2025

Xrp Price Prediction Can Xrp Rise Further After A 400 Surge

May 08, 2025 -

Will Xrp Reach 5 An Xrp Price Prediction Analysis Post Sec Lawsuit

May 08, 2025

Will Xrp Reach 5 An Xrp Price Prediction Analysis Post Sec Lawsuit

May 08, 2025 -

Xrp Price Prediction 5 Target Realistic After Sec Developments

May 08, 2025

Xrp Price Prediction 5 Target Realistic After Sec Developments

May 08, 2025