The Bitcoin Rebound: Understanding The Factors Driving The Rise

Table of Contents

Institutional Adoption and Growing Institutional Investment

The increased involvement of large financial institutions and corporations is a significant factor in the Bitcoin rebound. We're seeing a shift from tentative exploration to significant investment, signaling a growing acceptance of Bitcoin as a legitimate asset class. This institutional adoption exerts considerable buying pressure, directly impacting Bitcoin's price.

- MicroStrategy's significant Bitcoin holdings: MicroStrategy, a business intelligence company, has become a prominent example of institutional Bitcoin adoption, accumulating a massive Bitcoin treasury. Their strategy highlights the potential for Bitcoin as a long-term store of value for corporate balance sheets.

- Tesla's acceptance of Bitcoin for payments (past and present): While Tesla has temporarily suspended Bitcoin payments, its initial acceptance marked a watershed moment, demonstrating the potential for Bitcoin's use in real-world transactions by major corporations. Future adoption by other large companies remains a possibility that could drive further price increases.

- Grayscale Bitcoin Trust's growth: Grayscale Bitcoin Trust (GBTC) provides institutional investors with regulated exposure to Bitcoin. Its growth reflects the increasing demand for institutional-grade Bitcoin investment vehicles.

- Increased participation of hedge funds and investment firms: Numerous hedge funds and investment firms are now allocating a portion of their portfolios to Bitcoin, further contributing to the institutional buying pressure and driving the Bitcoin rebound.

Regulatory clarity, or the lack thereof, plays a crucial role. Clearer regulatory frameworks in various jurisdictions could encourage further institutional investment, while uncertainty can create hesitation. The evolving regulatory landscape is a key factor to watch as it impacts the Bitcoin rebound.

Macroeconomic Factors and Inflation Hedge

The current macroeconomic environment plays a significant role in Bitcoin's price appreciation. Global inflation rates are rising, and concerns about the devaluation of traditional fiat currencies are fueling demand for alternative assets like Bitcoin.

- Increased inflation rates globally: High inflation erodes the purchasing power of fiat currencies, pushing investors towards assets that potentially preserve value. Bitcoin, with its fixed supply, is increasingly seen as a hedge against inflation.

- Concerns about the devaluation of traditional fiat currencies: The ongoing expansion of global money supplies and government debt raise concerns about long-term currency stability. Bitcoin’s decentralized and deflationary nature offers a compelling alternative.

- Bitcoin as a potential hedge against inflation: Many investors view Bitcoin as a store of value, believing that its limited supply of 21 million coins will protect its purchasing power even as fiat currencies depreciate.

- Safe haven asset status during economic instability: During times of economic uncertainty, investors often seek safe haven assets. Bitcoin's decentralized nature and limited supply are attractive attributes during such periods.

Bitcoin's limited supply of 21 million coins is a core element of its value proposition. This scarcity contrasts sharply with the potentially unlimited supply of fiat currencies, making Bitcoin a potentially attractive store of value in inflationary environments. However, alternative narratives exist, suggesting that Bitcoin's price is also susceptible to speculative bubbles and market sentiment.

Technological Advancements and Network Growth

Significant technological advancements within the Bitcoin network are enhancing its functionality and appeal. These improvements are addressing scalability challenges and boosting user experience, further contributing to the Bitcoin rebound.

- The Lightning Network's scaling solutions: The Lightning Network provides a second-layer solution to improve Bitcoin's transaction speed and reduce fees, making it more practical for everyday use.

- Increased adoption of Bitcoin wallets and exchanges: The proliferation of user-friendly wallets and exchanges makes it easier for individuals to access and utilize Bitcoin, driving broader adoption.

- Improvements in transaction speed and fees: Ongoing developments are consistently improving transaction speeds and lowering fees, making Bitcoin transactions more efficient and cost-effective.

- Growing development of Bitcoin-related technologies and applications (e.g., DeFi): The development of decentralized finance (DeFi) applications built on top of Bitcoin's blockchain expands its functionality and utility, attracting new investors and users.

These advancements enhance Bitcoin's usability and appeal, making it a more attractive investment and a more practical payment method. Network upgrades and security enhancements also bolster investor confidence, contributing to the overall Bitcoin rebound.

Growing Retail Investor Interest and Public Awareness

Renewed retail investor interest is fueling the current Bitcoin price increase. Increased media coverage and improved accessibility are playing a key role.

- Increased media coverage of Bitcoin and cryptocurrencies: More frequent and positive media coverage of Bitcoin and cryptocurrencies has increased public awareness and interest.

- Greater accessibility through user-friendly platforms: User-friendly platforms and exchanges have made it easier for retail investors to buy, sell, and hold Bitcoin.

- Rising awareness among younger demographics: Younger generations are increasingly embracing Bitcoin and other cryptocurrencies, contributing to broader adoption and price appreciation.

- Influence of social media and online communities: Social media and online communities play a significant role in disseminating information and generating excitement around Bitcoin.

Increased retail investment translates into higher demand and subsequent price appreciation, further driving the Bitcoin rebound.

Conclusion

The Bitcoin rebound is a complex phenomenon driven by a confluence of factors, including significant institutional adoption, macroeconomic uncertainty driving demand as an inflation hedge, ongoing technological advancements enhancing its usability, and a resurgence of retail investor interest. Understanding these intertwined elements is crucial for navigating the ever-evolving cryptocurrency landscape. To stay informed about the future of Bitcoin and its price movements, continue researching the latest developments and trends affecting this dynamic market. Stay tuned for further analysis on the Bitcoin rebound and other crucial developments in the cryptocurrency space. Remember to conduct thorough research and due diligence before making any investment decisions related to Bitcoin.

Featured Posts

-

Wall Street Predicts 110 Gain For This Black Rock Etf Is It The Next Billionaire Bet

May 08, 2025

Wall Street Predicts 110 Gain For This Black Rock Etf Is It The Next Billionaire Bet

May 08, 2025 -

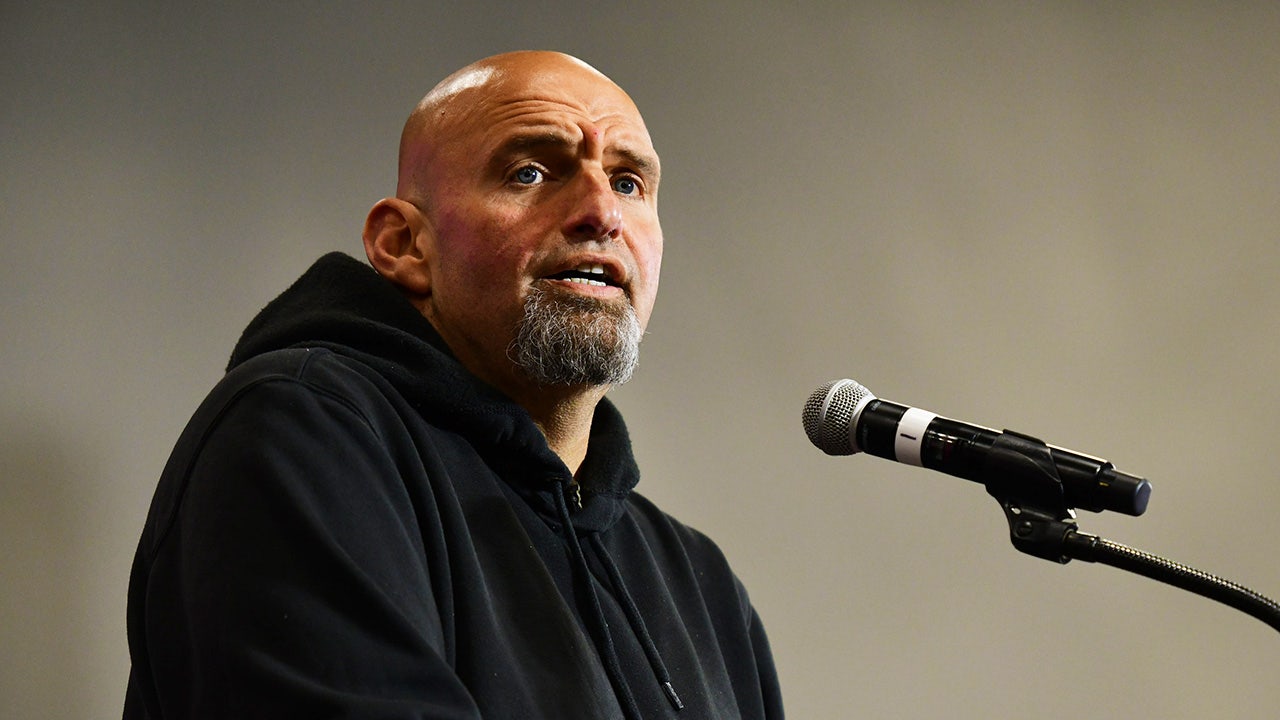

Fetterman Rejects Calls To Resign Remains Committed To Senate Service

May 08, 2025

Fetterman Rejects Calls To Resign Remains Committed To Senate Service

May 08, 2025 -

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025 -

360 Etf

May 08, 2025

360 Etf

May 08, 2025 -

Experience Enhanced Ps 5 Exclusives On The Ps 5 Pro

May 08, 2025

Experience Enhanced Ps 5 Exclusives On The Ps 5 Pro

May 08, 2025

Latest Posts

-

T

May 08, 2025

T

May 08, 2025 -

Andor Season 1 Where To Watch All Episodes Online

May 08, 2025

Andor Season 1 Where To Watch All Episodes Online

May 08, 2025 -

Watch Andor Season 1 On Hulu And You Tube A Guide

May 08, 2025

Watch Andor Season 1 On Hulu And You Tube A Guide

May 08, 2025 -

Princess Leias Return 3 Reasons To Expect A Cameo In The Upcoming Star Wars Show

May 08, 2025

Princess Leias Return 3 Reasons To Expect A Cameo In The Upcoming Star Wars Show

May 08, 2025 -

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025