Uber Stock: Can Robotaxi Strategy Fuel A Comeback?

Table of Contents

The Current State of Uber Stock

Uber's recent financial performance has been a mixed bag. While the company continues to expand its services globally, profitability remains elusive. High operating costs, fierce competition from rivals like Lyft and other ride-hailing services, and significant regulatory hurdles in various markets pose ongoing challenges. The fluctuating price of Uber stock reflects this uncertainty.

- Current Uber stock price and market capitalization: (Insert current data here. This should be updated regularly for SEO purposes).

- Recent financial reports – highlighting key performance indicators (KPIs): (Insert relevant data from recent quarterly or annual reports, focusing on KPIs like revenue growth, operating income, and rider and driver numbers).

- Analyst opinions and predictions regarding Uber's future: (Summarize opinions from reputable financial analysts, noting both positive and negative predictions. Include links to relevant sources).

Uber's Robotaxi Ambitions: A Deep Dive

Uber's significant investment in autonomous vehicle technology represents a bold bet on the future of transportation. The company is developing its own self-driving technology and also forging partnerships with established autonomous vehicle companies. The goal? To replace human drivers with autonomous vehicles, drastically reducing operational costs and improving efficiency.

- Key partnerships with autonomous vehicle companies: (List key partnerships and collaborations, briefly explaining the nature of each partnership).

- Stages of development for Uber's self-driving fleet: (Outline the current stage of development, including testing locations and progress made towards full autonomy).

- Projected timeline for widespread robotaxi deployment: (If available, include Uber's projected timeline for rollout of robotaxis in specific markets. Note that projections are subject to change).

- Potential impact on driver employment and labor costs: (Discuss the potential job displacement implications and the anticipated savings related to driver wages, benefits, and insurance).

Market Analysis: Competition and Opportunities

The autonomous vehicle market is incredibly competitive. Waymo, Cruise (GM), and other tech giants are aggressively pursuing the development and deployment of self-driving cars. However, the potential market size for autonomous ride-sharing is enormous. Success will hinge on technological superiority, efficient deployment, and navigating complex regulatory landscapes.

- Analysis of competitors' strengths and weaknesses: (Compare Uber's robotaxi strategy to its main competitors, highlighting advantages and disadvantages).

- Market projections for autonomous vehicle adoption: (Include market size projections from reputable sources, explaining the assumptions behind these forecasts).

- Key regulatory considerations and potential policy changes: (Discuss the regulatory hurdles, such as safety regulations, liability issues, and data privacy concerns, that could impact Uber's progress).

The Potential Impact on Uber's Bottom Line

The successful deployment of robotaxis could revolutionize Uber's financial performance. Significant cost reductions from eliminating driver wages and associated expenses could dramatically boost profitability. Increased efficiency and scalability could also lead to substantial revenue growth. However, this comes with risks.

- Projected cost savings from reduced driver wages and insurance: (Provide estimates, if available, of the potential cost savings resulting from a shift to autonomous vehicles).

- Estimated increase in revenue from higher efficiency and scalability: (Estimate potential revenue gains through higher vehicle utilization rates and expanded service areas).

- Potential risks associated with autonomous vehicle technology: (Discuss potential risks such as technological malfunctions, accidents, cybersecurity threats, and unexpected development costs).

- Impact on Uber's overall market valuation: (Explain how the success or failure of the robotaxi strategy could impact Uber's stock price and overall market valuation).

Conclusion

Uber's robotaxi strategy presents a high-stakes gamble with potentially enormous rewards. While the current state of Uber stock reflects challenges in its core business, the successful integration of autonomous vehicles could dramatically alter its trajectory. The potential for cost savings and increased efficiency is significant, but technological hurdles, competition, and regulatory uncertainty pose substantial risks.

Is Uber stock a smart investment considering its bold robotaxi strategy? Do your own thorough research and decide for yourself. Consider the potential benefits and risks carefully before making any investment decisions related to Uber stock and the autonomous vehicle sector. Remember to consult with a financial advisor before making any investment choices.

Featured Posts

-

Federal Charges Filed Millions Stolen Via Office365 Hacks

May 08, 2025

Federal Charges Filed Millions Stolen Via Office365 Hacks

May 08, 2025 -

Grbovic O Prelaznoj Vladi Svi Predlozi Su Na Stolu

May 08, 2025

Grbovic O Prelaznoj Vladi Svi Predlozi Su Na Stolu

May 08, 2025 -

Breaking Bread With Scholars A Guide To Meaningful Academic Discussion

May 08, 2025

Breaking Bread With Scholars A Guide To Meaningful Academic Discussion

May 08, 2025 -

Watch Andor Season 1 Episodes 1 3 Hulu And You Tube Streaming Options

May 08, 2025

Watch Andor Season 1 Episodes 1 3 Hulu And You Tube Streaming Options

May 08, 2025 -

Hot Toys Japan Exclusive 1 6 Scale Rogue One Galen Erso Figure Unveiled

May 08, 2025

Hot Toys Japan Exclusive 1 6 Scale Rogue One Galen Erso Figure Unveiled

May 08, 2025

Latest Posts

-

The Great Decoupling Rethinking Globalization And Trade

May 09, 2025

The Great Decoupling Rethinking Globalization And Trade

May 09, 2025 -

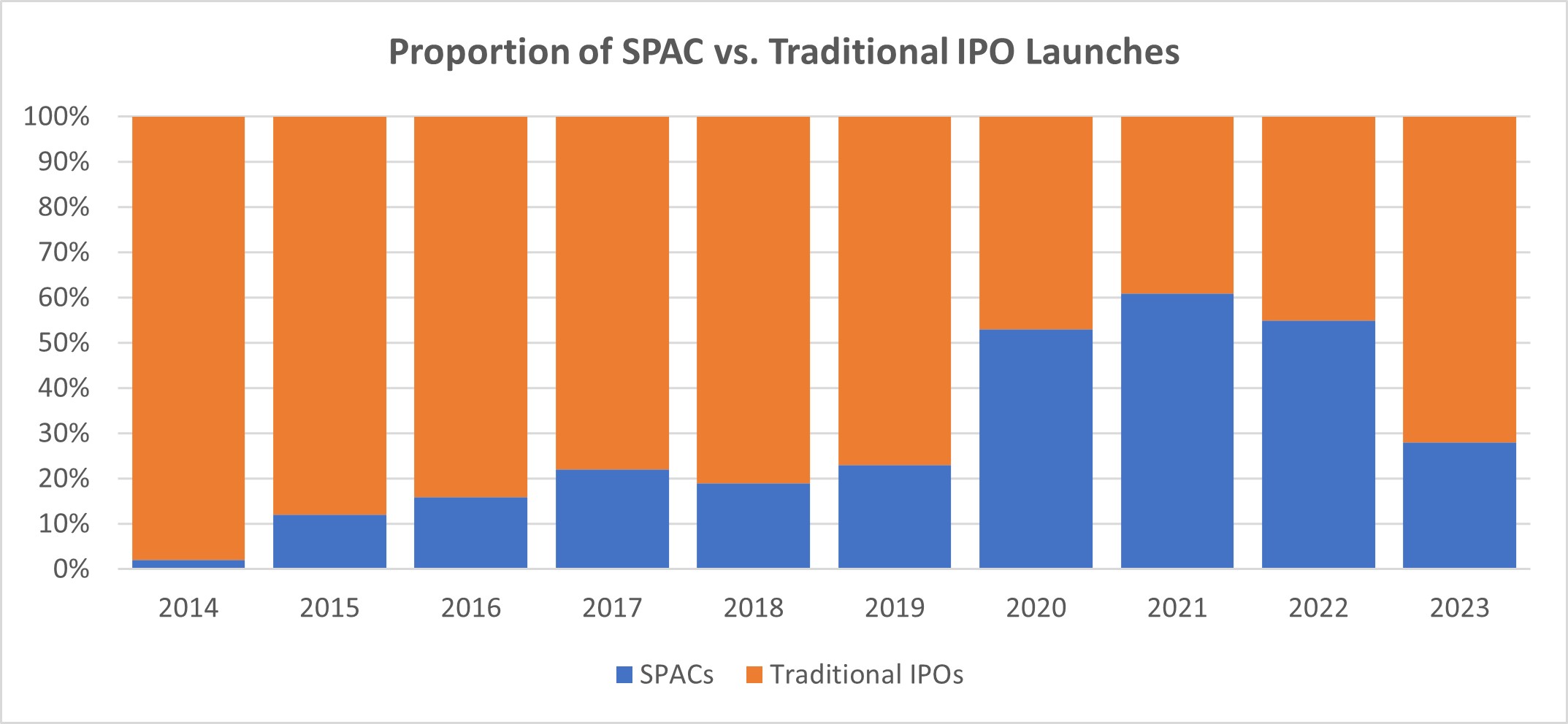

Is This Hot New Spac Stock A Smart Investment Comparing It To Micro Strategy

May 09, 2025

Is This Hot New Spac Stock A Smart Investment Comparing It To Micro Strategy

May 09, 2025 -

110 Potential Return Why Billionaires Are Investing In This Black Rock Etf

May 09, 2025

110 Potential Return Why Billionaires Are Investing In This Black Rock Etf

May 09, 2025 -

Is The Great Decoupling Inevitable Examining The Evidence

May 09, 2025

Is The Great Decoupling Inevitable Examining The Evidence

May 09, 2025 -

Wall Street Predicts 110 Growth For This Billionaire Backed Black Rock Etf In 2025

May 09, 2025

Wall Street Predicts 110 Growth For This Billionaire Backed Black Rock Etf In 2025

May 09, 2025