Trump's Tax Reform Faces Challenges From Within The GOP

Table of Contents

Conservative Concerns Over Spending and the Deficit

A significant hurdle for Trump's Tax Reform stemmed from concerns among fiscal conservatives within the GOP regarding its impact on the national debt and deficit. These "GOP fiscal hawks," prioritizing fiscal conservatism, worried that the substantial tax cuts would lead to unsustainable levels of government borrowing.

- Increased national debt projections: The Congressional Budget Office (CBO) projected significant increases in the national debt as a result of the tax cuts, fueling concerns among fiscally conservative Republicans.

- Concerns about long-term economic sustainability: Critics argued that the tax cuts prioritized short-term economic gains over long-term fiscal stability, potentially jeopardizing the nation's economic future.

- Differing views on appropriate levels of government spending: The debate highlighted fundamental disagreements within the GOP regarding the appropriate role and size of government, with some advocating for smaller government and lower spending.

- Specific Republican lawmakers: Senators like Bob Corker and Marco Rubio publicly voiced their reservations about the tax cuts' fiscal implications, highlighting the internal divisions within the party.

These concerns regarding the budget deficit and national debt became a significant point of contention, demonstrating the fractures within the Republican party on issues of fiscal responsibility. The debate centered around the trade-offs between immediate tax relief and long-term fiscal health, with considerable disagreement on which approach would ultimately benefit the American economy.

Differing Views on Tax Cuts' Economic Impact

Beyond fiscal concerns, disagreements within the GOP also revolved around the projected economic impact of the tax cuts. The debate pitted proponents of supply-side economics against those favoring more Keynesian approaches.

- Debate on supply-side economics versus Keynesian approaches: Supply-siders argued that the tax cuts would stimulate economic growth by encouraging investment and job creation. Conversely, critics argued that the tax cuts would disproportionately benefit the wealthy, leading to increased inequality without significantly boosting overall economic growth. This reflected a broader ideological clash within the GOP.

- Differing predictions on job creation and investment: Supporters of the tax cuts predicted significant job creation and increased investment, while opponents offered more pessimistic forecasts, highlighting the uncertainty surrounding the legislation's economic impact.

- Mention economic experts cited by both sides of the debate: Economists like Larry Summers (critical) and Arthur Laffer (supportive) represented the contrasting views and further fueled the internal debate within the Republican party.

The varying predictions on the effectiveness of the tax cuts in stimulating economic growth revealed deep divisions within the GOP on economic theory and policy prescriptions. The lack of consensus on the economic models used to justify the cuts further exacerbated the internal conflict.

Intra-Party Power Struggles and Political Maneuvering

The legislative process surrounding Trump's Tax Reform was far from harmonious. Significant political maneuvering and power struggles within the Republican party played a crucial role in shaping the final legislation.

- Competition between different factions within the GOP: Different factions within the GOP, with differing priorities and agendas, competed for influence during the legislative process. This led to compromises and concessions that ultimately altered the original proposal.

- Negotiations and compromises that diluted the original proposal: To secure enough votes for passage, the initial proposal underwent numerous revisions and compromises, often diluting its intended impact and reflecting the conflicting interests within the party.

- Specific instances of political infighting during the legislative process: The negotiations were often fraught with tension and disagreements, showcasing the deep-seated divisions within the GOP and the challenges of uniting the party behind a single legislative agenda.

The Role of Lobbying and Special Interests

The final shape of Trump's Tax Reform was also significantly influenced by lobbying efforts from various industries and special interest groups. This lobbying activity further contributed to the internal divisions within the GOP.

- Specific industries or groups that lobbied for favorable tax treatment: Powerful industries, such as the real estate and financial sectors, heavily lobbied for tax provisions that benefited their interests.

- How these lobbying efforts may have created divisions within the Republican party: These lobbying efforts often pitted different factions within the GOP against each other, as lawmakers weighed the interests of their constituents against the demands of special interests. This created further fissures within the already fractured party. The resulting compromises reflected the influence of these outside groups, further undermining the perceived unity of the GOP.

Conclusion: Assessing the Legacy of Trump's Tax Reform and its GOP Challenges

Trump's Tax Reform faced significant internal challenges from within the GOP, stemming from concerns about the national debt, differing views on its economic impact, intense political maneuvering, and the influence of lobbying and special interests. These internal divisions resulted in a final product that was a compromise, potentially diluting its effectiveness and leaving a legacy of internal GOP conflict. The long-term consequences of these divisions remain to be seen, but the debates surrounding the tax cuts’ effectiveness and fiscal responsibility continue to shape political discourse. Continue exploring the complex legacy of Trump's tax reform and the significant internal challenges it faced within the GOP.

Featured Posts

-

Fatal Shooting Of Georgia Deputy During Traffic Stop One Dead One Injured

Apr 29, 2025

Fatal Shooting Of Georgia Deputy During Traffic Stop One Dead One Injured

Apr 29, 2025 -

Us Stock Market Rally Fueled By Tech Giants Tesla In The Lead

Apr 29, 2025

Us Stock Market Rally Fueled By Tech Giants Tesla In The Lead

Apr 29, 2025 -

Understanding The Value Of Middle Management In Todays Workplace

Apr 29, 2025

Understanding The Value Of Middle Management In Todays Workplace

Apr 29, 2025 -

Latest On Anthony Edwards Will He Suit Up Against The Lakers

Apr 29, 2025

Latest On Anthony Edwards Will He Suit Up Against The Lakers

Apr 29, 2025 -

Office 365 Breaches Execs Targeted In Multi Million Dollar Scheme

Apr 29, 2025

Office 365 Breaches Execs Targeted In Multi Million Dollar Scheme

Apr 29, 2025

Latest Posts

-

Rosenberg Accuses Bank Of Canada Of Monetary Policy Mistake

Apr 29, 2025

Rosenberg Accuses Bank Of Canada Of Monetary Policy Mistake

Apr 29, 2025 -

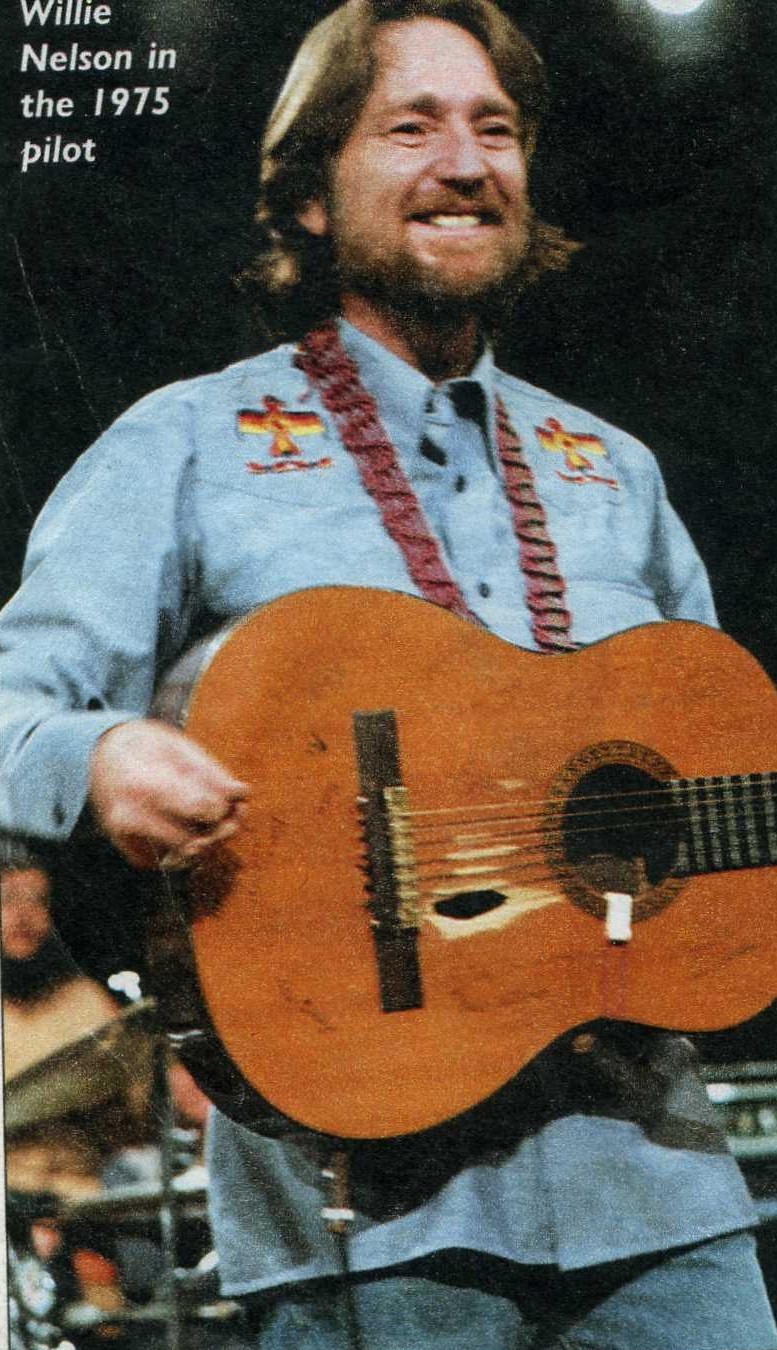

Willie Nelson And Family An Austin City Limits Concert Retrospective

Apr 29, 2025

Willie Nelson And Family An Austin City Limits Concert Retrospective

Apr 29, 2025 -

1 050 V Mware Price Increase At And T Details Broadcoms Proposed Hike

Apr 29, 2025

1 050 V Mware Price Increase At And T Details Broadcoms Proposed Hike

Apr 29, 2025 -

Rosenberg Critiques Bank Of Canadas Monetary Policy A Cautious Approach

Apr 29, 2025

Rosenberg Critiques Bank Of Canadas Monetary Policy A Cautious Approach

Apr 29, 2025 -

70 Off Hudsons Bay Final Store Liquidation Sale Begins

Apr 29, 2025

70 Off Hudsons Bay Final Store Liquidation Sale Begins

Apr 29, 2025